We provide new evidence on how ECB’s monetary policy decisions affect firms’ bank loan expectations in the euro area. We use survey-based data at firm level and identify the impact of monetary policy by comparing the responses of firms interviewed shortly before and after monetary policy shocks. We find that firms respond to monetary shocks by significantly updating their bank loan availability beliefs, and that the magnitude and the direction of the adjustment of expectations depend on the nature and characteristics of the shocks (large versus small; contractionary versus accommodative; conventional versus unconventional) and their information content (pure monetary policy versus central bank information shocks).

In a recent paper (Ferrando and Forti Grazzini, 2023), we provide novel evidence on the impact of the European Central Bank (ECB)’s monetary policy on bank loan expectations of euro area firms. Expectations on bank loans have an important role in firms’ investment and employment decisions (Ferrando et al 2022), but due to the relative unavailability of data, there is still very little empirical research on their determinants and to what extent monetary policy can influence them.

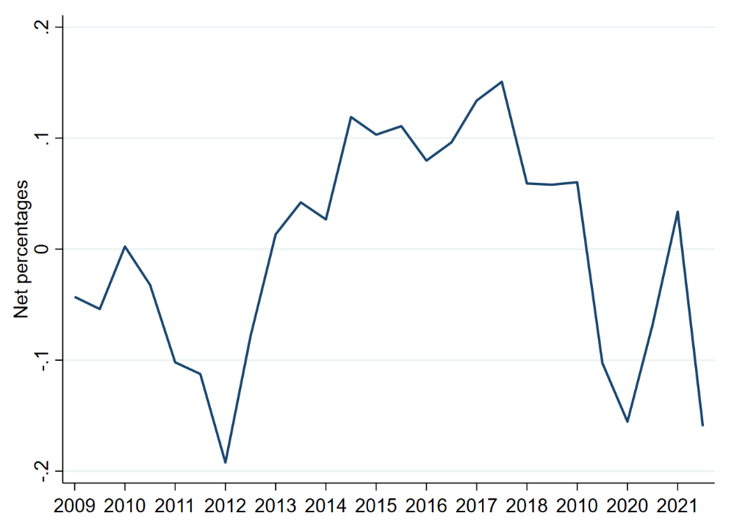

We use data from 2009 to 2022 gathered from the Survey on the Access to Finance of Enterprises (SAFE), a large bi-annual euro area firm-level survey conducted jointly by the ECB and the European Commission. To our knowledge, the SAFE is the only survey containing qualitative data on firms’ expectations about short-term (6 months) evolution of the availability of different sources of financing, including bank loans. Figure 1 plots firms’ bank loan expectations in net percentages for each survey round. Firms’ expectations fluctuate considerably over time, reaching their minimum around the peak of the sovereign debt crisis (2012), the Covid 19 crisis (2020), and the Russian invasion of Ukraine (2022).

Figure 1: Net percentages of firms’ bank loan expectations over time

Notes: net percentages are calculated as the difference between the percentage of enterprises reporting an increase in expectations of bank loans and the percentage reporting a decrease. Source: ECB and European Commission SAFE.

By exploring the information provided by the SAFE, our analysis centers around three main goals: the first one is to assess to what extent bank loan expectations react to monetary policy shocks; the second one is to understand whether the nature of the shocks (large versus small; contractionary versus accommodative; conventional versus unconventional) and the information content of the monetary policy announcements (pure monetary policy versus central bank information shocks) impact the way firms update their bank loan availability beliefs; the third one is to investigate whether firms’ characteristics drive heterogeneous reactions to a monetary policy change.

To identify the impact of monetary policy on firms’ expectations we exploit the information provided by the survey on the exact date in which firms respond to the SAFE questionnaire and compare expectations of those firms that respond shortly before and after selected monetary policy shocks. In a nutshell, the measure of the impact of the monetary policy shocks is given by the difference in expectations across the two groups of firms, after controlling for a large set of firm-specific characteristics. The shocks are constructed following the literature on high frequency identification of monetary policy shocks (among the others, Altavilla et al., 2019; Jarociński and Karadi, 2020).

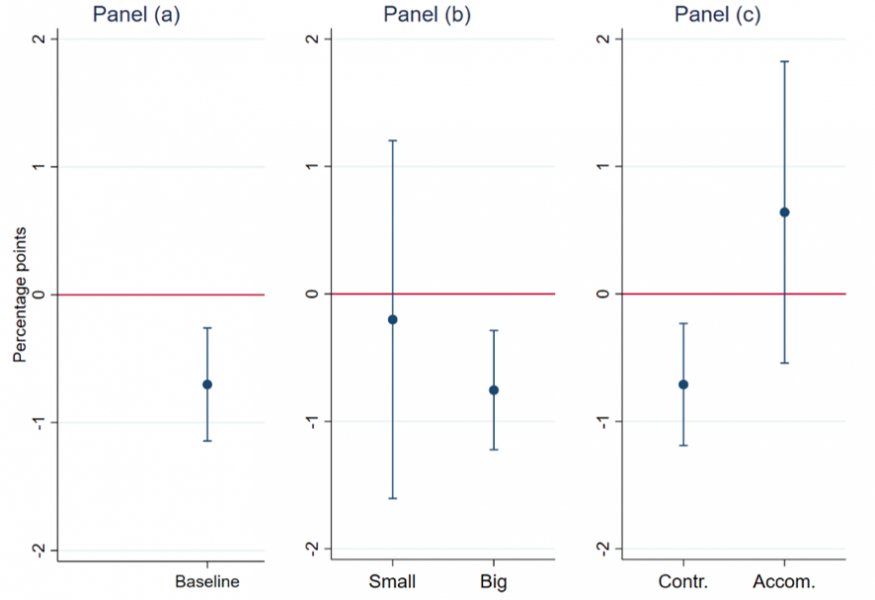

Our first set of results indicates that, on average, monetary policy shocks have a sizeable impact on bank loan expectations, with a 1 basis point contractionary shock decreasing the likelihood that a given firm increases its expectation on bank loan availability for the following six months by 0.70 percentage points (Fig 1, panel a). Moreover, we document that only large (Fig 1, panel b) and contractionary (Fig 1, panel c) shocks have a significant impact on expectations. This suggests that firms may pay little attention to monetary policy announcements if the news content is moderate or perceived positive for bank loan availability, but as soon as the shocks become bigger and deliver what is perceived as negative news for credit availability, firms start paying attention and update their bank loan expectations accordingly.

Figure 2: Monetary policy shocks and firms’ bank loan expectations, baseline results

Notes: the figure presents estimates of the impact of a 1 bp shock on firms’ bank loan expectations. Panel (a) reports the average impact of monetary policy shocks and depicts the effect of a contractionary shock on firms’ bank loan expectations. Panel (b) compares the impact on firms’ bank loan expectations of a (contractionary) shock smaller/larger than 1 standard deviation (corresponding to 2.3 basis points). Panel (c) compares the impact on firms’ bank loan expectations of a contractionary versus accommodative monetary policy shock. The dependent variable is a dummy that takes value 1 or 0 if the firm believes that the availability of bank loans will improve or deteriorate over the next 6 months. The estimation period is from 2009 to 2022. The models are estimated using OLS. Blue vertical lines indicate 90% confidence bounds. Coefficients are multiplied by 100.

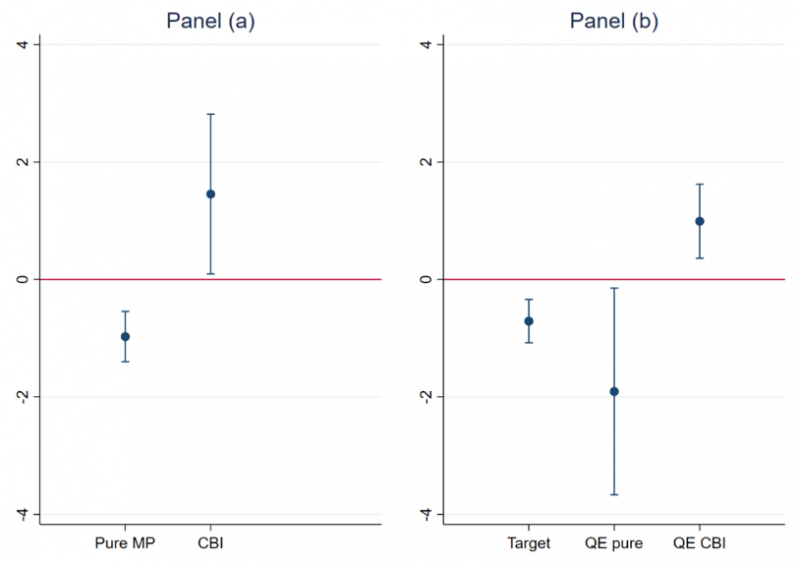

Our second set of results suggests that the impact of monetary policy on expectations is endogenous to the nature of the shocks. Enterprises clearly react to pure monetary policy shocks, i.e. shocks that capture genuine monetary policy changes (Fig 2, panel a). To the contrary, the impact of news related to the current state of the economy revealed by the ECB’s monetary announcements themselves –the so-called central bank information shocks (CBI)– seem to be only marginally significant. Nonetheless, this last result does not hold if the shocks are related to unconventional quantitative easing (QE) monetary policy tools. In fact, the analysis finds that both conventional and QE shocks have a significant impact on expectations (Fig 2, panel b). Yet, while the impact of the former is in line with the received wisdom about the monetary transmission mechanism (with a contractionary conventional shock decreasing expectations), the effect of QE shocks is mainly driven by their central bank information component (as the pure monetary policy component of QE shocks is barely significant) and delivers the opposite (positive) effect.

Figure 3: Monetary policy and firms’ bank loan expectations, additional shocks

Notes: the figure presents estimates of the impact of a 1 bp shock on firms’ bank loan expectations. Panel (a) compares the impact on firms’ bank loan expectations of a pure monetary policy shock and a central bank information shock. Panel (b) compares the impact on firms’ bank loan expectations of a target shock, a pure monetary policy QE shock and a QE central bank information shock. The dependent variable is trichotomous and takes values 1, 0 and -1 if the firm expects an improvement, no changes or a deterioration in bank loan availability over the next 6 months. The estimation period is from 2009 to 2022. The models are estimated using OLS. Blue vertical lines indicate 90% confidence bounds. Coefficients are multiplied by 100.

Finally, additional empirical analysis suggests that the response of expectations to monetary policy is heterogeneous along firms’ characteristics. Monetary actions appear to be especially impactful on the expectations of bank loans when firms perceive a worsening economic environment and are already financially weak. The impact, though, seems to be muted for younger or financially constrained enterprises.

Our work provides evidence that firms are not only attentive to ECB’s monetary policy announcements but are also able to disentangle the different components of the ECB’s communication, and they update their bank loan expectations accordingly. These results can have important policy implications. When combined with previous literature that has shown that credit condition expectations are an important driver of firms’ real decisions in terms of investment and employment (Ferrando et at 2022), our findings suggest that monetary policy is able to affect real economic conditions also through its impact on expectations about future credit conditions.

Altavilla, C., Brugnolini, L., Gurkaynak, R. S., Motto, R., and Ragusa, G. (2019). Measuring euro area monetary policy. Journal of Monetary Economics, 108:162–179.

Ferrando, A. and Forti Grazzini, C (2023). Monetary policy shocks and firms’ bank loan expectations. ECB working paper No. 2838.

Ferrando, A., Popov, A., and Udell, G. F. (2022). Unconventional monetary policy, funding expectations, and firm decisions. European Economic Review, 149:104268.

Jarociński, M., & Karadi, P. (2020). Deconstructing monetary policy surprises—the role of information shocks. American Economic Journal: Macroeconomics, 12(2), 1-43.