We estimate transaction and non-transaction (store of value) cash balances in Canada, Denmark, Iceland, Sweden and Norway over the last decades. These countries show large differences in aggregate cash balances, despite sharing key features relevant for cash demand. While cash balances have increased in Canada, Iceland and Denmark, they have fallen in Norway and Sweden. We find these differences to be due to a dramatic fall in non-transactional cash demand in Norway and Sweden. We argue that this fall is due to specific institutions and policy choices in Norway and Sweden, not a future international trend.

In the last 20 years, most OECD countries have experienced a ‘cash paradox’ whereby the demand for cash increased, despite the general trend towards digital payments and lower use of cash for transactions. The exceptions are Norway and Sweden. The development has been especially dramatic in Sweden where currency in circulation (CiC) has fallen by almost 50% since its peak in 2007.

The divergent development in Sweden cannot be explained by traditional cash demand models. We therefore take a different approach and investigate if the divergent patterns in Norway and Sweden compared to other countries can be explained by differences in the use of cash for transactional and non-transactional purposes.1 The non-transactional demand for cash can be thought of as cash being used as a store of value (savings in cash) but it also includes cash being lost, destroyed, used for precautionary motives or brought abroad etc.

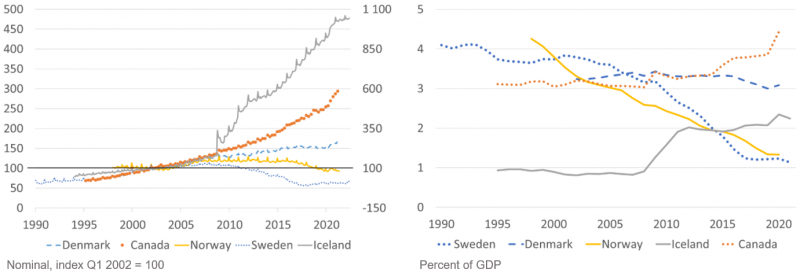

Our study includes Canada, Denmark, Iceland, Norway and Sweden. They share key similarities as they are small/medium-sized open high-income economies with a mature payment market and a banked and financially literate population. Denmark, Iceland, Norway and Sweden are also neighbouring countries with large cultural similarities. Despite the similarities, CiC developments differ significantly. The cash paradox is prevalent in Canada and Iceland but not in Norway and Sweden. Denmark lies between these two groups with a stable share of CiC, see Figure 1.

Figure 1: Currency in circulation in the selected countries

Note: The left graph illustrates the development of CiC in nominal value (index Q1 2002 = 100). Iceland is plotted on the right-hand scale. The right-hand graph shows CiC in relation to GDP. Source: National central banks.

To estimate the transactional and non-transactional cash shares, we apply the so-called seasonal method. The general assumption behind this method is that transaction balances show a higher seasonal fluctuation than non-transactional balances. To calculate the respective shares, proxies for the seasonal of transactional cash demand are needed. For that purpose, we evaluate data on transaction-related activities such as households’ consumption, banks’ vault cash or transaction banknotes etc.

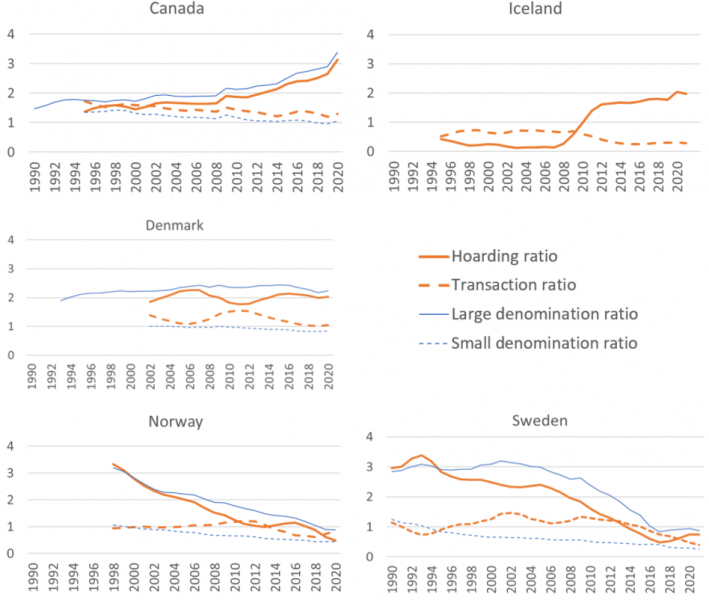

Our results are shown in Figure 2 where we also include the shares of small and large denominations, a measure often used to gauge transaction and non-transaction cash balances. The values are expressed relative to GDP to facilitate comparisons between the countries (normalization). Our estimates and the shares based on denominations tend to follow each other quite closely indicating that the estimations are reasonable. The solid blue line lies above the solid red line (estimate) indicating that some high-denomination notes are also used for transactions which is also the reason why the dotted red lines are above the dotted blue lines.

Figure 2: Estimated transaction and non-transaction cash balances together with small and large denominations relative to GDP

Note: Red lines show our estimated transaction balances (dashed) and non-transaction balances (solid). The blue lines show low-denomination banknotes (dotted) and high-denomination banknotes (solid). All balances as shares of GDP. Unfortunately, we do not have data on the different denominations for Iceland. Source: Own calculations.

All five countries show slowly decreasing transaction balances. This is as expected and consistent with the long-term increase of digital payment services such as cards and smartphone apps. However, there are marked differences between the countries in terms of non-transactional cash balances.

Two of the countries, Canada and Iceland, have seen increases in non-transactional cash balances. In Canada, the increase has been gradual. In Iceland it was rapid during the financial crisis indicating a rapid behavioural shift.

In Norway and Sweden, in contrast, there is a long-term decrease in non-transaction cash balances. Here, banknotes seem to gradually lose their function as a store of value. Obviously, consumers and businesses increasingly use other methods to store value. Denmark lies in the middle with non-transaction balances (more or less constant). To summarise, the differences in the development of CiC between the countries can largely be explained by differences in the non-transactional cash balances.

There are some policy and institutional differences between these apparently similar countries that help to explain the differences in the development of non-transaction cash balances.

First, practices regarding the validity of older banknotes differ. In Canada and Denmark, older banknote series are generally valid. In Iceland, Norway and Sweden, older banknotes become invalid shortly after new banknote series have been introduced. These practices have been particularly strict in Sweden since 2013 and in Norway since 2017, when old notes have become invalid about one year after new notes have been introduced. Strict practices regarding the validity of older banknotes are likely to reduce cash as a store of value as it introduces a risk that stored cash that lies idle may become invalid and worthless.

Second, the degree of acceptance of cash payments at the point of sale (POS) differs between the countries. While these differences are less clear-cut and harder to pinpoint, Sweden and to some degree Norway stick out. Swedish businesses and authorities are in practice not required to accept cash payments, and the share of businesses that accept cash has declined over the last decade. The most recent survey found that 12 % of stores do not accept cash. We assess the decline to be even more pronounced among the service providers as hotels, restaurants and public transport rarely accept cash payments. In Canada, only 3 % did so. The acceptance rate in Denmark should be at least as high as in Canada as Danish regulation specifies that cash must generally be accepted at the POS. The situation in Norway more closely resembles the situation in Sweden where more and more retailers and service providers no longer accept cash. In Iceland, there seem to be only few examples of non-acceptance of cash by retailers. The lower acceptance rate for cash in Norway and Sweden may not only lower the demand for cash for transactions, but also hoarding demand as it induces uncertainty that stored cash cannot later be used for payments.

Third, reduced access to cash in general and to high-denomination notes in particular differ which makes it more cumbersome to use cash as a store of value in Norway and Sweden. Norway and Sweden have the lowest number of bank branches per adult. Additionally, banks are reducing their over the counter (OTC) cash services, underscoring the importance of ATMs further. Cashless branches were introduced in 2010 in Sweden and by 2012 around 40 % of the branches did not offer any OTC cash services. Today banks have stopped providing cash OTC services with only a few exceptions for some small local banks. The situation is similar in Norway. The development has been less dramatic in Canada and Denmark. Regarding ATMs, Norway and Sweden have the lowest number of ATMs per adult. Denmark and Iceland have more than twice as many ATMs per capita as Norway and Sweden. Another important difference is that denominations above 500 krona (approximately 50 euro) are not available in Norwegian and Swedish ATMs while some Canadian ATMs dispense even CAD 100 notes, and some Danish ATMs dispense DKR 1000.

Fourth, the use of cash to store value tends to increase in times of perceived enhanced risk and uncertainty. The increased non-transactional demand in Iceland from 2008 is clearly related to the systemic banking crisis in Iceland. A considerable amount of cash was withdrawn from the banking system and placed in safety deposit boxes or stored in other places already in the run-up to the crisis. By the end of the year CiC had increased by more than 60 %. This surge in cash holdings continued for some years and by the end of 2011 CiC had risen by more than 200 %. There was stress in some banks in both Sweden and Norway during 2008, but that did not lead to increased cash demand suggesting that experiences with previous banking crises made people confident that their bank deposits were safe. Canada did not experience any banking collapse or any severe banking crisis during the great financial crisis.

Fifth, foreign demand for domestic banknotes is included in our non-transactional estimates. There are no reasons to believe that there has been any significant foreign demand for banknotes from Denmark, Iceland, Norway or Sweden. There has, however, been a significant foreign demand for Canadian banknotes during the observed period contributing to the demand for high-denomination banknotes in Canada.

Lastly, the shadow economy (unregistered economic activity) and tax evasion may affect the demand for high-denomination banknotes and be interpreted as non-transactional demand. However, this does not explain the differences between the countries. Other studies identify little difference between our countries in this respect. Instead, these activities show a similar (downward) evolution over time in the five countries.

All five countries have seen a slow but steady decline in the demand for cash for transactional purposes as a consequence of the rise in digital payments. The differences between cash demand in the studied countries is due to differences in the non-transactional demand for cash, i.e., cash used for store of value, precautionary motives or held abroad, not to differences in transactional cash demand. The non-transactional demand has declined significantly in Norway and Sweden, while it has increased drastically in Canada and Iceland and slightly in Denmark. These differences are likely to be explained by institutional and policy factors relating to access to cash and its usability in the economy. The enormous fall in non-transactional (store of value) cash balances in Norway and Sweden is probably due to specific institutions and policy choices in Norway and Sweden, not a future international trend.

See for more details Claussen, C.A., B. Segendorf & F. Seitz (2023), Cash for Transactions or Store-of-Value? A comparative study on Sweden and peer countries, Sveriges Riksbank, Working Paper Series 427, July.