In a recent paper, we use a novel granular price data set and provide robust evidence of a strong price pass-through (Ahlander et al, 2023). In particular, we provide new empirical evidence on the pass-through from producer to consumer prices, utilizing product-level data comprising all of the price observations underlying the official Swedish producer and import price index (PPI) and consumer price index (CPI). Importantly, we establish a link between products in the PPI and CPI by merging related product groups observed in both price indices. Examples of product groups included in both the PPI and CPI are food, furniture and fuels for transportation.

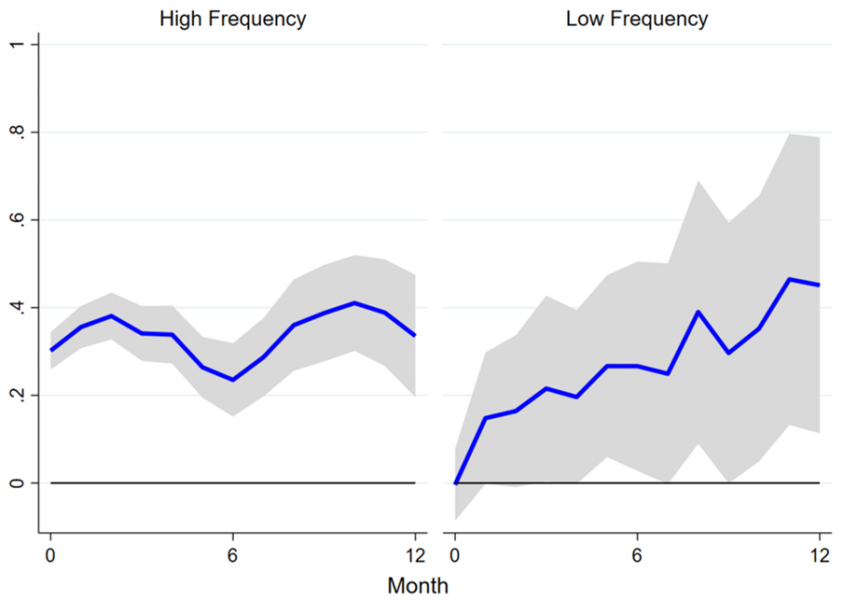

This merge enables us to investigate the price pass-through at the very granular level, which offers several important advantages compared to estimates at the aggregate level. First, organizing the data in comparable product groups solves any issues with differences in the composition of the two aggregate indices, as emphasized by e.g. Clark (1995) when discussing reasons that would weaken the link between aggregate PPI and CPI indices. Secondly, with group-level data it is possible to control for any general equilibrium feedback effects that influence the interpretation of a regression of one aggregate price index on another. Third, the large cross-sectional variation of our micro price data should reduce estimation uncertainty on the relation between producer and consumer prices. Finally, pooling the data might mask important heterogeneity across individual product groups. We indeed show that the price-change frequency across product groups significantly influences the price pass-through. Our micro price data set, which covers the period from January 2010 to September 2022, further allows for an in-depth analysis on the pass-through during the recent COVID and high-inflation episodes.

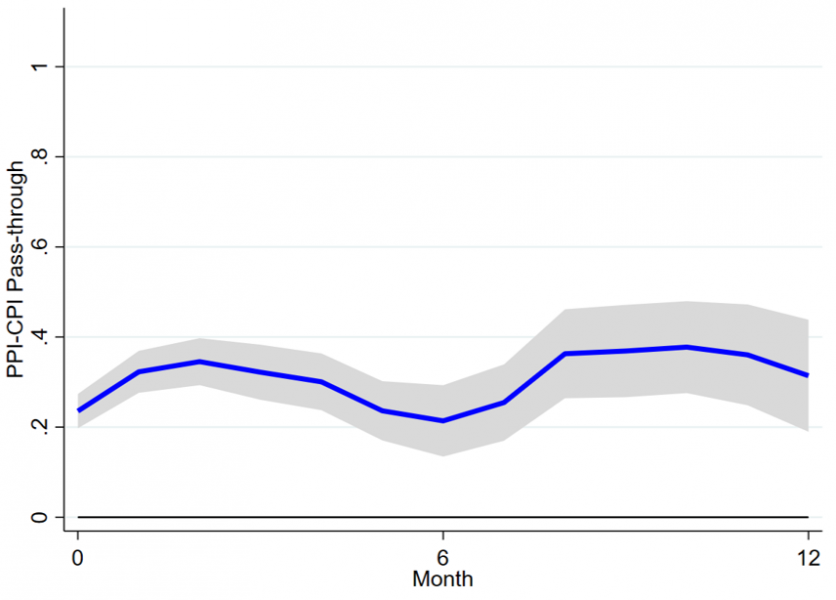

To evaluate the price pass-through, we estimate local projections relating cumulated changes in consumer prices to cumulated changes in producer prices. Our baseline model is set up to trace the dynamic group-level response of consumer prices to a shock to producer prices. In particular, throughout we control for aggregate shocks common to both consumer and producer prices and past innovations to producer prices by including current and lagged values of the aggregate CPI as well as lags of producer prices at the group level, respectively.