One important reason for these gaps in the literature is the mismatch between the high-frequency nature of news about leaks and the lack of fast-moving variables that could capture public perceptions and public policy outcomes. In a recent paper (Ehrmann et al., 2023), we attempt to overcome this challenge by analyzing leaks from one specific area of public policymaking: central banking. Central banks constitute particularly promising cases to study public policy leaks because news about monetary policy instantaneously move financial markets. Since markets listen when central banks speak, we can obtain a reliable high-frequency measure to study the impact of leaks on public views and policy effectiveness: financial market tick data. To be sure, there are also other advantages of studying central bank leaks. On the one hand, the well-defined scope and the recurrent nature of monetary policy decisions ensure that the content of related leaks is comparable over time, allowing the compilation of a consistent database over a long sample period. On the other hand, monetary policy represents a clear-cut case of decision-making by committee. Therefore, our analysis speaks to a form of decision-making prevalent in many public institutions, especially at the supranational level (e.g. the Council of the European Union, the United Nations Security Council or the World Trade Organization’s General Council).

To the best of our knowledge, our unique data and setting make the study underlying this article the most systematic quantitative assessment of public policy leaks to date. Our study contributes to several literatures, including interdisciplinary scholarship studying anonymous disclosures of confidential information in the realm of public policy-making, papers on the economics of decision-making by and disagreement in (monetary policy) committees (McMahon et al. 2015, Tietz et al. 2021), and past work on the effects of ad hoc central bank communication.

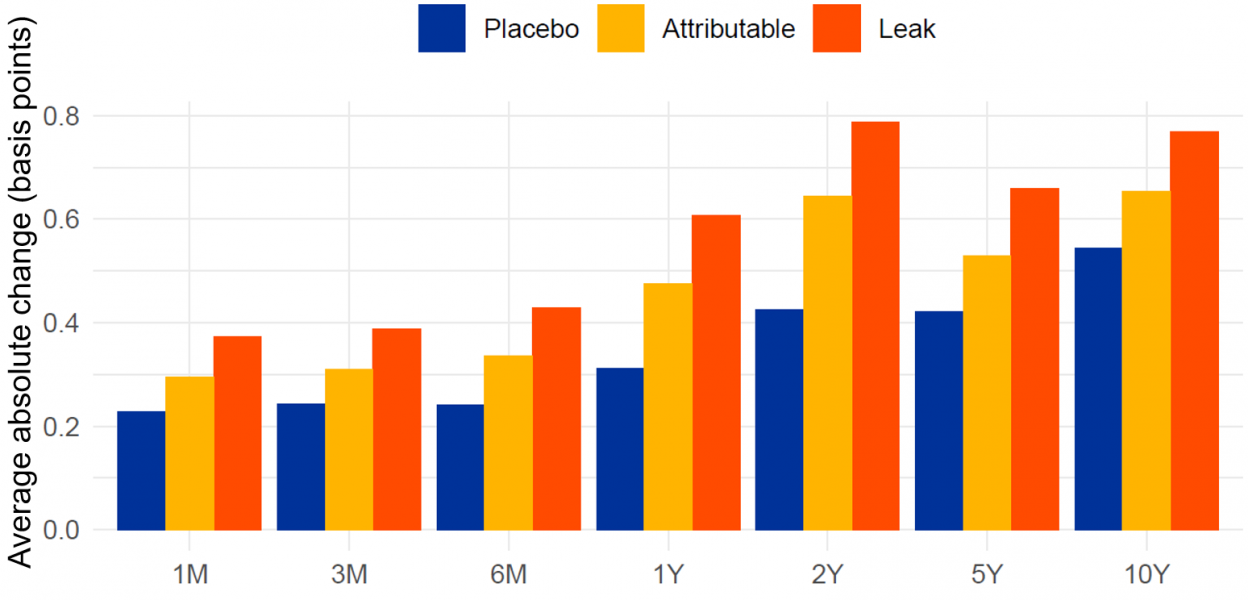

We would like to highlight two particular implications of our paper. First, our findings imply that markets respond to leaks although they are generally not informative. The market reaction to leaks can be rationalized by models formalizing the impact of media reporting on economic outcomes. Chahrour et al. (2021) show that accurate reporting about unrepresentative developments may still affect agents’ behavior. The analogy to leaks that mainly represent minority views is straightforward. Also, according to Nimark (2014), “unusual events are more likely to be considered newsworthy than events that are commonplace”, and the mere availability of these signals is in itself informative and affects agents’ beliefs. Leaks are a good example of “man-bites-dog” news: both their form and their information content are highly unusual because most central bank communication goes through official channels and contains little information about disagreement on the Governing Council.