The recent episode of high inflation on both sides of the Atlantic has kindled an active discussion about the drivers of elevated inflation expectations and in particular about the role of supply and demand contributions among economists and policymakers. This column summarizes new evidence of a recent paper in which we feed financial data into a structural model and attempt to inform the above debate. The results suggest that over the course of 2021-23 inflation expectations in the US were steadily sustained by domestic demand, while in the EA they mostly reflected the role of supply shocks, and only more recently a growing strength of demand factors. Our evidence also indicates that monetary policy shocks progressively contributed in soothing inflation expectations in both jurisdictions, although with a different timing and vigour.

At the beginning of 2021, inflation expectations in the medium-term were at historically low levels in the EA following the prolonged deflationary phase that led the ECB first to bring key rates to negative levels in 2014 and then to adopt a series of other unconventional measures. A mix of post-pandemic recovery, supply chain bottlenecks and rising energy prices ‒ especially after the Russian invasion of Ukraine ‒ then triggered a sharp and prolonged increase not only in inflation readings but also in Inflation-linked swaps (ILS) which reflect genuine inflation expectations plus a time-varying unobservable inflation risk premium. In the US, inflation expectations started from a higher level than in the EA in 2021, but overall displayed a somewhat similar pattern.

This increase has ignited a debate about the underlying structural drivers of these dynamics in inflation expectations. In the post-Covid high inflation environment, the assessment of inflation expectations ‒ and in particular of the risk of their possible de-anchoring ‒ plays a crucial role for central banks. Decomposing the relative contributions of supply and demand factors is however challenging as supply and demand shocks play out simultaneously. Moreover, interconnected financial markets transmit shocks across economies; this makes accounting for spillovers important when identifying structural shocks. In particular, it has been documented that the US economy plays a central role in financial markets and that developments in that country affect the rest of the world through financial linkages (Rey, 2016; Farhi and Werning, 2014; Bruno and Shin, 2015).

In a recent paper (Hoynck and Rossi, 2023) we propose a methodology to assess the structural drivers of inflation expectations, as measured by inflation-linked swaps. To this end, we estimate a Bayesian Vector Autoregressive (BVAR) model for the euro area (EA) and the United States (US) on daily asset price movements in the two economies. Shocks are identified using sign and magnitude restrictions (Arias et al., 2018), taking also into account international spillovers. In particular, identification builds on theoretical insights, which suggest that asset prices, including ILS rates, react with a specific pattern to each of the different shocks that may hit the economy. The use of daily data also offers a real time narrative that allows circumventing the issues of publication lags and infrequent availability that plague macroeconomic data.

The inclusion of inflation expectations allows to neatly differentiate between supply and demand innovations by imposing reasonable assumptions regarding how stock prices, bond yields and ILS co-vary with these shocks. Favourable EA demand and supply shocks have a positive effect on equity prices. However, they have an opposite effect on long term yields and inflation expectations. A positive demand shock raises inflation expectations and long-term yields. A favourable supply shock, instead, lowers inflation expectations.

We use our model to study the drivers of the recent surge in inflation expectations in the US and the EA, and focus on two questions. First, what are the underlying sources of the increase in inflation expectations? Second, has monetary policy been effective in containing their surge since the start of the monetary policy tightening processes?

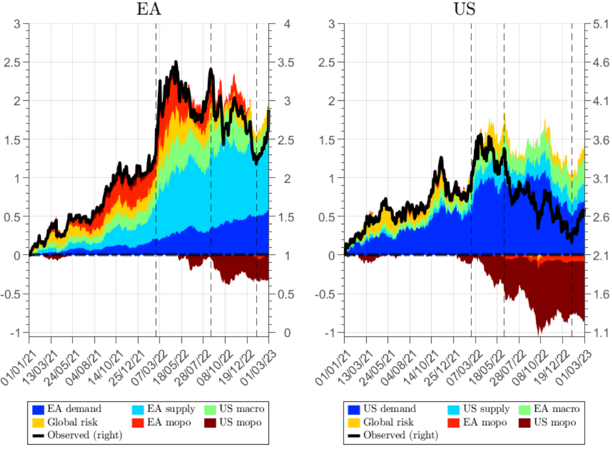

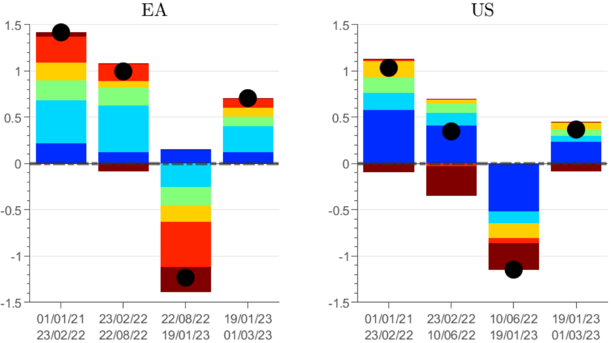

According to our estimates, the structural drivers of medium-term inflation expectations in the US and the EA were in stark contrast as reflected by cumulative historical decompositions (Figure 1). In the Euro Area (EA), the dynamics of 5Y ILS since the beginning of 2021 can be divided into four sub-periods.

Figure 1: Decomposition of 5-year ILS since the beginning of 2021

Note: The top left (right) panel shows the time series of cumulated historical decompositions as well as observed 5-year ILS for the EA (US) since January 1, 2021. The left axis reports cumulated changes since the starting period, whereas the right axis reports actual ILS values. The bottom left (right) panel plots overall cumulated historical decompositions for the EA (US) during four different sub-periods. Those subsamples are highlighted with black dashed lines in the top panels.

Although medium-term inflation expectations dynamics were qualitatively similar in the US, the underlying drivers were markedly different. The right panel of Figure 1 shows the dynamics of medium-term inflation expectations in the US.

In the post-Covid high inflation environment, monitoring inflation expectations plays a crucial role for central banks. In our paper, we propose a methodology to quantify the structural drivers of EA and US inflation expectations as measured in real time by inflation-linked swaps. We decompose their daily fluctuations into domestic, foreign and global shocks by means of a Bayesian VAR model.

Since the beginning of 2021 until mid-2022, medium-term inflation expectations in the EA increased mostly in response to adverse supply shocks, while the contribution of EA demand shocks rose progressively over the course of 2022, reflecting improved business cycle conditions. Our evidence also documents strong US monetary policy spillovers on EA inflation expectations since the second half of 2022 and a strong soothing effect stemming from EA monetary policy tightening. In the US instead, inflation expectations have been steadily sustained by domestic demand shocks until the end of October 2022, and reined-in by contractionary monetary policy shocks since March 2022, when the Fed started its tightening cycle.

Arias, Jonas E., Juan F. Rubio-Ramirez, and Daniel F. Waggoner (2018), “Inference based on structural vector autoregressions identified with sign and zero restrictions: Theory and applications,” Econometrica, Vol. 86(2), pp. 685-720.

Brandt, Lennart, Arthur Saint Guilhem, Maximilian Schröder, and Ine Van Robays (2021), “What drives euro area financial market developments? The role of US spillovers and global risk”, ECB Working paper series, No. 2560, May.

Bruno, Valentina and Hyun Song Shin (2015), “Capital flows and the risk-taking channel of monetary policy”, Journal of Monetary Economics, 71, 119–132.

Cecchetti, Sara, Adriana Grasso and Marcello Pericoli (2022). “An analysis of objective inflation expectations and inflation risk premia”, Temi di Discussione (Economic Italy Working Papers Series), 1380, Bank of Italy, Economic Research and International Relations Area.

Cieslak, Anna and Andreas Schrimpf (2019), “Non-monetary news in central bank communication”, Journal of International Economics, 118, 293–315.

Cieslak, Anna and Hao Pang (2020), “Common Shocks in Stocks and Bonds”, SSRN Electronic Journal, 2020.

Degasperi, Riccardo (2021), “Identification of Expectational Shocks in the Oil Market using OPEC Announcements”, mimeo.

Farhi, Emmanuel and Ivan Werning (2014), “Dilemma not trilemma? Capital controls and exchange rates with volatile capital flows”, IMF Economic Review, 2014, 62 (4), 569–605.

Jarocinski, Marek and Peter Karadi (2020), “Deconstructing monetary policy surprises -The role of information shocks”, American Economic Journal: Macroeconomics, 12 (2), 1–43.

Rey, Helene (2016), “International channels of transmission of monetary policy and the Mundellian trilemma”, IMF Economic Review, 64 (1), 6–35.

Venditti, Fabrizio and Giovanni Furio Veronese (2020), “Global Financial Markets and Oil Price Shocks in Real Time”, SSRN Electronic Journal, 2020.

Visco, Ignazio (2023), “Inflation expectations and monetary policy in the euro area”, 95th International Atlantic Economic Conference, Robert Mundell Distinguished Address, March 23 2023.