In the last decades, populist parties have gained massive support. At the same time, many countries implemented large-scale fiscal consolidations to avert the risk of sovereign default. Using a novel regional database covering over 200 elections in several European countries, this column provides new evidence on the political consequences of austerity. Fiscal consolidations lead to a significant increase in extreme parties’ vote share, lower voter turnout, and a rise in political fragmentation. Austerity-driven recessions amplify the political costs of economic downturns considerably by increasing distrust in the political environment.

Anti-establishment and populist parties have gained significant support since the Great Recession in many advanced economies around the globe. Higher vote shares for these parties have increased partisan conflict and led to more fragmented parliaments. The resultant polarized political environment is generally associated with higher policy uncertainty and lower economic growth (Funke et al. 2020).

The rise in support for extreme parties occurred in a period of significant fiscal policy interventions. Several European countries have implemented large-scale fiscal consolidation measures to reduce high levels of public debt. The massive reductions in public spending faced significant opposition and resulted in anti-austerity movements. In a recent paper, we investigate the link between fiscal consolidations and rising polarization and provide new evidence on the political costs of fiscal austerity (Gabriel et al. 2022).

To this end, we assemble a novel regional dataset on election outcomes that provides detailed voting results on regional, national, and European elections. Our final dataset covers 124 European regions from 8 countries and spans from 1980 to 2015. We collect data on more than 200 elections: roughly 20 elections per region and, on average, one election every two years.

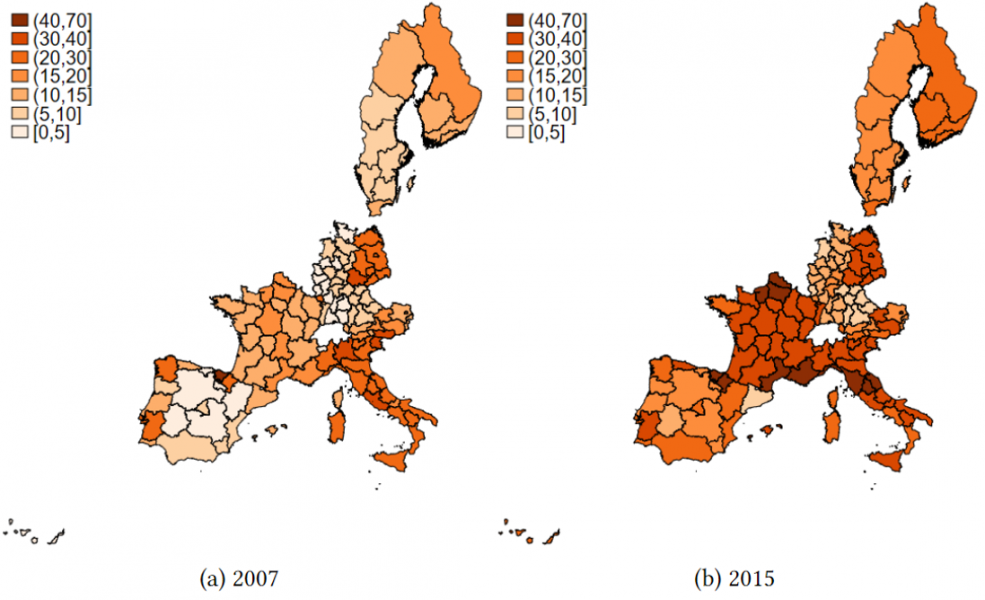

Figure 1 gives a first impression of the regional election data. It shows the regional vote shares for extreme parties for the regions in the sample for the years 2007 and 2015, just before the start of the Great Recession and after the height of the Sovereign Debt Crisis. The figure shows that more extreme voting in the recent past is a shared phenomenon across countries and regions. Particularly strong increases in the vote shares of extreme parties can be observed for regions in France, Spain, and Italy. However, there are also significant differences across regions within the same country. For example, while regions in the western and southern part of Germany show lower vote shares for extreme parties, voters in the eastern part favor extreme parties more strongly.

Figure 1: Regional vote shares on extreme parties in 2007 and 2015

Notes: Figures 1a and 1b depict, in percent, the sum of the far-left and far-right vote shares for European regions at the NUTS 2 level in 2007 and 2015, respectively. If elections do not take place in these specific years, the map shows the outcome from the previous ballot.

To test the causal relationship between fiscal austerity and voting outcomes, we identify exogenous changes in national government expenditures that are motivated by a desire to reduce budget deficits in response to past decisions. We then combine them with regional sensitivities to fiscal spending to account for the fact that regions that rely heavily on public spending are likely to be more affected by national government austerity measures.

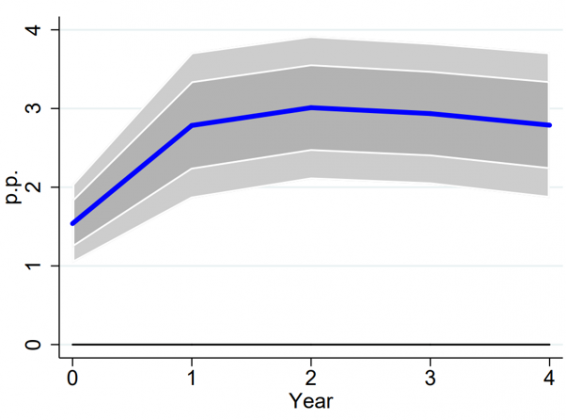

Figure 2 presents the response of extreme parties’ vote share to a fiscal consolidation. A 1% reduction in regional public spending leads to an increase in extreme parties’ vote share of around 3 percentage points. Our results suggest that around 10% of the variation in extreme parties’ vote share is indeed due to fiscal consolidations, which further highlights the importance of austerity in understanding shifts in voters’ preferences toward the more extreme ends of the political spectrum.

Figure 2: Response of extreme parties’ vote share to austerity

Notes: The figure plots the impulse response in percentage points of the vote share for the extreme parties to an austerity-induced change in government spending by one percent. Bands are 68% (dark) and 90% (light) confidence intervals.

We also show that the higher vote share captured by extreme parties can be explained by a fall in voter turnout together with an increase in the total votes for these parties. Thus, in response to fiscal consolidations, fewer people vote and those who do exhibit a higher tendency to vote for extreme parties. In addition, austerity increases fragmentation, which suggests that austerity affects economic outcomes through a more polarized political environment.

When differentiating between election types and far-left and far-right parties, we find only mild differences in political outcomes. While austerity leads to the largest shift toward extreme parties for European elections, the movement away from more traditional parties is also present for national and regional elections. Moreover, although both extremes gain vote shares as a result of fiscal consolidations, far-right parties experience a slightly stronger rise in voters’ support. We further test for potentially important state dependencies and find that the increase in extreme parties’ vote share is significantly larger when the fiscal consolidation is implemented during a recession as opposed to a period of expansion. In addition, the effects are somewhat stronger in rural and poor regions compared to urban and rich ones, respectively.

To rationalize our main findings on the political consequences of austerity, we also estimate the economic effects of fiscal consolidations at the regional level. Austerity leads to a significant fall in regional output, employment, investment, durable consumption, and wages. Furthermore, the reduction in public spending lowers the labor income share thereby inducing a redistribution of income away from working households. These findings highlight the close relationship between detrimental economic developments and voters’ support for extreme parties following fiscal consolidations.

Ultimately, we examine whether austerity-driven recessions yield different political outcomes than general economic downturns do. We differentiate between recessions that coincide with fiscal consolidations (“austerity recessions”) and those not related to austerity (“non-austerity recessions”) and estimate the response of extreme parties’ vote share in both episodes of economic slack. Our estimates imply that austerity recessions lead to a significantly larger increase in the vote share for extreme parties than other recessions.

We relate this result to a potential trust channel of fiscal consolidations by showing that people’s trust in the government deteriorates much more during austerity recessions compared to non-austerity recessions. This might point toward a “doom loop” between distrust in the political system and more extreme voting following fiscal consolidations. In sum, austerity-driven recessions are special in the sense that they considerably amplify the political costs of economic downturns by creating more distrust in the political environment.

Algan, Y., S. Guriev, E. Papaioannou, and E. Passari (2017), “The european trust crisis and the rise of populism”, Brookings Papers on Economic Activity 2017(2), 309–400.

Funke, M., M. Schularick, and C. Trebesch (2016), “Going to extremes: Politics after financial crises, 1870–2014”, European Economic Review 88, 227–260.

Funke, M., M. Schularick, and C. Trebesch (2020), “Populist Leaders and the Economy”, Technical Report 15405, C.E.P.R. Discussion Papers.

Gabriel, R. D., Klein, M., and A. S. Pessoa (2022), “The Political Costs of Austerity”, Sveriges Riksbank Working Paper No. 418.