Many central banks have a mandate that outlines their objectives and responsibilities. The Federal Reserve (Fed), for example, is required to pursue maximum sustainable employment and price stability. In this policy brief, we discuss recent work by Bertsch et al. (2022), which uses state-of-the-art methods from natural language processing and the largest corpus of Fed speeches assembled to-date to examine the evolution of the Fed’s interpretation of its mandate over time. We find that the Fed takes an expansive interpretation that sometimes incorporates secondary objectives, such as financial stability. The interpretation of the Fed’s mandate can be linked to their monetary policy stances. Moreover, we find that the Fed’s perception of its mandate, as measured by text variables extracted from speeches, predicts the returns of broad asset classes, even after including macroeconomic and financial controls.

An expansive view of the Fed’s mandate allows for the pursuit of secondary objectives, as long as they facilitate the stated dual objectives of maximum sustainable employment and price stability. This includes, for example, the use of monetary policy to achieve financial stability1 and, more recently, the pursuit of an inclusive monetary policy that promotes maximum employment for low- and moderate-income communities2 and the Fed’s role in addressing climate change risks.3 However, it is not clear whether the argument for such secondary objectives is compelling. In the case of financial stability, for example, much of the academic literature has concluded that monetary policy is the wrong tool and cannot be used without inhibiting the Fed’s pursuit of its narrower mandate. This view, however, is not held universally. Other academics and central bankers see secondary objectives, such as the pursuit of financial stability through monetary policy, as an implicit part of the dual mandate and, thus, a necessary consideration when conducting monetary policy.

We attempt to identify changes in the Fed’s perception of its own mandate over its institutional history, drawing from a unique corpus of speeches given by Fed officials. While this corpus extends back to the founding of the Federal Reserve System in 1914, we focus on the period starting in the 1960s and extending to the present, where speeches are given more frequently, and the language used to describe central banking and macroeconomics is stable.

To evaluate the Fed’s perception of its mandate, we make use of pre-trained transformer models (Vaswani et al., 2017; Devlin et al., 2019; and Liu et al., 2019), which have recently achieved substantial gains on natural language processing tasks. The artificial intelligence chatbot ChatGPT, for example, which has recently demonstrated considerable prowess at generating high-quality text in the context of a conversation, is built on the same underlying technologies used in Bertsch et al. (2022). We use these technologies to extract difficult-to-measure features from speeches that provide insights into the Fed’s perception of its mandate.

The paper first identifies how the Fed’s attention has shifted over time relative to the dual mandate. Because the sample starts prior to the codification of the Fed’s dual mandate, the paper avoids measuring discussion of the dual mandate itself in the text. Instead, it uses a sentence transformer model (Reimers and Gurevych, 2019) to measure the similarity between the main components of the dual mandate—inflation, employment, and output growth— and each paragraph in a given speech.

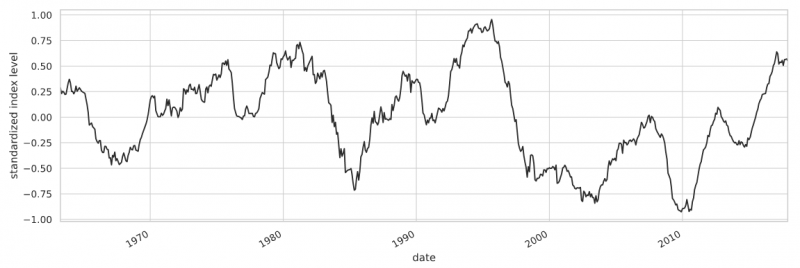

This exercise yields a measure of the “dual mandate” content of speeches, which is visualized in Figure 1. A high value of this measure indicates a higher intensity of dual mandate content in Fed speeches. The plot of this variable over time reveals that the Fed’s public communication focused narrowly on employment and output growth prior to the Great Moderation. It then shifted in the mid-1990s to a focus on balancing the dual mandate’s two competing objectives. Finally, following the Great Financial Crisis, discussions drifted away from the dual mandate and instead centered around financial stability considerations. In fact, formal structural break tests using the multiple break test of Bai (1997) and Bai and Perron (1998) reveal structural breaks in the “dual mandate” content series in 1996 Q3 and 2010 Q4.

Figure 1: The “dual mandate” content of speeches

A high value indicates a higher intensity of dual mandate content of Fed speeches

Note: This graphic is computed by measuring the similarity between the main components of the dual mandate—inflation, employment, and output growth— and each paragraph in a speech. The figure above shows the 2-year rolling mean of the standardized measure of all speech paragraphs in each month during the time window from 1960 to 2020.

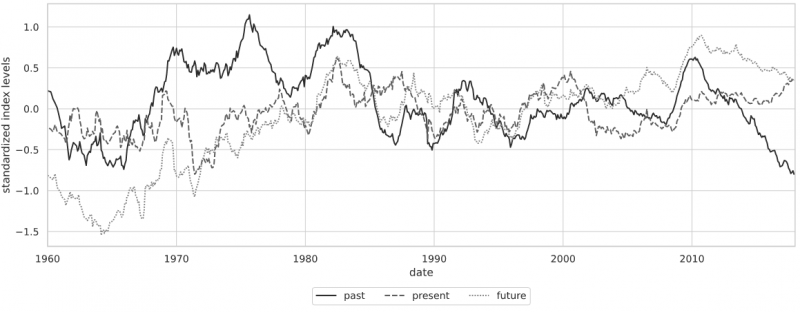

The methods employed in the paper allow us to delve into the findings further. In particular, an evaluation of paragraphs that have low “dual mandate” scores reveals that the most common topic is financial stability. Again, using sentence transformer models to compare the similarity of statements, we identify whether statements about financial stability relate to the past, present, or future; and whether they indicate that banking regulation or monetary policy should be used as a tool to achieve it. Figure 2 shows the relative frequency of material that focuses on the past, present, and future in Fed speech content. We can see that the focus on the past was lowest during the Great Moderation and during the period of unconventional policy after the Great Financial Crisis. The focus on the future was lowest at the beginning of the sample period, climbing to a higher level during the 1970s and 1980s, where it remained thereafter. This finding resonates with the acknowledgement of the importance of expectations for macroeconomic policymaking, which took center stage in the academic debate during the rational expectations revolution in the 1970s.

Figure 2: The temporal focus of content in speeches

A high value indicates a higher focus on the past, present of future in Fed speeches

Note: The figure above shows the standardized classification score for the speech tense for a temporal focus on the “past”, “present” and “future.” This is computed by classifying each paragraph and then computing the average score for each month, standardizing it, and then plotting the 2-year rolling mean during the time window from 1960 to 2020.

The paper shows that during tightening periods the Fed is more likely to discuss the use of monetary policy to achieve financial stability, as well as non-dual mandate topics. Conversely, the discussion is more likely to focus on monetary policy and the dual mandate topics of inflation and employment during easing periods. Extended Taylor rule regressions suggest that contemporaneous financial stability concerns are associated with a more accommodative monetary policy, while the leaning against the wind rationale is of a longer-term nature. Among the non-dual mandate topics we consider, discussion of financial crises has a negative effect on all asset returns, while discussion of financial stability only significantly affects equity and risky asset returns. The discussion tense also matters for asset returns, with a focus on either the past or present being associated with positive bond and safe asset returns and a focus on the future being better for equity and risky asset returns.

This paper employs the novel technology for text analysis to dissect the evolution of the Fed’s interpretation of its own mandate over time and to analyze the consequences of deviations from the Fed’s dual mandate for the conduct of monetary policy and for the relationship between asset prices and monetary policy stances. Transformer models provide us with a powerful tool to extract difficult-to-measure features from speeches that offer insights into the Fed’s changing perception of its mandate. Starting with a generic model of textual features has the advantage of avoiding the need to pre-specify the scope of text analysis to certain topics like financial stability. Moreover, it allows the unveiling of different layers of communication and capture of sophisticated text features, such as the policy discussion regarding the use of monetary policy to achieve a financial stability goal.

Bai, Jushan, “Estimating multiple breaks one at a time,” Econometric Theory, 13 (3), pp. 315–352, 1997.

Bai, Jushan and Pierre Perron, “Estimating and testing linear models with multiple structural changes,” Econometrica, 66 (1), pp. 47–78, 1998.

Bernanke, Ben, “The Aftermath of the Crisis,” Lecture 4, George Washington University School of Business, March 29, 2012.

Bertsch, Christoph, Isaiah Hull, Robin L. Lumsdaine, and Xin Zhang, “Central Bank Mandates and Monetary Policy Stances: through the Lens of Federal Reserve Speeches,” Sveriges Riksbank Working Paper Series No. 417, 2022.

Devlin, Jacob, Ming-Wei Chang, Kenton Lee, and Kristina Toutanova, “BERT: Pre-training of Deep Bidirectional Transformers for Language Understanding,” in Jill Burstein, Christy Doran, and Thamar Solorio, eds., Proceedings of the 2019 Conference of the North American Chapter of the Association for Computational Linguistics: Human Language Technologies, NAACL-HLT 2019, Minneapolis, MN, USA, June 2-7, 2019, Volume 1 (Long and Short Papers), Association for Computational Linguistics 2019, pp. 4171–4186.

Liu, Yinhan, Myle Ott, Naman Goyal, Jingfei Du, Mandar Joshi, Danqi Chen, Omer Levy, Mike Lewis, Luke Zettlemoyer, and Veselin Stoyanov, “RoBERTa: A Robustly Optimized BERT Pretraining Approach,” CoRR, 2019, abs/1907.11692.

Powell, Jerome, “New Economic Challenges and the Fed’s Monetary Policy Review” at the Federal Reserve Bank of Kansas City Jackson Hole Economic Symposium on “Navigating the Decade Ahead: Implications for Monetary Policy,” August 27, 2020.

Powell, Jerome, “Nomination Hearing” at the Senate Committee on Banking, Housing and Urban Affair, January 11, 2022.

Reimers, Nils and Iryna Gurevych, “Sentence-BERT: Sentence Embeddings using Siamese BERT-Networks,” in Kentaro Inui, Jing

Jiang, Vincent Ng, and Xiaojun Wan, eds., Proceedings of the 2019 Conference on Empirical Methods in Natural Language Processing and the 9th International Joint Conference on Natural Language Processing, EMNLP-IJCNLP 2019, Hong Kong, China, November 3-7, 2019, Association for Computational Linguistics 2019, pp. 3980–3990.

Vaswani, Ashish et al., “Attention is All you Need,” in Isabelle Guyon et al., eds., Advances in Neural Information Processing Systems 30: Annual Conference on Neural Information Processing Systems 2017, December 4-9, 2017, Long Beach, CA, USA, 2017, pp. 5998–6008.

See, e.g., Ben Bernanke’s deliberations in the College Lecture Series on the importance of maintaining financial stability as a corner stone of the Fed’s mission: “It’s now clear that maintaining financial stability is just as an important a responsibility as monetary and economic stability” (Bernanke, 2012).

See, e.g., Jerome Powell’s speech at the 2020 Jackson Hole Economic Policy Symposium: “With regard to the employment side of our mandate, our revised statement emphasizes that maximum employment is a broad-based and inclusive goal. This change reflects our appreciation for the benefits of a strong labor market, particularly for many in low- and moderate-income communities” (Powell, 2020).

See, e.g., Jerome Powell’s statement in a testimony to the Senate Committee on Banking, Housing and Urban Affairs: “We have a role to play. It’s a narrow one, but an important one. And that is it relates to our existing mandates. We don’t have a new mandate on climate change” (Powell, 2022).