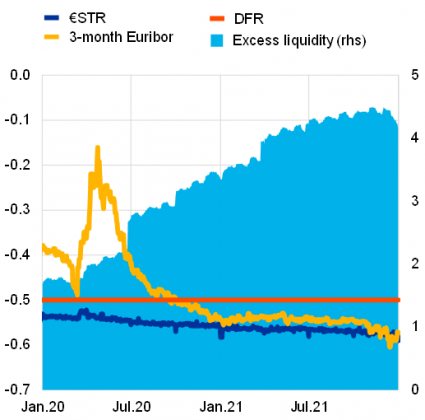

Non-bank financial institutions (NBFIs) had been increasingly holding deposits often resulting from the sale of securities to the Eurosystem. Since NBFIs do not fulfil the necessary Eurosystem eligibility criteria and thus do not have access to the Eurosystem balance sheet, they resorted to banks for liquidity storage by lending them liquidity, which banks in turn deposited with the Eurosystem by charging a spread. As a result, benchmark rates, such as €STR, declined below the DFR.