Using daily data on sovereign bond yields for 9 advanced economies, we highlight that the co-movement of yields is unusually high in the most recent period. We conduct a principal component analysis and decompose the sovereign yields into a global and local factors. The global factor usually explains much of the variation in 10-year yields. What is particularly striking over the recent months is the importance of the global factor in explaining 2-year yields. This suggests a common shock is driving expectations of monetary policy in the major advanced economies.

Historically, the dynamics of nominal bond yields of major advanced economies is characterized by periods of high co-movement and periods of dissociation. Sometimes the co-movement is only evident between groups of countries. How can we turn this stylized fact into a measure that we can track and compare over time? This policy brief explains one approach and what we can learn from this about the current monetary policy debate.

We consider daily data on 2-year and 10-year sovereign bond yields from January 1, 2015 to August 30, 2022 for 9 advanced economics: France, Germany, Italy, Spain, Canada, US, UK, Australia and Japan. Our first step is to identify a global factor common to all yields for each maturity. Technically, this is the first principal component. By construction, it is common to the time series of yields of all 9 countries. We then construct a series for each country of that part of their yields that cannot be explained by the global factor. Countries with similar patterns of yield dynamics are then grouped together (France, Germany and Spain) and (Australia, Canada, United Kingdom, United States) to identify a “euro-area” factor and an “Anglo-Saxon” factor, respectively. Italy is not part of the group used to identify the euro-area factor because of its low correlation with the rest of the group. Japan is a factor all by itself. For 10-year yields we find that we need to split the “Anglo-Saxon” countries in North America and Australia/UK. To estimate the euro-area factor, we again extract the first principal component which explains the co-movement of the residual components of those countries’ yields after accounting for the contribution of the global factor. We do the same for the Anglo-Saxon factor. Finally, we regress the yields of each country on all these factors to establish the importance of each factor for each yield. The residual that we cannot explain is labelled the idiosyncratic factor.

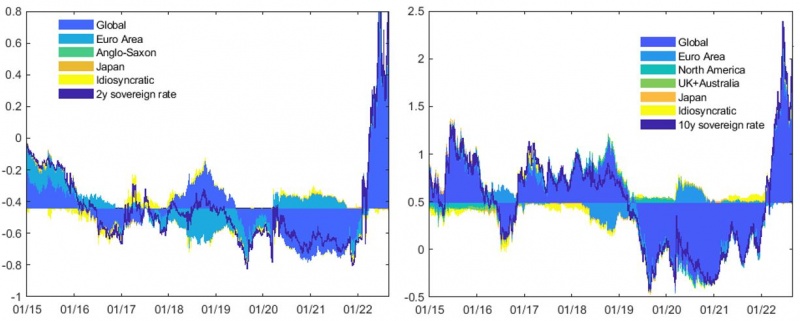

Figure 1 illustrates the decomposition of the French 2-year and 10-year sovereign yields. The solid line depicts the yield, while each coloured area corresponds to the contribution of each factor. For instance, the dark blue area reflects the contribution of the global factor. Two observations stand out. Firstly, our factors can explain almost all of the variations in these yields: the idiosyncratic contributions are fairly small. Secondly, the global factor is much more important in explaining longer term maturities than shorter term ones. This suggests that sovereign bond markets are globally highly integrated.

Figure 1: Global-local decomposition of French 2-year and 10-year sovereign yields

Source: Bloomberg, authors’ calculations. Note: Solid lines represent the yields. Areas show the contribution of each factor relative to the 2015-2022 average rate. Latest observation: 30/08/2022.

We investigate the nature of the global factor. It is sometimes argued that US markets drive a global financial cycle (Miranda-Agrippino and Rey, 2021). In this case, we would expect to find the highest correlation between US yields and the global factor. We do not find this. Rather, we find that the US correlation is even below the median for both maturities.

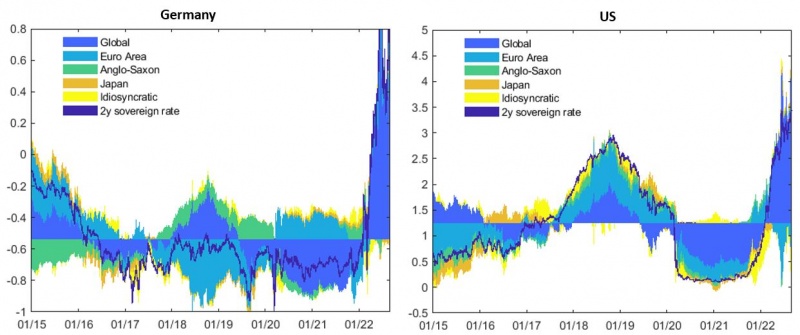

Figure 2 illustrates the decompositions for Germany and the United States for 2-year maturity. The patterns highlighted for France also hold for Germany and the US. Interestingly, we observe that all factors are present in all yields. So, for example, the Japan factor has an influence on euro-area bond yields and the euro-area factor influences US yields. Above all, we see that the global factor does not always explain most of the yield level, suggesting that currency areas have significant monetary sovereignty in the short-term. That is, policy interest rates can diverge in response to local shocks.

If we focus on the most recent period, we see that 2-year yields in Germany and the US have been strongly driven by the global factor since early 2022. This suggests that monetary policy expectations have been responding to a common global shock, which could be related to global inflation pressures. Still, the pace of monetary policy normalization is different on both sides of the Atlantic, the euro-area factors hence contributing to slowdown the increase in US yields.

Figure 2: Global-local factor decomposition of the German and US 2Y sovereign nominal yields

Source: Bloomberg, authors’ calculations. Note: Solid lines represent the yields. Areas show the contribution of each factor relative to the 2015-2022 average rate. Latest observation: 30/08/2022.

Miranda-Agrippino, S. and Rey, H., 2021. “The global financial cycle,” NBER Working Paper No. 29327.