Make-up monetary policy strategies in which the central bank keeps the policy rate low for long to compensate for past inflation misses can be effective in stabilizing the economy and reducing the probability of hitting the effective lower bound. Their effectiveness hinges on agents’ inflation expectations being forward-looking. When the latter assumption is relaxed, the advantage of make-up strategies over inflation targeting remains, but it is smaller.

In the last two years, the Federal Reserve and the European Central Bank have reviewed their monetary policy strategies.2 The reviews were motivated by the need to adapt the strategies to a macroeconomic environment (“New Normal”) where the natural rate of interest is low and the risk that the policy rate hits its effective lower bounds (ELB), limiting the space for supporting the economy, is elevated. Both central banks acknowledged that persistently below-target inflation requires a persistent monetary policy response.3

In a recent paper (Busetti, Neri, Notarpietro and Pisani, 20214), we study the stabilization properties of monetary policy strategies alternative to inflation targeting (IT) in this kind of a low-natural rate environment. We use a medium-scale New Keynesian dynamic stochastic general equilibrium model calibrated on euro-area data, similar to Smets and Wouters (2003), widely adopted in central banks analyses.5 The alternative strategies are characterized as interest rate rules in which monetary policy responds to deviations of inflation from the target (2 per cent) and to output fluctuations. IT is compared to three so-called “make-up” strategies: (i) price level targeting (PLT), where the central bank responds to the deviations of the price level from a given target path; (ii) temporary price level targeting (TPLT), which is implemented only when the policy rate reaches its ELB; (iii) average inflation targeting (AIT). We consider two alternative assumptions on the formation of inflation expectations: they can be either rational (forward-looking), or “hybrid”, i.e. an average of rational and adaptive (backward-looking) expectations.

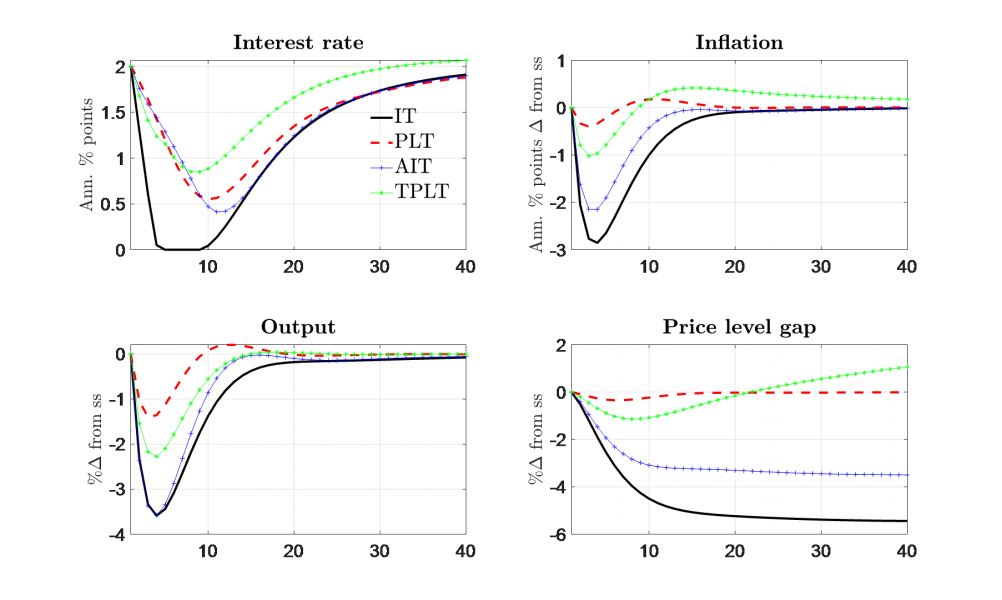

Figure 1 reports the impulse responses of the policy rate, inflation, output and the price level gap to a recessionary demand shock of the alternative monetary strategies under the benchmark case of rational expectations.6 The lower current and future aggregate demand induces firms to decrease the production and the price of goods. The central bank responds to the fall of economic activity and inflation by cutting the policy rate. Under IT (black solid lines), the policy rate hits the ELB: the real interest rate (not reported) correspondingly increases, amplifying the negative effects of the recessionary shock. Under PLT (red-dashed lines), households anticipate that the central bank could keep the policy rate “low for long” to achieve higher inflation in the future to compensate for the below-target inflation. Output and inflation fall by less compared to IT. The price level gap is stabilized and inflation remains close to its target. A TPLT strategy delivers similar results, although its effectiveness is lower compared to PLT as the central bank reverts to IT away from the ELB. Under AIT, the central bank targets a backward-looking average inflation rate and therefore responds gradually to the recessionary shock. Also in this case, households anticipate that the policy rate will remain persistently low. Under none of the three make-up strategies the policy rate reaches the ELB.

Figure 1. Impulse responses to a recessionary demand shock

Source: Busetti et al. (2021). Note: quarters on the horizontal axis; on the vertical axis, percent deviations from the baseline; inflation rate: annualized percentage point deviations; interest rate: annualized percentage points, level. For AIT, the chart reports results for the case of a 2-year window.

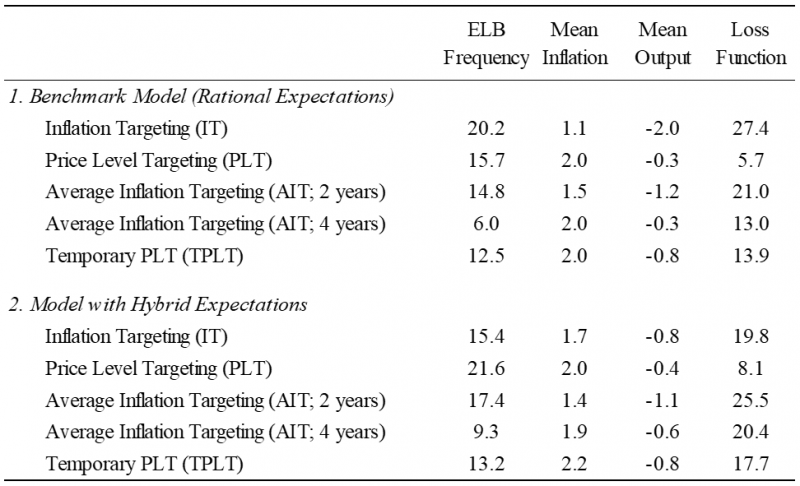

In Table 1, we provide a ranking of the alternative strategies in terms of the frequency of ELB episodes, the mean of inflation and output, and a quadratic loss function. The ranking is based on stochastic simulations in which the economy is repeatedly hit by demand and supply shocks. Under rational expectations (upper part of the table), PLT is the most effective strategy in stabilizing inflation and output, and reducing the frequency of ELB episodes. TPLT and AIT are also effective in reducing ELB episodes, although this comes at the cost of a lower mean output (reported as percentage deviation from its steady state level).

Table 1. Summary results for the alternative monetary policy strategies

Source: Busetti et al. (2021). The ELB frequency is reported as percentage of simulated periods. The loss function is defined as: L = σ2(π) + 0.5 σ2(y), where σ2(π) is the variance of inflation and σ2(y) is the variance of output.

The effectiveness of make-up strategies crucially hinges on the anticipation effect implied by rational expectations.7 If agents’ inflation expectations are partly adaptive, incorporating the past-realized inflation rates, the efficacy of make-up strategies may be reduced. The lower part of Table 1 reports the results for the case of “hybrid” inflation expectations. Since households and firms are less forward-looking, they take into account the future consequences of a shock to a lesser extent compared to the case of rational expectations. For this reason, the make-up strategies, which imply a persistent degree of monetary accommodation under recessionary shocks, are somewhat less effective. A wider window improves AIT stabilization properties, in particular under hybrid expectations.

Our analysis highlights the important role that “low for long” policies can play in delivering price stability, in particular when agents’ expectations are forward-looking, as also shown by Bernanke et al. (2019) for the US.8 These policies can benefit from central banks’ communication aiming at steering inflation expectations and the economic behavior of both expert and non-expert audiences.

Banca d’Italia, Directorate General for Economics, Statistics and Research. The views expressed are those of the authors and do not necessarily reflect the official views of Banca d’Italia or the Eurosystem. Corresponding author: stefano.neri@bancaditalia.it.

The Federal Reserve statement on longer-run goals and monetary policy strategy is available at: https://www.federalreserve.gov/monetarypolicy/review-of-monetary-policy-strategy-tools-and-communications-statement-on-longer-run-goals-monetary-policy-strategy.htm. For the European Central Bank’s strategy review see: https://www.ecb.europa.eu/home/search/review/html/index.en.html.

For example, the ECB communication states that “[…] When the economy is operating close to the lower bound on nominal interest rates, it requires especially forceful or persistent monetary policy action to avoid negative deviations from the inflation target becoming entrenched. This may also imply a transitory period in which inflation is moderately above target”. See https://www.ecb.europa.eu/press/pr/date/2021/html/ecb.pr210708~dc78cc4b0d.en.html .

Busetti, F., Neri, S., Notarpietro, A., Pisani, M. (2021). Monetary policy strategies in the New Normal: A model-based analysis for the euro area. Journal of Macroeconomics, forthcoming.

Smets, F., Wouters, R. (2003). An estimated dynamic stochastic general equilibrium model of the euro area. Journal of the European Economic Association, 1 (5), 1123–1175.

The price level gap is the difference between the actual price level and its targeted path.

Rational expectations may be a too restrictive assumption when large shocks affect the inflation process. Moreover, during the transition to a new monetary policy strategy, expectations formation mechanisms that include some adaptive components may be more appropriate. See Bernanke, B. S., M. T. Kiley and J. R. Roberts (2019), Monetary policy strategies in a low-rate environment, AEA Papers and Proceedings, 109: 421-426.

Bernanke, B. S., M. T. Kiley and J. R. Roberts (2019), Monetary policy strategies in a low-rate environment, AEA Papers and Proceedings, 109: 421-426. Similar arguments are also included in: “The ECB’s price stability framework: past experience, and current and future challenges” Work stream on the price stability objective, European Central Bank, Occasional paper series No. 269, September 2021.