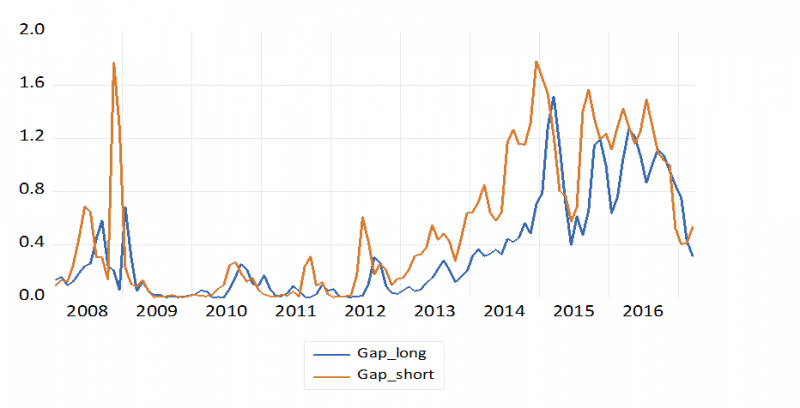

There is a gap between experts’ inflation forecasts and inflation expectations by private agents (Figure 2). Website-based communication by central banks can influence inflation expectations through the information and news channel. This study uses a new dataset from Google Analytics on ECB website traffic as proxy for visitors’ attention to its communication. We conduct several econometric tests with daily data to measure the impact of ECB communication on the information demand of the public and ultimately on inflation expectations. Overall, this study shows that website attention, as captured by search activity of visitors, influences euro area inflation expectations. We demonstrate that increased website attention can help close the gap between market-based inflation forecasts and longer-term professional expectations.

Public communication by central banks has often helped them to stabilise inflation expectations around the inflation target (Issing, 2005). Earlier studies have shown that information provided by central banks may have a larger impact on market expectations than private information (Amato and Shin, 2003). The Internet has made it easier for the public to gather relevant information, while increasing the range of audiences that central banks can reach. Because of its timely and non-discriminatory information provision, central bank websites have become a key communication tool for transmitting their monetary policy narratives (Fracasso, Genberg and Wyplosz, 2013).

Today, little is still known about whether website-based communication influences the expectations of economic actors. We argue that knowledge about visitors’ information search behaviour on a central bank’s website not only gives clues about their information needs on monetary policy, but also on the formation of their inflation expectations in case the central bank’s primary objective is price stability. The seminal study by Carroll (2003) has demonstrated that more news coverage on inflation can bring households’ inflation expectations closer to the expectations of professional forecasters. Inflation expectations of professional watchers may adjust faster to news than inflation expectations of households, while the success of central banks to stabilise inflation close to target may have made economic actors less attentive to news (Coibion, Gorodnichenko, Kumar and Pedemonte, 2020). In this paper, we examine whether attention of website visitors to the ECB communication has helped to stabilise euro area inflation expectations.

Several forms and channels of communication between the central bank, financial markets and the public exist. The famous Shannon and Weaver model (Shannon, 1948; Shannon and Weaver, 1949) explained how central bank communication impacts on audiences. In this model, a central bank can be considered as emitter of an information signal, while the public is the receiver of it. The central bank can choose the information signal on monetary policy (time and content) and the communication channel, while its audiences can obtain monetary news either directly from the central bank (information or news channel) or indirectly via intermediaries (media channel).

An empirical measurement of the effects of communication on inflation expectations is possible because the expectation formation process proceeds in two main stages (Eusepi and Preston, 2010): (1) before the central bank communication people form their expectations based on atheoretical beliefs; and (2) after the communica-tion the central bank credibly announces its monetary policy, and people must incorporate the news in their expectation model. This setting allows detecting announcement effects through the information channel (updating of beliefs) or the news channel (change in the number of informed subjects) or both (Lamla and Vinogradov, 2019). The empirical measurement of the transmission is further facilitated, if the central bank provides clear information on policy objectives, the economic outlook, and possibly the likely path for future monetary policy decisions is provided. In the following, we focus on the information and news channel.

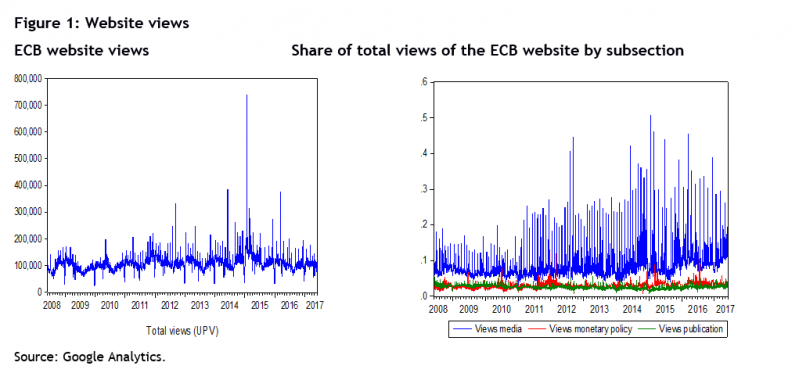

Big data have become an important aspect of the analysis of the decisions of economic agents (Choi and Varian, 2012). To assess the public’s information demand to ECB communication, we use a data set on visits of the ECB’s website. The digital footprints of individuals on the ECB website allow us to track website traffic on a daily basis, and thus to measure the public’s information demand to ECB communication. Our novel dataset on search volumes of visitors was extracted with Google Analytics. The new dataset covers daily search activities by the public during 2008 and 2017 for the ECB website. Breakdowns of search activity by external users are available by sections of the ECB website, thereby distinguishing the information demand by content. The ECB provides information that can be considered monetary news in the website subsection ‘Media’, whereas the subsections ‘Research & Publications’ and ‘Monetary Policy’ provide background and institutional information. Focussing on the accesses of the ‘Media’ subsection allows us to disentangle monetary news from other website information. For example, communication on interest rates at press conferences show up in the subsection ‘Media’. Strong increases in media attention on Governing Council meeting days confirm the importance of press conferences as a key communication event of the ECB (see Figure 1).

Google Analytics provides anonymous tracking of website visitors and relies on cookies which are stored on the user’s device. The tool tracks users who have initiated at least one session during the specified date range. A Unique Page View (UPV) aggregates page views that are generated by the same user during the same session. It refers to the number of sessions during which a website page was viewed. When a user visits a page several times during a session, it is counted as one UPV. Likewise, information about the number of visitors is available at the same frequency. The number of unique visitors refers to individuals visiting the ECB website and is measured by the visitor’s IP address.

Information demand drives inflation expectations

Taking a demand perspective, we analyse whether visitors’ activity on the ECB’s website influences private forecasts of future inflation and whether it reduces the gap between market forecasts and professional forecasters. Because previous studies on media attention measure the information supply derived from newspapers or TV, they only allow inference about whether agents were actively looking for the respective information, if information demand and supply are equal. Our approach based on search volumes of visitors is more targeted than supply-based approaches, since the proxy for information on demand captures the deliberate decision of agents to obtain more (or less) information on the ECB’s monetary policy.

There is a gap between experts’ inflation forecasts and inflation expectations by private agents (Figure 2). This study shows that website attention, as captured by visitor activity, influences euro area inflation expecta-tions. In a first step, we show that the public’s information demand for monetary news is driven by the (absolute) size of the ECB’s monetary policy shock and that it is also sensitive to different degrees of uncertainty and the complexity linked to non-standard monetary policy measures. In a second step, we show how these factors influence euro area inflation expectations.

Figure 2: Gap measures of euro area inflation expectations (percentages per annum)

Source: ECB, Thomson Reuters.

Notes: We show monthly observations. Gap_short (Gap_long) is the squared deviation between ILS1y1y (ILS5y5y) and the 5-year ahead inflation forecast from SPF (survey of professional forecasters).

In terms of methodology, a high frequency identification (HFI) is at the core of the econometric analysis. It explains (daily) movements in search activity on press conference days by coinciding (high-frequency) monetary policy shocks and controls. The HFI method has received particular attention in studies using financial asset prices that aim at disentangling the causal impact of monetary policy communication on financial asset prices.

Based on these regressions, we find that increased website attention contributes to narrowing the gap between market-based forecasts and (the mean of) longer-term professional inflation expectations. Our findings add to the theoretical evidence on the existence of an information and news channel.

Conclusion

Because of a tight two-way relationship between central banks and financial markets, there is a central role of financial market expectations in the conduct of monetary policy. For this reason, a central bank may not aim to directly reach all private actors, but its website-based communication can increase the awareness of consumers about central bank announcements. In this respect, both the website and the media are important transmission channels between the central bank and the public. In line with the predictions from theoretical communication models, this study shows that website attention, as captured by visitor activity, influences euro area inflation expectations and helps to close the gap between market-based inflation forecasts and longer-term professional expectations.

Amato, J., Shin, H., 2003. Public and private information in monetary policy models. BIS Working Paper No. 138.

Carroll, C., 2003. Macroeconomic expectations of households and professional forecasters. The Quarterly Journal of Economics, 118, 269-298.

Choi, H., Varian, H., 2012. Predicting the present with Google Trends. The Economic Record, 88 (Special Issue), 2-9.

Coibion, O., Gorodnichenko, Y., Kumar, S., Pedemonte, M., 2020. Inflation expectations as a policy tool? Journal of International Economics, 124, Article 103297.

Eusepi, S., Preston, B., 2010. Central bank communication and expectations stabilization. American Economic Journal: Macroeconomics, 2, 235-271.

Fracasso, A., Genberg, H., Wyplosz, C., 2013. How Do Central Banks Write? An Evaluation of Inflation Targeting Central Banks. Geneva Reports on the World Economy Special Report 2, Geneva.

Issing, O., 2005. Communication, transparency, accountability: monetary policy in the twenty-first century. Federal Reserve Bank of St. Louis Review, 87(2), 65-83.

Lamla, M., Vinogradov, D., 2019. Central bank announcements: Big news for little people?, Journal of Monetary Economics, 108, 21-38.

Shannon, C., 1948. A mathematical theory of communication, Part I. Bell Systems Technical Journal, 27, 379-423.

Shannon, C., Weaver, W., 1949. A Mathematical Model of Communication. Urbana, IL: University of Illinois Press.

At the time the paper was written.