The holy grail of cross-border payments is a solution allowing cross-border payments to be immediate, cheap, universal, and settled in a secure settlement medium. The search for such a solution is as old as international commerce and the implied need to pay. Based on Bindseil and Pantelopoulos (2022), this policy brief describes in particular one vision as to how the holy grail can be found within the next decade through interlinked instant payment systems with a FX conversion layer. In doing so, the settlement mechanics are explained, and an assessment is provided on its potential to be the holy grail of cross-border payments.

Cross-border payments consist of transactions where the payer and payee (and typically their financial institutions) are located in different jurisdictions (e.g. Bech, Faruqui and Shirakami, 2020). They are more complex than domestic payments as they often involve different national legal and regulatory frameworks, more than one currency, multiple time zones, and often need to be facilitated through several intermediaries and financial market infrastructures (CPMI, 2020).´

The holy grail of cross-border payments is a solution which allows cross-border payments to be (1) immediate, (2) cheap, (3) universal, in the sense of covering ideally every addressable party in the world, and (4) settled in a secure settlement medium, such as central bank money. Unlike settlement in commercial bank money – which by definition implies the potential for liquidity and/or credit risk to arise for end-users – both forms of risk do not apply when transactions are settled in central bank money (see Bindseil, 2019, Chapter 2).

In 2020, improving cross-border payments was set as a key priority for the G20: the G20 asked the Financial Stability Board (FSB), working with the Bank for International Settlements‘ Committee on Payments and Market Infrastructures (CPMI) and other standard-setting bodies to co-ordinate a three-stage process to develop a roadmap to enhance cross-border payments.

In Bindseil and Pantelopoulos (2022), we reviewed in total 6 technical options for achieving the holy grail: modernised correspondent banking; emerging Fintech solutions; Bitcoin; global stablecoins; interlinking domestic fast payment system through a cross-system and FX conversion layer; future CBDC. This policy brief argues that the holy grail of cross-border payments can be found within the next ten years, if also the compliance with AML/CFT is made sufficiently efficient. While several options have further potential, we see particular benefits in interlinked instant payment systems with a FX conversion layer. We therefore focus on this solution. The settlement mechanics are explained, and an assessment is provided on its potential to be the holy grail of cross-border payments.

The basis for interlinking instant payment systems in a cross-border context is the rise of domestic instant payment platforms in many jurisdictions around the globe, as noted by CPMI (2016). Instant (or “fast”) payments are payments in which the transmission of the payment message and the availability of final funds to the payee occur in real time or near-real time and as close to a 24/7 basis as possible.

The interlinking of national payment systems as one option for enhancing cross-border payments constitutes building block 13 of the FSB/CPMI work on cross-border payments (CPMI, 2020). The creation of bilateral or multilateral arrangements – through interlinking payment systems – and integrating an instant FX conversion layer – would in principle allow for cross-border payments to be completed in central bank money. A number of preconditions however need to be fulfilled for this:

A number of initiatives aim at interlinking instant payment systems in different currencies. For instance, Project Nexus, is a blueprint for interlinking instant payment systems cross-border, published by the Bank of International Settlements Innovation Hub Singapore Centre and the Monetary Authority of Singapore (MAS). The July 2021 report by the BISIH (2021a) describes the potential benefits of linking instant payment systems with the purpose of completing cross-border payments. The report notes that the interlinking of existing domestic payment platforms face a number of challenges, such as adding a conversion layer, and AML/CFT compliance checks. In addition, it highlights the difficulties of making different domestic instant payment processes compatible with one another (e.g. data formats, scheme rules, etc). Such complexities would obviously increase exponentially the more one links a greater number of domestic instant payment systems through bilateral solutions. For example, it is noted that “a network of 20 countries would require 1901 country-to-country links”, as each payment system operator would be required to maintain 19 separate links with each payment system operator. Nexus would remedy such issues by setting one single standard and processing model for cross-border and cross-currency payments. The Nexus platform would also cover currency conversion, through the system coordinating with FX providers to ensure that the currency of the payer is swapped for the currency of the payee via FX providers competing against one another to provide the best swap rates. Although FX providers can set a quote which is below the market rate, they are not permitted to “exit” the market (BISIH, 2021a). Moreover, it is anticipated that through “pre-screening” the system will be designed to mitigate common sources of delay through automatic processes (i.e. AML/CFT). Finally, with regards to message formats, Nexus will employ ISO 20022, but will provide a message translation service for those payment systems which do not use ISO 20022 (BISIH, 2021b).

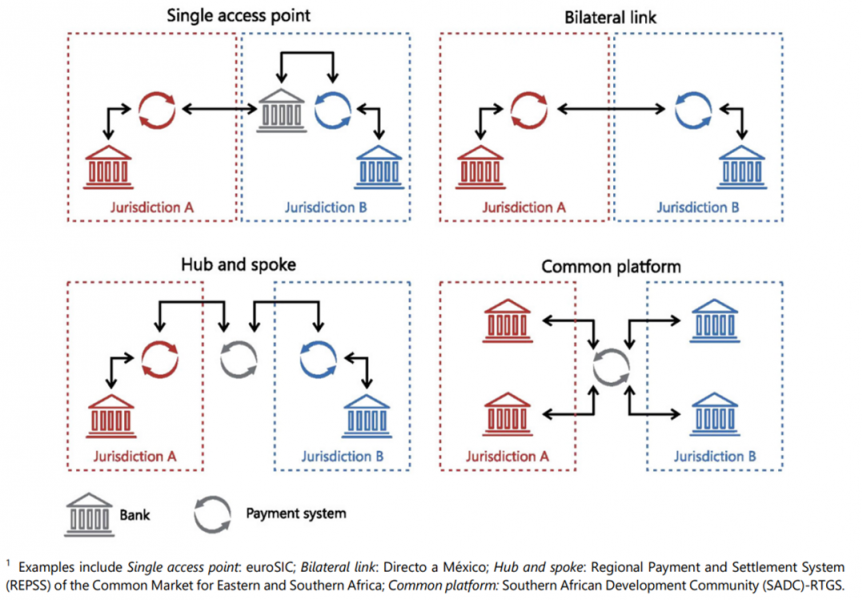

Figure 1: Interlinking payment systems1

Source: CPMI. (2022). Interlinking payment systems and the role of application programming interfaces: a framework for cross-border payments. Report to the G20. Bank of International Settlements, Basel.

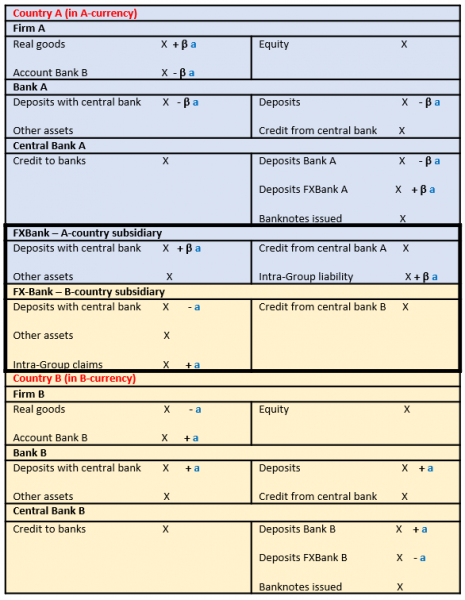

The following steps take place in this case:

Table 1: Instant cross-border payment with central FX conversion layer

There are a number of advantages of interlinking domestic instant payment systems including a competitive FX conversion layer, as also developed in the Nexus report (BISIH, 2021a):

Potential challenges relate to the technicalities and costs of interlinking and setting up the competitive and instantaneous currency conversion layer, which requires willingness and ability to collaborate not only by network service providers and message standard setters (e.g. SWIFT, ISO 20022) but also by legislators and central banks, i.e. there needs to be a political will to remove possible barriers and to make the arrangement legally sound, also in contingency scenarios, such as the default of a party to a payment. In other words, the legal and political set up costs have to be added to the other fixed costs of such arrangements. Interlinking will probably not be a solution for very narrow cross-border payment corridors in which the costs of the interlinking will be relatively high, and where it will be difficult to organize sufficient competition within the FX conversion layer, also in view of liquidity costs for the FX conversion services providing banks.

A key element of the efficiency of interlinking will be the width of the bid-ask spread on which users can rely. This width will depend on factors such as (i) volatility of exchange rate; (ii) cost and reliability of liquidity available to FX conversion service providing banks in both currencies; (iii) duration for which a quote needs to remain binding (in view of processing times in the payment initiation phase). Notwithstanding these various challenges, it seems that for more important corridors the interlinking of domestic instant payment systems can constitute the holy grail of cross-border payments: it appears efficient, relies on existing tested and successful infrastructures, and avoids closed loop systems and the associated fragmentation and potential abuse of market power, whilst preserving monetary sovereignty. Global initiatives like Nexus could reduce the set-up costs for individual payment corridors by realizing economies of scale on the technical side and by providing a benchmark for domestic system providers and legislators.

This policy brief has argued that through interlinked instant payment systems, the holy grail – whereby cross-border payments can be (1) immediate, (2) cheap, (3) universal in terms of reach, and (4) be settled in a secure settlement medium such as central bank money – is in reach for the first time. This is thanks to the rapid decline in the costs of global electronic data transmission and computer processing, new payment system technology (allowing for instant payments), innovative concepts (such as the interlinking of payment systems including a currency conversion layer; or CBDC), and unprecedented political will and global collaboration like the G20 work on enhancing cross-border payments. Progress to make compliance with AML/CFT rules more efficient and reduce related costs and legal risks is however also necessary.

Bank of International Settlements Innovation Hub (BISIH). (2021a). Nexus – A blueprint for instant cross-border payments. Bank of International Settlements, Basel

Bank of International Settlements Innovation Hub (BISIH). (2021b). Liquidity Providers. Available at: https://nexus.bisih.org/fx-providers-and-liqudity-providers/liquidity-providers

Bech, M. L., Faruqui, U., & Shirakami, T. (2020). Payments without borders. BIS Quarterly Review, March.

Bindseil, U. (2019). Central Banking before 1800: A Rehabilitation. Oxford University Press.

Bindseil, U., & Pantelopoulos, G. (2022). Towards the Holy Grail of Cross-Border Payments. ECB Working Paper No. 2693.

CPMI. (2016). Fast payments – Enhancing the speed and availability of retail payments. Bank of International Settlements, Basel.

CPMI. (2020). Enhancing cross-border payments: building blocks of a global roadmap. Stage 2 report to the G20 – technical background report. Bank of International Settlements, Basel.

This number should probably be 380 (20*19)