The views expressed in this column are those of the authors and do not necessarily represent those of the European Central Bank or the Eurosystem. The associated paper “Inflation and floating rate loans: Evidence from the euro area” is part of the ChaMP Research Network.

Abstract

This policy brief investigates whether the effectiveness of monetary policy is hindered by the presence of floating-rate corporate loans. After a rate hike, firms with floating-rate loans keep prices elevated to offset higher borrowing cost, a supply-side effect offsetting the standard demand-side transmission. Using monthly data on product-level prices, industry-level inflation rates and the confidential ECB euro-area credit register from 2021 to 2023, we find that the short-run impact of monetary tightening on inflation is 50% smaller when firms rely on floating-rate loans. This effect is stronger for firms that rely more on working capital to finance production and when they can easily pass on higher prices to their sticky customer base (customer capital). Overall, if firms across the euro area had a lower reliance on floating-rate loans, inflation would have been 0.8 percentage points lower in 2022-2023. Our findings highlight a novel dimension of the well-known heterogeneity in the transmission of monetary policy in the euro-area and suggest that monetary policymakers should consider the structure of floating-rate corporate debt when assessing the likely effects of rate hikes on inflation.

Central bankers increase interest rates to discourage investment and consumption and hence lower inflation. This view, embedded in standard macroeconomic models and policymaking, assumes that tighter monetary conditions reduce aggregate demand, which in turn brings inflation down. Households with mortgages, for example, reduce spending as interest payments rise (Di Maggio et al. 2017; Cloyne et al. 2020), while firms scale back investment when credit tightens (Bernanke and Gertler 1989). Yet this view often overlooks a parallel and potentially offsetting supply-side mechanism: firms exposed to rising borrowing costs may keep their prices elevated to protect current cash flows.

This alternative, supply-side transmission channel is relevant for recent euro-area debates, as the disinflationary impact of the ECB’s tightening has varied across countries and sectors. For instance, some have highlighted the role of supply chain disruptions and of firms taking advantage of such disruptions to raise prices ‘greedflation’ (Acharya et al., 2024; Franzoni et al., 2024), while others show the role of firms’ expectations in pricing decisions (Baumann et al., 2025). Our research identifies a novel factor in this mix: the prevalence of floating-rate loans among firms. When policy rates rise, these firms see their interest expenses increase immediately and respond by hiking prices, relative to fixed-rate firms. Doing so allows floating-rate firms to maintain or boost their current cash flows at the expense of losing future profitability and market shares. In this way, floating-rate corporate debt dampens the intended disinflationary effects of monetary policy.

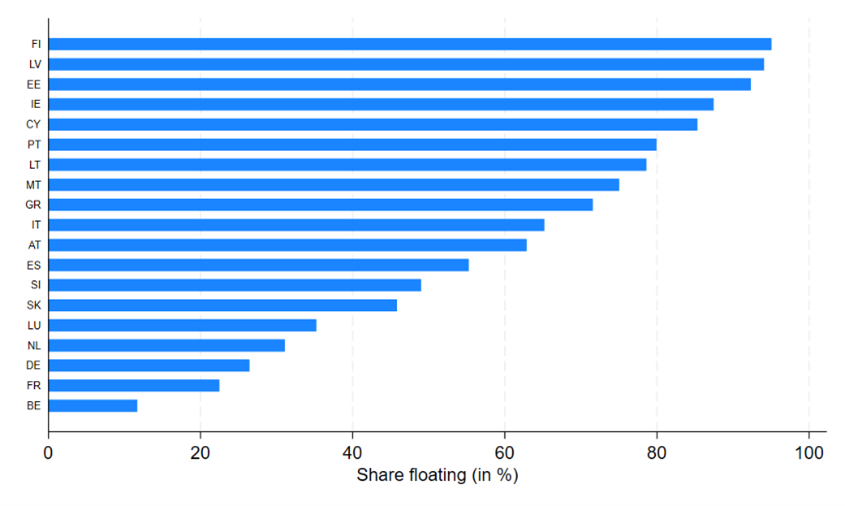

Our analysis in Core et al., (2025) combines monthly euro-area credit register data (AnaCredit) with industry-level inflation figures and product-level prices from 2021–2023. The euro area is not all the same when it comes to corporate loan structures. Figure 1 shows that in countries like Germany and France, most corporate borrowing is at fixed rates. But in the periphery, notably Italy, Spain, and Portugal, floating-rate loans dominate.

Figure 1. Share of Floating-rate Loans by euro-area country, 2021

This heterogeneity matters for how monetary policy affects inflation. We find that in markets where firms rely more heavily on floating-rate loans, the ECB’s monetary tightening had a significantly weaker impact on inflation. Specifically, the short-run disinflationary effect of a rate hike was 50% smaller in these “floating-rate markets.” Even at the firm-product level, we show that a 1 percentage point increase in the policy rate reduces price growth by 0.51 percentage points for firms using fixed-rate loans. But for firms relying on floating-rate credit, the effect is less than half that size (0.23 percentage points).

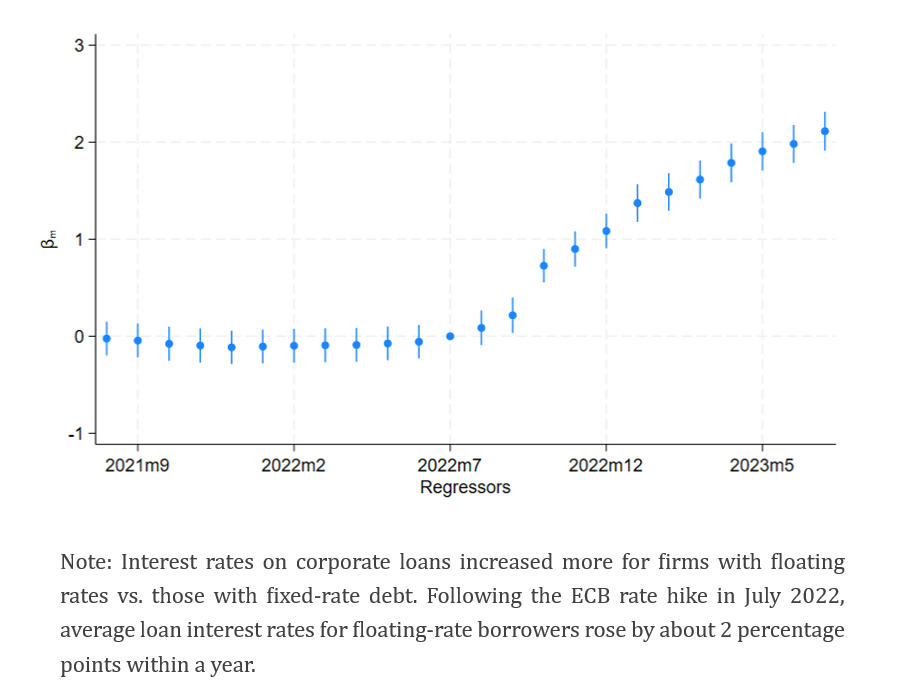

This pattern arises because floating-rate debt creates an immediate link between the policy rate and a firm’s cost of funding. Figure 2 shows how the interest rates faced by floating-rate firms surged almost instantly after the ECB began raising the Deposit Facility Rate. Fixed-rate firms, by contrast, saw much smaller increases, as their contracts were locked in before the hiking cycle began.

Floating-rate firms may then have incentives to increase prices and offset the decrease in their cashflows (Gürkaynak et al., 2022). At least in the short-run, in fact, it may be optimal for a financially constrained firm to increase prices, sacrificing future market shares to boost current cash flows (Gilchrist et al. 2017).

Figure 2. Loan rate increases for firms with floating-rate loans

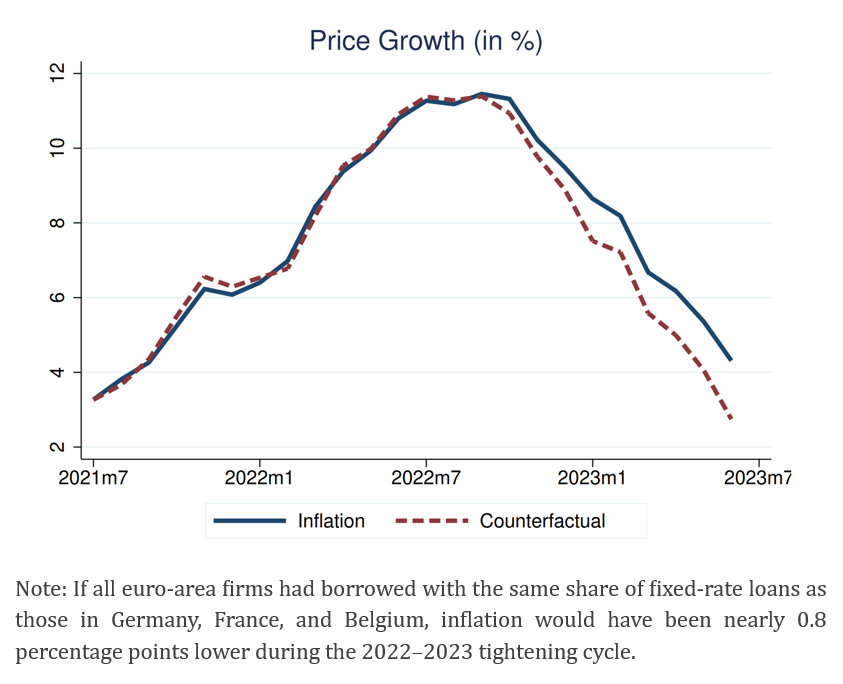

The difference in floating-rate loans matters in the aggregate. To assess the economic relevance of this channel, we simulate a counterfactual scenario: What if firms across the euro area had borrowed with the same share of fixed-rate debt as firms in the same industry in countries where such contracts are most common (say, Germany)? Figure 3 shows the result: inflation would have been nearly 0.8 percentage points lower by the end, converging faster to the ECB’s 2% target.

The floating-rate channel we identify is distinct from traditional lending channels: it operates not through reduced loan supply or impaired credit access, but through firms’ reactions to increased financial costs on existing loans. In that sense, it resembles a financially induced cost shock, a concept discussed during earlier inflation episodes (Gaiotti and Secchi, 2006), but largely sidelined in recent models.

Figure 3. Real and counterfactual (simulated) inflation

Firms do not respond uniformly to increased funding costs. There are two key dimension of heterogeneity.

First, when firms rely on credit to finance production and have to pay for input of production (e.g., materials and labor) upfront, their production is affected by changes in the monetary policy rates. Accordingly, we find a stronger impact of floating-rate loans on inflation in markets characterized by firms with high working capital, defined as the ratio of the stock of inventories plus trade receivables over assets.

Second, only firms operating in concentrated markets, i.e., those with high “customer capital”, appear able to pass through interest rate hikes via higher prices. This is consistent with the theory that firms with pricing power will prioritise short-term cash flows over long-term customer loyalty when under financial stress (Gilchrist et al. 2017). By contrast, in highly competitive sectors, firms cannot easily raise prices without losing customers. In such markets, the supply-side transmission is muted. These findings imply that fostering competition can enhance the effectiveness of monetary policy, by limiting the ability of firms to offset interest rate hikes through higher prices.

Our findings suggest that monetary policymakers should consider the structure of floating-rate corporate debt when assessing the likely effects of rate hikes on inflation. This is especially important in the euro area, where cross-country variation in floating-rate corporate loans is substantial.

Moreover, our results highlight another dimension of the well-known heterogeneity in the transmission of monetary policy in the euro-area and contribute to the debate about the ‘long and variable lags’ of monetary policy (Friedman, 1961). When the policy rate increases borrowing costs for firms with floating-rate debt, it can look, at least temporarily, like inflation is not responding. Understanding this delay can prevent premature policy reversals or misinterpretation of inflation persistence.

Finally, our results point to a potential role for prudential or competition policy. Encouraging fixed-rate borrowing for corporate borrowers through financial regulation, or improving competition in product markets, could enhance monetary transmission and reduce inflation inertia.

The fight against inflation depends not just on how much central banks raise rates, but on how those rate changes affect firms’ behaviour. In a world where many euro-area firms borrow at floating rates, the monetary transmission mechanism includes a cost-based supply-side channel: higher interest rates lead to higher prices at some firms, not lower ones. This does not mean monetary policy is ineffective. But it does mean that policymakers must account for the financial structure of the economy and the distribution of pricing power among firms. Understanding these frictions will be critical to designing effective responses to future inflationary pressures.

Acharya, V., M. Crosignani, T. Eisert & C. Eufinger (2024). “How do supply shocks to inflation generalize? Evidence from the pandemic era in Europe, CEPR Working Paper.

Bernanke, B., & Gertler, M. (1989). “Agency Costs, Net Worth, and Business Fluctuations.” American Economic Review, 79(1), 14–31.

Core, F., De Marco, F., Eisert, T., & Schepens, G. (2025). Inflation and Floating-Rate Loans: Evidence from the Euro-Area. CEPR DP 20354; ECB WP 3064.

Baumann, U., Ferrando, A., Georgarakos, D., Gorodnichenko, Y., Reinelt, T., (2025), “Inflation expectations and anchoring during a disinflation episode: Evidence from the euro area.” AEA Papers and Proceedings, vol. 115, 266–70

Cloyne, J., Ferreira, C., & Surico, P. (2020). “Monetary Policy when Households have Debt.” Review of Economic Studies, 87(1), 102–129.

Di Maggio, M., Kermani, A., Keys, B., Piskorski, T., Ramcharan, R., Seru, A., & Yao, V. (2017). “Interest Rate Pass-Through: Mortgage Rates, Household Consumption, and Voluntary Deleveraging.” American Economic Review, 107(11), 3550–3588.

Franzoni, F, M Giannetti and R Tubaldi (2024), “Supply Chain Shortages, Large Firms’ Market Power, and Inflation”, CEPR Discussion Paper 18574.

Gaiotti, Eugenio and Alessandro Secchi, “Is There a Cost Channel of Monetary Policy Transmission? An Investigation into the Pricing Behavior of 2,000 Firms,” Journal of Money, Credit and Banking, 2006, 38 (8), 2013–2037.

Gilchrist, S., Schoenle, R., Sim, J., & Zakrajšek, E. (2017). “Inflation Dynamics during the Financial Crisis.” American Economic Review, 107(3), 785–823.

Gürkaynak, Refet, Hatice Gokce Karasoy-Can, and Sang Seok Lee, “Stock Market’s Assessment of Monetary Policy Transmission: The Cash Flow Effect,” The Journal of Finance, 2022, 77 (4), 2375–2421.

Friedman, M (1961), “The Lag in Effect of Monetary Policy”, Journal of Political Economy 69(5): 447–447.