All opinions expressed here are our own and do not necessarily reflect those of Bank of Finland or the Eurosystem.

After 30 years of life with the Stability and Growth pact, it is surely worth asking whether the basic elements of the treaty still make sense and whether the proposed changes in the treaty would make a difference. We show that the deficit criterion is based on overly optimistic assumptions on economic growth that lowers debt ratios. If economic growth settles down to current rates, a much more stringent deficit level is required. Hence, attempts to allow more flexibility to this criterion will also be counterproductive.

The 1992 Maastricht Treaty aimed to set clear rules for fiscal policy that would eventually provide the conditions for a monetary union. Even at this stage it was understood that a monetary union (EMU) would only succeed if Member States practiced responsible fiscal policy avoiding excessive debt. Hence clear limits were set for deficits and debt levels (3% and 60%) and it was agreed that sanctions would be imposed for breaching the rules. Although the EU Commission does not admit it, the implementation of the Maastricht Treaty and the complementary Stability and Growth Pact has been anything but a success story. Member States’ debt has continued to grow almost uninterrupted, from the 60% level to 90%. Deficits have repeatedly exceeded the 3% limit in situations where Member States were not in the stipulated recessionary situation. The decisions in 2003 and 2005 not to apply sanctions against countries that breach the agreement have led to the neglect of the treaty. Although EU countries seemingly act as if the treaty is in force and comply with the treaty’s reporting and statistical formalities, it is unclear to what extent the treaty has actually affected fiscal behavior in reality.

At the national level, fiscal policy has also been poorly implemented, according to a recent study by Gootjes and de Haan in 2022, which shows that fiscal policy has generally been pro-cyclical, when the aim should have been to smooth out economic fluctuations. This result does not directly challenge the Stability and Growth Pact (especially since pro-cyclicality has been greatest in “good times”), but it does point to something being seriously wrong with the fiscal policy architecture in the European Union. For the EU, a pertinent question is whether the parameters of the agreement are still in line with economic realities. At the time when the aforementioned limits were set, the world was living in a world where the public debt-to-GDP ratio was 60%. At that time, the normal rate of economic growth was considered to be 3%, and with an inflation target of 2%, the nominal GDP growth rate was about 5%. From the public debt equilibrium equation (G + rD – T)/Y = gD/Y, where G refers to public expenditure (excluding interest payments rD) and T to revenue, Y to GDP, and D to debt, it can be concluded that if the GDP growth rate is the aforementioned 5 % and the debt/GDP ratio 60 % the result is that the deficit-GDP ratio can be no more than 3%. If the interest rate r is equal to the growth rate of GDP g, then the basic deficit-GDP ratio must be no more than zero.

From the data we can see that debt and deficits have not stayed within the agreed limits, but also that high levels of debt are associated with an increase in the interest rate and a slowing of total production growth. There may be many interpretations of cause and effect, but it appears that at least the increase in interest rates is to be blamed on debt (debt increases the risk associated with the repayment of bonds issued). All this means that in countries where public finances have failed, the interest rate can easily exceed the growth rate of production, and debt will only increase, even if public sector expenditure and income are equal.

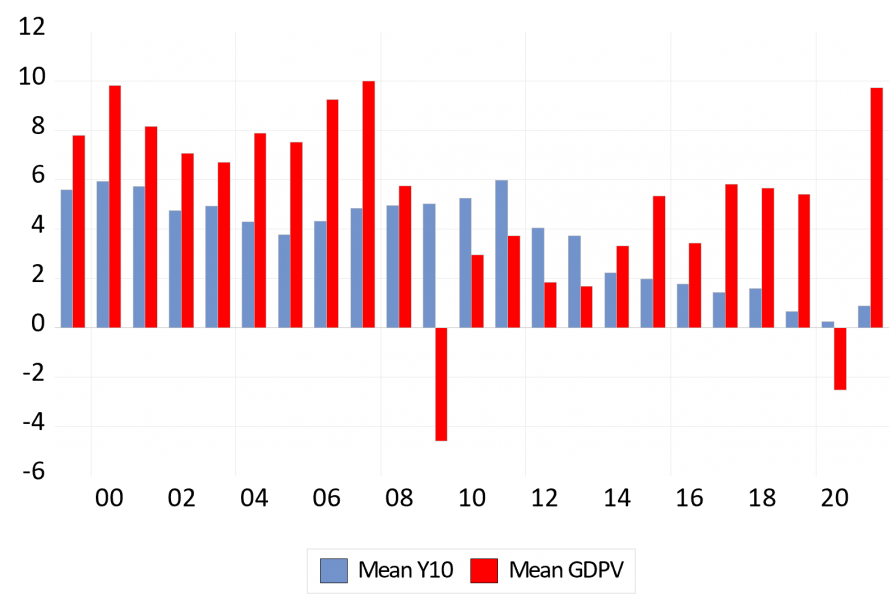

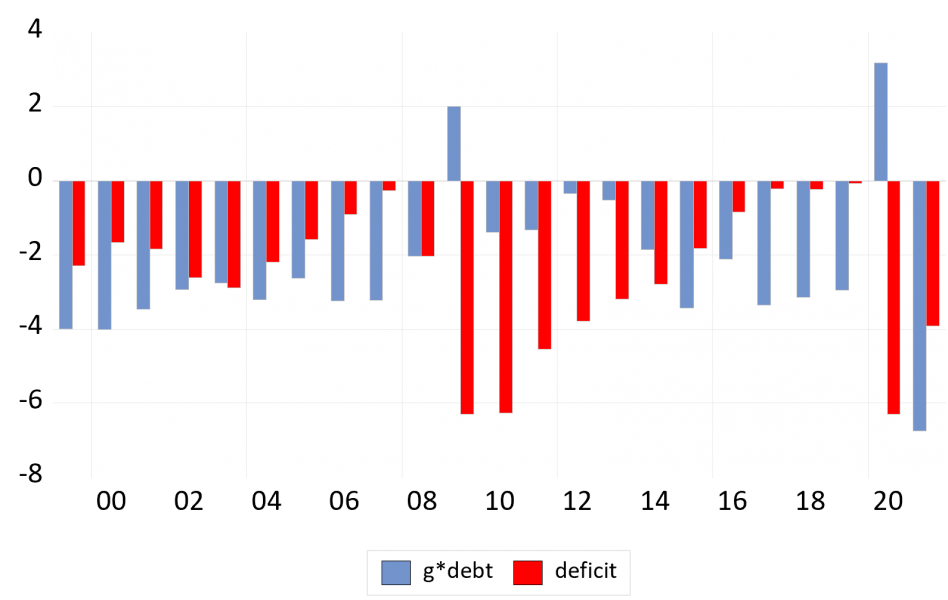

Thus far, the interest rates have been lower than the growth rate of GDP as can be seen from Figure 1, where EU average values are displayed, so that almost the whole EMU period is characterized by a negative differential between interest rates and GDP growth (the mean value for the whole period is -0.96 %). Thus, it has been possible to have larger deficits than the 3 per cent limit of the SGP. This shows up in Figure 2 where actual deficits are compared with the implied deficits which keep the debt/GDP level constant.

During the post-Lemann period, and again during the COVID-19 epidemic, deficits have been bigger, which shows up in the time path of the debt ratios. An alarming possibility is that fiscal authorities assume that also in the future, interest rates are kept much lower than nominal GDP growth and they pursue permanently much more expansive fiscal policies than what is allowed by the Stability and Growth Pact.

Figure 1: 10-year government bond yield Y10 and the nominal GDP growth rate GDPV, %

Figure 2: Government deficit and the implied equilibrium value in EU, %

Notes: g*debt corresponds the right-hand-side of the equilibrium relationship between government deficit and government debt (G + rD – T)/Y = gD/Y cited in the text.

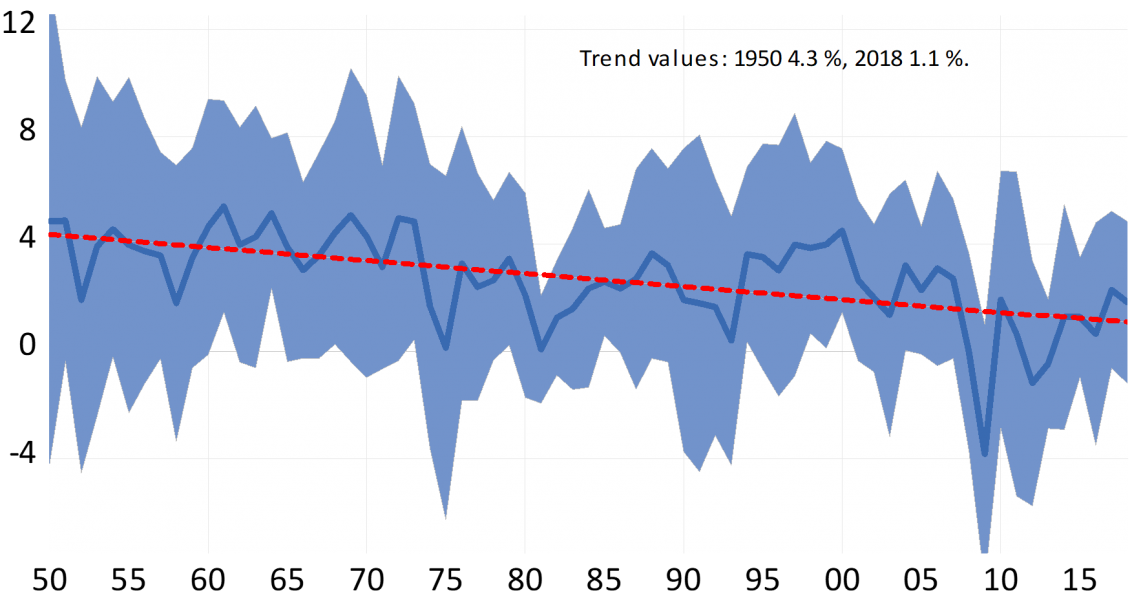

The problem is that the debt/GDP ratio is no longer 60%, but on average 90%. In some countries (Greece) it is 180%, and in some (Estonia) only 15%. Total production (GDP) growth is no longer at 3%, but rather generally declining to around 1% (see Figure 3). It is almost impossible to provide precise future values for changes in the price level (inflation) and interest rate. But it is clear that if the real growth drops much lower, the debt equilibrium requires that the deficit must be substantially less than 3%. If the economy in nominal terms does not grow at all, the EMU deficit (net borrowing) must simply be zero, and not 3%, so that debt does not continue to grow. If the interest rate in such a situation is anything other than zero, the primary balance must be significantly positive. But can anyone really maintain a primary surplus of even 10% relative to GDP!

Figure 3: Average GDP growth rate (+/- 2SD) in Western Europe (1950-2018)

Notes: The blue line is the per capita GDP growth rate for 15 Western European countries (derived from the Maddison historical data set). The red line is the mean value of the time trend for the growth rates.

It must be remembered that a deficit in public finances combined with higher interest rates leads to a so-called ’snowball effect’, i.e. an acceleration of the debt. This can even accelerate if the rates react to the weakened public financial situation in a way that has been typical for most crisis countries. In recent times, the rates have been historically low, which has blocked the way for the snowball effect for most countries, but it is difficult to see that the same type of interest rate regime could be repeated indefinitely in the future. From the point of view of public debt management, this (the ‘normalization’ of interest rates) is of course bad news.

It is obvious that the 3% deficit threshold is hard to change, since it is an integral part of the whole monetary union framework. But it should clearly be acknowledged that in the current circumstances it is too loose, and instead of making exceptions regarding it, a move should be made towards a situation where deficits only exceptionally reach such high levels: not so that deficits are constantly just a few basic points away from 3 percent. The public sector & the national economy don’t need a large public debt. A large public debt only displaces private sector debt opportunities. There is no sense in a system where the best investment opportunities are seemingly risk-free government debt instead of productive investment opportunities.

In view of the background discussed above, it is worrying that almost permanent exceptions could be allowed regarding the deficit criteria on the basis of “structural reforms” and “public investments for the improvement of the public economy” (see EU 2020). There are no clear definitions for either of these concepts, and it is clear that the views of the different parties, especially concerning structural reforms, differ from one another. For example, “green transition” could be interpreted as a structural reform, even though it could heavily burden the public economy.

In terms of investments, the situation is in principle clearer, as the national accounts provide clear boundaries for interpretation, but even from that point of view there should have been more precise distinctions, especially when, at least verbally, it has become a common practice to call almost all expenses investments (a typical example is schooling).

The conceptual problems do not end here. Also in terms of so-called net expenditure (which is focused on when assessing the adjustment path of public finances) there is suspicion that interest and employment-related cyclical components have been removed from the expenses. Calculations commissioned by the European Parliament (European Parliament Think Tank 2022) show that the cyclical component is associated with a large and, one could say, huge uncertainty, which, if argued about, can again undermine the requirements for the restoration of public finances.

It is that Country X cannot immediately affect the interest rates of the debt it issues, but ultimately the interest rates are in its own hands in the sense that reckless debt accumulation will eventually lead to higher debt servicing costs. Therefore, it can be asked how sensible it is to try to net out these expenditures, let alone other items. In the end, all of these “flexibilities” will only lead to an endless struggle over whether the limits have been exceeded and whether the development of expenditures is really in the right direction.

The Commission’s proposal describes in many words the dialogue that is intended to be held between the Commission and the Member States at various stages. However, the problem is that the dialogue (plans, feedback received from them and revised plans, etc.) has not been sufficient in all cases. Even though the Commission assures that “this time is different”, we have no reason to trust it. If member states know that in the end sanctions will be watered down (changed to warnings and/or postponed to the next electoral term), why would they react to edicts and letters? In the same way, one can relate to the so-called “binding” public budget plans; it is unlikely that the plans will become more binding, even though they are called binding. Reuter (2019) shows that only half of all financial regulations have been complied with in EU countries. The result is not very flattering.

The idea that smaller sanctions are more easily implementable is not very credible either. Just as unbelievable is the notion that “reputational sanctions” would somehow work, especially when it often concerns chronic underperformers. If the EU (and ECB) de facto prevent the disciplining of state debt on the market, only bad substitutes are left. If a member state knows that reckless debt accumulation will only be met with reprimands by the Commission, nothing will change. “Reputational damage” only matters if state bond markets function according to market conditions, but if it is known that the EU & ECB will intervene in market functioning in “crisis situations”, reputational damage may have only internal political significance, if any.

In 2003, France and Germany effectively annulled the Stability and Growth Pact with the help of Commission President Romano Prodi at the time. It is thought that in the current situation it is much more difficult than in 2003 to impose sanctions, because most of the EU/Euro countries are in a much more difficult economic situation. There is more debt and economic prospects are significantly weaker for all countries than in 2003. All EU countries already have difficulty dealing with the costs caused by aging, and it is known that these costs will increase by several tens of percent in the coming decades. The green transition will inevitably also lead to increased costs. The deficits of the EU as well as the Eurozone are larger than in 2003, the ratio of public spending to GDP is higher and the ratio of public debt to GDP is essentially higher than in 2003. The differences between the countries have not decreased since 2003, but on the contrary have increased. The number of member states has also increased, so reaching consensus is even more difficult.

In what follows, we scrutinize how government balances deficits have reacted to interest rates, growth, and the debt burden by estimating a simple equation from a panel for all EU countries for 1999-2021. The results are illustrated in Figure 4. The message of the results is quite clear: government balances (surpluses/deficits) are quite persistent, they depend positively on income growth and negatively on interest rates. In the same way as in several earlier studies, we find a positive relationship between government balances and the lagged debt ratio indicating some sort of disciplinary effect: high debt levels limit possibilities of deficit spending. Basically, we would expect that the growth rate of nominal income and the nominal interest rate have a similar-sized effect on deficits, but it seems that the growth effect is larger, even though in the nonlinear case the difference is very small (see Figure 4). It could be due to time lags or maturity of debt or loan portfolio composition effects, which we cannot control here.

Figure 4: Average GDP growth rate (+/- 2SD) in Western Europe (1950-2018)

Notes: The bars indicate panel regression coefficients for the lagged debt/GDP ratio debt-1, growth rate of nominal GDP gv and the 10-year government bond yield R. The dependent variable is the government balance (net lending/GDP). The data cover all EU countries and have 648 data points for 1999-2021. The model is estimated with a linear model with all data, with all data cum the fixed effects, and using a threshold model, in which three regimes (and accordingly two threshold values) in terms of indebtedness were found.

These basic results are no surprise given the government income accounting identity at the backdrop of the estimating equation. What is interesting, is the nonlinear relationship between government balances and the right-hand-side variables, in particular with the lagged debt level and the interest rate. So, we find that the basic effects are operational only when the debt ratios are reasonably low but when they get closer to 100 percent or over, the disciplinary effect is no longer significant. The interest rate effect even behaves in a perverse way.

If the GDP growth rate keeps falling over time and even goes to zero, the three per cent SGP limit for government deficits is no more reasonable, unless the relevant interest rate also goes to zero. Otherwise, more stringent deficit level is required. Right now, nominal (inflation induced) income growth clearly outperforms interest rates and diminishes incentives to curtail deficits, which is not a good thing thinking about the accumulation of debts in the future. Econometric analyses also show government deficits do not strongly react to growing debts, or at least the reactions are state-dependent. Thus, it seems that the disciplinary factor works only in the case of relative low levels of debt, but with high levels of debt, the relationships seems to break down.

EU (2020) European Commission communication.

European Parliament Think Tank (2022) New life for an old framework: redesigning the European Union’s expenditure and golden fiscal rules.

Gootjes, B. and de Haan, J. (2022) Procyclicality of fiscal policy in European Union countries. Journal of International Money and Finance 120, 1-29.

Hukkinen, J. and M. Virén (2017) How toxic is public debt? International Journal of Public Policy 1-2, 53 – 68.

Reuter, W. (2019) When and why do countries break their national fiscal rules?, European Journal of Political Economy, 28, 125-141.