This Policy Brief is based on Banque de France Working Paper #999. Working Papers reflect the opinions of the authors and do not necessarily express the views of the Banque de France.

Abstract

This brief documents the asymmetric transmission of monetary policy to euro area nominal yields. The effect of easing monetary surprises is stronger than the effect of monetary tightening. We provide evidence that this asymmetry is driven by signals about the future policy path. While we find no role for country-specific risk premia, we show that the response of expectations of future short-term rates generates the differentiated effects, and the term premium further amplifies the asymmetry. Using textual analysis to extract policymakers’ signals from press conferences, we also document that central bank communication can affect this asymmetric transmission to yields.

Monetary policy affects long-term interest rates not only through the direct impact of its instruments such as the short-term policy rate or asset purchases, but also by shaping market expectations about the future path of policy. While the effects of monetary policy actions on financial markets have been widely studied, much less is known about whether investors respond symmetrically to tightening versus easing monetary policy. In Hubert and Portier (2025), we investigate this question in the context of the euro area, examining whether sovereign bond markets react asymmetrically to monetary policy surprises from the European Central Bank (ECB).

While monetary policy shocks are expected to have only short-lived real effects, a large body of evidence shows that policy announcements can move long-term interest rates well beyond that horizon (Cochrane and Piazzesi, 2002). This influence can operate through several channels: by signaling policymakers’ assessment of the economic outlook (Melosi, 2017; Nakamura and Steinsson, 2018), long-term inflation expectations (Gürkaynak et al., 2005a), or the likely future policy path (Gürkaynak et al., 2005b). It may also stem from changes in the term premium (Hanson and Stein, 2015; Kaminska et al., 2021) or from shifts in beliefs about the central bank’s reaction function (Bauer and Swanson, 2023; Bauer and Swanson, 2024; Bocola et al., 2024).

The sign of monetary policy surprises can itself convey valuable information to markets. Easing decisions have been linked to yield-seeking behaviors and declines in the term premium (Hanson et al., 2021), while the asymmetric nature of policy cycles – typically gradual in tightening phases and more abrupt in easing episodes (Cieslak and Vissing-Jorgensen, 2021) – can shape perceptions about the persistence of the monetary policy stance. This suggests that the sign of monetary policy surprises may convey long-term monetary policy signals.

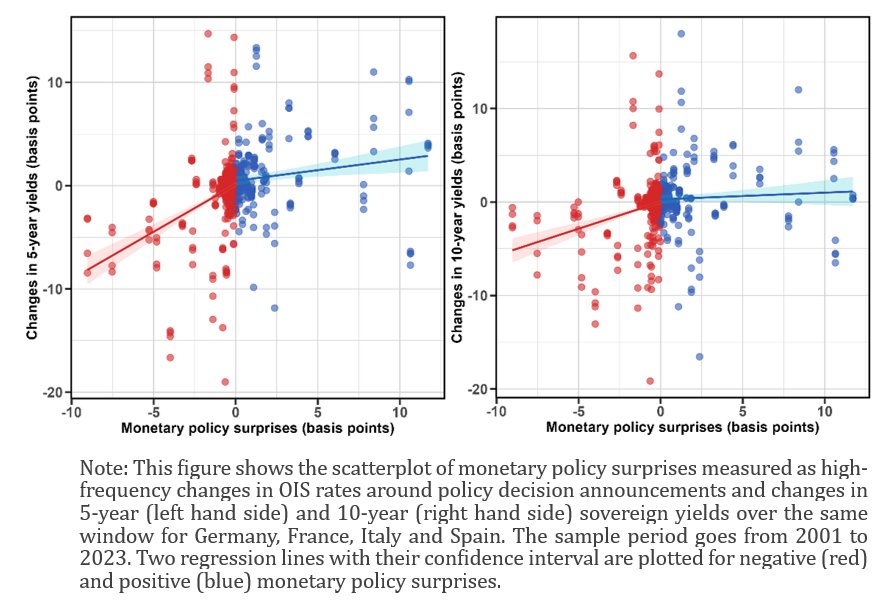

Figure 1. Monetary surprises and sovereign interest rate changes

This paper aims to document how investors learn about these long-term factors, and whether they learn differently from tightening and easing monetary policy surprises. To do so, we measure monetary policy surprises (MPS) using a principal component analysis of high-frequency changes in OIS rates over a narrow window around the press release of the policy announcement using the Altavilla et al. (2019) database. We capture the yield curve response to monetary policy considering the changes, around both the press release and press conference, in 2-, 5-, and 10-year sovereign yields for the four largest euro area economies (Germany, France, Italy and Spain). Figure 1 plots monetary surprises against changes in 5 and 10-year sovereign rates and points to an asymmetric response to easing versus tightening surprises.

We also exploit a key feature of the eurozone framework for identifying news about the future path of monetary policy: the short-term policy rate is the same across all euro area countries, but long-term interest rates are not. Therefore, the effect of news about future policy is uniform across all countries because they share the same policy rate. Changes in long-term sovereign yields unrelated to changes in expected future short-term rates or the term premium are mechanically due to changes in country-specific risk premia.

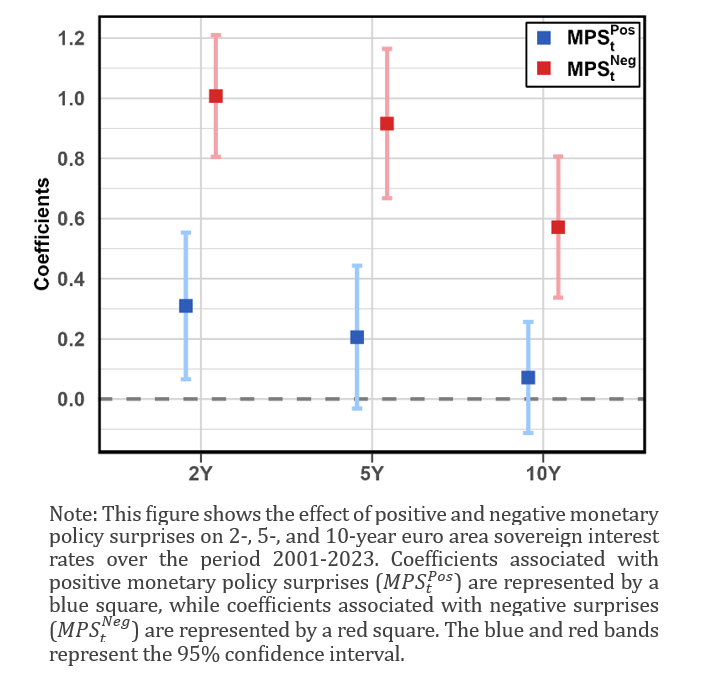

We find strong evidence of asymmetric effects: easing surprises—those that suggest a more accommodative stance than markets expected—lead to significantly larger declines in bond yields than the corresponding increases observed after tightening surprises. More specifically, a 100-basis-point easing surprise reduces 5-year sovereign bond yields by approximately 92 basis points, while a 100-basis-point tightening surprise increases them by only 21 basis points. Figure 2 shows that this pattern holds across short-, medium-, and long-term maturities, and that the difference in response to tightening and easing surprises is statistically significant.

Figure 2. The effect of positive and negative monetary policy surprises on sovereign yields

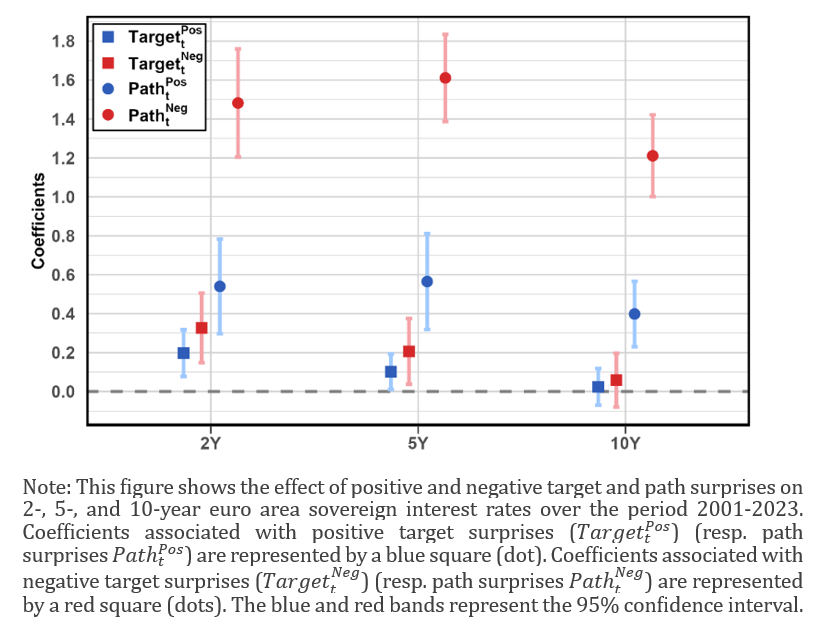

We explore the potential drivers of this asymmetry. We find that the asymmetry does not stem from central bank information effects (i.e. macroeconomic information implicitly revealed by policy decisions, see Jarociński and Karadi, 2021) or from differences in prevailing economic and financial conditions. We provide evidence that the asymmetry is driven by signals about the future likely policy path. Figure 3 clearly illustrates this pattern. Investors appear to view an unexpected easing as a signal of a more persistent stance, while an unexpected tightening is perceived as more limited or transitory.

To further understand how policy signals translate into yield changes, we identify three distinct components in sovereign yields: a common expectations hypothesis factor reflecting changes in policy rate expectations, a common term premium, and a country-specific risk premium. We find that two complementary forces are at play in creating the asymmetric transmission. On the one hand, the common expectations hypothesis component reacts asymmetrically such that easing surprises convey stronger signals about the future policy cycle. On the other hand, tightening surprises convey signals about the common term premium that attenuate the response of interest rates.

Figure 3. The effect of Target and Path surprises

Finally, we examine how central bank communication during ECB press conferences shapes investors’ reactions. By conducting textual analysis of press conference transcripts, we derive a measure of the communication signals conveyed by the ECB. We document that this variable is correlated with the near-future policy stance in the short-run, but also signals the available future policy space in the long-run. Eventually, we find that tightening surprises have stronger effects when associated with signals of more upside future policy space. The pattern is similar for easing surprises: they have stronger effects on interest rates if associated with signals about more downside future policy space. These results suggest that central bank communication is a powerful instrument that can amplify or dampen interest rate responses to policy decisions.

Overall, this paper provides novel evidence on the asymmetric effects of monetary policy on euro area sovereign yields. Easing surprises have a stronger and more persistent impact on long-term yields than tightening surprises. These findings have important implications for policymakers and the design of central bank communication.

Altavilla, C., L. Brugnolini, R. Gürkaynak, R. Motto, and G. Ragusa (2019): “Measuring Euro Area Monetary Policy,” Journal of Monetary Economics, 108, 162–179.

Bauer, M. D., C. E. Pflueger, and A. Sunderam (2024): “Perceptions about monetary policy,” The Quarterly Journal of Economics, 139, 2227–2278.

Bauer, M. D. and E. Swanson (2023): “An alternative explanation for the “Fed information effect”,” American Economic Review, 113, 664–700.

Bocola, L., A. Dovis, K. Jørgensen, and R. Kirpalani (2024): “Bond market views of the Fed,” NBER Working Paper, No. 32620.

Cieslak, A. and A. Vissing-Jorgensen (2021): “The economics of the Fed put,” Review of Financial Studies, 34, 4045-4089.

Cochrane, J. and M. Piazzesi (2002): “The Fed and interest rates—A high-frequency identification,” American Economic Review, 92, 90–95.

Gürkaynak, R., B. Sack, and E. Swanson (2005a): “The sensitivity of long-term interest rates to economic news: Evidence and implications for macroeconomic models,” American Economic Review, 95, 425–436.

Gürkaynak, R., B. Sack, and E. Swanson (2005b): “Do Actions Speak Louder Than Words? The Response of Asset Prices to Monetary Policy Actions and Statements,” International Journal of Central Banking, 1, 55–93.

Hanson, S., D. Lucca, and J. Wright (2021): “Rate-amplifying demand and the excess sensitivity of long-term rates,” Quarterly Journal of Economics, 136, 1719–1781.

Hanson, S. and J. Stein (2015): “Monetary policy and long-term real rates,” Journal of Financial Economics, 115, 429–448.

Hubert, P. and R. Portier (2025): “The Signaling Effects of Tightening and Easing Monetary Policy”, Banque de France Working Paper, No. 999.

Jarociński, M. and P. Karadi (2020): “Deconstructing Monetary Policy Surprises — The Role of Information Shocks,” American Economic Journal: Macroeconomics, 12, 1–43.

Kaminska, I., H. Mumtaz, and R. Sustek (2021): “Monetary policy surprises and their transmission through term premia and expected interest rates,” Journal of Monetary Economics, 124, 48–65.

Melosi, L. (2017): “Signalling Effects of Monetary Policy,” Review of Economic Studies, 84, 853–884.

Nakamura, E. and J. Steinsson (2018): “High-Frequency Identification of Monetary Non-Neutrality: The Information Effect,” Quarterly Journal of Economics, 133, 1283–1330.