This pölicy brief is based upön Hördahl and Valente (2022).

We study the relationship between international bond flows and exchange rate returns for a panel of emerging market economies (EMEs). Specifically, we investigate whether international net bond flows are correlated with subsequent changes in the value of the local currency against the US dollar. Using a portfolio approach, we find evidence of a positive relationship between bond flows and future exchange rate returns of EMEs, which is not present for advanced economy currencies. EME currencies tend to depreciate following large bond outflows, while they tend to appreciate following inflows. A dollar-neutral portfolio that goes long in inflow currencies and shorts outflow currencies, earns large excess returns that are not correlated with ones from known international portfolio strategies. Moreover, using an asset pricing approach, we find strong evidence that a risk factor implied by this result is priced in the cross-section of currencies. These findings are consistent with investors requiring compensation for the risk that countries experiencing large portfolio inflows today could be facing a future tightening of their aggregate financial conditions.

International portfolio flows related to investments in emerging market economies (EMEs) have grown tremendously over the past decade. Among several asset markets, the sovereign bond market has seen substantial growth among EMEs, especially in the local currency segment, where global funds’ assets under management reached US$383 billion in 2020. Because of this growth, both academic and policy attention has naturally focused on the role of portfolio flows for the behaviour of exchange rates, looking to identify and explain potentially profitable predictability patterns in exchange rates and monitor sources of concern for monetary and financial stability.

A vast academic literature has investigated currency risk and equilibrium exchange rates from empirical and theoretical angles (see, among others, Lustig et al, 2011; Lustig et al., 2014, Gabaix et al, 2015; Della Corte et al., 2016; Mueller et al., 2017; Verdhelan, 2017; Kojen and Yogo, 2019; Jiang, 2022; Andrews et al., 2022). However, despite the sheer number of studies being published on this subject suggesting links between bond prices, exchange rate returns, portfolio flows and macroeconomic fundamentals, there is no clear consensus regarding the size and the economic significance of such links in integrated international markets.

In this study, we aim to provide some evidence on this question by exploring the extent to which international bond flows affect returns on EME currencies. More specifically, using a portfolio approach commonly adopted in the recent literature (see, among others, Lustig and Verdelhan, 2007; Burnside et al, 2011; Menkhoff et al., 2012a,b), we sort currencies into portfolios based on the size of bond flows into, or out of, the corresponding economies. We then compute the exchange rate returns, in excess of the interest rate differential between each currency and the US dollar (a.k.a Uncovered Interest Parity deviations), of these flow-sorted portfolios over a subsequent period and examine a trading strategy that goes long (investing) in the portfolio with the largest inflows and short (selling) in the one with the largest outflows.

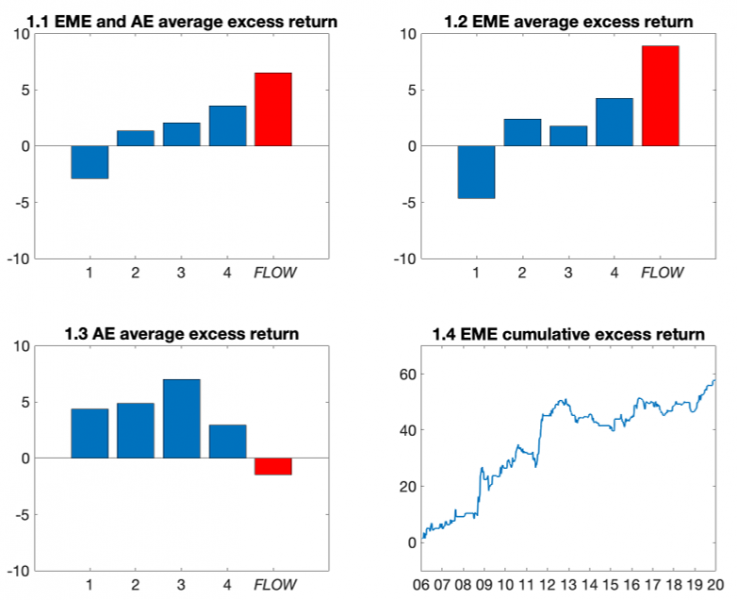

Using a large sample of EMEs over a period spanning the past 14 years, we document a host of interesting results. First, there is clear evidence that for EMEs that experience large bond outflows, their exchange rates subsequently depreciate significantly, generating large negative currency excess returns. Economies that experience inflows tend to face an appreciation of their exchange rate leading to positive currency excess returns (Chart 1.1 and 1.2).

Second, a long-short portfolio that goes long in the currencies of the countries with the largest inflows and short in the one with the largest outflows generates an annualised excess return differential of about 9 percent. This is statistically significant on average and, when cumulated over the sample period, amounts to a strategy excess return of around 60 percent over the full sample period (Chart 1.4). Importantly, these effects are not present in advanced economies (AEs), for which there is no statistical evidence of a cross-sectional response of exchange rate excess returns to bond flows (Chart 1.3).

Chart 1: Portfolio Strategy Returns

Notes: Excess returns of portfolios formed by sorting on bond portfolio flows. Portfolio 1 consists of currencies with the largest outflows prior to the formation of the portfolio, and portfolio 4 the ones with the largest inflows. Portfolio FLOW goes long portfolio P4 and shorts portfolio P1. Bar charts show average excess returns over the sample period between January 2006 and December 2019; the line graph is the cumulative excess return of the EME FLOW portfolio. Returns are continuously compounded and expressed in percentages.

Third, the returns originating from our strategy are higher on average than any of the ones exhibited by popular FX strategies over the sample period, including FX carry, momentum and value. The strategy’s annualised Sharpe ratio is also the highest at a value higher than 1. Moreover, the strategy returns exhibit a low, and often negative correlation, with the ones from other FX strategies. Fourth, using a battery of asset pricing tests, we find strong evidence that a risk factor implied by our dollar-neutral long-short portfolio strategy is priced in the cross-section of EMEs currencies. Moreover, our novel risk factor is not displaced when the asset pricing tests include popular alternative risk factors, such as the dollar or the carry factor, among others.

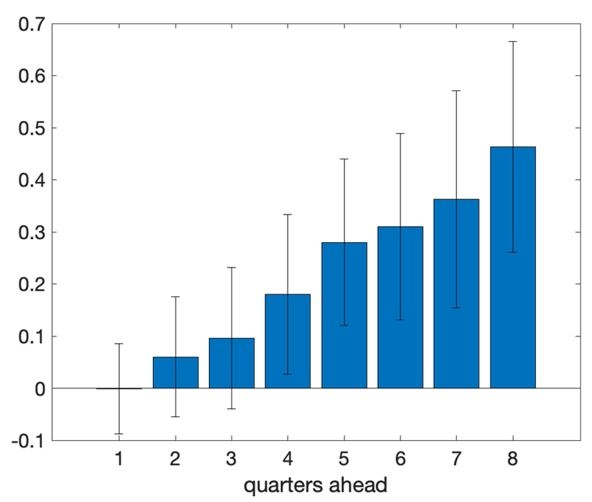

We provide a potential explanation of our empirical results by documenting that economies whose currencies have received large bond inflows tend to experience a tightening of their financial conditions over the subsequent 1-2 years. This deterioration could be the result of overheating or excessive risk-taking following large portfolio inflows. In fact, the results of our estimations suggest that the future financial conditions for the economies that have experienced the largest inflows are always tighter than for the ones with the largest outflows (Chart 2). Considering this evidence, we argue that the sizeable excess returns accruing to the proposed portfolio strategy can be viewed as risk premium required by investors for sustaining the risk of future deterioration of financial conditions associated with the portfolio.

Chart 2: The Role of Future Financial Conditions

Notes: The chart shows the difference in average future financial conditions between economies that have experienced large bond inflows (i.e. economies included in Portfolio 4 shown in Chart 1) and economies that have experienced large bond outflows (i.e. economies included in Portfolio 1 shown in Chart 1). Financial conditions are measured using Goldman Sachs’ financial conditions indices (FCI). A higher FCI value indicates tighter financial conditions. Changes are calculated up to 8 quarters ahead from each portfolio formation date. The error bars are 95% confidence intervals.

Andrews, Spencer, Riccardo Colacito, Mariano Massimiliano Croce, and Federico Gavazzoni, 2022, Concealed Carry, mimeo.

Burnside, Craig, Martin Eichenbaum, Isaac Kleshchelski, and Sergio Rebelo, 2011, Do Peso Problems Explain the Returns to the Carry Trade? Review of Financial Studies 24, 853- 891.

Della Corte, Pasquale, Steven J. Riddiough, and Lucio Sarno, 2016, Currency Premia and Global Imbalances, Review of Financial Studies 29, 2161-2193.

Gabaix, Xavier and Matteo Maggiori, 2015, International Liquidity and Exchange Rate Dynamics, Quarterly Journal of Economics 130, 1369-1420.

Hördahl, Peter and Giorgio Valente, 2022, Emerging Market Bond Flows and Exchange Rate Returns, BIS Working Paper N. 1042 and HKIMR working paper (forthcoming)

Jiang, Zhengyang, 2022, Fiscal Cyclicality and Currency Risk Premia, Review of Financial Studies 35, 1527-1552.

Koijen, Ralph S.J., and Motohiro Yogo, 2019, Exchange Rates and Asset Prices in a Global Demand System, University of Chicago, Becker Friedman Institute for Economics Working Paper No. 2019-91.

Lustig, Hanno, Nikolai L. Roussanov, and Adrien Verdelhan, 2011, Common Risk Factors in Currency Markets, Review of Financial Studies 245, 3731-3777.

Lustig, Hanno, Nikolai L. Roussanov, and Adrien Verdelhan, 2014, Countercyclical Currency Risk Premia, Journal of Financial Economics 111, 527-553.

Lustig, Hanno, and Adrien Verdelhan, 2007, The Cross Section of Foreign Currency Risk Premia and Consumption Growth Risk, American Economic Review 97, 89-117.

Menkhoff, Lukas, Lucio Sarno, Maik Schmeling, and Andreas Schrimpf, 2012a, Carry Trades and Global Foreign Exchange Volatility, Journal of Finance 67, 681-718.

Menkhoff, Lukas, Lucio Sarno, Maik Schmeling, and Andreas Schrimpf, 2012b, Currency Momentum Strategies, Journal of Financial Economics 106, 660-684.

Mueller, Philippe, Alireza Tahbaz-Salehi, and Andrea Vedolin, 2017, Exchange Rates and Monetary Policy Uncertainty, Journal of Finance 72, 1213-1252.

Adrien Verdelhan, 2017, The Share of Systemic Variation in Bilateral Exchange Rates, Journal of Finance 73, 375-418.