Abstract

Trump’s uncertain tariff policy has reignited debate over the relationship between uncertainty and inflation—especially in light of inflation expectations remaining well above the Federal Reserve’s target. We empirically document that uncertainty shocks are particularly damaging to the macroeconomy when inflation is high. Using a structural New Keynesian business cycle model featuring trend inflation, we uncover the presence of an inflation–uncertainty amplifier: when inflation is elevated, the macroeconomic effects of uncertainty shocks are magnified due to increased price dispersion under sticky prices. From a policy perspective, our model suggests that a forceful disinflationary response to heightened uncertainty can mitigate its inflationary and recessionary effects by dampening price dispersion.

Uncertainty and inflation. The recent election of Donald Trump as the 47th President of the United States has prompted academics and commentators to anticipate, among other outcomes, a surge in economic uncertainty and a resurgence of high inflation (see, e.g., Coibion and Pandalai-Nayar (2024)). This combination is not unprecedented. In the wake of the COVID-19 pandemic, the U.S. economy – like those of many other countries – faced historically high levels of uncertainty and a sharp, persistent surge in inflation, with lasting effects on inflation expectations (Gorodnichenko and Coibion 2025). These developments led policy institutions to adopt a “two-regime” perspective on inflation (see, e.g., Borio, Lombardi, Yetman, and Zakrajsek (2023)).1 A comparable scenario – marked by simultaneous spikes in inflation and uncertainty – dates back to the 1970s, a decade defined by rising price pressures and repeated bouts of economic uncertainty. While a substantial body of empirical research has examined the business cycle implications of uncertainty shocks,2 less is known about how uncertainty interacts with periods of elevated inflation. This gap is concerning, as high and persistent inflation may fundamentally alter the transmission of macroeconomic shocks (Coibion and Gorodnichenko (2011), Ascari and Sbordone (2014)).

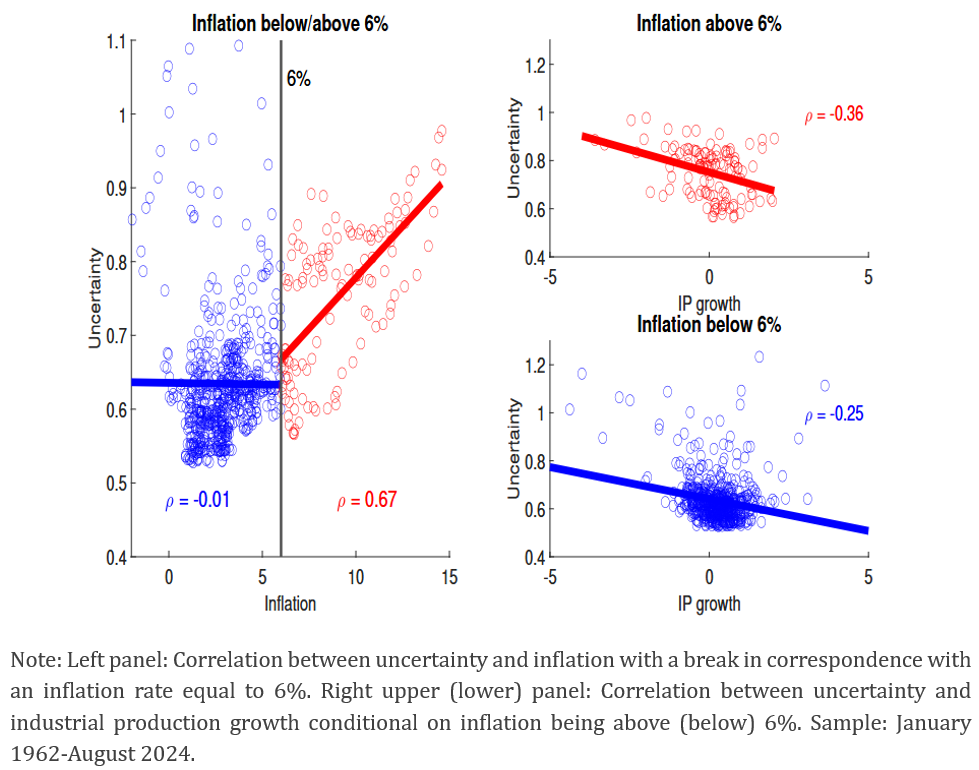

Figure 1 documents evidence consistent with this possibility. It plots correlations involving macroeconomic uncertainty (as recently estimated by Ludvigson, Ma, and Ng (2021)), inflation, and industrial production growth in the United States conditional on realizations of inflation above/below 6%, a reference for high inflation used by Coibion and Gorodnichenko (2011) and supported by the empirical analysis by Schorfheide (2005), Canova and Forero (2024), Gargiulo, Matthes, and Petrova (2024), and our empirical investigation (more on it later). Two striking facts emerge. First, uncertainty and inflation are positively correlated when inflation is high while they display no correlation when inflation is low. Second, the well-known countercyclicality of uncertainty (Bloom (2014)) is confirmed in both states, but it is stronger when inflation is high. These state-dependent correlations, which are robust to dropping COVID-19 observations, motivate our analysis of the possibly nonlinear effects of uncertainty shocks.

Uncertainty shocks along the inflation cycle: Empirical evidence. In a recent paper (Castelnuovo, Pellegrino, Særkjær 2025), we investigate the effects of macroeconomic uncertainty shocks on the U.S. business cycle. Our contribution is threefold.

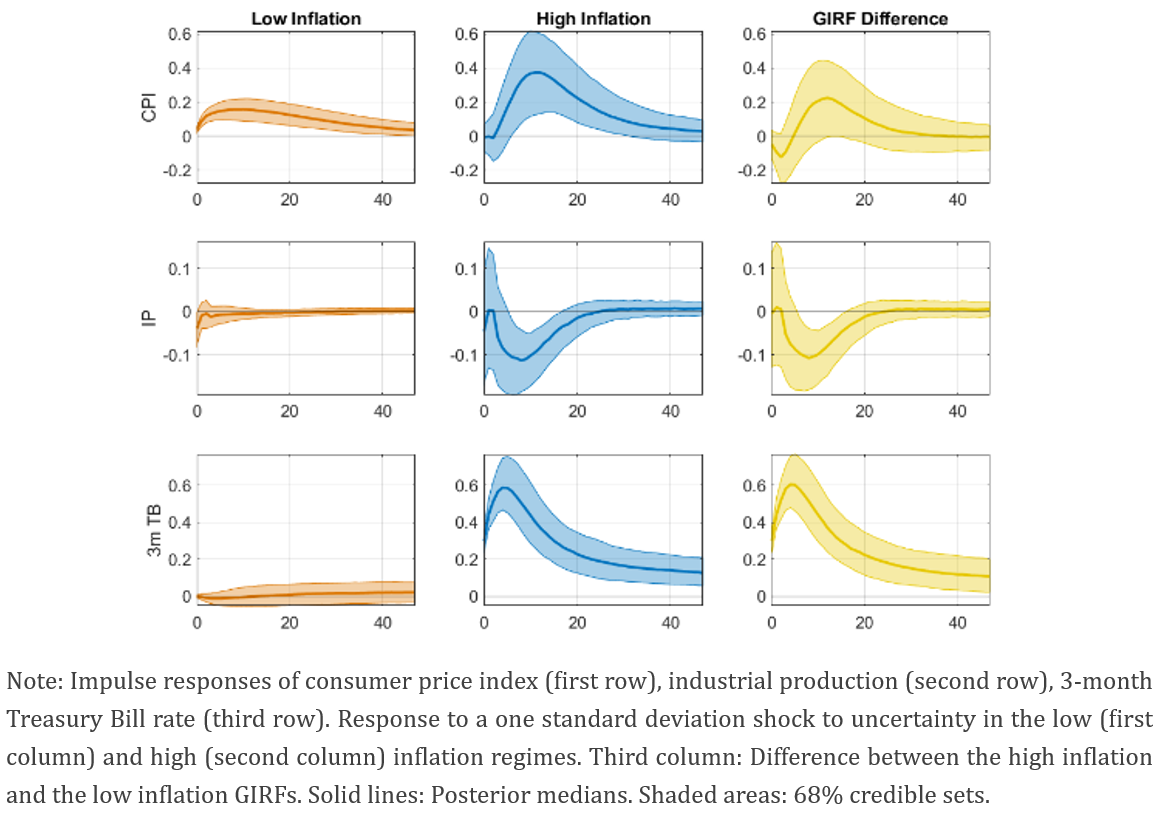

First, we empirically document – via the estimation of a state-of-the-art nonlinear vector autoregressive framework à la Alessandri and Mumtaz (2019)- that such shocks are significantly more inflationary and recessionary when inflation is high (e.g., during phases like the 1970s in the US or the recent COVID-19 pandemic) than in normal times. Figure 2 documents this empirical evidence. Conditional on the same uncertainty process in the two regimes, it is evident how the inflationary and recessionary effects of a bout in uncertainty are much larger when uncertainty hits in the high inflation regime.

Figure 1. Uncertainty and Business Cycle Indicators: High vs. Low Inflation

Figure 2. Generalized impulse response functions for the high and low inflation regimes

A model-based interpretation of our empirical findings: The role of price dispersion. How to interpret this finding? To address this question, we work with a monetary policy new Keynesian model of the business cycle à la Coibion and Gorodnichenko (2011) and Ascari and Sbordone (2014) that features trend inflation, i.e., a long-run reference for inflation that we calibrate to separate phases of high inflation from normal times. We endow such a model with a process capturing macroeconomic uncertainty (in the model, surrounding future realizations of total factor productivity shocks) and solve it nonlinearly to interpret our empirical findings.

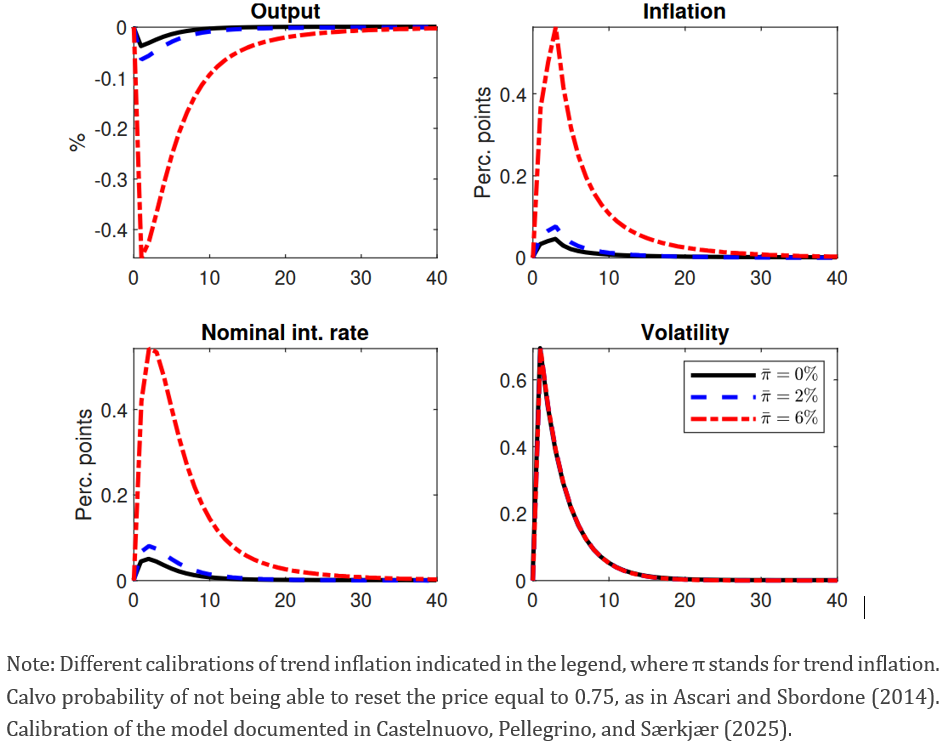

Working with this model, we unveil a novel mechanism, which we term ”inflation-uncertainty amplifier”. Basically, nonlinear models with nominal rigidities and uncertainty shocks feature an ”upward pricing bias” mechanism, i.e., firms optimally set prices higher than they would in the absence of uncertainty to ensure themselves against future states of the economy characterized by high demand but low profits (Fernandez-Villaverde, Guerron-Quintana, Kuester, and Rubio-Ramirez (2015), Born and Pfeifer (2021)). The novelty in our paper is that we unveil the interaction between upward pricing bias and trend inflation, i.e., the higher the trend inflation rate is, the higher the optimal reset price set by firms able to reoptimize will be. This is due to firms’ desire to maintain their markup close to the desired one in a world in which they do not know when they will be able to re-optimize again in the future. As a consequence, the price dispersion generated by an uncertainty shock is (very much!) larger in the presence of high trend inflation as opposed to normal times. This is the reason why uncertainty shocks exert larger business cycle effects in the high inflation regime, as clearly shown in Figure 3, where we plot the model-consistent impulse responses to an uncertainty shock for three different calibrations of trend inflation, which are 0% (often employed by the literature, depicted with the solid black impulse responses), 2% (dashed blue lines, capturing the low inflation regime), and 6% (dashed dotted red lines, high inflation regime).3

Figure 3. Impulse response functions to a second-moment technology shock for different levels of trend inflation

Policy and modeling implications. The third contribution of our paper asks the following question. Suppose that, for some reason, an economy finds itself in a high inflation regime because of, say, oil shocks or global supply chain disruptions. Suppose also that, while in this high-inflation regime, the economy is hit by an uncertainty shock (say, the news regarding the future implementation of a very uncertain tariff-related plan) that acts as a negative supply shock. Can systematic monetary policy do something about it? Even though an uncertainty shock in the model (as in the data) acts as a supply shock, the answer is positive! The intuition is the following. An aggressive monetary policy in the high inflation regime works to keep inflation expectations low and reduces price dispersion, which is the crucial element behind the inflationary and recessionary effects of uncertainty. Hence, policymakers should aggressively respond to bouts of uncertainty when inflation is high because the response of inflation could be kept moderate at very low output costs.

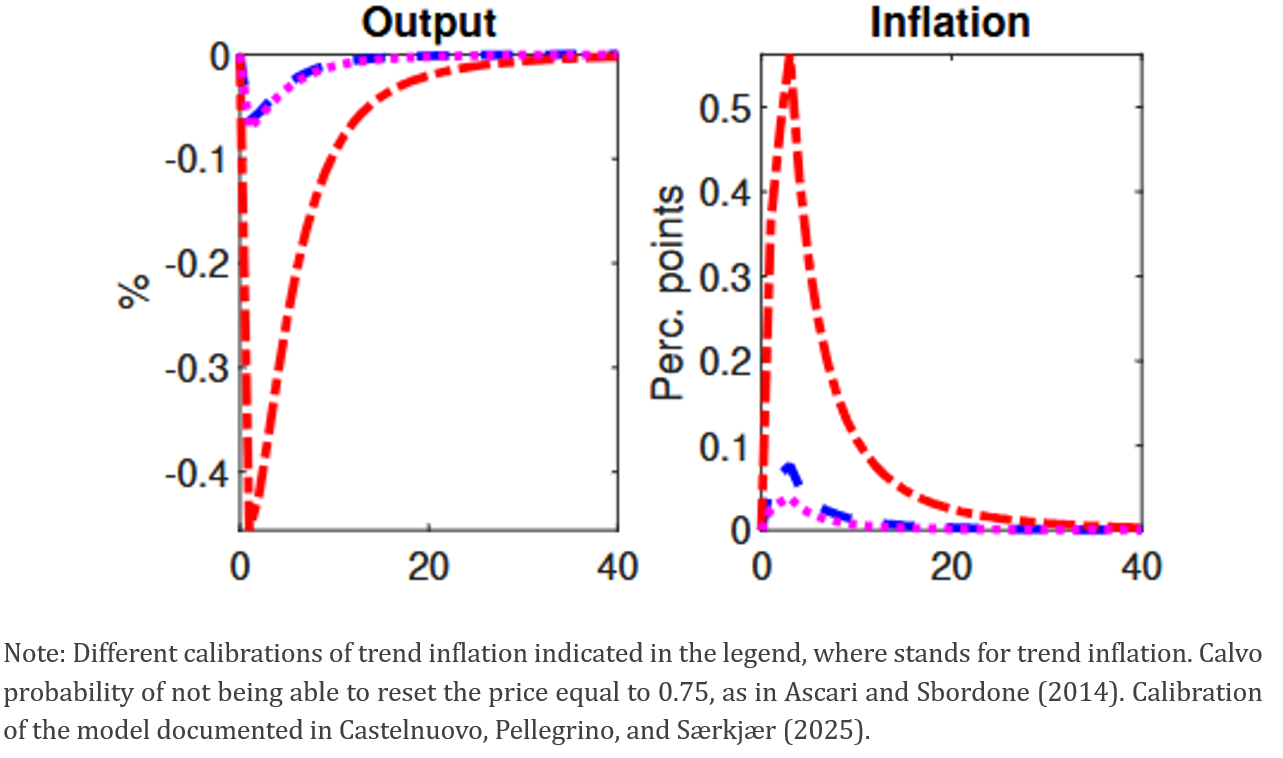

Figure 4 captures the effectiveness of an aggressive systematic monetary policy in a high inflation regime. The red-dashed dotted (blue dashed) lines plots the response of output and inflation to an uncertainty shock in the high (low) inflation regime conditional on the same systematic monetary policy response to an uncertainty shock (calibration of the Taylor-rule response to inflation: 1.75), while the magenta dotted reponses are those in the high inflation regime conditional an aggressive (but feasible) response to inflation (calibration of the Taylor-rule response to inflation: 3). Such an aggressive policy replicates the dynamic responses of inflation and output in the low-inflation regime conditional on a ”normal times” type of systematic monetary policy response to inflation.

Figure 4. Policy exercise: Role of “hawkish” monetary policy when trend inflation is high

What are the implication of our findings? From a modeling standpoint, our contribution points to the need to work with nonlinear frameworks to fully understand the link between uncertainty and inflation. Poliywise, our paper stresses the importance of timely and aggressive monetary policy interventions to tackle the inflationary and recessionary effects of uncertainty shocks.

Alessandri, P., and H. Mumtaz (2019): “Financial Regimes and Uncertainty Shocks,” Journal of Monetary Economics, 101, 31–46.

Angelini, G., E. Bacchiocchi, G. Caggiano, and L. Fanelli (2019): “Uncertainty Across Volatility Regimes,” Journal of Applied Econometrics, 34(3), 437–455.

Angelini, G., and L. Fanelli (2019): “Exogenous uncertainty and the identification of Structural Vector Autoregressions with external instruments,” Journal of Applied Econometrics, 34(6), 951–971.

Ascari, G., D. Bonam, L. Mori, and A. Smadu (2024): “Fiscal Policy and Inflation in the Euro Area,” CEPR Discussion Paper No. 19683.

Ascari, G., and A. M. Sbordone (2014): “The Macroeconomics of Trend Inflation,” Journal of Economic Literature, 52(3), 679-739.

Baker, S., N. Bloom, and S. J. Davis (2016): “Measuring Economic Policy Uncertainty,” Quarterly Journal of Economics, 131(4), 1539–1636.

Basu, S., and B. Bundick (2017): “Uncertainty Shocks in a Model of Effective Demand,” Econometrica, 85(3), 937–958.

Bernanke, B., and O. Blanchard (2023): “What Caused the U.S. Pandemic-Era Inflation?,” American Economic Journal: Macroeconomics, forthcoming.

Bloom, N. (2009): “The Impact of Uncertainty Shocks,” Econometrica, 77(3), 623–685.

Bloom, N. (2014): “Fluctuations in Uncertainty,” Journal of Economic Perspectives, 28(2), 153–176.

Borio, C., M. J. Lombardi, J. Yetman, and E. Zakrajsek (2023): “The two-regime view of inflation,” BIS Working Paper No. 133.

Born, B., and J. Pfeifer (2021): “Uncertainty-driven business cycles: assessing the markup channel,” Quantitative Economics, 12(2), 587–623.

Canova, F., and F. J. P. Forero (2024): “Does the transmission of monetary policy shocks change when inflation is high?,” available at https://sites.google.com/view/fabio-canova-homepage/home.

Carriero, A., T. E. Clark, and M. Marcellino (2019): “The Identifying Information in Vector Autoregressions with Time-Varying Volatilities: An Application to Endogenous Uncertainty,” Queen Mary University of London, Federal Reserve Bank of Cleveland, and Bocconi University, mimeo.

Cascaldi-Garcia, D., C. Sarisoy, J. M. Londono, J. Rogers, D. Datta, T. Ferreira, O. Grishchenko, M. R. Jahan-Parvar, F. Loria, S. Ma, M. Rodriguez, and I. Zer (2021): “What is Certain about Uncertainty?,” Journal of Economic Literature, forthcoming.

Castelnuovo, E. (2023): “Uncertainty Before and During COVID-19: A Survey,” Journal of Economic Surveys, 37(3), 821-864.

Castelnuovo, E., G. Pellegrino, L. L. Særkjær, 2025, The Inflation Uncertainty Amplifier, mimeo, available at https://sites.google.com/site/efremcastelnuovo/home

Coibion, O., and Y. Gorodnichenko (2011): “Monetary Policy, Trend Inflation and the Great Moderation: An Alternative Interpretation,” American Economic Review, 101, 341–370.

Coibion, O., Y. Gorodnichenko, and M. Weber (2023): “Monetary policy communications and their effects on household inflation expectations,” IMF Economic Review, 71, 326–368.

Coibion, O., and N. Pandalai-Nayar (2024): “What does the Trump win mean for the U.S. and global economic outlook?,” Empirical Macroeconomics Policy Center of Texas, November 13.

Fasani, S., H. Mumtaz, and L. Rossi (2022): “Monetary Policy Uncertainty and Firm Dynamics,” Review of Economic Dynamics, forthcoming.

Fernandez-Villaverde, J., and P. Guerron-Quintana (2020): “Uncertainty Shocks and Business Cycle Research,” Review of Economic Dynamics, 37(1), S118–S146.

Fernandez-Villaverde, J., P. Guerron-Quintana, K. Kuester, and J. F. Rubio-Ramırez (2015): “Fiscal Volatility Shocks and Economic Activity,” American Economic Review, 105(11), 3352–3384.

Forni, M., L. Gambetti, and L. Sala (2021): “Macroeconomic Uncertainty and Vector Autoregressions,” available at http://pareto.uab.es/lgambetti/research3.htm.

Gargiulo, V., C. Matthes, and K. Petrova (2024): “Monetary Policy across Inflation Regimes,” Federal Reserve Bank of New York Staff Report No. 1083.

Giannone, D., and G. Primiceri (2024): “The Drivers of Post-Pandemic Inflation,” NBER Working Paper No. 32859.

Gorodnichenko, Y., and O. Coibion (2025): “What’s happening with inflation expectations?,” Empirical Macroeconomics Policy Center of Texas, April 28.

Ludvigson, S. C., S. Ma, and S. Ng (2021): “Uncertainty and Business Cycles: Exogenous Impulse or Endogenous Response?,” American Economic Journal: Macroeconomics, 13(4), 369–410.

Meyer, B. H., E. Mihaylov, J. M. Barrero, S. J. Davis, D. Altig, and N. Bloom (2022): “Pandemic-Era Uncertainty,” NBER Working Paper No. 29958.

Reis, R. (2021): “Losing the Inflation Anchor,” Brookings Papers on Economic Activity, pp. 307–361.

Reis, R. (2022): “The Burst of High Inflation in 2021-22: How and Why Did We Get Here?,” BIS Working Papers No. 1060.

Schorfheide, F. (2005): “Learning and Monetary Policy Shifts,” Review of Economic Dynamics, 8(2), 392–419.

For an account of how uncertainty played out during the pandemic, see Meyer, Mihaylov, Barrero, Davis, Altig, and Bloom (2022). For recent surveys on uncertainty, see Fernandez-Villaverde and Guerron-Quintana (2020), Cascaldi-Garcia, Sarisoy, Londono, Rogers, Datta, Ferreira, Grishchenko, Jahan-Parvar, Loria, Ma, Rodriguez, and Zer (2021), and Castelnuovo (2023). For analysis and discussions on the build-up of inflation during and after the pandemic, see Reis (2021, 2022), Coibion, Gorodnichenko, and Weber (2023)) Bernanke and Blanchard (2023), Giannone and Primiceri (2024), and Ascari, Bonam, Mori, and Smadu (2024).

Examples focusing on macroeconomic uncertainty shocks are Carriero, Clark, and Marcellino (2019), Angelini and Fanelli (2019), Angelini, Bacchiocchi, Caggiano, and Fanelli (2019), Forni, Gambetti, and Sala (2021), and Fasani, Mumtaz, and Rossi (2022)). A different, although connected strand of the literature has investigated the effects of financial uncertainty shocks (see, e.g., Bloom (2009), Basu and Bundick (2017), Ludvigson, Ma, and Ng (2021)) and economic policy uncertainty shocks (Baker, Bloom, and Davis (2016)).

Importantly, Sheremirov (2020) and Alvarez-Blaser (2024) find a positive correlation between price dispersion and inflation in US micro data when excluding temporary sales and focusing on regular prices, while Ropele, Coibion, and Gorodnichenko (2024) work with firm-level Italian data and document a causal link going from changes in the dispersion of beliefs about future inflation and misallocation of resources, which the authors quantify to induce a more severe misallocation in times of high inflation.