This policy brief is based on “German Inflation-Linked Bonds: Overpriced, yet Undervalued”. The views expressed are those of the authors and not necessarily those of the institutions the authors are affiliated with.

Abstract

In a surprising move, the German Federal Finance Agency halted all future issuance of its inflation-linked government bonds in November 2023. We document that this decision had virtually no impact. We show that these bonds carried a measurable 0.33% “safety premium” — a clear signal of investor confidence. Crucially, after the government pulled the plug, neither this premium nor the bonds’ trading liquidity suffered. Our findings show that this vital segment of the euro area’s debt market remains a resilient and rich source of information on real interest rates, continuing to offer investors a safe, inflation-protected refuge.

Standard fixed-coupon German government bonds, widely known as bunds, represent the benchmark class of safe assets in the euro area and are second only to U.S. Treasuries in terms of investor base, liquidity, and market depth. In contrast, German inflation-linked government bonds, though important, have received much less attention. In an extraordinary move, the German Federal Finance Agency announced in November 2023 that it would cease all future issuance of these important inflation-protected assets. We provide the first comprehensive analysis of this market, studying its response to the government’s decision.

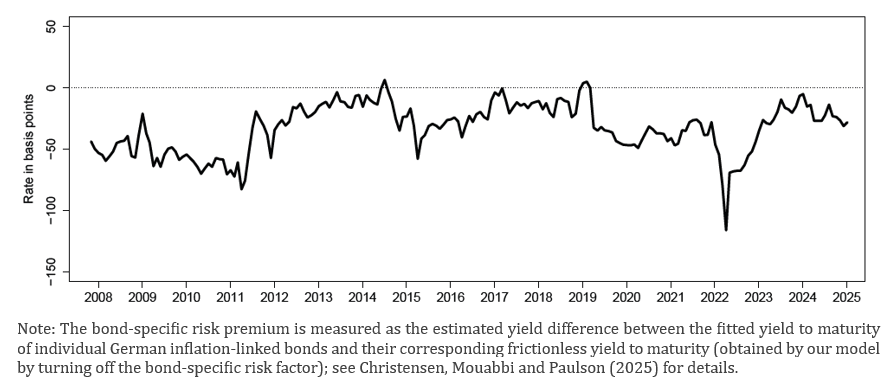

Based on the large and well-documented flight-to-safety effects in the German bund market, we conjecture that investors may also be willing to pay a premium — albeit a smaller one — for the security of storing their wealth in German inflation-linked government bonds. To investigate this idea, we employ an arbitrage-free dynamic term structure model of real yields augmented with a bond-specific risk factor. Figure 1 plots the average estimated bond-specific risk premium across all outstanding German inflation-linked bonds over time. A negative value indicates that the fitted bond price exceeds the model-implied frictionless price — that is, prices are higher than they would be in a world without frictions. Notably, the series has a mean of –0.33 percent. Thus, on average, German inflation-linked bond prices appear elevated relative to the levels implied by a frictionless market without excess demand for safe assets. Given the relatively low liquidity of these securities, this convenience premium is unlikely to reflect any form of moneyness, as trading these bonds in large volumes on short notice is difficult. Instead, following Christensen and Mirkov (2022), we interpret this premium as a safety premium that investors are willing to pay due to the exceptionally high credit quality of these bonds.

Figure 1. Average Estimated German Inflation-Linked Bond-Specific Risk Premium

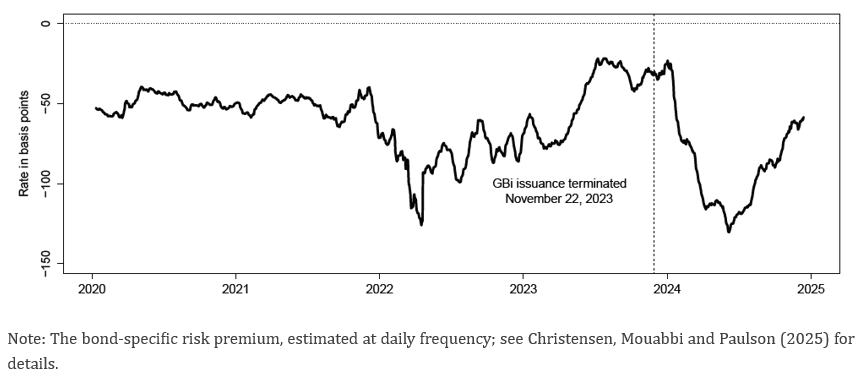

We analyze the market reaction to the German Federal Finance Agency’s announcement on November 22, 2023, that it would cease issuing new inflation-linked debt. To do so, we re-estimate our model using daily data rather than the monthly frequency employed thus far. Figure 2 displays the resulting average estimated bond-specific safety premium from the beginning of 2020 through the end of December 2024. We find no evidence that the announcement adversely affected either the safety premia or the trading conditions of existing inflation-linked bonds. Investors did not position themselves for a future decline in market activity. Overall, the market reaction was muted, and the inflation-linked market continued to operate in line with historical patterns through the end of our sample. Hence, despite the absence of new issuance since November 2023, trading in German inflation-linked securities has remained robust. If anything, their safety premium is larger now, likely due to their inevitably increasing scarcity.

Figure 2. Average Daily Estimated Bond-Specific Safety Premium since 2020

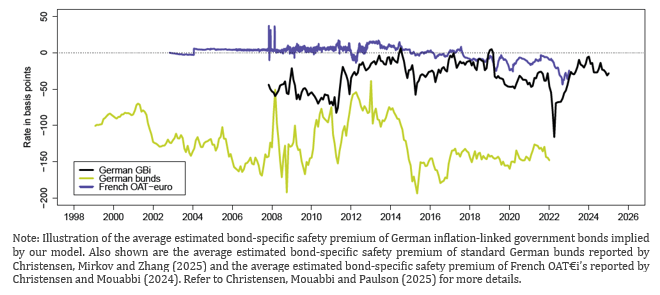

As an additional validation exercise — and to place our estimated average safety premium for German GBis in an international context — we compare it with corresponding estimates from two other major bond markets: the French OAT€i market, whose HICP (ex-tobacco)-indexed cash flows are studied by Christensen and Mouabbi (2024), and the much larger market for standard German bunds examined in Christensen, Mirkov and Zhang (2025). Figure 3 plots the resulting average estimated bond-specific safety premia for all three euro-area markets. As noted earlier, the estimated safety premia for German inflation-linked bonds are –33 basis points, on average, over our sample from October 2007 to December 2024, whereas the estimated premia for French OAT€i average –1 basis point over the period from October 2002 to December 2022. Hence, in contrast to our findings for German inflation-linked bonds, Christensen and Mouabbi (2024) report no detectable safety premium, on average, in the French inflation-linked market. More importantly, the estimated safety premia for German nominal bunds average –124 basis points. Thus, the safety premium in the nominal bund market is roughly four times larger than in the smaller and less liquid market for German inflation-linked bonds.

Figure 3. Comparison of Average Estimated Bond-Specific Safety Premia

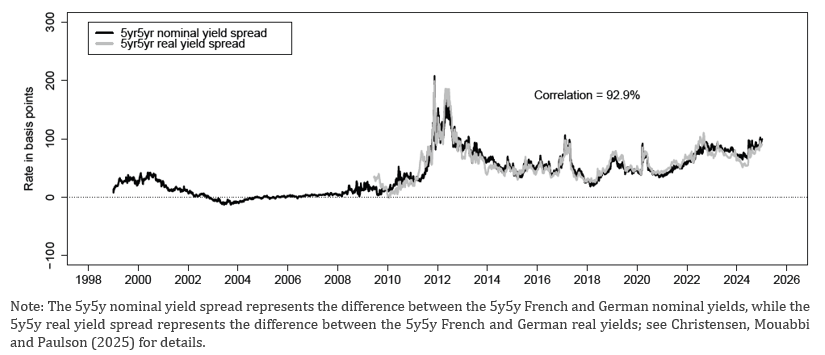

We now assess whether German inflation-linked government bonds are priced differently from standard German bunds by comparing each market with its French counterpart. If nominal bunds and German inflation-linked bonds are priced on fundamentally different terms — as suggested by the sizable gap in their average safety premia in Figure 3 — this should be reflected in differences in their yield spreads relative to French bonds. As our representative metric, we use the five-year forward yield spread between French and German inflation-linked bonds for the period beginning five years ahead. Figure 4 shows that the 5y5y real and nominal Franco-German yield spreads move strikingly in tandem. We interpret these spreads primarily as differences in credit risk premia rather than liquidity premia. Both spreads exhibit temporary spikes during classic flight-to-safety episodes. Yet these surges are short-lived, and the spreads remain persistently above zero with meaningful variation even in calm periods. Taken together, these patterns indicate that the spreads embed safety premia. Moreover, both series have trended higher since 2018, suggesting that German government bonds have become increasingly safe relative to French government bonds. Equally important, German inflation-linked bonds appear just as advantageous to issue — relative to French inflation-linked bonds — as nominal German bunds are relative to French OATs. The yield spread savings are statistically indistinguishable throughout nearly the entire fifteen-year period. As a result, there is no clear point at which issuing only nominal bunds would have been materially more beneficial than the actual mix of bunds and inflation-linked bonds. If anything, issuing fewer inflation-linked bonds might have increased their scarcity and made their relative pricing even more favorable.

Figure 4. Franco-German Government Bond Yield Spreads

Christensen, Jens H. E. and Nikola Mirkov, 2022, “The Safety Premium of Safe Assets,” Working Paper 2019-28, Federal Reserve Bank of San Francisco.

Christensen, Jens H. E., Nikola Mirkov, and Xin Zhang, 2025, “Quantitative Easing and the Supply of Safe Assets: Evidence from International Bond Safety Premia,” Journal of International Economics, Vol. 157, 104146.

Christensen, Jens H. E. and Sarah Mouabbi, 2024, “The Natural Rate of Interest in the Euro Area: Evidence from Inflation-Indexed Bonds,” Working Paper 2024-08, Federal Reserve Bank of San Francisco.

Christensen, Jens H. E., Sarah Mouabbi and Caroline Paulson, 2025. “German Inflation-Linked Bonds: Overpriced, yet Undervalued”, Working papers 1012, Banque de France.