This policy brief is based on BIS Working Papers No 1305. The views expressed here are those of the authors and do not necessarily reflect those of the Bank of Italy, the Bank for International Settlements or any of their policy committees.

Abstract

Firms’ pricing decisions play a crucial role in shaping inflation. Understanding how firms translate input price changes into their own pricing and broader views on inflation is essential for central banks to manage inflation effectively. In this column, we examine the pass-through from input prices to firms’ expectations and pricing decisions using data from the Bank of Italy’s Survey on Inflation and Growth Expectations (SIGE). We find that the pass-through is strong and asymmetric: when firms face higher-than-expected input costs, they revise prices upward and expect higher near-term inflation. By contrast, unexpectedly lower input prices have little effect. The magnitude of the pass-through varies systematically across firms: it is stronger for upstream firms and for those facing greater uncertainty, adjusting prices more frequently, or operating with thinner margins. The pass-through also depends on the inflation environment: firms respond more strongly to firm-specific signals when inflation is low, whereas aggregate conditions dominate when inflation is high. Finally, we show that providing firms with information on current inflation attenuates the pass-through to their expectations, highlighting the role of central bank communication.

Firms’ pricing decisions are especially important at times of elevated inflation and supply chain disruptions. When input costs rise, firms must decide how much of these changes to absorb and how much to transfer to their selling prices. Their decisions influence not only current inflation but also expectations that guide their future decisions. Despite its policy relevance, empirical evidence on how firms react to input price movements remains limited, largely because of limited availability of micro-level data.

In a recent paper (De Fiore et al., 2025), we study how Italian firms update both their expectations and their pricing behaviour when confronted with unexpected changes in input costs. We also explore how these responses differ across inflation regimes and across firms with different characteristics.

Our analysis draws on firm-level data from the SIGE, a quarterly, nationally representative survey covering a wide set of Italian firms. The survey asks firms about business-specific variables — such as expected input price growth, expected own-price growth over a 12-month horizon, and realised price changes over the previous 12 months — as well as inflation expectations at various horizons (6, 12, 24 and 36–60 months ahead). Our sample spans the years from 2017 to 2024.

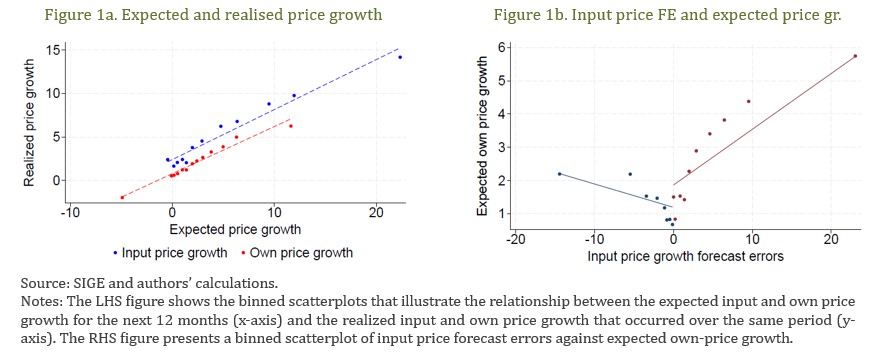

Figure 1a shows the relationship between expected and realised input and output price growth. The strong positive correlation confirms that firms track the evolution of their own input and selling prices remarkably well, supporting the reliability of the survey and the elicited expectations.

To capture unexpected changes in input costs, we construct forecast errors as the difference between realised input price growth and the growth firms had predicted one year earlier. These forecast errors provide an exogenous measure of unanticipated cost shocks. Figure 1b shows a pronounced asymmetry: positive forecast errors, i.e., input prices turning out higher than expected, are associated with substantial upward revisions in expected own-price growth. By contrast, negative forecast errors are not associated with comparable downward adjustments.1

Figure 1. Firms’ expected and realised own price growth and input price forecast errors (FE)

We quantify the impact of unexpected input cost changes by estimating regressions of firms’ expectations and pricing decisions on their input price forecast errors, and a set of controls like the sector in the firm operates and its size.

We find a strong pass-through from unexpected input cost increases to both expected and realised selling prices. This indicates that firms tend to shift part of the cost increase onto their customers.2 However, the effect is marked asymmetric: firms adjust prices upward in response to positive forecast errors, whereas negative forecast errors have only negligible effects on pricing decisions.

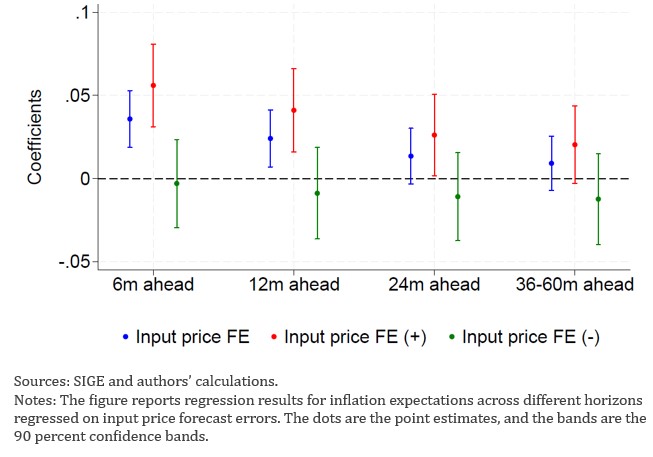

Figure 2 illustrates how these shocks affect inflation expectations across different horizons. Higher-than-expected input prices increase short-term inflation expectations, while longer-term expectations remain relatively stable, suggesting that firms view cost shocks as transitory. Separating positive from negative forecast errors reveals that the aggregate effect is almost entirely driven by the positive surprises.

Figure 2. Input price forecast errors and firms’ inflation expectations

The magnitude of the pass-through depends heavily on firms’ characteristics and on the inflation regime.

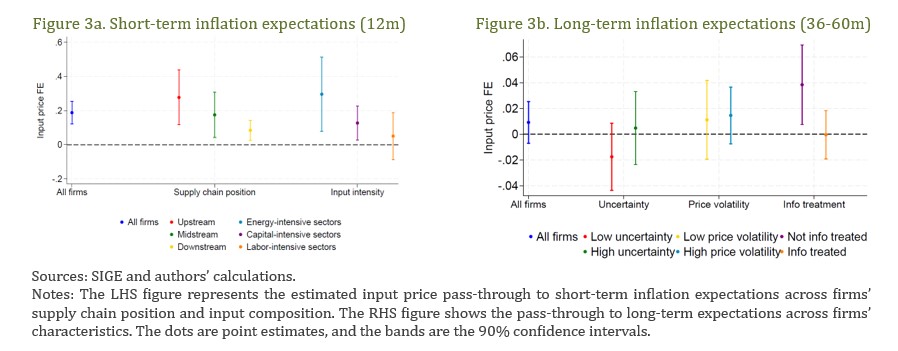

We estimate heterogeneous pass-through coefficients by conditioning on several firm-level attributes. Figure 3a shows that the pass-through to 12-month-ahead expected inflation is substantially stronger for firms in upstream sectors — those furthest from the final consumer — and for firms whose cost structures are more energy- or capital-intensive.3 These firms are particularly exposed to global input price swings.

Across other characteristics, we find higher pass-through for firms operating under greater uncertainty, in markets with volatile prices, with stronger market power, or with more liquidity available.4 The inflation regime also matters: firms place more weight on firm-specific signals when inflation is low, but react more to aggregate signals when it is high, suggesting that high-inflation environments make firms more attentive to aggregate developments, as opposed to firm-specific ones.

Finally, we assess whether providing firms with information on current inflation affects the passthrough. Since 2012, two-thirds of SIGE respondents have been randomly exposed to the most recent inflation data before reporting their expectations. Prior research shows that this type of information provision significantly influences expectations (Coibion et al., 2020). Figure 3b shows that the pass-through to long-term expectations is virtually absent for firms receiving additional information, whereas it is sizable for firms not exposed to it. This finding underscores the potential of communication strategies in anchoring expectations and dampening the transmission of cost shocks.

Figure 3. Input price pass-through to expectations across firms’ characteristics

We document a strong yet asymmetric pass-through of unexpected input price movements to firms’ expectations and pricing decisions. Firms react forcefully to rising costs but barely respond to falling ones. This asymmetry helps explaining why inflation tends to rise rapidly but decline only gradually. The extent of the pass-through varies across firms depending on their sector, cost structure, market environment, and financial conditions, and differs across inflation regimes. Our findings highlight the importance of understanding firm heterogeneity and the broader macroeconomic context when interpreting inflation dynamics.

Our results have relevant policy implications. Since firms respond more strongly to cost increases than decreases, disinflation may proceed more slowly even as cost pressures ease. Structural characteristics, such as economic uncertainty and market power, along with firms’ financial conditions, including liquidity and leverage positions, influence the transmission of shocks and should be taken into account when formulating policy responses. Finally, clear and timely central bank communication can significantly dampen the effects of cost shocks by anchoring expectations, underscoring its role as a key complement to conventional monetary policy.

Coibion, O., Gorodnichenko, Y., Ropele, T., 2020. Inflation expectations and firm decisions: New causal evidence. Quarterly Journal of Economics 135, 165–219.

Conflitti, C., Zizza, R., 2021. What’s behind firms’ inflation forecasts? Empirical Economics. 61, 2449–2475.

De Fiore, F., Lombardi, M., and Mangiante, G. (2025). The asymmetric and heterogeneous pass-through of input prices to firms’ expectations and decisions. Working Paper Series No 1305, Bank of International Settlements.

Gilchrist, S., Schoenle, R., Sim, J., Zakrajšek, E., 2017. Inflation dynamics during the financial crisis. American Economic Review 107, 785–823.

Gödl-Hanisch, I., Menkhoff, M., 2024. Firms’ pass-through dynamics: A survey approach. LMU Munich, CEPR, CESifo, and ifo Institute, Working Paper.

Riggi, M., Tagliabracci, A., 2022. Price rigidities, input costs, and inflation expectations: Understanding firms’ pricing decisions from micro data. Bank of Italy Working Paper No. 733.

The same pattern is observed with realised price growth. Moreover, this asymmetry is not driven by the recent high-inflation episode but is also evident during the preceding low-inflation period up to the end of 2021.

The strong but incomplete pass-through is in line with the literature. See, among others, Conflitti and Zizza (2021) and Riggi and Tagliabracci (2022).

Consistent with evidence from Gödl-Hanisch and Menkhoff (2025).

In line with Gilchrist et al., (2017).