The analysis is based on Kolasa et al. (2025). See that paper for further analysis, explanations, and results. The views expressed in this article are our own and should not be construed as reflecting the views and positions of Sveriges Riksbank, IMF staff, IMF management or IMF Executive Board.

Abstract

Between 2015 and 2019, the Riksbank used unconventional tools – negative policy rates and large-scale asset purchases – to stimulate the Swedish economy and reinforce confidence in the inflation target. This brief analyses the macroeconomic and fiscal effects of these policies using a structural macroeconomic model. We find that the Riksbank’s actions brought inflation closer to target and boosted GDP. By end-2019, they strengthened public finances far more than subsequent post-pandemic Riksbank balance sheet losses. This contradicts claims that the Riksbank asset purchases imposed large costs on the Swedish Treasury. Our analysis suggests that quantitative easing should remain as a complementary policy option to negative policy rates, though its risks – highlighted by post-Covid central bank losses – warrant caution.

Following the global and euro area crises, central banks adopted unconventional monetary policy (UMP) measures to tackle low inflation and falling expectations. In 2015, the Riksbank combined negative rates with government bond purchases. These policies remain controversial. Proponents argue they countered deflation, while critics — especially after the 2022 inflation surge and central bank losses — claim they were ineffective and costly. In 2024, the Riksbank requested a capital injection of SEK 43.7 billion (0.7% of GDP) due to portfolio losses.

The 2023 report of the Swedish National Audit Office (NAO) and several academics have criticised the Riksbank’s asset purchases as costly and ineffective. The Long-Term Inquiry (SOU 2023:85) echoed scepticism.

Despite this critical reassessment, there has been no comprehensive analysis of the overall effects and costs of the Riksbank’s unconventional monetary policy between 2015 and the onset of the pandemic—nor of how those outcomes compare to alternative fiscal strategies. Our recent study (Kolasa et al. 2025) addresses this gap by extending the closed-economy model of Adrian et al. (2025a) to an open economy framework. This allows us to conduct the first thorough evaluation of both the macroeconomic impact and the consolidated public finance effects of the Riksbank’s policy during this period.

One of the central contributions of our analysis is the explicit inclusion of the exchange rate channel — a mechanism often overlooked but playing a pivotal role in the transmission of both monetary and fiscal policy in a small open economy like Sweden. QE affects long-term interest differentials, influencing the exchange rate and thus inflation and output via trade prices. We show this channel is vital to understanding the effects of unconventional policy.

Importantly, our calibration is conservative. It relies on the same empirical foundation (Fabo et al. 2021) used by the NAO and others in their critique. This ensures that the estimated benefits are not overstated.

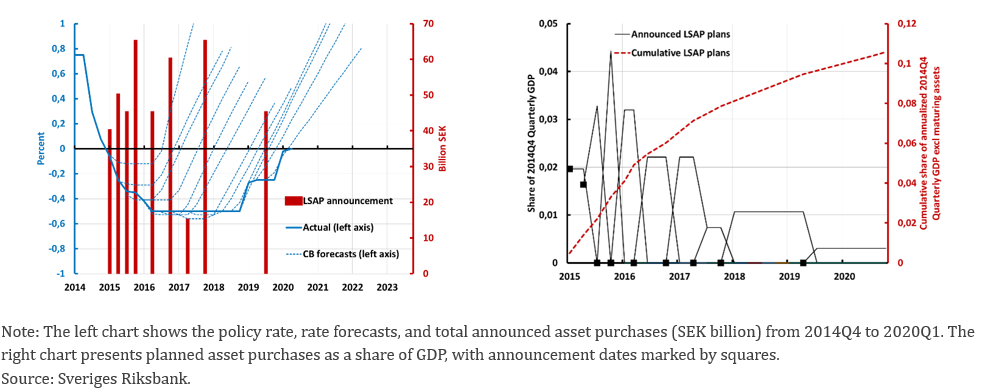

We conduct a case study of the Riksbank’s asset purchases and negative interest rate policy from 2015 to 2019 by calibrating a model to replicate the key monetary policy decisions and forecasts during this period. Figure 1 illustrates these policies: the left panel shows the actual policy rate and forecast paths at each monetary policy meeting, while the bars indicate the size of asset purchase announcements. The right panel displays how these purchases were phased in over time.

Before 2017, the Riksbank cut rates deeper into negative territory but never signalled further cuts; only in 2017 did it suggest that additional reductions below –0.5% might be warranted. Throughout the period, the Riksbank consistently projected a gradual return to positive rates within a three-year horizon, avoiding any signal of permanently low nominal rates. Most asset purchases were announced in 2015–2016, with only three programmes launched thereafter. Early purchases were front-loaded, while later ones were more gradual. By end-2019, total announced purchases equalled just over 10% of 2014 GDP.

We integrate these policy paths into a macroeconomic model to simulate a low-inflation, low-activity environment in which the Riksbank responds with negative rates and multiple rounds of asset purchases aimed at preventing exchange rate appreciation and stimulating inflation. The simulation begins in 2014Q4, just before the introduction of negative rates, with inflation below target and the policy rate at zero. From 2015 onwards, we introduce quarterly shocks that match the timing, size, and duration of the Riksbank’s asset purchases, as well as negative demand shocks and a falling effective lower bound to reflect interest rate cuts and forecasts.

The simulation proceeds quarter by quarter until 2019, updating with each new policy announcement. We then compare three counterfactuals: (i) negative rates without asset purchases, (ii) asset purchases with a zero policy rate, and (iii) no unconventional measures at all.

Figure 1. The Riksbank’s policy rate forecasts and announced and planned purchases of government bonds

Percent, SEK Billion, Share and cumulative share of 2014 quarterly GDP

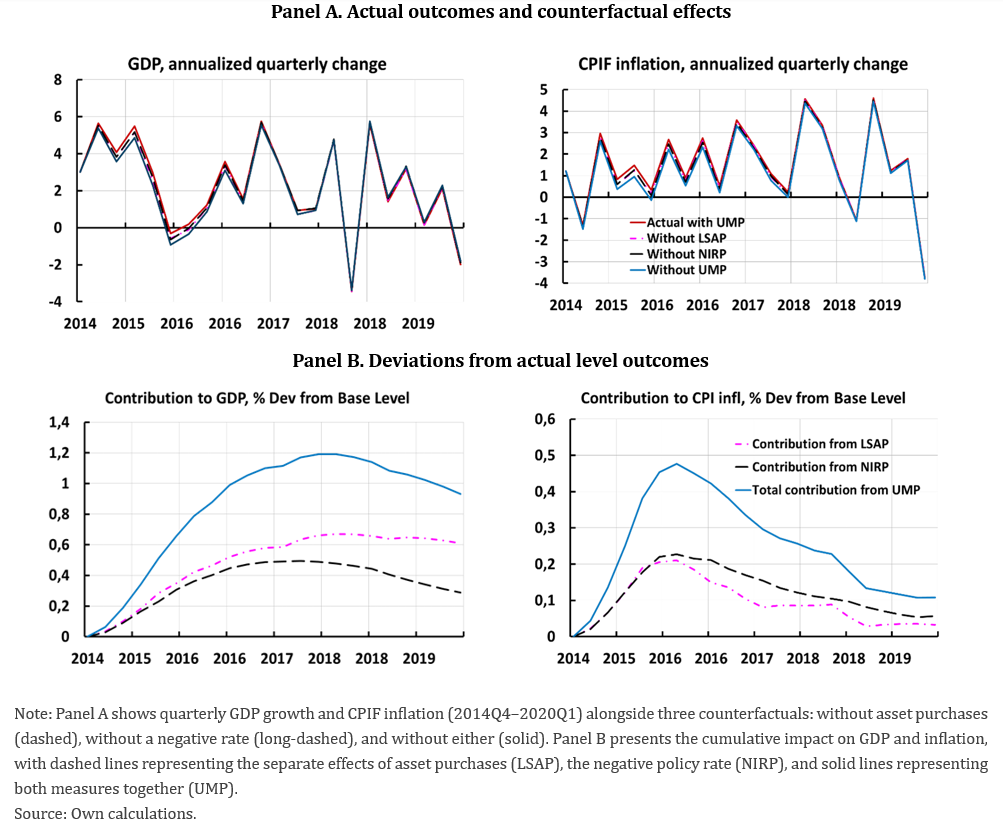

Figure 2 (Panel A) shows GDP growth (left) and the CPIF inflation (right) from 2014Q4 to 2020Q1. Solid lines show actual outcomes; dotted lines depict the counterfactuals. While the absence of negative rates and asset purchases would have reduced both GDP and inflation, quarter-to-quarter fluctuations obscure these effects in real time. This can create the impression that unconventional monetary policy is ineffective — even when it has meaningful underlying impact.

Panel B shows the accumulated effects over time. The contribution to the GDP level exceeds 1 per cent, while the effect on inflation peaks at nearly 0.5 percentage points in early 2016. The Riksbank’s policy also led to a persistent exchange rate depreciation of around 5 per cent (not shown).

Both asset purchases and negative policy rates contributed meaningfully and in a complementary way: lower rates stimulated domestic demand, while asset purchases supported net exports via a weaker krona. The results suggest that short-term event studies risk underestimating the medium-term impact of unconventional monetary policy. When viewed through an accumulated lens, the measures clearly played an important role in stabilising the economy and improving goal attainment. Importantly, these estimates are conservative, as the non-linear model we use tends to yield lower inflation effects than standard linear models.

Figure 2. Effects of the Riksbank’s UMP on GDP and inflation in Sweden 2015–2019

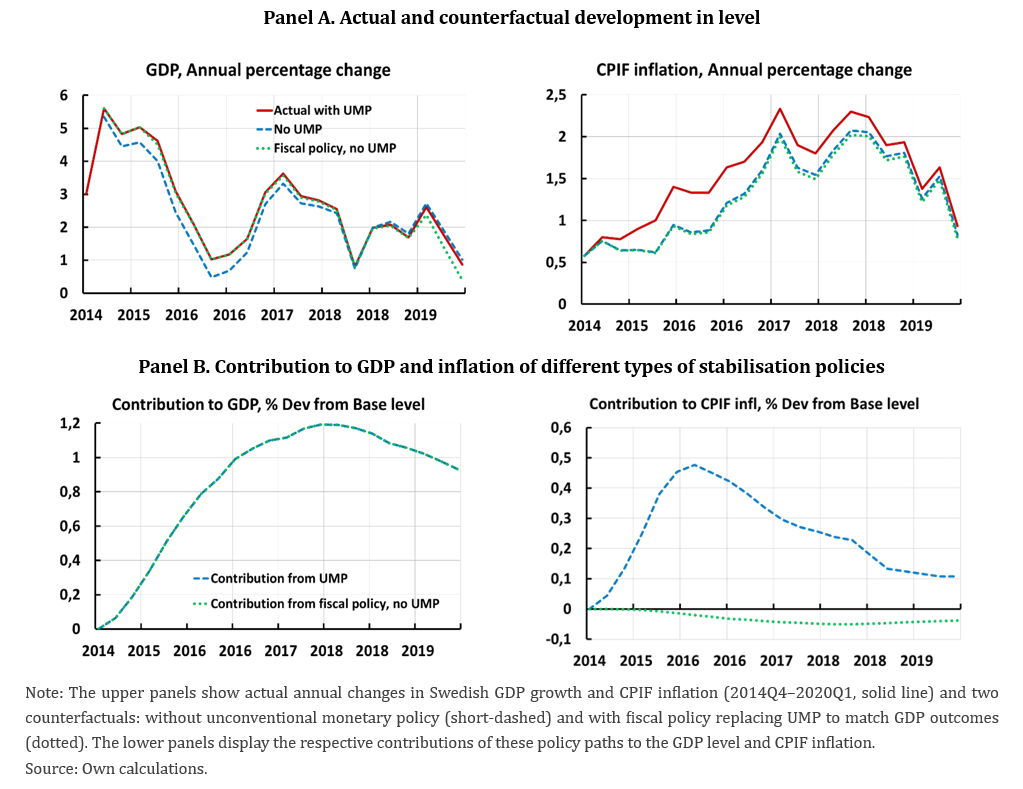

We also simulate a scenario in which fiscal policy replaces unconventional measures (Figure 3). Starting from the same conditions and shocks, we adjust public spending to match the observed GDP path. A fiscal expansion of just over 1% of GDP would have sufficed — implying a multiplier close to 1.

Figure 3. Macroeconomic effects of alternative monetary and fiscal policy combinations 2015–2019

However, while output paths are similar, inflation remains lower under the fiscal-only scenario. QE weakens the exchange rate and raises import prices and domestic demand, lifting inflation. Fiscal policy, by contrast, tends to strengthen the currency and may therefore even dampen price pressures. In fact, our model implies that fiscal stimulus alone may result in lower inflation if the exchange rate channel (lower import prices) dominates the domestic demand (higher domestic prices) channel.

Moreover, monetary policy raises demand without expanding potential output, widening the output gap and raising inflation. Fiscal policy increases potential GDP through higher public consumption, thus easing inflationary pressure.

Our model also shows that inflation responds sluggishly to higher demand when inflation is low and rates are constrained, due to nominal rigidities. This further limits the effectiveness of fiscal stimulus under such conditions.

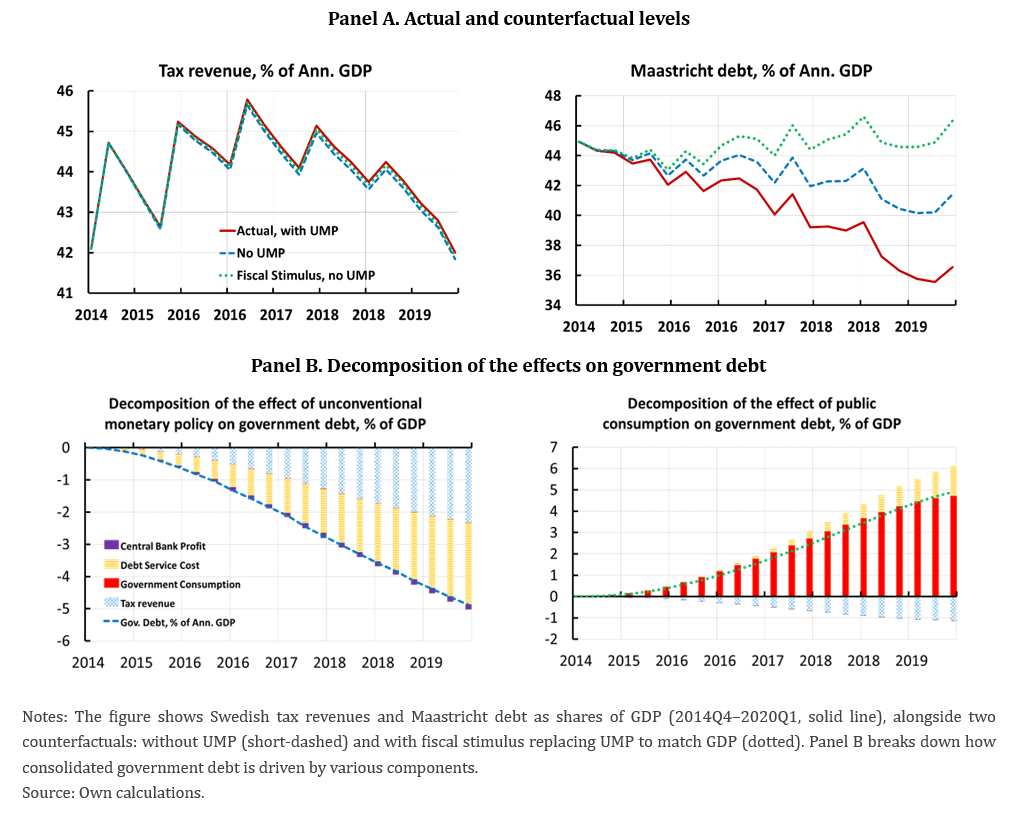

We then assess the fiscal impact of these policies (Figure 4). Without the Riksbank’s unconventional measures, government debt would have been about 5 percentage points higher by end-2019. Replacing QE with fiscal stimulus would have raised debt by another 5 points. In total, public debt would have been roughly 10 percentage points higher entering the Covid crisis.

Figure 4. Fiscal consequences of alternative combinations of fiscal and monetary policies 2015–2019

A key takeaway is that while both monetary and fiscal policy can stabilise GDP, they have very different effects on public finances. Fiscal stimulus involves direct expenditures, while the Riksbank’s measures lowered borrowing costs through reduced interest rates and higher bond prices. Fiscal stimulus also yields lower tax revenues—due to weaker effects on private consumption and wage inflation—compared to monetary stimulus.

Over time, these differences become more pronounced: during this period, fiscal policy would have been significantly more expensive than the Riksbank’s unconventional measures. This does not imply that all fiscal interventions — such as investments in infrastructure or R&D — would have been ineffective. Nor does it mean that future asset purchases will be equally cost-efficient, especially if financial conditions change. However, our findings suggest that in the years 2015–2019, the Riksbank’s unconventional monetary policy delivered meaningful macroeconomic benefits and likely contributed positively to the public finances.

Our conservative counterfactuals suggest that the fiscal gains from the Riksbank’s unconventional policy measures far exceeded the balance sheet losses recorded in 2022. While previous evaluations struggled to identify clear macroeconomic effects, our analysis suggests the combined use of asset purchases and negative rates lowered borrowing costs, boosted output and inflation, and raised revenues — strengthening public finances overall.

It is therefore misleading to claim, as some reports do, that QE imposed large costs without recognising its broader benefits. Our estimated net benefit is robust and would require extreme assumptions to overturn. Against this backdrop, the post-pandemic losses appear modest.

We acknowledge that alternative or combined fiscal strategies — such as those proposed by Correia et al. (2013) and Farhi et al. (2014) — might have achieved similar outcomes with different costs or inflation effects. This merits further research in the Swedish context.

Our analysis abstracts from the effects of QE abroad, which may operate differently in large, closed economies. In Sweden, the exchange rate channel is more prominent and the effects of QE on other countries are negligible.

Finally, the post-pandemic experience reminds us that QE entails real risks, especially in response to large demand and supply shocks. Hence, QE can pose significant risks of central bank losses which in turn may weaken central bank credibility and independence. As Adrian et al. (2025b) argue, alternative and more risk-based approaches to allocating central bank profits to the Treasury may be helpful in reducing risks to the central bank’s balance sheet position, and thus in protecting central bank credibility and independence.

Ultimately, the merits of unconventional monetary policy must be judged in relation to alternative tools. This broader perspective is essential for designing future policy.

Adrian, T, C Erceg, M Kolasa, J Linde and P Zabczyk (2025a), “Macroeconomic and Fiscal Consequences of Quantitative Easing”, IMF Working Papers 158, International Monetary Fund.

Adrian, T, C Erceg, M Kolasa, J Lindé and P Zabczyk (2025b), ‘New Perspectives on Quantitative Easing and Central Bank Capital Policies’, in Central Bank Capital in Turbulent Times, Eds. D. Broeders, A. Houben and M. Bonetti, Springer: Contributions to Finance and Accounting.

Andersson, F N G och L Jonung (2023), ”Riksbanken måste erkänna sina misstag”, Svenska Dagbladet, 28 oktober 2023.

Calmfors, L, J Hassler and A Seim (2022), Interaction for stability – an ESO report on the division of roles between fiscal and monetary policy, ESO report 2022:3.

Correia, I, E Farhi, J P Nicolini and P Teles (2013), “Unconventional Fiscal Policy at the Zero Bound”, American Economic Review, vol 103, no. 4, pp. 1172-1211.

Fabo, B, M Jančoková, E Kempf and Ľ Pástor (2021), “Fifty Shades of QE: Comparing Findings of Central Bankers and Academics”, Journal of Monetary Economics, vol 120(C), p 1-20.

Farhi, E, G Gopinath and O Itskhoki (2014), “Fiscal Devaluations”, Review of Economic Studies, vol 81, no. 2, pp. 725-760.

Kolasa, M, S Laséen and J Lindé (2025), “Unconventional Monetary Policies in Small Open Economies”, Working Paper 450, Sveriges Riksbank.

RiR 2023:21, The Riksbank’s asset purchases – hard-earned experiences, Swedish National Audit Office Audit Report 2023.

SOU 2023:85, Fiscal Policy Stabilisation, Long-Term Inquiry 2023.

Walentin, K (2023), Monetary and fiscal policy stabilisation, SOU 2023:91, Appendix 6 to the Long-Term Inquiry 2023.

Walentin, K (2024), “Fiscal policy should stabilize the economy”, Svenska Dagbladet, 26 January 2024.