Since inception, enforcement of the EU’s Stability and Growth Pact has been a challenge. Unless member states concluded on their own that following EU rules would be to their advantage, the effect of external constraints has been limited. Branded by the fallout of the global financial crisis, in 2012 22 EU member states took a leap of faith and signed the Fiscal Compact, an intergovernmental agreement aimed at backing EU fiscal rules with national arrangements. The main objective of the initiative was to strengthen ownership through a national correction mechanism triggered in case public finances deviate from ‘the path of virtue’. While design choices vary considerably across countries, our analysis reveals distinct patterns: better compliance tends to be associated with superior design elements of the correction mechanism, with a better overall quality of governance and a stronger media presence of independent fiscal institutions (IFIs). Economic growth can make up for a less sophisticated design. Our analysis also indicates that many countries linked the trigger of the correction mechanism to EU decisions rather than to independent assessors at the national level. This choice defeats the original purpose of the correction mechanism.

Religion and EU fiscal rules – forgive us the analogy – both define a path towards redemption: religion for our souls, fiscal rules for government debt. Following the path of virtue is a question of conviction that no external constraint can match. In the case of religion we call it faith, in the case of fiscal rules national ownership.

The EU’s fiscal framework, the Stability and Growth Pact (SGP), is a very clear case in point. Since its inception, the Commission and the Council exhibited a considerable degree of forbearance in applying the EU rules and found it difficult to impose sanctions on countries that had significantly departed from the recommended fiscal path. As a result, public finance developments diverged across member states largely reflecting national preferences: some managed to follow a more prudent course of action safeguarding or building fiscal space to react to economic shocks, others recorded consistent increases in government debt relative to GDP leaving little room for manoeuvre when times turned bad.

In light of this experience, reinforcing national fiscal frameworks became the key theme in the aftermath of the Great Financial Crisis. In 2012, 22 EU member states signed an intergovernmental agreement, the Fiscal Compact2 that came on top of other ambitious reforms of the EU fiscal rules. The contracting parties committed to introducing national rules and institutions that would (i) be consistent with the main thrust of the SGP; and (ii) fix any deviation from the path of virtue by way of an automatic correction mechanism. What could be stronger and more credible than a formal commitment enshrined in national law?

In the context of the ongoing economic governance review at the EU level3, the Secretariat of the European Fiscal Board has taken a closer look at how the national correction mechanisms have been designed and implemented. To ensure an impartial view, we consulted independent fiscal institutions (IFIs) in the EU member states that signed the Fiscal Compact. While setting out general principles, the Compact left considerable leeway for national authorities to design the correction mechanism. The actual diversity can be used to identify elements that enhance or hinder compliance. This piece summarises the main findings of a more comprehensive study published as ZEW discussion paper (Larch et al. (2021)).

The idea of strengthening compliance with EU fiscal rules through national ownership played a crucial role in the aftermath of the Great Financial Crisis of 2008-09. The conviction had gained ground that ownership could only be improved if on top of professing the respect of EU rules, member states put in place institutions and processes at the national level that would be consistent with and ensure respect of EU rules. Already the budgetary frameworks directive of the so-called six-pack reform of 2011 asked EU member states to adopt national provisions specifying consequences in the event of non-compliance with their own numerical rules.

The Fiscal Compact of 2012 was a particularly important step towards national ownership for at least two reasons. First, by signing the Compact member states agreed to design and adopt, preferably at the constitutional level, a national fiscal rule ensuring a rapid convergence of the budget balance towards the country’s medium-term objective (MTO) where the latter should not exceed a deficit of 0.5% of GDP in structural terms. Second, the Compact asked member states to complement the national rule with a correction mechanism to be triggered automatically in the event the structural budget balance deviates significantly from the medium-term objective or the adjustment path towards it.

Given that in several member states key elements of the national fiscal framework predated the Fiscal Compact (e.g. structural budget balance rules and national IFIs already existed in several countries), and with a view to respecting the diversity of national administrative settings and legal traditions, no one-size-fits-all model was imposed. Instead, the Commission was empowered to detail common principles for the design of the correction mechanism, which emphasise four key elements4: (i) legal status set to be of higher order than the budget law; (ii) well-defined circumstances for triggering the mechanism; (iii) pre-determined rules to frame the size and timeline of the fiscal adjustment; and (iv) role of national IFIs in monitoring all relevant aspects of the mechanism, and in particular its triggering, progress and extension, all under the aegis of the comply-or-explain principle.

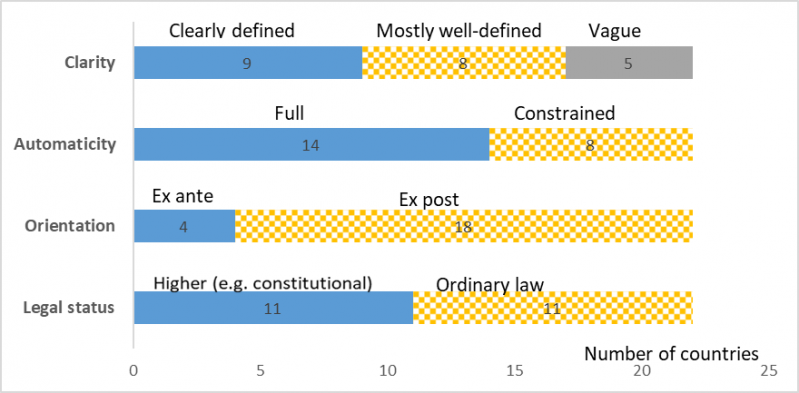

Despite these jointly agreed common principles, there are significant differences in the design of the correction mechanism across the 22 countries that signed the Fiscal Compact. This heterogeneity can be used to identify elements of best practice, especially as regards the correction mechanism, which was introduced to effectively ensure compliance with fiscal rules. Our analysis identifies four crucial dimensions of national correction mechanisms directly linked to their perceived or potential deterrence effect and where strong patterns emerged (see also Graph 1):

Graph 1: Design features of national correction mechanism

Source: Survey of the EFB Secretariat

One notable result of our survey pertains to the automatic trigger of the correction mechanism. The overwhelming majority of the Fiscal Compact countries decided to link it to formal surveillance decision at the EU level. Although, in principle, this approach ensures consistency between the EU surveillance framework and national budgetary procedures, it does not appear to promote local ownership over EU rules, which was the primary objective of the Fiscal Compact. In particular, linking the trigger to the supranational level is to be assessed against the track record of the Commission and the Council in implementing the EU fiscal rules. As highlighted by the EFB (2019), the Commission and the Council have shown a considerable degree of forbearance vis-à-vis a number of countries when assessing compliance with fiscal requirements (e.g. ad hoc adjustments to relevant fiscal indicators, and/or a generous interpretation of various flexibility clauses under the SGP). Between 2012 and 2019, EU institutions launched a significant deviation procedure only against one country, Romania, a comparatively small member state outside the euro area. This happened although developments of relevant budgetary variables in several other countries, including in particular larger ones, pointed to clear issues.

Overall, the automatic correction mechanisms cannot produce their intendent effect when the trigger is subject to ad hoc interpretations or improvisation of EU provisions. This outcome resonates with the political economy or political science literature looking at the background of different enforcement designs of supranational agencies. In particular, Franchino and Mariotto (2021) argue that EU governments anticipating a greater risk of non-compliance will prefer a solution that offers greater discretion, and countries with higher voting power push for a stronger involvement of the Council.

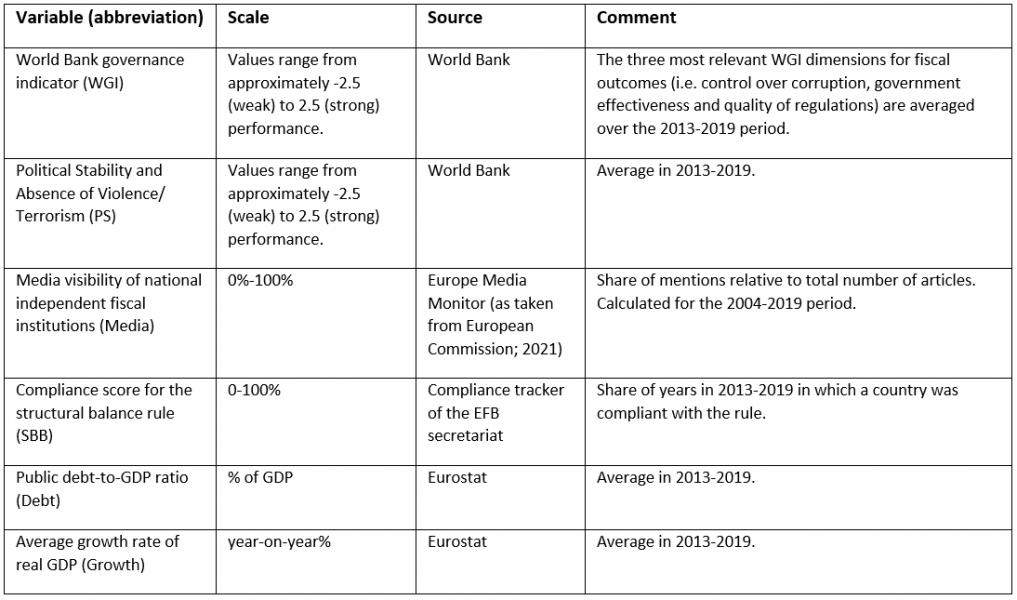

Having established a certain degree of heterogeneity in the transposition of the correction mechanism under the Fiscal Compact, the next step in our analysis was to check whether differences in design are in any meaningful way associated with other factors that are generally taken to influence compliance with fiscal rules. On top of the four dimensions of the national correction mechanisms presented in Graph 1 we consider the economic, fiscal and institutional variables listed in Table 1.

The indicator measuring compliance with fiscal rules is of particular interest. We draw on the compliance tracker of the Secretariat of the European Fiscal Board, a database measuring numerical compliance with the quantitative constraints imposed on budgetary and fiscal aggregates by the EU fiscal framework.6 Since national correction mechanisms of the Fiscal Compact are built around the structural budget balance rule, we use the score covering that particular constraint. The compliance score is binary: it takes the value 1 when a country is compliant and 0 when non-compliant. For each country, we use the share of compliant years in the sample period 2013-2019.

Table 1: Additional institutional and economic variables used in the cluster analysis

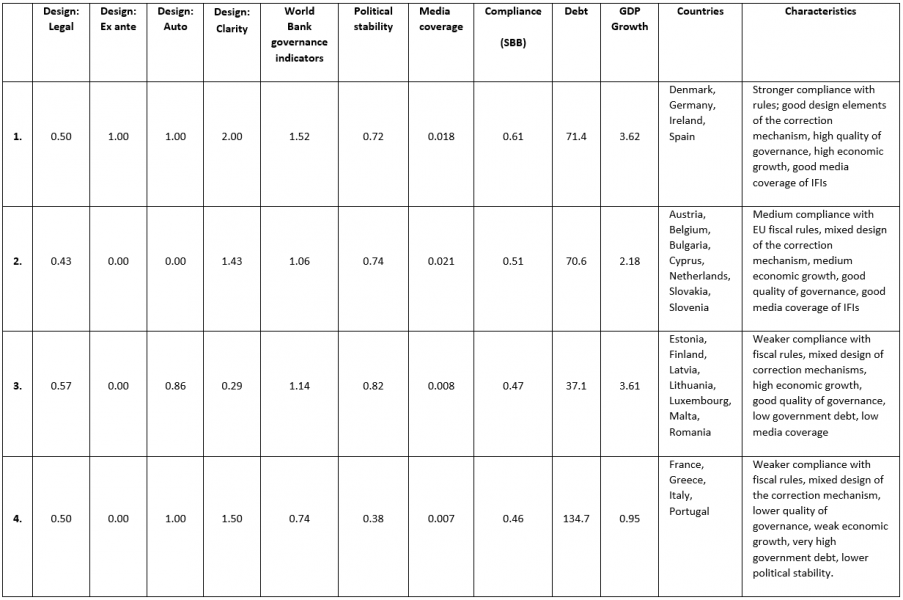

A simple cluster analysis reveals some very telling patterns.7 The clearest results are achieved by splitting the 22 Fiscal Compact countries into four groups (see Table 2):

Table 2: Results of cluster analysis (mean scores)

Notes: Dimensions of national correction mechanisms: Legal: higher status=1 vs lower status=0. Ex ante=1 vs ex post=0. Auto: fully automatic trigger=1 vs constraint=0. Clarity: clearly defined=2, mostly well-defined=1, vague=0. WGI: country-score of the World Bank governance Indicators, normalised units around 0. PS: World Bank political stability indicator; Media: media visibility index of IFIs: share of total number of articles. SBB: compliance score with the structural balance rule, 1 equal to full compliance. Debt: government debt in % of GDP; Growth: average real GDP growth rate, y-o-y % change. The reference period for all indicators is 2013-2019 with the exception of media visibility (2004-2019). The values in the table are cluster means for each indicator.

Source: Survey of the EFB secretariat, World Bank WGI database, Europe Media Monitor, Eurostat, compliance tracker of the EFB secretariat.

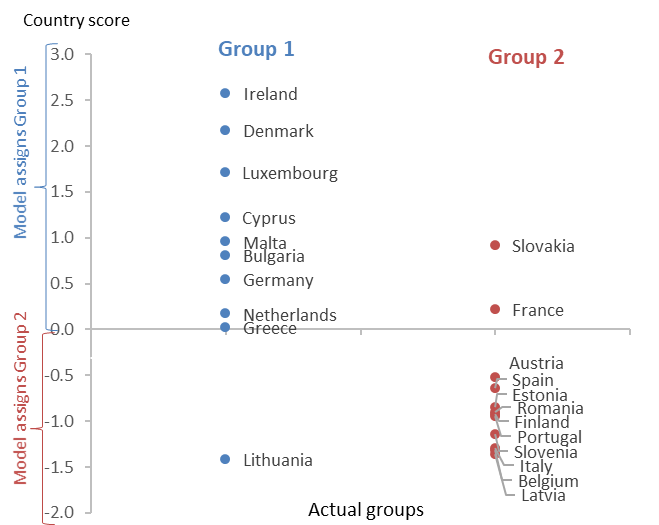

Overall, these results suggest the design of the correction mechanisms matters for compliance but other elements of institutional and economic performance play an important role. To better understand possible interactions, we apply a canonical discriminant analysis.8 We first split the 22 Fiscal Compact countries into two groups based on their compliance record: above and below average compliance with the structural budget balance rule. The first group encompasses 10 countries with an average compliance score of 80% and the second 12 countries with an average compliance score of only 30%.

The results of the discriminant analysis confirm a number of important priors. Elements of institutional or economic virtue such as better design elements of the correction mechanism, a higher quality of governance, political stability, higher economic growth and lower government debt are clearly associated with the first group, the one recording above average compliance with the structural budget balance rule. The estimated impact of the media coverage of IFIs differs from our expectations. There seem to be interactions with other explanatory variables that do not emerge clearly in our discriminant analysis. As indicated above, there is an important group of countries with a high media coverage of IFIs but comparatively weaker design features.9

Graph 2 visualises the predictive power of our selection of indicators.10 Overall, the discriminant function separates the groups very well: it predicts 19 out of 22 cases correctly. These results are encouraging. Our limited set of variables already separates countries quite clearly into those with an above and below average compliance record. In a possible extension of this analysis, it would be useful to add a larger number of explanatory variables to the discriminant analysis and, when available, broaden the time period covered.

Graph 2: Discriminant analysis – true and model-based classification of Fiscal Compact countries

Note: The x-axis shows the actual groups according to the observed compliance score with the structural budget balance rule. The y-axis shows the discriminant score, which is used to separate the countries into two groups (below and above zero). These are derived by the discriminant function coefficients.

The introduction of national correction mechanisms with the Fiscal Compact did not automatically foster better compliance with fiscal rules. Our analysis supports two insights: (i) the design of the correction mechanism matters; and (ii) there are important interactions with other institutional and economic factors of the countries concerned. The possibility of triggering the correction mechanism ex ante, i.e. on the basis of a risk assessment by an independent fiscal institution, appears to stand out as a desirable design feature. Automaticity and clarity of the correction mechanism also seem to be positively associated with better compliance. At the same time, countries with higher economic growth can potentially afford a more lenient design in their domestic fiscal frameworks while averting an accumulation of government debt. In a similar vein, high public visibility of IFIs in charge of monitoring public finances and a better overall quality of governance can compensate for design flaws.

To achieve the initial objective of the Fiscal Compact, a number of actions seem warranted. First, the automatic trigger of national correction mechanisms should be linked to the assessments of independent entities at the national level. Second, all decisions around establishing significant deviations from fiscal rules and the concomitant activation of the correction mechanism should be subject to intense public scrutiny, preferably via both media and institutional rendezvous, most importantly presentations and discussions in national parliaments. Third, since economic growth supports better fiscal outcomes, growth oriented policies should receive more attention, in particular structural reforms and government investment.

European Commission (2021): Report on Public Finances in EMU 2020. Institutional Papers No. 147.

European Fiscal Board (2019): Assessment of EU fiscal rules with a focus on the six and two-pack legislation, 11 September.

Franchino, F. and C. Mariotto (2021): Noncompliance risk, asymmetric power and the design of enforcement of the European economic governance. European Union Politics, Vol. 22:4, pp. 591-610.

Larch, M. and S. Santacroce (2020): Numerical compliance with EU fiscal rules: The compliance database of the Secretariat of the European Fiscal Board. May 2020.

Larch, M., M. Busse and L. Jankovics (2021): Enforcement of Fiscal Rules: Lessons From the Fiscal Compact. ZEW Discussion Papers 21/085 (Leibniz Centre for European Economic Research).

The views expressed in this contribution are solely those of the authors and do not necessarily reflect the official position of the European Fiscal Board or the European Commission.

The Fiscal Compact is Title III of the intergovernmental Treaty on Stability, Coordination and Governance in the economic and monetary union (EMU), signed in March 2012. It currently binds the 19 euro area countries, while three non-euro countries, Bulgaria, Denmark and Romania, are also bound by the same requirements on a voluntary basis.

European Commission (2012): Communication from the Commission – Common principles on national fiscal correction mechanisms, 20 June.

While some fundamental provisions (such as the stipulation of the structural balanced budget rule) were adopted in a legal instrument having a higher status than ordinary law, the detailed implementing arrangements for these norms (such as the steps and procedures for the correction mechanism or the governing arrangements for the monitoring institution) were typically set out in associated ordinary legislation. In these cases, the respective countries were assigned to the ‘constitutional’ group as the binding force of the entire arrangement is better captured by the legal status of its core element(s).

The compliance database is available at the EFB website. For a description and related analysis, see Larch and Santacroce (2020).

A Ward-type cluster analysis (minimum variance method) was used given the large number of variables and difference in scales. In line with common practice, the data was standardised prior to the cluster analysis.

In essence, the discriminant analysis amalgamates the indicators we have used in the cluster analysis to predict if a country belongs to the group of above or below average compliance score. If the indicators are well chosen and have strong predictive power, then the allocation of countries should resemble the one derived from the actual compliance scores.

In an alternative setup and robustness check, the compliance score for the structural budget balance rule is replaced by the average deviations from the same rule in percent of GDP. The first group overachieves the rule by on average 1 % of GDP, the second group averages a shortfall of 0.3% of GDP. In this specification, only two countries are misclassified. It provides a similar prediction in terms of group membership and variables tend to pull in similar directions as in the original setup. Notably, the debt ratio seems to have a stronger influence on group membership when using deviations from the rule, i.e. large negative deviations are associated with high debt.

Since all variables have been standardised, any country with a score above zero is predicted to belong to the high compliance group.