Based on IMF Working Paper, Optimal Taxation of Inflation. The views expressed therein are those of the authors and do not necessarily represent the views of the IMF, its Executive Board, or IMF management.

When inflation originates from distributional conflicts, shifts in inflation expectations, or energy price shocks, monetary policy is a costly stabilization instrument. Based on a recent working paper, we argue that a tax on inflation policy (TIP), which would require firms to pay a tax proportional to the increase in their prices, would effectively correct externalities in firms’ pricing decisions, tackle excessive inflation and reduce output volatility, without exacerbating price distortions.

Monetary Policy (MP) is a powerful tool to lean against fluctuations in aggregate demand. But the episode of high and persistent inflation in the wake of the pandemic has highlighted that it faces significant challenges when confronted with other sources of shocks. Shocks to energy prices, disruptions in supply chains and shocks to inflation expectations have introduced a trade-off for central banks between letting inflation rise temporarily to preserve employment or accepting a recession to stabilize inflation. Distributional conflicts, either opportunistic increases in profit margins, known as “greedflation,” or persistent wage-price spirals as emphasized by Werning and Lorenzoni (2023), have further contributed to the challenges of managing inflation. Financial instability triggered by a fast monetary tightening has also been a source of concerns among central bankers and complicates the conduct of monetary policy.

In the perspective of broadening the set of tools to regulate inflation, we analyze the effectiveness of a tax on inflation policy (TIP), which would require firms to pay a tax proportional to the increase in their prices or wages. By giving direct incentives to firms to moderate their price increases without exacerbating relative price distortions, we find that TIP would be an effective instrument to control aggregate inflation, especially in the face of markups shocks and shocks to inflation expectations. We do so by embedding a TIP in a workhorse New Keynesian model that includes several exogenous drivers of inflation and by deriving the optimal combination of MP and TIP in response to these shocks.

Starting with the proposal by Wallich and Weintraub (1971), TIP was widely discussed in the 1970s in the U.S. and in Western Europe, at a time when persistent inflation was the main concern of policymakers. TIP was initially known as “Tax-based Incomes Policies,” and most proposals consisted in taxing wage increases exceeding a pre-announced target, would be paid by employers, and sought to address inflation exacerbated by oil price shocks and wage-price spirals.

Early studies, such as Seidman (1978), explored the theoretical rationale for TIP, emphasizing its potential to align private and social valuations and internalize the externalities of firms’ pricing behaviors. Implications of TIP for macroeconomic stabilization were investigated, showing that TIP could reduce the volatility of business cycles. Discussions on the optimal design of TIP arose, debating issues such as whether it should be based on price or wage increases, paid by employers or employees, continuous or discontinuous, and applicable to all firms or only large ones. At the 25th Panel on Economic Activity organized by the Brookings Institution in 1978 on how to cure inflation, TIP was the most debated issue, and the discussion was centered around its optimal design (Okun and Perry, 1978). At this conference, Lerner (1978) proposed a market-based plan involving the issuance and exchange of permits to slow wage inflation, providing firms with incentives to moderate wage increases.

In a few countries, versions of TIP were even briefly implemented, such as in Brazil, the Netherlands, Italy and France. Despite initial interest, discussions about TIP faded in the U.S. due to concerns about its budgetary impact (the Carter administration’s proposals were closer to a feebate than a tax), its (unfortunate) association with unpopular price controls, and the emergence of monetary policy as the predominant tool for achieving price stability. TIP briefly resurfaced during the transition of formerly Soviet countries to market economies and was implemented in Bulgaria, Poland and Romania. Although data is limited, the few studies on these more recent experiments suggest that TIP is implementable and can be successful.

Building on ideas developed in this early literature, we leverage the tremendous advancements in the theoretical and empirical analyses of the role of sticky prices made in the last decades to formalize TIP and characterize the optimal conduct of TIP in a fully microfounded framework. The policy instrument we put forward is a simple linear tax on a firm’s price increases that scales with its output: τt (Pt-Pt-1) Yt. The tax rate is allowed to vary over time, rising with inflation and decreasing when inflation reaches its target.

Our first important result is that combining TIP with conventional MP can perfectly stabilize both inflation and the output gap under any path of demand, productivity, markup, and inflation expectation shocks. This is in sharp contrast with a setting where only MP is available, because markup and inflation expectation shocks cannot be entirely addressed with MP.

The second important result is that TIP and MP are complementary, each specializing in specific drivers of inflation. MP should track the neutral rate of interest, which varies with aggregate demand and productivity shocks, to keep output at its efficient level, and TIP should rise with markup and inflation expectation shocks. By introducing a wedge between the private and the social returns to price increases, markup and inflation expectation shocks create an externality in the firms’ pricing decision. By giving direct incentives to moderate price increases, TIP can re-align the private with the social valuations and correct excessive inflation. The view that TIP and MP are complementary contrasts with the earlier literature which saw TIP as a substitute for MP.

Is TIP the only instrument that can address these distortions? In general, no. The New Keynesian literature has traditionally emphasized the role of production or payroll subsidies to address the distortion implied by markups. But while both these subsidies and TIP can stabilize inflation as a response to markup and inflation expectation shocks, subsidies entail very large and persistent fiscal costs. This suggests that TIP may be a more appealing alternative.

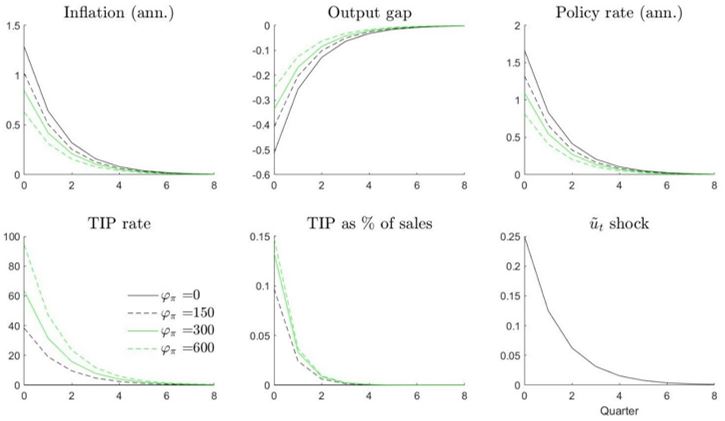

In practice, policymakers don’t perfectly observe the underlying shocks driving inflation. What if instead they must follow rules targeting inflation and the output gap, such as the Taylor rule for monetary policy? Do the stabilization properties of TIP continue to hold in a setting in which TIP follows a simple rule targeting inflation? As shown in Figure 1, the answer to this question is positive! This figure shows the IRF of inflation, the output gap, the policy rate, the TIP rate (which follows the rule τ=φππ), and the implied tax burden for firm (tax payments over their sales) in response to a markup or an inflation expectation shock, for different rules φπ.

In simulations of a fully calibrated model, the stabilization gains turn out to be substantial. Consistent with the first-best setting, these gains are especially large for markup and inflation expectation shocks: a reasonably calibrated TIP could lower the variance of inflation by 45% and of output by 44%. Welfare gains are smaller for TFP and demand shocks, because the lower inflation volatility is partially mitigated by higher output gap volatility. Also consistent with the first-best policies, we find that some specialization is desirable: TIP should target inflation and MP should increase its focus on the output gap.

Figure 1: TIP stabilizes inflation and the output gap following a markup or inflation-expectation shock

(Percentage points)

Source: Capelle and Liu (2023).

Notes: The initial markup or inflation expectation shock in the lower right panel is 0.25pp. Inflation and the policy rate are annualized. A higher φπ reflects a stronger TIP rule. The lower left panel shows the tax rate on price changes, and the lower middle panel shows the tax paid by firms relative to their sales.

One concern with TIP is that it could impede the adjustment of relative prices leading to a misallocation of resources, like price controls. Surprisingly, we find that TIP does not exacerbate distortions in relative prices, in stark contrast with price controls.

Intuitively, this is because TIP is linear in price increases and symmetric across firms, contrary to price controls which are convex and asymmetric. In the presence of TIP, while firms that are hit by a negative productivity shock moderate their price increases, firms that would otherwise not change their prices are incentivized to decrease them to get a subsidy from TIP. The linearity of TIP keeps relative prices across sectors broadly unchanged.

Another argument against TIP is that it would be costly to implement at least in the short run because the tax administration would have to collect additional information from all firms. A solution that would limit these costs would be to apply TIP only to very large corporations as proposed by Dildine (1978). Quantitatively, we find that a TIP restricted to the largest 1% of firms, would still be very effective.

It was also argued in the early literature on TIP that taxing wage changes would be easier than taxing price changes because it is easier to observe the quantity of days worked separately from wages and more difficult to mis-report wages. It turns out that a TIP on wages can also be very effective but only for a subset of markup and inflation expectation shocks. More specifically, it is effective when the shocks arise from the setting of wages (but not from the setting of prices independently of wages).

One other concern is that TIP increases the tax burden on firms. While this is qualitative true, our simulations reveal that the tax burden on firms implied by TIP is very small. In addition, we show that it is possible to design a system that is budget-neutral on average, in which firms whose prices increase less than the average firm would receive a subsidy and firms whose prices increase more would pay a tax. Such combination of a tax on inflation with a well-designed rebate, a feebate, would preserve firms’ profits on average and would be as effective as TIP.

We finally consider the market for inflation permits (MIP) proposed by Lerner (1978), where firms would issue and trade rights to increase their prices. With a MIP, the quantity of permits is controlled by the government and the price for a firm to change its price is an endogenous clearing price. Relative to a tax on inflation, a MIP would not require approval from the fiscal authority, allowing for a quicker reaction when inflation rises. It turns out that a well-designed MIP can be as effective as TIP to regulate inflation.

Overall, we find that TIP is an effective instrument to control inflation, especially in the face of markup and inflation expectation shocks. Combining TIP with MP can significantly lower the volatility of inflation and output relative to an economy where only MP is available, without distorting prices. While this instrument was widely discussed in the 1970s, it has since been forgotten. Our analysis suggests that policymakers should discuss this instrument again.

Capelle, D. and Liu, Y. (2023). Optimal Taxation of Inflation. IMF Working Paper 2023/254.

Dildine, L. L. and Sunley, E. M. (1978). Administrative Problems of Tax-Based Incomes Policies. Brookings Papers on Economic Activity, 9(2):363–400.

Lerner, A. P. (1978). A Wage-Increase Permit Plan to Stop Inflation. Brookings Papers on Economic Activity, 9(2):491–505.

Okun, A. M. and Perry, G. L. (1978). Curing Chronic Inflation.

Seidman, L. S. (1978a). Tax-Based Incomes Policies. Brookings Papers on Economic Activity, 9(2):301–361.

Wallich, H. C. and Weintraub, S. (1971). A Tax-Based Incomes Policy. Journal of Economic Issues, 5(2):1–19.

Werning, I. and Lorenzoni, G. (2023). Inflation is conflict. Technical report.