This policy brief is based on Adão, Alpizar and Gomes (2025), published in Banco de Portugal Economic Studies, Vol. XI, No. 2, Apr. 2025. The views here expressed are those of the authors and not necessarily those of the institutions the authors are affiliated with.

Abstract

How can one assess the macroeconomic impact of monetary policy? This is a challenging undertaking, as interest rate changes often reflect policymakers’ responses to economic developments, which in turn are influenced by policy choices. There is a large literature assessing the impact of monetary policy, that we overview in Adão, Alpizar and Gomes (2025). Part of this literature focuses on exogenous changes in monetary policy, i.e. monetary policy shocks. This literature has found that an unexpected increase in the policy rate typically reduces real economic activity and inflation, but the magnitude and duration of this impact vary across different economic contexts. To analyse the impact of monetary policy that includes its endogenous response to economic conditions, the literature often relies on counterfactuals. These studies generally find that the way monetary policy reacts to economic developments plays a crucial role in shaping those developments.

In the aftermath of the pandemic crisis, the world economy recovered considerably, which coupled with supply chain disruptions and geopolitical conflicts, fuelled inflationary pressures. The global and strong rise in inflation from pre-pandemic lows compelled central banks to act. In the case of the ECB, it raised policy rates at an unprecedented pace, as inflation peaked at 10.6% in October 2022.

Understanding the macroeconomic impact of a policy rate change is a question of interest, namely to the policymaker that wants to assess the decisions taken as well as to inform future ones. However, it is a complex challenge. There is a problem of simultaneity as changes in interest rates often reflect policymakers’ responses to economic developments, and economic developments reflect the impact of policy choices.

In Adão, Alpizar and Gomes (2025) we review the literature that assesses the impact of interest rate monetary policy on macroeconomic variables such as inflation and GDP. This is a large literature that has evolved significantly over time.

To circumvent the simultaneity problem described above, researchers have focused on the impact of monetary policy shocks, i.e. unexpected changes in interest rates. Even though these shocks account for a limited fraction of fluctuations in economic activity — generally not more than 25% for GDP and under 10% for inflation (and often much less than that, see for example Ramey (2016), Smets and Wouters (2005) and Warne, Coenen and Christoffel (2008)) — their value lies in being exogenous, which allows to isolate their effect in the macroeconomy.

Researchers use various tools to estimate how the economy responds to monetary policy shocks, most notably statistical models like Vector Autoregressions (VAR) and Local Projections (LP), as well as theory-driven structural models. Structural models like Dynamic Stochastic General Equilibrium (DSGE) models, rooted in economic fundamentals, enable the analysis of the economic impact of shocks and help understand their transmission mechanisms.

Statistical models

The VAR model captures the linear relationships among multiple time series variables. Its coefficients do not have a structural interpretation, so one needs to impose restrictions on the structure of the model to identify the structural shocks affecting the system. There are several types of identification assumptions that correspond to introducing restrictions on some coefficients of the VAR model, including restrictions on the contemporaneous response of some model variables to the shock (short-run restrictions), on the long-run response of the model variables to the shock, or on the sign of the response of macroeconomic variables. Other approaches in the literature identify structural shocks without imposing direct restrictions on the VAR model. Instead, they rely on external data that correlates with specific shocks but is exogenous to the other variables in the model.

More recently, a statistical method called LP gained popularity. This method focuses on estimating the effects of a shock at each time horizon separately, instead of inferring for several horizons simultaneously, like in VAR models. This “horizon-by-horizon” approach avoids certain structural assumptions required in VAR models, providing an alternative that is less susceptible to misspecification errors.

Main results of statistical models

There is a vast empirical literature studying how monetary policy shocks affect the macroeconomy. Early influential work by Christiano, Eichenbaum and Evans (1999) used short-run restrictions in VAR models to show that a contractionary monetary policy shock leads to a “hump-shaped” decline in real US GDP, peaking within 12–18 months, and a delayed fall in prices. Later studies confirmed these patterns but reported wide variation in the magnitude and timing of the effects. For example, Ramey (2016) finds that a re-estimation of previous studies suggests weaker effects, possibly because monetary policy has become more systematic and predictable over time. Studies across countries also show heterogeneity, e.g. Almgren et al. (2022) using LP methods documents significant differences in monetary transmission across euro area countries.

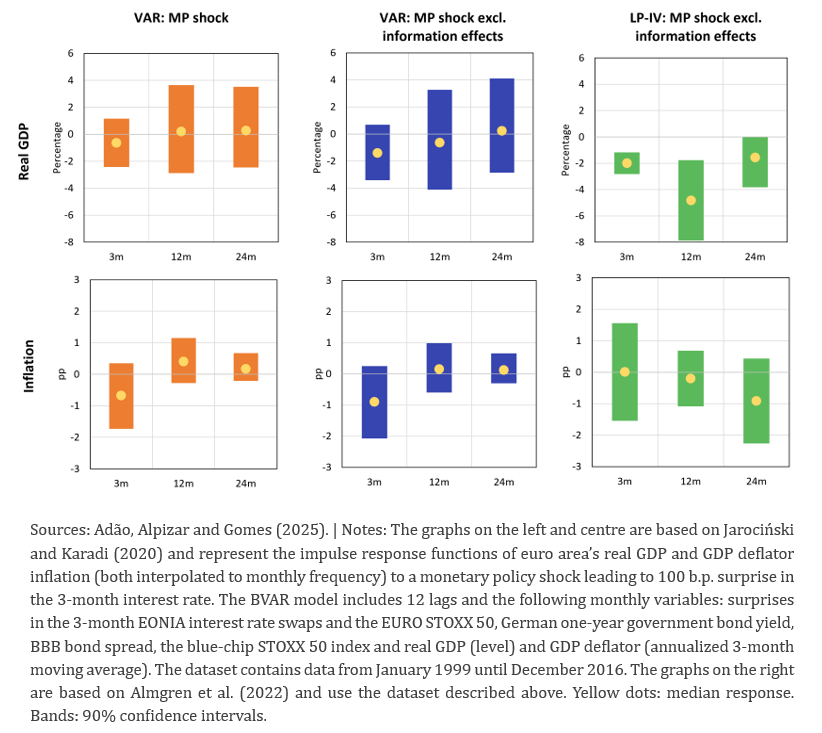

Even though the quantification of the impact of monetary policy shocks is not an objective of Adão, Alpizar and Gomes (2025), they provide an illustration based on Jarociński and Karadi (2020) and Almgren et al. (2022). The results shows that even when using the same data (for the euro area, 1999–2016), estimated effects differ depending on the identification strategies as illustrated in chart 1. Still, all methods show that a surprise rate hike reduces GDP and lowers inflation, but results are not always statistically significant.

Chart 1. Monetary policy shock in statistical models – euro area main variables

Structural models

Unlike statistical models, which are designed to fit historical data patterns, structural models, such as DSGE models, provide a theoretical framework that can be used to analyse transmission mechanisms and policy trade-offs. These models are based on fundamental features, such as people’s intertemporal choices and firms’ production functions, so their structure remains unchanged despite policy changes, providing a structural interpretation of the coefficients. In other words, structural models are less vulnerable to the Lucas critique (Lucas, 1976), which argues that shifts in economic policies can alter the structure of the economy itself due to changes in agents’ behaviour.

Early structural models like Real Business Cycle models viewed macroeconomic fluctuations as driven by real shocks, like technology, and assumed perfect markets and no short run frictions, leaving little room for monetary policy. Their limitations led to the development of more realistic frameworks. Modern monetary policy analysis often uses large-scale semi-structural and fully structural DSGE models that incorporate frictions such as price stickiness and imperfect competition, improving their empirical fit and policy relevance.

Main results of structural models

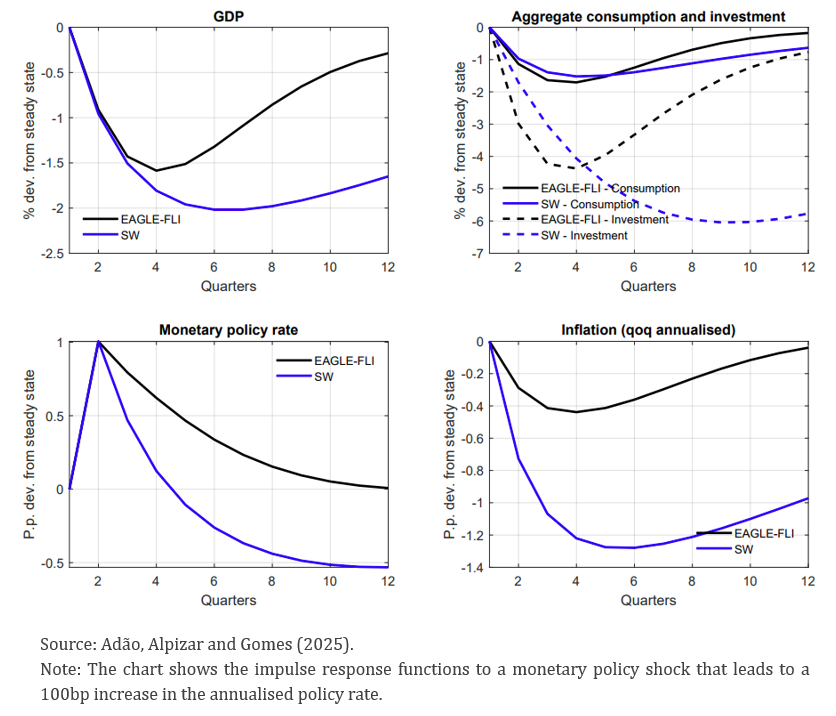

The IRFs to a monetary policy shock derived from structural models are generally qualitatively in line with those obtained from statistical models, as structural models are often informed or calibrated using empirical findings from statistical approaches. For instance, both in the EAGLE-FLI model (a calibrated multi-country open-economy model with financial frictions, see Bokan et al., 2018) and in the Smets and Wouters model (an estimated closed-economy model without financial frictions, see Smets and Wouters, 2003) higher interest rates reduce economic activity over several quarters and gradually lower inflation, reaching its lowest point around three quarters after the shock (chart 2). While the size of these effects varies depending on the model, the message is consistent: temporarily tighter monetary policy slows demand and brings down inflation over time.

Chart 2. Monetary policy shock in two euro area structural models

The shock-based approach is useful to understand how monetary policy impacts macroeconomic variables. Yet, it does not address the impact of specific monetary policy actions, which may include both exogenous and endogenous (or systematic) changes in monetary policy. To assess the impact of systematic monetary policy or of specific policy paths, economists use counterfactuals, i.e. “what if” scenarios, in both statistical and structural models.

Statistical models

Statistical models, like VARs, are widely used in the literature to simulate counterfactual policy scenarios. As explained before, these models are popular since they closely match the data and do not require strong assumptions about how the economy works. However, a key limitation is that the structure of these models may change when policy changes (the Lucas critique).

Early studies used unanticipated monetary policy shocks to construct counterfactuals in VAR models. For instance, Sims and Zha (1998) compared actual outcome responses to non-policy shocks to a scenario where the policy rate remained unchanged. Though the authors acknowledge that this approach unrealistically assumes that people are repeatedly surprised by the lack of policy reaction, they argue their results could still offer useful insights as agents may take time to adjust their expectations. Later work by Leeper and Zha (2003), suggested that if policy changes are small and do not signal a broader shift in regime, the Lucas critique may be less of a concern. Following this intuition, Jordá and Taylor (2024) provide a framework for counterfactual analysis using LPs and relying on the method’s asymptotic characteristics.

More recent studies propose new ways to design counterfactuals that aim to be robust to the Lucas critique. McKay and Wolf (2023), for example, show that the causal effects of (contemporaneous and news) shocks to a given policy rule can be sufficient to construct counterfactuals for different policy rules. Instead of applying new shocks over time, they suggest using a combination of policy shocks in the initial period, which shapes both how the economy evolves and what people expect. The downside is that there is often limited data on these shocks, so not all policy alternatives can be perfectly simulated. In follow-up work, McKay, Wolf, and Caravello (2024) propose a solution that combines standard model projections with information on how the economy responds to policy changes to estimate the missing information. Applying this method to US history, they find that more active policy could have delivered better outcomes, such as less output volatility and more stable inflation.

Structural models

Structural models like DSGE models are commonly used to evaluate different monetary policy options thanks to their sound theoretical grounding. Nevertheless, it is important to interpret results with caution as results are model dependent and there is no clear consensus on the appropriate model, several assumptions can be contested, and inconsistencies with data exist.

Once a model is chosen, it can be used to simulate how the economy might have evolved under different systematic monetary policy responses to economic developments or specific alternative policy rate paths. For example, Crump et al. (2023) show that the Fed’s post-pandemic response led to stronger GDP than a counterfactual average inflation targeting rule, largely due to its accommodative stance in 2021. De Fiore et al. (2023) compare aggressive tightening with a more delayed approach using the New York Fed’s model and find that neither would have prevented the recent inflation surge. For the euro area, Darracq-Pariès et al. (2024) explore scenarios with earlier or more gradual tightening and find that while earlier action might have reduced the inflation peak, the actual strategy avoided inflation persistence. Other studies focus on how the changes in the systematic monetary policy actions (or rules) alters the transmission of other shocks (e.g. fiscal shocks or oil shocks).

Assessing the impact of policies that were implemented is challenging as realistic counterfactuals need to be constructed. An example, Darracq-Pariès et al. (2023) evaluates the impact of the ECB’s monetary policy tightening that began in December 2021 by comparing several models against the counterfactual interest rate path of the ECB’s December 2021 projections. They find that this tightening lowered inflation and output, although the size of these effects differs across models. Yet, the counterfactual assumes implausibly low rates for a prolonged period, which may call into question the reasonability of the results.

Estimating the impact of monetary policy on the real economy is not straightforward. Changes in interest rates often reflect policymakers’ responses to economic developments, while economic developments, in turn, reflect the impact of policy choices. Based on Adão, Alpizar and Gomes (2025), this brief explores various methodologies used in the literature to assess the impact of monetary policy. The literature has tackled the challenges of estimating the impact of interest rate policy in different ways. The literature that explores monetary policy shocks generally finds that an unexpected increase in the policy rate induces a reduction in real activity and prices. Yet, the magnitude and duration of these effects vary, namely according to the type of model used, the countries analysed, or the sample period used. Another strand of the literature assesses the impact of systematic monetary policy, focusing on counterfactual analysis. Choosing the appropriate counterfactual scenario is crucial for the analysis but entails significant challenges.

Adão, B., Alpizar, L., & Gomes, S. (2025). On how to assess the impact of monetary policy, Banco de Portugal Economic Studies, XI(2).

Almgren, M., Gallegos, J.-E., Kramer, J., & Lima, R. (2022). Monetary policy and liquidity constraints: Evidence from the euro area. American Economic Journal: Macroeconomics, 14(4), 309–340.

Bokan, N., Gerali, A., Gomes, S., Jacquinot, P., & Pisani, M. (2018). EAGLE-FLI: A macroeconomic model of banking and financial interdependence in the euro area. Economic Modelling, 69, 249–280.

Caravello, T., McKay, A., & Wolf, C. (2024). Evaluating policy counterfactuals: A VAR-plus approach (NBER Working Paper No. w32988). National Bureau of Economic Research.

Christiano, L. J., Eichenbaum, M., & Evans, C. L. (1999). What have we learned and to what end? In M. Woodford & J. D. Taylor (Eds.), Handbook of Macroeconomics.

Crump, R., Del Negro, M., Dogra, K., Gundam, P., Lee, D., Nallamotu, R. and Pacula, B. (2023). “The New York Fed DSGE Model Perspective on the Lagged Effect of Monetary Policy.” Federal Reserve Bank of New York Liberty Street Economics, November 21.

Darracq Pariès, M., Kornprobst, A. & Priftis, R. (2024). Monetary policy strategies to navigate post-pandemic inflation: an assessment using the ECB’s New Area-Wide Model. ECB Working Paper Series 2935.

Darracq-Paries, M., Motto, R., Montes-Galdón, C., Ristiniemi, A., Saint Guilhem, A., & Zimic, S. (2023). A model-based assessment of the macroeconomic impact of the ECB’s monetary policy tightening since December 2021. ECB Economic Bulletin, Issue 3/2023. ECB.

De Fiore, F., Mojon, B., Rees, D. & Sandri, D. (2023). Monetary policy frameworks away from the ELB. BIS Working Papers 1156.

Jarociński, M. & Karadi, P. (2020). Deconstructing Monetary Policy Surprises—The Role of Information Shocks. American Economic Journal: Macroeconomics, American Economic Association, 12(2), 1–43.

Jordà, Ò., & Taylor, A. M. (2024). Local projections. NBER Working Paper No. 32822.

Leeper, Eric M., and Tao Zha. (2003). Modest policy interventions. Journal of Monetary Economics, 50(8): 1673–1700.

Lucas, R. E. (1976). Econometric policy evaluation: A critique. Carnegie-Rochester Conference Series on Public Policy, 1, 19-46.

McKay, A., & Wolf, C. K. (2023). What can time-series regressions tell us about policy counterfactuals? Econometrica, 91(5), 1695–1725.

Ramey, V. A. (2016). Macroeconomic shocks and their propagation. Handbook of Macroeconomics, 2, 71–162.

Sims, C., & Zha, T. (1998). Does monetary policy generate recessions? Federal Reserve Bank of Atlanta Working Paper 98-12.

Smets, F. & Wouters, R. (2005). “Comparing shocks and frictions in US and euro area business cycles: a Bayesian DSGE Approach,” Journal of Applied Econometrics, 20(2), 161–183.

Smets, F., & Wouters, R. (2003). An estimated dynamic stochastic general equilibrium model of the euro area. Journal of the European Economic Association, 1(5), 1123–1175.

Warne, A. & Coenen, G. & Christoffel, K. (2008). “The new area-wide model of the euro area: a micro-founded open-economy model for forecasting and policy analysis,” Working Paper Series 944, European Central Bank.