This policy brief analyzes monetary policy communication, focusing on recent efforts by central banks to engage with a wider audience via Twitter. We document the social media presence of major central banks and discuss how exploring Twitter content by and about monetary policy makers can inform about the effectiveness of communication in influencing beliefs. We focus on recent techniques employed in analyzing social media content in order to understand how central bank communication affects expectations and, subsequently, behavior in financial markets.

Central banks have transformed their communication practices significantly over the past three decades (Issing, 2005; Assenmacher et al., 2021). Whereas prior to the 1990s, communication around monetary policy was surrounded by silence and secrecy, in recent decades central bank transparency and communication have become key instruments in central bankers’ policy toolkit and have drastically transformed the way monetary policy is conducted (Bini Smaghi, 2007; Blinder et al., 2008). Communication can enhance the effectiveness of monetary policy either by creating news that are complementary to policy actions or by “reducing noise” and, thereby, uncertainty in the public’s interpretation of policy actions (Blinder et al., 2008). This is achieved through increasing the predictability of monetary policy, clarifying policy objectives and strategies to allow for more informed decisions by firms and households, as well as enabling financial market participants to gain a better understanding of how policy is likely to respond to incoming information (Bernanke, 2004). Beyond its role in enhancing policy effectiveness, the importance of communication also rests on its democratic accountability: the way central banks communicate their policy objectives, deliberations, and decisions to the public is central to their accountability as a public policy institution (Bank for International Settlements, 2009).

Moreover, the adoption of unconventional monetary policy tools such as forward guidance and quantitative easing since the 2008 global financial crisis, has further stressed the importance of communication as a monetary policy instrument. Central bank communication has become more frequent and diverse since the crisis and is increasingly aiming to reach a wider non-expert audience (ECB, 2021).

In a recent paper (Masciandaro et al., 2022) we show that major central banks are employing Twitter as the main social media platform to engage with both experts and a wider non-expert public. We document Twitter activity by central banks of G20 countries and classify the content of a large sample of tweets into several categories. We show that tweets announcing the launch of new coins and banknotes, but also those related to monetary policy decisions and operations are associated with a higher public engagement in the form of likes and re-tweets.

As central banks have started employing communication as a core part of their monetary policy toolkit in the early 1990s, they primarily targeted expert audiences, such as financial market participants, academics, policymakers and specialized media, rather than wider public (Assenmacher et al., 2021). Although this strategy has been largely successful in explaining monetary policy decision to expert audiences, the communication with the general public has lagged behind.

Consequently, in an effort to strengthen their accountability, central banks have increasingly devoted their attention to communicating with the general public (Moschella et al., 2020). For example, during the September 2019 hearings for the appointment of the President of European Central Bank, Christine Lagarde indicated communication with non-experts as one of the priorities of her presidency.

The need for improving communication with the general public is also shared by former members of the ECB’s Governing Council surveyed in Ehrmann et al. (2022). The results of this survey show that the large majority of these former ECB policy makers consider the communication with the general public as inadequate and see substantial room for improvement in this area. Respondents also suggest that, in order to reach the target groups of interest, central bank communication ought to be tailored on the basis of the communication channels employed.

In this context, two channels are typically used: an indirect communication using traditional media outlets, or a more direct approach via central bank websites and social media platforms. Focusing on the first channel, Ter Ellen et al. (2021) build a measure of “narrative monetary policy surprises’ based on the difference between media narratives prior to monetary policy announcements and the actual communication of Norges Bank. They show that households’ beliefs are shaped by media coverage on the central bank policy and that monetary policy surprises affect interest rates, the stock market, consumer confidence, house prices and industrial production.

However, in recent years, major central banks are increasingly relying on the more direct channel of disseminating policy communication by using their website and social media accounts. To this end, not only have central banks made their websites more user friendly through, for example, educational resources and tools, but they have also strengthened their presence on social media platforms such as Facebook, LinkedIn, and Twitter.

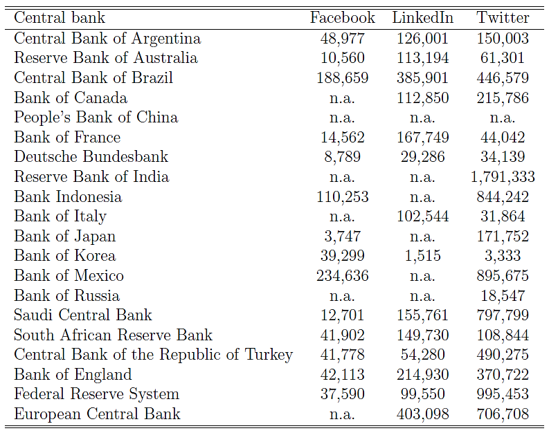

Table 1 provides information on the number of followers recorded on the social media platforms of the G20 countries’ central banks as of September 2022.1 Twitter appears to be the most popular social media channel among most of the central banks, with the exceptions of the Reserve Bank of Australia, Bank of France, Bank of Italy, the South African Reserve Bank, which are mainly followed on LinkedIn, and Bank of Korea, which is more popular on Facebook.

Table 1: Central banks’ social media presence and followers (as of September 2022)

Note: The table presents data on the followers on social media platforms of G20 countries as of September 2022. The data is collected from the social media accounts advertised on the official website of these central banks. The European Central Bank is included as the central bank of the European Union. Whenever multiple profiles were advertised in relation to the same platform, the reported data only refers to the most followed account.

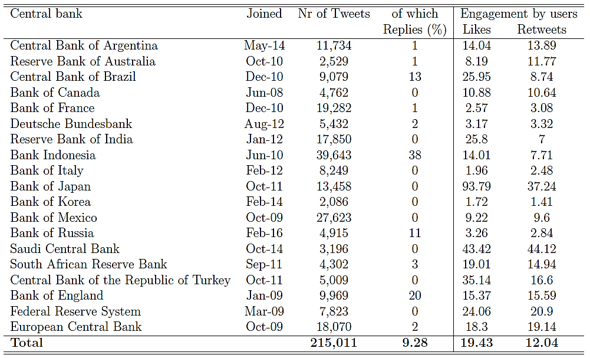

To provide more details on how central banks use social media as a communication tool, we use the Twitter Academic API to extract all the Twitter messages generated by G20 central banks since the creation of their accounts. For each tweet, we extract the text, date and language of the tweet as well as the number of likes and retweets. We end up with a database of 215,011 tweets (excluding retweets) sent between June 2009 and September 2022.2

Table 2 provides information on the number of tweets and other engagement statistics with the social media content of major central banks.3 Since joining Twitter in June 2010, Bank Indonesia has posted around 40,000 tweets and its number of social media posts is more than double that of the second most active central bank in our sample, Bank of France. Bank of Indonesia is also the central bank with the highest number of replies to tweets by other users. However, with the exception of this central bank, on average, only 2.5% of the tweets of the other central banks are replies to other social media users.

Table 2: Central banks’ Twitter engagement statistics (as of September 2022)

Note: The table presents data on the number of tweets made by G20 central banks as of September 2022, together with the average number of likes and retweets received by their tweets. The data is collected using the Twitter Academic API. The European Central Bank is included as the central bank of the European Union. All retweets made by central bank in reaction to tweets made by other users have been excluded.

Yet, the number of tweets only measures the effort made by central banks to draw attention to their communication. Another important aspect to consider is the public engagement with the social media posts of central banks, which can be derived, for example, from the number of likes and retweets. The last two columns of Table 2 provide information on the average influence of the central bank tweets. The Saudi Central Bank has the highest average number of retweets per tweet, followed by Bank of Japan, the Federal Reserve System and the European Central Bank. Bank of France, Bank of Korea and Bank of Russia are characterized by the lowest average engagement per tweet.

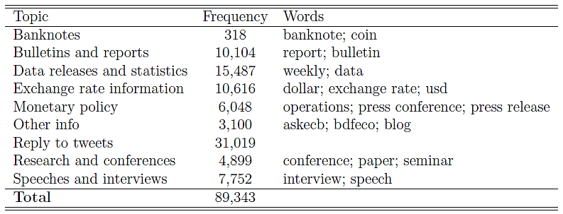

We then investigate the content of individual tweets to understand if certain topics are associated with a higher public engagement. To do so, we first translated all the tweets written in a language different from English by using Microsoft Translator (138,667 tweets or 65% of the sample).4 We then extract a random sample of 5,000 tweets and manually classify them into 9 different topics: Banknotes, Bulletins and reports, Data releases and statistics, Exchange rate information, Monetary policy, Other information, Reply to tweets, Research and conferences, Speeches and interviews.5

After this classification, we compute the set of the most frequently used unigrams and bigrams terms for each topic, and we use them to further classify the remaining tweets. This procedure allows us to classify a total of 89,343 tweets, or 42% of the sample.

Table 3 shows the distribution of the classified tweets across the different topics, together with the most frequent words associated to each topic. Using this classification and looking at the ten most liked and retweeted tweets, we find that all of them were made to announce the introduction of new coins or banknotes.6

Table 3: Distribution of classified tweets by topic

Note: The table presents data on the number of tweets associated to the 9 topics identified in the classification of tweets. The last column shows the most frequent words in each classification.

To provide a more systematic analysis of which topics are associated with higher public engagement, we regress the number of retweets received by a tweet on the dummy associated to banknotes-related topics. As mentioned above, banknotes announcements attract a disproportionally larger number of retweets as compared to tweets related to all other topics. In addition to the tweets related to banknotes, tweets discussing monetary policy decisions and operations also attract a larger reaction from Twitter users as compared to all other topics.

Overall, this suggests that the increased use of social media by central banks might represent an effective tool to communicate monetary policy decisions. Together with the raising popularity of quantitative text analysis techniques this gave rise to a burgeoning literature that studies the role played by central bank social media communication.

This policy brief discusses central bank communication via Twitter. Traditionally central banks have mainly communicated with financial markets participants that had a well-defined profile: a professional interest to follow monetary policy information and the necessary knowledge to understand central bank messages (Ehrmann and Wabitsch, 2022). But the widespread use of unconventional monetary policy tools in recent years has called for better explanations of what central banks do and led many central banks to step up their efforts to communicate to a wider audience, i.e. non-experts. However, communication with non-experts raises a number a challenges, starting from the fact that audiences are far more segmented and less likely to take interest in monetary policy announcements.

As such, central banks are increasingly engaging in social media as a regular feature of their communication policy. Future research can delve deeper into the analysis of high frequency social media content as a tool for measuring market expectations and the effectiveness of central bank communication. Another avenue for future research is the role of social media presence by monetary policy committee members who have also significantly increased their efforts to engage with the wider public.

Assenmacher, K., G. Glockler, S. Holton, P. Trautmann, D. Ioannou, S. Mee, K. Bakk- Simon, S. Bergbauer, M. Catenaro, E. Charalampakis, et al. (2021). Clear, consistent and engaging: ECB monetary policy communication in a changing world. Occasional Paper Series, No 274, ECB, Frankfurt am Main.

Bank for International Settlements (2009). Issues in the governance of central banks. A report from the central bank governance group. Bank for International Settlements.

Bernanke, B. (2004). Fed speak. Remarks at the Meetings of the American Economic Association, San Diego, California, January 3, 2004.

Bini Smaghi, L. (2007). The value of central bank communication. Financial Market Speech Series, Landesbank Hessen-Thuringen, November 20.

Blinder, A. S., M. Ehrmann, M. Fratzscher, J. De Haan, and D.-J. Jansen (2008). Central bank communication and monetary policy: A survey of theory and evidence. Journal of Economic Literature 46 (4), 910–45.

Choi, J. (2022). Social media: an essential tool for central bank communication. mimeo.

De Vries, E., M. Schoonvelde, and G. Schumacher (2018). No longer lost in translation: Evidence that google translate works for comparative bag-of-words text applications. Political Analysis 26 (4), 417–430.

ECB (2021). Economics bulletin. Technical report, Issue n. 8.

Ehrmann, M., S. Holton, D. Kedan, and G. Phelan (2022). Monetary policy communication: Perspectives from former policy makers at the ECB. ECB Working Paper.

Ehrmann, M. and A. Wabitsch (2022). Central bank communication with non-experts. A road to nowhere? Journal of Monetary Economics, 127, 69-85.

Gorodnichenko, Y., T. Pham, and O. Talavera (2021). ’Liked’, ’shared’, ’commented’: Central bank communication on Facebook and Twitter. Technical report.

Issing, O. (2005). Communication, transparency, accountability: monetary policy in the twenty-first century. Federal Reserve Bank of St. Louis Review 87, March/April.

Masciandaro, D., O. Peia and D. Romelli (2022). Central Bank Communication and Social Media: From Silence to Twitter. BAFFI CAREFIN Centre Research Papers, n. 187.

Moschella, M., L. Pinto, and N. Martocchia Diodati (2020). Let’s speak more? How the ECB responds to public contestation. Journal of European Public Policy 27 (3), 400–418.

Ter Ellen, S., V. H. Larsen, and L. A. Thorsrud (2021). Narrative monetary policy surprises and the media. Journal of Money, Credit and Banking, 54(5), 1525-1549.

Note that the information presented in Table 1 only pertains to the institutional account of the central banks in our sample. However, an increasing number of monetary policy committee members use their personal Twitter account to inform the general public about their speeches.

Around 80% of these tweets contain a link to the central bank’s webpage where more details are provided. This suggests that social media postings by central banks are aimed at catching users’ attention to specific topics with the goal of directing them to their websites, where the full set of information is provided.

China is excluded from the list as the People’s Bank of China does not have a Twitter account.

The appropriateness of our strategy is supported by the findings in De Vries et al. (2018), that use the corpus of multi-language debates in the European Parliament to show a considerable overlap in the set of features generated from human-translated documents and those translated using Google Translate.

The “replied to id” information extracted from the Twitter API allows us to identify the code associated with the original tweet generated by a user. Whenever the original tweets has been created by the central bank of reference, we consider this tweet part of a thread and assign the tweet to the topic of the first message. All other replies to other users are assigned to the Reply to tweets topic.

Among the top-20 most liked and retweeted tweets, we also found the one made by the ECB on Valentine’s Day in 2021, a parody of the love poem “Roses are red”: “Roses are red Violets are blue We’ll keep financing conditions favorable ‘til the crisis is through’”. As discussed by Sakari Suoninen, team leader of the European Central Bank’s (ECB) digital content team, this tweet went viral but his team “also got a lot of criticism for trying to be too light-hearted” (Choi, 2022).