This SUERF Policy Brief summarizes Imam and Poghosyan (2025). The views expressed in this study reflect those of authors and are not necessarily those of the International Monetary Fund.

Abstract

The inflation surge of 2022, driven largely by global supply shocks, tested the resilience of monetary policy frameworks designed mainly for managing demand-driven shocks. We find that inflation-targeting (IT) economies did not systematically outperform their non-IT peers: inflation rose and fell at similar rates across both groups. What proved decisive was not the framework itself, but the timeliness, coherence, and credibility of policy actions. Central banks that tightened early and communicated clearly, whether or not they operated under formal inflation targets, anchored expectations more effectively. As supply shocks linked to geopolitical fragmentation, climate change, and energy transition become more frequent, monetary frameworks will need to evolve, embracing greater flexibility, closer policy coordination, and a clearer recognition of their limits.

The 2022 inflation surge marked the most severe test of monetary policy credibility in decades. After years of low and stable prices, global inflation accelerated rapidly, reaching multi-decade highs. The source was overwhelmingly supply-driven. Russia’s invasion of Ukraine disrupted energy and food markets, with shipping bottlenecks, semiconductor shortages, and labor market frictions lingering after the pandemic. Monetary policy could not reopen ports or restore gas flows, yet central banks were judged by their ability to prevent second-round effects and maintain credibility.

The episode represented a globally synchronized cost shock, transmitted through energy, food, and logistics channels (see Bernanke and Blanchard, 2023, 2024). Pandemic-related distortions in transport, logistics, and labor markets were still unwinding when commodity prices surged. The result was a cost-push cycle of unprecedented breadth, eroding real incomes and compressing output across advanced and emerging economies alike. Policymakers confronted an uncomfortable truth, that monetary instruments could not restore supply, yet inaction risked un-anchoring expectations.

The challenge reignited an enduring question if an inflation-targeting (IT) regime inherently superior at preserving price stability, or can credibility also arise under different institutional arrangements? IT frameworks, which flourished during the Great Moderation, a period characterized by (mostly mild) demand shocks, had seldom been tested under supply shocks. The 2022 inflation surge offers a nuanced answer. Institutional architecture mattered less than policy coherence and clear communication.

Our recent research (Imam and Poghosyan 2025 Navigating the 2022 Inflation Surge) examined a global sample of 33 inflation-targeting and 37 non-targeting countries. We compare inflation outcomes, expectations, and output dynamics before and after the 2022 supply shock.

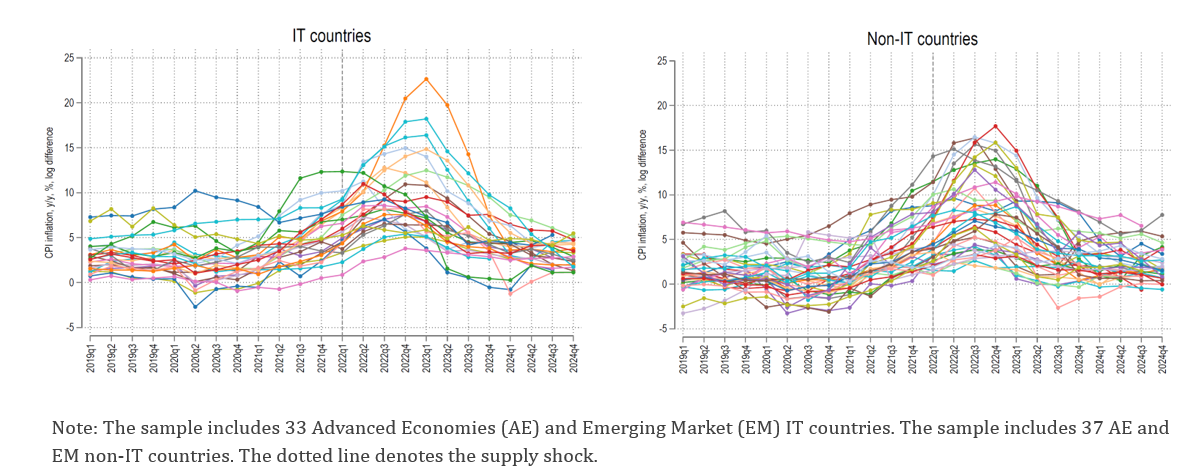

The episode represented a globally synchronized supply-side shock, transmitted through energy, food, and logistics channels. Inflation rose sharply almost everywhere, peaking close to high single digits, with no statistically significant difference between inflation-targeting and non-targeting economies (see Figure 1). This convergence underscores that the inflation impulse originated in external cost pressures rather than domestic factors. Central banks were mainly responding to a common global disturbance.

Figure 1. CPI inflation in IT and non-IT countries

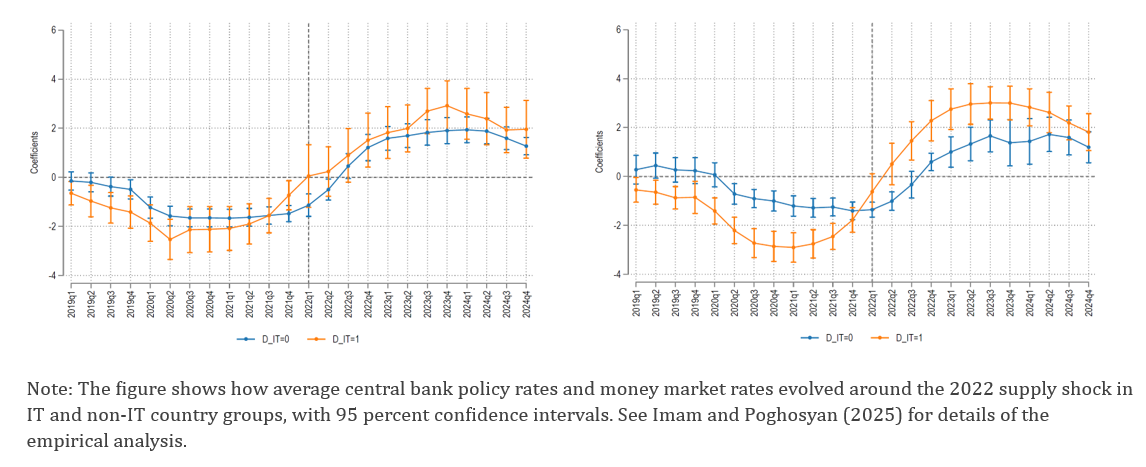

Yet behavior differed markedly. Inflation-targeting central banks generally raised interest rates earlier and by larger increments (see Figure 2). These moves reflected reputational incentives. Established credibility encouraged prompt action to preserve it. This aligns with evidence from Hernández de Cos (2025) and Coibion and Gorodnichenko (2025), who argue that credibility now depends more on actions than on frameworks. However, the outcome, measured by the pace of disinflation, proved similar across frameworks. This credibility–action paradox suggests that credibility influenced policy response more than policy frameworks.

Figure 2. Event study analysis: Evolution of average policy rates in IT and non-IT countries after controlling for country-specific unobserved heterogeneity

(Central bank policy rates (Panel A) and money market rates (Panel B))

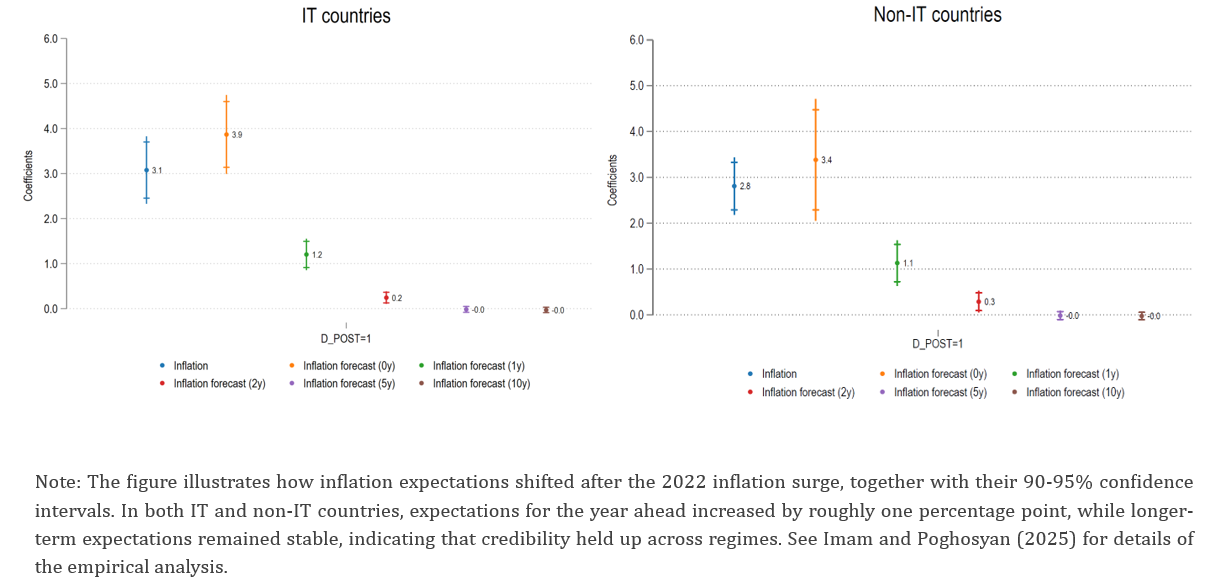

Expectations data confirm that credibility was preserved through behavior (see Figure 3). Medium- and long-term inflation expectations remained stable across regimes, indicating that decisive action and transparent communication, rather than formal frameworks, anchored beliefs. Taken together, these findings show that policy coherence and timeliness, rather than institutional design, determined how economies navigated the 2022 inflation surge.

Figure 3. Change in inflation expectations following the 2022 inflation surge

The inflation surge revealed that credibility is earned through adaptive behavior, not conferred by statute. Central banks that acted pre-emptively and communicated transparently preserved trust despite temporary target deviations. Others, confident that their reputation would suffice, responded more cautiously and faced prolonged inflation.

Research by Jácome et al. (2025) provides further historical context. The authors identify an enduring “inflationary memory” among central banks. Those with high-inflation legacies continue to react strongly to expectation gaps even after credibility has been established. This behavior creates what they term a “credibility puzzle”, with vigilance remains intense long after stability is restored, suggesting that experience, not rules, anchors conduct.

This behavioral dimension was visible in 2022. Central banks conditioned by past crises responded with greater urgency, while others initially viewed the shock as transient. Credibility thus appeared path-dependent, shaped by institutional memory as well as public expectations.

Communication proved just as important as the policy stance itself. As uncertainty rose, the credibility of central banks depended less on projecting confidence and more on explaining constraints. The transition from assertive forward guidance to open recognition of limits marked a turning point in central-bank communication. Policymakers such as Greene (2025) and Hernández de Cos (2025) have highlighted this evolution. In a world of persistent supply shocks, acknowledging uncertainty enhances, rather than undermines, credibility. Clear communication about what monetary policy can and cannot achieve helps anchor expectations and sustain trust when outcomes deviate temporarily from targets.

Three broad lessons emerge from the recent inflation episode for the evolution of monetary frameworks.

First, credibility must be demonstrated through performance, not presumed from institutional form. Rule-based systems remain valuable commitment devices, but they cannot replace sound judgment when inflation originates on the cost side. Frameworks that allow temporary deviations, through longer policy horizons or tolerance bands, can enhance rather than weaken credibility. Trust depends less on mechanical adherence to targets than on the perceived competence and coherence of policy.

Second, macroeconomic stability requires policy coherence across instruments. Fiscal alignment proved decisive for disinflation during 2022–24, a finding consistent with IMF’s Integrated Policy Framework (see Adrian et al. 2020 and Basu and Gopinath, 2024). In a world of recurrent supply disruptions, the capacity of monetary policy to stabilize prices single-handedly is inherently limited (see Hofmann et al., 2024). Coordination with fiscal and structural policies is essential to anchor expectations and contain second-round effects.

Third, IT must evolve into a risk-based and more flexible framework. Traditional models rely on a stable Phillips curve relationship that weakens under supply shocks. When inflation stems from energy transition, geopolitical fragmentation, or climate disturbances, short-term precision becomes less meaningful than medium-term credibility. Modern frameworks should emphasize managing expectations about the trajectory of inflation and exercise flexibility.

The stability of the Great Moderation owed much to benign global conditions, ranging from abundant energy, integrated trade, and expanding labor supply, that kept inflationary pressures subdued. Those tailwinds have now faded. The current macroeconomic landscape is defined by geopolitical fragmentation, climate transition, and fragile supply chains, where supply shocks are likely to be more frequent. These shifts call for a second-generation approach to monetary policy, one that maintains disciplined medium-term objectives while acknowledging the limits of short-term control.

IT remains a valuable compass but must evolve to navigate this new regime. The aim should shift from rigid compliance with point targets toward sustained credibility built on transparency, fiscal coherence, and pragmatic flexibility. For emerging and developing economies, the recent experience demonstrates that credibility can be earned through consistent actions and clear communication, even in the absence of formal targets. For advanced economies, the task is to maintain confidence while managing increasingly complex trade-offs between inflation and output stability. The enduring lesson is clear: credibility is not a legacy but a practice, it is earned continuously through coherent action in an uncertain world.

Adrian, T., C. Erceg, J. Lindé, P. Zabczyk, J. Zhou (2020). “A Quantitative Model for the Integrated Policy Framework,” IMF Working Paper No. 20/122 (link).

Basu, K. and G. Gopinath (2024). “An Integrated Policy Framework (IPF) Diagram for International Economics,” IMF Working Paper No. 24/38 (link).

Bernanke, B., and O. Blanchard (2023), “What Caused the US Pandemic-Era Inflation?” Peterson Institute for International Economics Working Paper 23-4 (link).

Bernanke, B., and O. Blanchard (2024), “An Analysis of Pandemic-Era Inflation in 11 Economies,” NBER Working Paper 32532 (link).

Coibion, O. and Y. Gorodnichenko, Y. (2025), “Inflation, Expectations and Monetary Policy: What Have We Learned and to What End?” NBER Working Paper No. 33858 (link).

Greene, M. (2025) “The supply side demands more attention,” Bank of England speech (link).

Hernández de Cos, P. (2025), “Delivering on Central Bank Mandates in a Changing World,” BIS speech (link)

Hofmann, Boris, Cristina Manea, and Benoît Mojon. (2024). “Targeted Taylor Rules: Monetary Policy Responses to Demand- and Supply-Driven Inflation,” BIS Quarterly Review (December): 17–33 (link).

Imam, P. A., and T. Poghosyan (2025), “Navigating the 2022 Inflation Surge: A Comparative Analysis of IT and Non-IT Central Banks,” IMF Working Paper 25/212 (link).

Jacome, L, N. Magud, S. Pienknagura and M. Uribe (2025) “Inflation Targeting and the Legacy of High Inflation”. IMF Working Paper 25/079 (link)