This policy brief represents the views of the authors and not necessarily those of the Bank for International Settlements.

US Treasury bills (T-bills) and repurchase agreements are among the most important instruments of global finance, and US money market funds (MMFs) play a key role as investors in these markets. Our study provides novel evidence that MMFs’ portfolio allocations affect the pricing of near-money assets. We show that when MMFs invest more funds in T-bills, their price impact in the T-bill market leads to lower T-bill rates, especially when the T-bill market is illiquid. By affecting T-bill rates, their portfolio allocation also impacts common measures of T-bills’ convenience yield. Our results have important implications for how previous work has interpreted the liquidity premium/convenience yields, as well as for monetary policy transmission, government debt issuance, and regulation of the MMF industry.

US Treasury bills (T-bills) and repurchase agreements (repos) are among the most important instruments of global finance. T-bills are considered highly liquid and viewed as the global risk- free asset, commanding a sizable convenience yield in the form of a safety and liquidity premium (Krishnamurthy and Vissing-Jorgensen, 2012; Greenwood, Hanson and Stein, 2015; Nagel, 2016). Repos are instrumental for banks and other financial institutions to raise short-term capital and manage liquidity needs, and the reverse repo (RRP) facility of the Federal Reserve constitutes a critical monetary policy instrument (Afonso et al., 2022a).

US money market funds (MMFs) play a key role as investors in markets for these near-money assets. MMFs are short-term investment vehicles with total assets under management of about $6 trillion as of mid-2023, equal to about 20% of US GDP or total commercial bank assets. MMFs’ investments in T-bills and repos amount to more than $3 trillion. On aggregate, MMFs’ average market share in the T-bill market is 20%, and their holdings significantly co-move with the T-bill supply, suggesting an important role for MMFs as marginal investors.

In a recent study (Doerr, Eren and Malamud, 2023), we present new evidence that MMFs’ portfolio allocations affect the pricing of T-bills, with important implications for how previous work has interpreted the liquidity premium. We argue that MMFs, as large players in repo and T-bill markets, take into account their market power in repo markets and their price impact in the T-bill market when deciding on how to allocate their assets under management. In particular, our theory predicts that when funds have more cash to invest in the T-bill market (what we call “residual cash”), this will have a negative price impact on T-bill rates and hence also affect common measures of the liquidity premium. Importantly, these effects are expected to be more pronounced when the Treasury market is illiquid and funds’ price impact greater.

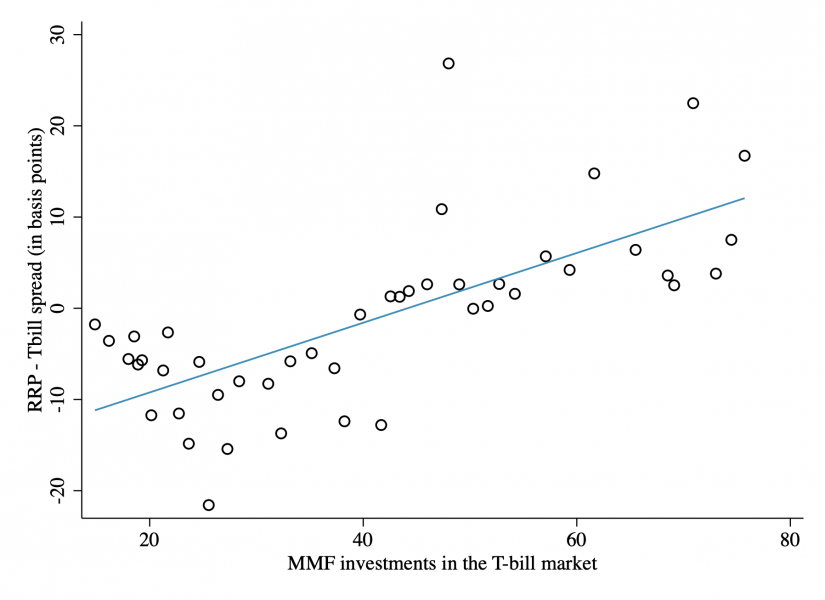

We provide causal evidence consistent with our arguments. Figure 1 shows that when money market funds have more residual cash, the RRP-Tbill spread is higher – implying a lower T-bill rate. We confirm this positive relationship in a regression analysis with an instrumental variable. Guided by our model, we take the RRP-Tbill spread, rather than just the T-bill rate, as outcome variable. In this way, our analysis accounts for the impact of macroeconomic conditions on the general level of rates, as they are reflected in the interest rate on the RRP set by the Federal Reserve. In terms of magnitude, our estimates suggest that a one standard deviation increase in the residual cash share (or 22%) leads to an almost 7 basis point increase in the RRP-Tbill spread.

We use a detailed dataset of US MMFs’ individual portfolio holdings to analyse the underlying channels uncovered in the model. Consistent with our arguments, we find that MMFs internalize their price impact in the T-bill market when setting repo rates. Moreover, they take into account liquidity conditions in the T-bill market when deciding on their portfolio allocations. Second, funds with a higher residual cash share allocate relatively more to the RRP facility, especially when the T-bill market is less liquid.

To establish causality, we use an instrumental variable. The instrument exploits exogenous changes in the demand for repos by European banks due to ‘window dressing’ for regulatory proposes. The Basel III leverage ratio allows European banks to report their leverage based on a quarter-end snapshot of their balance sheet, as opposed to a measure based on the daily average of the balance sheet over the entire quarter (eg Aldasoro, Ehlers and Eren, 2022). This leads to quarter-end window dressing for European banks, which sharply contract their repo transactions. Lower demand for repos means that MMFs have more residual cash they can invest in T-bills. Instrumental variable results confirm the pattern in Figure 1.

Figure 1: When MMFs invest more in the T-bill market, T-bill rates decline (and the RRP-Tbill spread increases)

Note: This figure plots the RRP-Tbill spread on the vertical axis against MMFs’ “free cash share” (the share of funds’ assets allocated to T-bills or the RRP) on the horizontal axis. As MMFs allocate a greater share of their assets to the T-bill market, the T-bill rate declines and the RRP-Tbill spread increases.

Our findings offer a new interpretation of T- bills’ liquidity premium/convenience yields. Market participants are typically willing to pay for the liquidity service flow provided by near- money assets. This premium, commonly referred to as liquidity premium (which forms part of the “convenience yield”), is often measured as the difference between the prices of two securities that have identical characteristics except their liquidity. The liquidity premium commanded by T-bills is usually computed as the spread between the 1-month General Collateral (GC) repo rate and the T-bill rate. The intuition is that a 1-month repo contract collateralized by US Treasuries is considered as safe as a T-bill but, unlike a T-bill, cannot be liquidated before maturity.

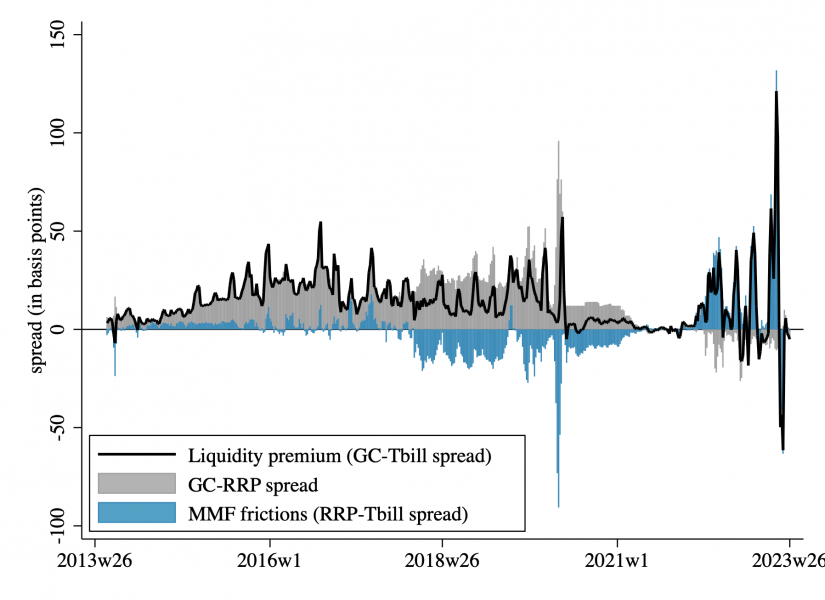

Such measures of the liquidity premium implicitly assume negligible intermediation frictions and a highly liquid T-bill market. However, our results suggest that MMFs impact T-bill rates through their purchases, especially when T-bill markets are less liquid. In turn, we find that MMFs’ portfolio allocations also affect the liquidity premium measured by the GC repo and T-bill spread. In particular, a one standard deviation increase in the residual cash share (or 22%) has a significant positive impact on the GC repo-Tbill spread (and hence the liquidity premium) that is equivalent to the effect of a 1 percentage point rise in the federal funds rate or a fifth of a percent decrease in the bills-to-GDP ratio. These results suggest that the GC-Tbill spread might not only capture investor preferences for liquidity, but also reflect intermediation frictions and market illiquidity. In our analysis, we decompose the GC repo-Tbill spread to quantify the importance of these frictions. The decomposition, also shown in Figure 2, reveals that frictions in the money market funds sector together with illiquidity in the T-bill market – represented by the blue shaded area – can explain large parts of the movements in the liquidity premium (black line), in particular since 2022.

Figure 2: Frictions in the MMF sector drive a sizeable share of T-bills’ liquidity premium

Note: This figure plots the liquidity premium (black line, measured as the spread between the 1-month GC repo rate and 1-month T-bill rate), as well as the GC repo-RRP spread (gray bars) and RRP-Tbill spread (blue bars). The RRP-Tbill spread captures the contribution of intermediation frictions in the MMF sector, which we uncover in our analysis, to T-bills’ measured liquidity premium. The sum of the gray and blue bars adds up to the black line. Source: Doerr, Eren and Malamud (2023).

All in all, our results illustrate why considering intermediation frictions in the MMF sector and market liquidity in the T-bill market are important to understand the pricing of near-money assets and the observed time-variation in the liquidity premium of T-bills. Our findings also have implications for the transmission of monetary policy, government debt issuance, and the regulation of MMFs.

MMFs typically receive inflows during episodes of monetary tightening (Drechsler, Savov and Schnabl, 2017; Xiao, 2020). Our results suggest that these inflows could put downward pressure on both T-bill rates and repo rates through MMFs’ price impact, weakening monetary policy transmission. Illiquid Treasury markets exacerbate these concerns.

Our analysis also helps understand developments at the short end of the yield curve, with implications for government debt issuance. In the presence of the frictions identified in our analysis, higher government issuance could reduce supply-demand imbalances and allow the government to borrow at more favourable rates, in particular at times of illiquidity in the T-bill market.

Finally, our results inform policy on the regulation of the MMF sector. The MMF reform in 2016 has increased concentration in the MMF sector. Higher market concentration in the repo market can exacerbate the trade-offs highlighted in our analysis. For example, the reform resulted in a shift from prime to government money market funds. Government funds are more limited in the set of instruments they are allowed to hold. As a result, large inflows (eg during flight-to-quality or tightening episodes) could worsen supply-demand imbalances, including in the T-bill market. Our results highlight a trade-off for policy makers between improving the resilience of the MMF sector and possible exacerbating market inefficiencies through higher market concentration.

Afonso, G, L Logan, A Martin, W Riordan and P Zobel (2022): “How the Fed’s overnight reverse repo facility works”, Liberty Street Economics, January.

Aldasoro, I, T Ehlers and E Eren (2022): “Global banks, dollar funding, and regulation”, Journal of International Economics, no 137, 103609.

Doerr, S, E Eren and S Malamud (2023): “Money market funds and the pricing of near-money assets”, BIS Working Paper, no 1096.

Drechsler, I, A Savov and P Schnabl (2017): “The deposits channel of monetary policy”, The Quarterly Journal of Economics, vol 132, no 4, pp 1819–76.

Greenwood, R, S G Hanson and J C Stein (2014): “A comparative-advantage approach to government debt maturity”, The Journal of Finance, no 70 (4), pp 1683–1722.

Krishnamurthy, A and A Vissing-Jorgensen (2012): “The aggregate demand for treasury debt”, Journal of Political Economy, no 120 (2), pp 233–267.

Nagel, S (2016): “The liquidity premium of near-money assets”, The Quarterly Journal of Economics, no 131 (4), pp 1927–1971.

Xiao, K (2020): “Monetary transmission through shadow banks”, The Review of Financial Studies, vol 33, no 6, pp 2379–420.