Opinions expressed by the authors of studies do not necessarily reflect the official viewpoint of the Oesterreichische Nationalbank or the Euro system.

Abstract

This brief examines the impact of economic uncertainty on the effectiveness and transmission of monetary policy, focusing particularly on the euro area. After discussing market- and news-based uncertainty indicators, we examine how uncertainty interacts with conventional and unconventional monetary policy tools. Our findings reveal that conventional measures, such as interest rate adjustments, are significantly less effective during periods of high uncertainty. In contrast, unconventional tools, particularly quantitative easing, maintain their effectiveness. These results emphasize the importance of tailoring monetary policy strategies to prevailing levels of uncertainty and highlight the crucial role of central bank communication in improving policy transmission.

Over the past 25 years, central banks have repeatedly experienced both huge uncertainty shocks and prolonged periods of exceptionally high economic uncertainty, which has posed a challenge to the conduct of monetary policy. The sources of this uncertainty have varied, ranging from political events such as Brexit to geopolitical risks and the global impact of the pandemic. Each episode has required central banks to act swiftly and decisively, often under conditions of limited information. The most recent development is ongoing uncertainty around US tariff policies, which have led to soaring levels of economic uncertainty. This raises the question: How effective is monetary policy when the future is unknown and unpredictable?

Economic uncertainty is an abstract concept. It can occur as a result of forces outside the economic sphere (for example, the 9/11 terror attacks or the Covid-19 pandemic), or it can arise from other economic processes (recessions and elevated uncertainty usually go hand in hand, but it is unclear whether one causes the other). Economic uncertainty can be defined as the perception of unpredictability of conditions, impacting both micro- and macroeconomic decision-making. In the former case, it can cause firms to postpone investments or households to save more, for example. In the latter case, uncertainty poses challenges to economic growth and price stability that must be countered by suitable fiscal or monetary policy measures.

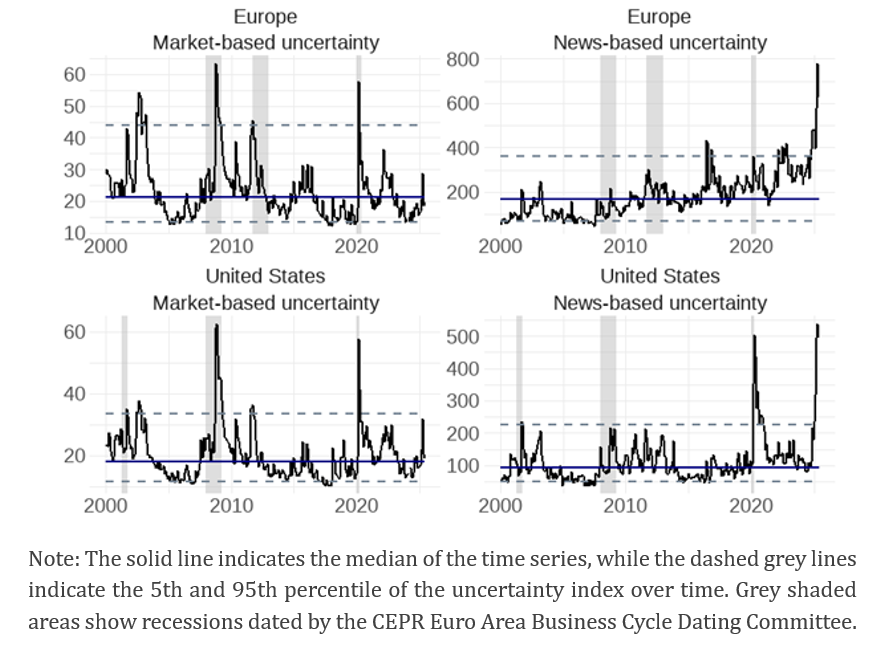

The challenge for policymakers begins with assessing the current level of economic uncertainty, since it is not directly observable and there is no single, universal uncertainty measure. Two widely used indices are based on either news- or market-related information. A news-based uncertainty indicator, such as the Economic Policy Uncertainty index (EPU; Baker et al., 2016), quantifies the extent to which policy-related economic uncertainty is covered in newspapers. In contrast, market-based indices, such as the VIX for the US and the VSTOXX for the euro area, are based on forward-looking measures of expected future stock market volatility. The latter often reflects financial uncertainty, rather than policy or macroeconomic uncertainty. Figure 1 shows recent developments in uncertainty in both Europe and the United States (US). Significant episodes of uncertainty include the early 2000s, marked by geopolitical tensions surrounding the Iraq War, the global financial crisis of 2008/2009 (which triggered a sharp increase in uncertainty due to concerns about financial stability and policy responses), the European sovereign debt crisis of 2010–2013 (characterized by surging credit risk and fiscal stress across euro area member states), and the 2016 Brexit referendum. The Covid-19 pandemic caused another spike in uncertainty measures due to concerns about health, the economic outlook, and policy responses. The most recent increases in economic uncertainty, triggered by announcements of a high level of US tariffs, have caused news-based measures of uncertainty to surge to unprecedented levels during the aforementioned crises.

A few observations are worth mentioning. Firstly, exceptionally high peaks of market-based uncertainty (i.e., when uncertainty exceeds the 95th percentile of the index over time) often coincide with recessions, as indicated by the grey shaded areas in the figure. News-based uncertainty also tends to be elevated during recessions; however, except for US news-based uncertainty in 2020, levels rarely exceeded the 95th percentile of the series. Therefore, the correlation between recessions and uncertainty is not perfect. Figure 1, shows that, on the one hand, high levels of uncertainty can occur without a recession, and, on the other hand, recessions can occur without very high levels of uncertainty. Secondly, while market-based uncertainty shows some cyclical patterns, news-based uncertainty shows some trending behavior. Interestingly, the recent uncertainty surrounding US trade policies resulted in unprecedented levels of news-based uncertainty, whereas market-based uncertainty did not exceed the 95th percentile at the same time. These two indices, which measure different aspects of economic uncertainty, therefore often pick up common trends, but not always.

Figure 1. Market- and news-based uncertainty in Europe and the United States

Throughout these varying levels of uncertainty, central banks are tasked with fulfilling their mandate. The question among policymakers in central banks is whether recent high levels of uncertainty (uncertainty levels, as measured by both indices, exceed historical medians in both the US and Europe) will impact the effectiveness of their policy measures. Since monetary policy largely works by influencing the expectations of economic actors, it is important to analyze whether it can steer the economy equally under low or high levels of uncertainty.

In order to stimulate aggregate demand, central banks employ both conventional and unconventional monetary policy measures. There are several possible ways in which economic uncertainty can hinder the transmission of monetary policy. Firstly, monetary policy largely works through expectations regarding inflation, interest rates, and general future economic conditions. When these expectations are affected by high uncertainty and become less anchored, it becomes more difficult for central banks to influence the behavior of economic agents through conventional monetary policy, i.e. setting key interest rates. Bloom (2009), for example, shows in his seminal contribution that uncertainty shocks can lead to sharp declines in investment and hiring. This drop in activity implies that uncertainty about the future may delay consumption and investment, thereby reducing the effectiveness of monetary policy in stimulating aggregate demand. Lu et al. (2025) find that the expansionary effect of monetary policy on firm loan demand is notably reduced when uncertainty is high. Castelnuovo and Pellegrino (2020) also find that, as a result of the Phillips curve becoming steeper under uncertainty, inflationary effects are stronger. Secondly, the interaction between uncertainty and financial markets poses an additional challenge to the transmission of monetary policy under uncertainty. Alessandri and Mumtaz (2019) find that the recessionary effects on the economy are heightened when high uncertainty and financial crisis coincide. In such situations, when financial markets are impaired or distressed, the transmission of monetary policy may therefore also be hindered.

The interaction between the prevailing level of uncertainty in the economy and monetary policy leads to nonlinearities in the transmission mechanism, meaning that the same interest rate cut can have different effects on the real economy.1 Aastveit et al. (2017) find that, in the US, high levels of uncertainty reduce the impact of monetary policy on real economy measures, such as GDP and investment, by around half. Caggiano et al. (2021) identify another asymmetry in the effects of monetary policy under uncertainty. Following an uncertainty shock, monetary policy can stabilize real activity more easily during expansions than during recessions. Similar results indicating the muted effects of monetary policy under uncertainty have been found in other studies for the US (Castelnuovo and Pellegrino, 2018; Pellegrino, 2020), but evidence for the euro area remains sparse. Furthermore, the effects of unconventional monetary policy tools interacting with uncertainty have not received the same attention as those of conventional monetary policy.

In Hauzenberger et al. (2021), we aim to address this gap in the literature by examining the impact of monetary policy measures implemented by the European Central Bank (ECB), contingent upon the prevailing level of economic uncertainty. Specifically, we examine the dynamic impact of changes to the conventional and unconventional monetary policy on a range of macroeconomic and financial variables, alongside a variety of survey-based expectation measures. Monetary policy shocks were identified using high-frequency identification and financial market surprises around ECB announcement windows, based on the Euro Area Monetary Policy Event-Study Database (Altavilla et al., 2019). Using these data, we identify three types of shock: a conventional monetary policy shock; a forward guidance shock, which measures an unconventional monetary policy measure that works via communication about future policy paths; and quantitative easing, which is another unconventional monetary policy measure in the form of the large-scale purchase of longer-term assets. We incorporate these shocks into a smooth-transition vector autoregression (ST-VAR) model, which enables us to examine how the impact of monetary policy shocks varies continuously with the prevailing level of uncertainty rather than in fixed regimes such as recession versus expansion. The model incorporates macroeconomic, financial, and survey-based expectation variables and uses the EPU index to distinguish between periods of low and high uncertainty.

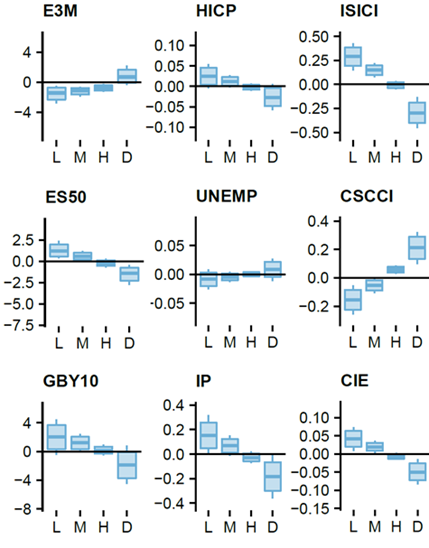

Figure 2. Impulse responses to a conventional monetary policy shock on impact under varying uncertainty levels

Note: The boxplots illustrate the differential impact across low, medium, and high uncertainty regimes.“E3M” denotes the Euribor 3-month rate, “GBY2” the 2-year government bond yield, “GBY10” the 10-year government bond yield, “ES50” the Euro Stoxx 50, “HICP” the consumer price inflation, “UNEMP” the unemployment rate, “IP” the industrial production growth rate, “ISICI” industrial confidence, “CSCCI” consumer confidence, and “CIE” consumer inflation expectations.

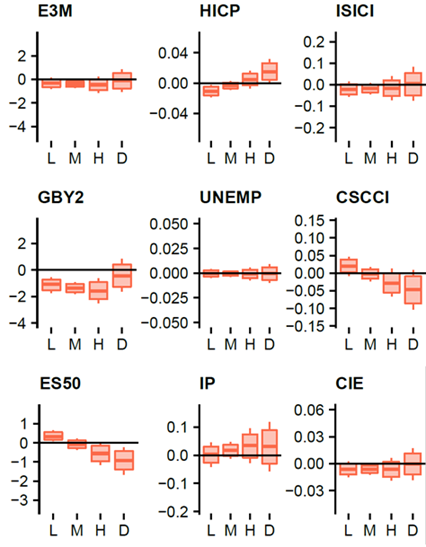

Figure 3. Impulse responses to a forward guidance shock on impact under varying uncertainty levels

Note: The boxplots illustrate the differential impact across low, medium, and high uncertainty regimes. “E3M” denotes the Euribor 3-month rate, “GBY2” the 2-year government bond yield, “GBY10” the 10-year government bond yield, “ES50” the Euro Stoxx 50, “HICP” the consumer price inflation, “UNEMP” the unemployment rate, “IP” the industrial production growth rate, “ISICI” industrial confidence, “CSCCI” consumer confidence, and “CIE” consumer inflation expectations.

As shown in Figure 2, we find markedly diminished effectiveness of conventional monetary policy under uncertainty. Our econometric framework enables us to estimate the impact of monetary policy on a range of macroeconomic variables. We summarize our results by showing how the variables respond to monetary policy shocks in states of low (L), medium (M) and high (H) uncertainty, based on the 5th, 50th and 95th percentiles of the uncertainty indicator over time. We also depict the difference in responses between low and high uncertainty states to make it easy to see at a glance whether the difference between L and H is statistically significant. Boxplots summarize the range and confidence of estimated effects, helping to identify statistically significant differences across uncertainty regimes. In other words, if the rectangle and whiskers do not touch the zero-line, monetary policy has a statistically significant effect on the variable in question.2

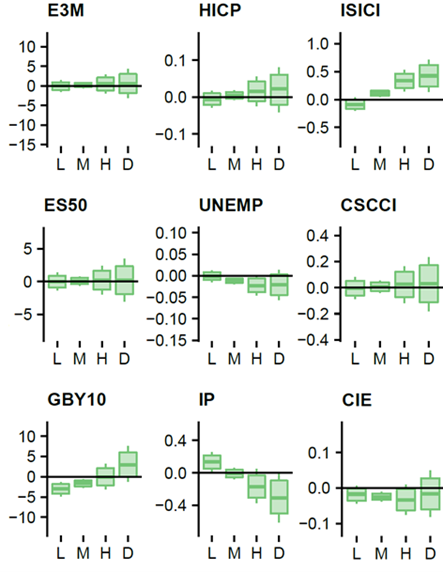

Although interest rates (E3M) react as expected to a conventional monetary policy shock, the transmission to financial conditions (such as stock prices, ES50, and credit spreads) and real economic variables (such as inflation, HICP, and unemployment, UNEMP) is weaker under elevated uncertainty. We also find that expectation channels are impaired under uncertainty, with both household and firm expectations (ISICI, CSCCI and CIE) showing a limited response to the policy signal. Regarding responses to forward guidance (depicted in Figure 3), we observe more persistent effects than with conventional monetary policy, particularly with regard to medium-term interest rates. However, the effects on macroeconomic variables and expectations are mixed and sometimes counterintuitive under high uncertainty. We conjecture that this may be due to information effects in central bank communication playing a larger role when uncertainty is high. In contrast, we find that quantitative easing is relatively more effective in environments of high uncertainty. Responses are shown in Figure 4. It has stronger and more persistent effects on long-term yields, unemployment, and economic confidence indicators. These results suggest that quantitative easing may have helped offset the impaired transmission of conventional monetary policy during uncertain times.

Figure 4. Impulse responses to a quantitative easing shock on impact under varying uncertainty levels

Note: The boxplots illustrate the differential impact across low, medium, and high uncertainty regimes. “E3M” denotes the Euribor 3-month rate, “GBY2” the 2-year government bond yield, “GBY10” the 10-year government bond yield, “ES50” the Euro Stoxx 50, “HICP” the consumer price inflation, “UNEMP” the unemployment rate, “IP” the industrial production growth rate, “ISICI” industrial confidence, “CSCCI” consumer confidence, and “CIE” consumer inflation expectations.

Economic uncertainty has increased significantly over the past years and continues to pose challenges to policy makers in central banks. These challenges are not only limited to the correct monitoring of current uncertainty levels. Studies consistently show that conventional monetary policy is significantly less effective when uncertainty is high. Even when interest rates react as expected, their impact on financial conditions and real variables such as inflation or unemployment is often limited. Expectation channels, which are critical for monetary policy, often become impaired in times of uncertainty. This implies that uncertainty introduces considerable nonlinearity into the monetary policy transmission mechanism. The same change in interest rates can have different effects depending on the level of uncertainty. Unconventional monetary policy can complement conventional measures when uncertainty is high. In particular, quantitative easing is relatively more effective in high-uncertainty environments. It has stronger and more persistent effects on long-term bond yields, unemployment, and confidence indicators, which may help to offset the impaired transmission of conventional monetary policy.

Crucially, the fact that the effects of monetary policy are dampened under uncertainty does not mean that monetary policy actions become obsolete. This is particularly relevant in the context of financial markets. Indeed, research by Brandão-Marques et al. (2024) indicates that, when faced with inflation of uncertain persistence, a robust monetary policy would necessitate tighter measures than under normal circumstances. Conversely, a “wait-and-see” approach could incur significant economic costs. From this particular aspect of economic uncertainty (regarding the nature of current inflation persistence), we can infer that, when uncertainty is high, more forceful monetary policy actions are required to shift expectations. Furthermore, studies using measures of market-based uncertainty have found that both conventional and unconventional monetary policy can reduce uncertainty (Bekaert et al., 2013; Lutz, 2017; Bauer et al., 2021). In contrast, Hauzenberger et al. (2021) did not find evidence of such an effect using a news-based measure of uncertainty. Nevertheless, these findings offer hope that monetary policy can facilitate better transmission further down the line by alleviating certain aspects of economic uncertainty related to financial markets.

It follows that central banks should tailor their policy tools to the prevailing level of uncertainty where possible, and that monitoring multiple uncertainty indicators is crucial for effective policy design. Different measures capture different aspects of uncertainty, and empirical insights suggest that market-based uncertainty reacts differently to monetary policy than economic policy uncertainty does. Furthermore, the state of the economy is another factor for policymakers to consider. Elevated uncertainty during recessions poses a greater challenge to the effectiveness of monetary policy than during periods of economic growth.

Lastly, while this brief primarily focused on the effects of monetary policy on financial and economic outcomes through policy instruments, the power of central bank communication seems to be heightened during times of elevated uncertainty and therefore deserves extra attention. Clear and transparent communication from central banks can ensure the effective transmission of monetary policy, whereas uncertainty around monetary policy itself can result in negative transmission effects (Husted et al., 2020). Hutchinson and Smets (2017) discuss this in more detail, showing that the ECB’s clear communication of its reaction function improved financial and economic conditions after a period of high uncertainty during the European debt crisis.

Therefore, creating robust monetary policy under uncertainty is no easy feat, and elevated uncertainty continues to challenge monetary policymakers around the world (Lane, 2024; Williams, 2025). Given the multifaceted nature of economic uncertainty, it is also unclear a priori what the optimal monetary policy strategy is in any given situation. However, rich economic research offers insights into the conditions under which monetary policy is more or less likely to be effective.

Aastveit, Knut Are, Gisle James Natvik, and Sergio Sola. “Economic uncertainty and the influence of monetary policy.” Journal of International Money and Finance 76 (2017): 50-67.

Alessandri, Piergiorgio, and Haroon Mumtaz. “Financial regimes and uncertainty shocks.” Journal of Monetary Economics 101 (2019): 31-46.

Altavilla C, Brugnolini L, Gürkaynak RS, Motto R, and Ragusa G (2019), “Measuring euro area monetary policy,” Journal of Monetary Economics 108, 162–179.

Baker SR, Bloom N, and Davis SJ (2016), “Measuring economic policy uncertainty,” Quarterly Journal of Economics 131(4), 1593–1636.

Bauer, Michael D., Aeimit Lakdawala, and Philippe Mueller. “Market-based monetary policy uncertainty.” The Economic Journal 132.644 (2022): 1290-1308.

Bekaert, Geert, Marie Hoerova, and Marco Lo Duca. “Risk, uncertainty and monetary policy.” Journal of Monetary Economics 60.7 (2013): 771-788.

Bloom N (2009), “The impact of uncertainty shocks,” Econometrica 77(3), 623–685.

Brandão-Marques, Mr Luis, Mr Roland Meeks, and Vina Nguyen. “Monetary Policy with Uncertain Inflation Persistence. ” International Monetary Fund Working Paper WP/24/47 (2024).

Caggiano, Giovanni, Efrem Castelnuovo, and Gabriela Nodari. “Uncertainty and monetary policy in good and bad times: A replication of the vector autoregressive investigation by Bloom (2009).” Journal of Applied Econometrics 37.1 (2022): 210-217.

Castelnuovo, Efrem, and Giovanni Pellegrino. “Uncertainty-dependent effects of monetary policy shocks: A new-Keynesian interpretation.” Journal of Economic Dynamics and Control 93 (2018): 277-296.

Hauzenberger, Niko, Michael Pfarrhofer, and Anna Stelzer. “On the effectiveness of the European Central Bank’s conventional and unconventional policies under uncertainty.” Journal of Economic Behavior & Organization 191 (2021): 822-845.

Husted, Lucas, John Rogers, and Bo Sun. “Monetary policy uncertainty.” Journal of Monetary Economics 115 (2020): 20-36.

Hutchinson, John, and Frank Smets. “Monetary policy in uncertain times: ECB monetary policy since June 2014.” The Manchester School 85 (2017): e1-e15.

Lane, Philip R. “Monetary policy under uncertainty.” Keynote speech at the Bank of England Watchers’ Conference 2024, King’s College London, 25 November 2024.

Lu, Jiajun, et al. “The real effect of monetary policy under uncertainty: Evidence from the change in corporate financing purposes.” Journal of Banking & Finance 172 (2025): 107381.

Lutz, Chandler. “Unconventional monetary policy and uncertainty.” Available at SSRN 2505943 (2017).

Pellegrino, Giovanni. “Uncertainty and monetary policy in the US: A journey into nonlinear territory.” Economic Inquiry 59.3 (2021): 1106-1128.

Williams, John C. “Uncertainty and robust monetary policy.” Remarks at the Reykjavík Economic Conference, Reykjavík, 9 May 2025.

Additionally, a large body of economic literature has established the fact that monetary policy works less effectively in a recession, which as mentioned above often coincides with elevated uncertainty, than during an expansion.

Hauzenberger et al. (2021) chooses Bayesian estimation techniques, which result not in point estimates, but estimates the whole posterior distribution of parameters, which can be summarized in a multitude of ways. While the paper shows responses of variables over different horizons and over all points in time, this brief focusses on responses on impact in the interest of brevity.