This policy brief is based on Banque de France Working Paper no. 1007. The views expressed are those of the authors and should not be interpreted as reflecting the views of the Banque de France or the Eurosystem.

Households’ inflation expectations play a key role in macroeconomic dynamics, not only because they influence saving and consumption decisions, but also because they serve as an important gauge of central bank credibility. In the euro area, the European Central Bank’s Consumer Expectations Survey (ECB-CES) provides benchmark indicators of households’ inflation expectations. However, measuring these expectations is challenging. Unlike professional forecasters, households tend to be less informed about inflation, making their responses particularly sensitive to the questionnaire framing and design. A key feature of the ECB-CES is that it allows respondents to participate repeatedly, enabling researchers to track how the expectations of the same individuals evolve over time. Yet repeated participation may itself influence responses by prompting participants to acquire information or become more familiar with the concept of inflation. This phenomenon is commonly referred to as learning through survey or panel conditioning and could become a concern if the objective of the survey is to measure households’ expectations as spontaneous answers to the survey. This is especially crucial when assessing the anchoring of inflation expectations or testing theories of expectation formation since any systematic bias introduced by repeated survey participation could distort the interpretation of results.

In Gautier and Montornès (2025), we estimate panel conditioning effects on quantitative answers provided by households to several questions of the euro area ECB-CES survey. This survey has several distinctive features that make it well suited for this analysis. First, respondents can participate up to 24 times (i.e. months) in the survey, which is much more than in other comparable surveys. Second, the ECB-CES collects a wide range of quantitative expectations, covering not only aggregate inflation but also other macroeconomic variables such as unemployment, as well as household-level variables like income and consumption growth. Third, the survey is large in scale, conducted monthly across 11 different euro area countries, involving about 20,000 households. Finally, it covers the entire inflation cycle from 2020 to 2024, providing sufficient time variation to identify panel conditioning effects on inflation expectations (Bańkowska et al., 2021).

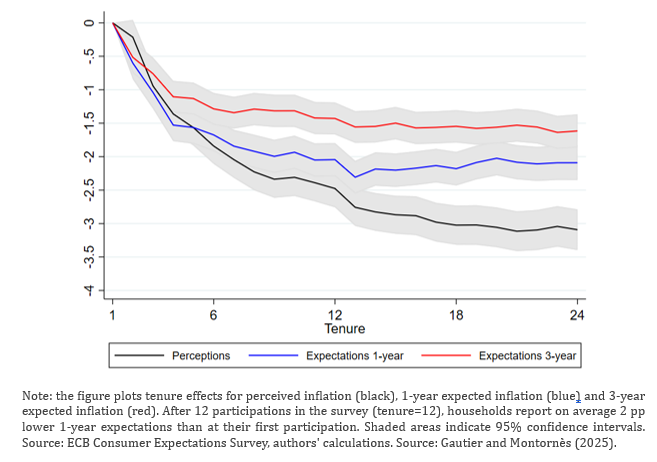

Using more than 950,000 monthly responses from about 100,000 unique participants in the ECB-CES between 2020 and 2024, we show that, all else being equal, households report lower inflation perceptions and lower inflation expectations when they participate in the survey for several consecutive months (Figure 1). This panel conditioning effect becomes significant from the second survey participation, with its magnitude increasing rapidly over subsequent waves before stabilizing at its maximum (in absolute terms). After 12 consecutive participations in the ECB-CES, one-year inflation expectations are, on average, about 2 percentage points lower than at the first interview. Beyond this point, the panel conditioning effect remains stable up to the maximum participation duration. A similar pattern is observed for long-term inflation expectations, although the magnitude of the effect is smaller.

Kim and Binder (2023) were the first to document panel-conditioning effects in surveys of inflation expectations. Using answers of U.S. households to the FRBNY Survey of Consumer Expectations (SCE), they estimate that US households reduce their inflation expectations by an average of 2.6pp after 12 months of participation in the FRBNY-SCE. Our estimates are slightly smaller but comparable, and as in Kim and Binder (2023), we find that panel conditioning effects emerge only after some months of survey participation. In a similar way, Mitchell et al. (2025) show that probabilistic questions in the FRBNY-SCE are more prone to panel conditioning effects than point estimates.

Figure 1. Estimates of tenure effects on perceived and expected inflation (in pp)

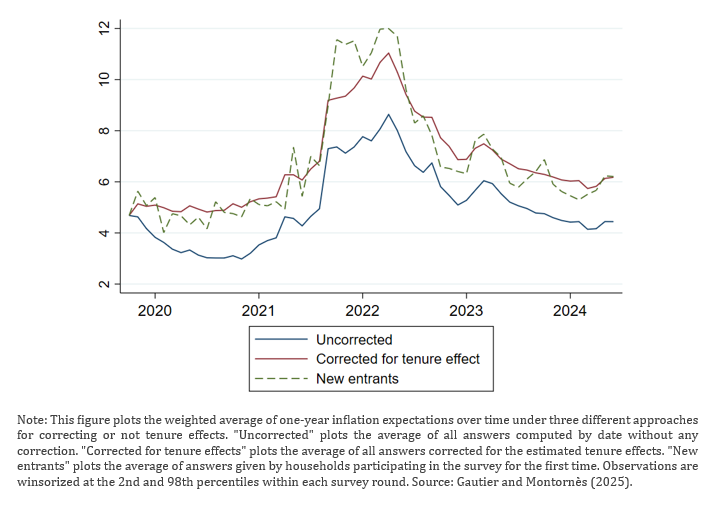

Answering the survey in a repeated way significantly affects inflation responses of households. This might blur the reading of aggregate indicators since they will reflect average tenure effects specific to households participating repeatedly in the survey. Thus, the aggregate indicators might be less representative of spontaneous answers provided by the general population. To assess how much tenure effects can affect aggregate indicators, we compute an aggregate series restricting the sample to households answering for the first time to the survey (who are by definition not affected by panel conditioning) but also an aggregate series where every answer is corrected by the average panel conditioning effect estimated by tenure. These two alternative aggregate indicators of inflation expectations are, on average, larger than those computed from the raw data, although they remain quite correlated with published aggregate series (Figure 2). The average expectation of new entrants is a little more volatile and possibly less precise because the number of new entrants is much smaller than the full sample.

Figure 2. Average 1-year inflation expectations with and without controlling for tenure effects (in %)

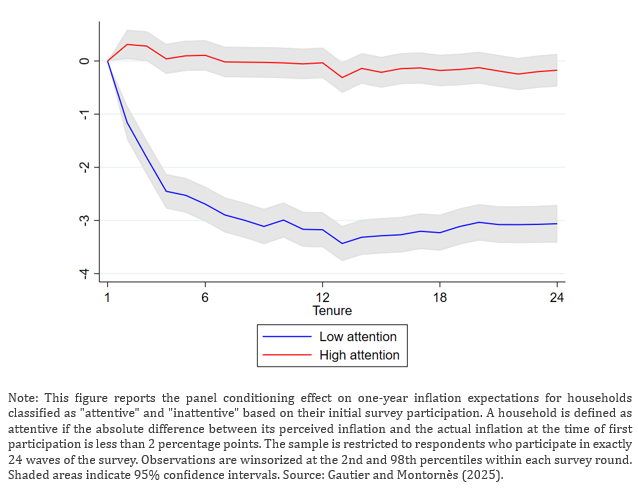

We find that tenure effects are stronger when households initially report very high inflation expectations (i.e. above 10%) and that repeated participation leads to less rounding in responses and less reported uncertainty of answers. As they participate in additional survey waves, households with initially high expectations may become more attentive or engage in greater information gathering. This increased focus of households could lead to a reassessment and subsequent revisions of their inflation expectations. To investigate the role of attention in driving tenure effects, we rely on a simple measure of inflation attention defined as the absolute difference between households’ perceived inflation and actual inflation (Coibion et al., 2018). Figure 3 plots the estimation results for 1-year inflation expectations when we consider separately households who are defined as attentive or as inattentive the first time they answer the survey. We find that tenure effects are close to zero and statistically insignificant for attentive households, whereas inattentive households exhibit much larger tenure effects, about -3pp after six months of participation. These findings suggest that households inattentive to inflation tend to provide more consistent responses over time as they might become more attentive or better informed about inflation.

Figure 3. Estimates of tenure effects on perceived and expected inflation (in pp)

However, greater familiarity with the questionnaire structure may also encourage respondents to put less effort into answering, potentially reducing response accuracy. Only about half of the observed panel conditioning effects can be attributed to improved forecasting performance. For instance, all things equal, we find that the share of households expecting inflation to be exactly “0” increases with tenure, suggesting some “speed-through” behavior of respondents. Overall, repeated participation may also reduce engagement and lead to less accurate responses.

We document that tenure effects are not specific to inflation. We also obtain significant tenure effects for other macroeconomic variables, such as unemployment or economic growth. Households have more optimistic expectations about the economy after some repeated participations in the survey. By contrast, we find much smaller panel conditioning effects for household-specific variables, such as their own income or consumption. These results suggest that households are more attentive or informed about variables reflecting their own economic situation than about the macro variables, in particular inflation or unemployment.

Our results highlight the importance of considering panel conditioning when designing or comparing household expectation surveys. This issue is already acknowledged in survey practice: for example, the FRBNY’s SCE (Armantier et al. 2017) and the ECB’s CES limit respondents’ participation to a maximum of 12 or 24 months respectively. A smaller influence of panel conditioning on the survey results could be obtained by further reducing the maximum participation period. However, this would also imply also higher costs of recruiting new participants to maintain sample size and representativeness. Panel conditioning effects imply a trade-off between operational cost and measurement issues related to repeated participation. Panel conditioning effects also complicate the comparison of results across surveys. For instance, Coibion and Gorodnichenko (2025) show that panel conditioning effects can partly explain why the Michigan survey and the FRBNY-SCE have recently delivered different signals on the anchoring of households’ inflation expectations in the United States. In a similar way, panel conditioning effects could also partly explain why the ECB-CES reports on average lower inflation perception and expectation than the European Commission Survey.

Armantier, O., Topa, G., Van der Klaauw, W., & Zafar, B. (2017). An overview of the survey of consumer expectations. Economic Policy Review, (23-2), 51-72.

Bańkowska, K., Borlescu, A., Charalambakis, E., Dias da Silva, A., Di Laurea, D., Dossche, M., … & Törmälehto, V. M. (2021). ECB Consumer Expectations Survey: an overview and first evaluation. ECB Occasional Paper, (2021/287).

Coibion, O., Gorodnichenko, Y., & Kumar, S. (2018). How do firms form their expectations? New survey evidence. American Economic Review, 108(9), 2671-2713.

Coibion, O. & Gorodnichenko, Y., (2025). What’s Happening with Inflation Expectations? EMPTC Empirical Macroeconomics Policy Center of Texas, U Austin, blog 28th April 2025.

Gautier, E., & Montornès, J. (2025). Measuring households’ inflation expectations in the euro area: The effect of panel conditioning, Banque de France Working Paper, No. 1007.

Kim, G., & Binder, C. (2023). Learning-through-survey in inflation expectations. American Economic Journal: Macroeconomics, 15(2), 254-278.

Mitchell, J., Shiroff, T., & Braitsch, H. (2025). Practice makes perfect: Learning effects with household point and density forecasts of inflation. International Journal of Forecasting.