Our research reveals substantial spillover effects across the euro area from the Eurosystem’s Public Sector Purchase Programme (PSPP), providing evidence for arbitrage within the euro area sovereign bond markets. These spillover effects are particularly large when the Eurosystem buys bonds with longer maturities and bonds issued by non-core countries, due to investors rebalancing towards higher yielding government bonds. Our study contributes to discussions on the design of central bank purchase programs and offers new insights on their transmission and market arbitrage.

Since the Global Financial Crisis, major central banks have extensively used large-scale asset purchases in their monetary policy toolkit. By altering demand and supply of financial assets, central bank purchases can influence market functioning, with risks of scarcity and segmentation, potentially leading to unintended price differentials. The existence of market arbitrage can help spread the effects of purchases across jurisdictions and market segments, alleviating distortions created by these purchases. The arbitrageurs can play an important role for smoothing market adjustments in the net asset purchases phase as well as during the assets run-off. Given the current unwinding of asset purchases in the euro area and shrinking of central bank balance sheets across jurisdictions, exploring spillovers from central bank purchases and market arbitrage remains relevant.

We study the role of market arbitrage in the euro area (EA) by examining the impact of the Eurosystem’s Public Sector Purchase Programme (PSPP) on bond returns for the ten largest EA countries (see Mudde et al., 2024). Our approach crucially relies on distinguishing between the direct effect of purchases on the corresponding bond’s return and the spillover effects to other bonds with different durations or issued by other governments.

Asset purchases influence bond yields and returns through the portfolio rebalancing channel. It implies that a purchase-induced price change in one asset spills over to prices of other assets that investors perceive as substitutes. In our context, PSPP transactions in the government bond market affect a broad spectrum of asset prices by changing relative yields. These indirect effects can be triggered by other domestic purchases (i.e., domestic purchases of bonds other than the specific bond that is bought under the PSPP) as well as by spillovers from purchases of bonds issued by other countries’ governments.

The strength of the portfolio rebalancing channel depends on the relative amount and interplay between preferred habitat investors and arbitrageurs in the market. When the group of preferred habitat investors is large, central bank purchases may create a shortage that drives up bond prices in specific markets. Meanwhile, arbitrageurs integrate markets by spreading the shortage – created by central bank purchases in a particular bond – across maturities and bonds with similar characteristics. The above mechanism can apply within domestic markets as well as to spillovers from purchases by central banks in other jurisdictions, provided there is a sufficient number of arbitrageurs able to trade across national markets.

Kabaca et al. (2023) show that portfolio rebalancing can explain cross-border spillovers of government bond purchases across regions within a monetary union. The union-wide purchases directly lower the term premium of domestic long-term yields, which spill over through portfolio rebalancing of cross-border assets within the monetary union, lowering term premia on foreign long-term bonds. Thus, the impact of spillovers may depend on a number of factors, such as the size of purchases relative to the pool of substitutable assets, the degree of substitutability of domestic bonds with foreign ones, the risk premium on bonds, and maturity.

We examine the effects of PSPP purchases using different categories of purchase volumes. We do so by regressing the return of a specific bond on the relative volume purchased of i) the bond itself (own purchases), ii) other bonds issued by the same government (domestic close and distant substitutes purchases), and iii) bonds issued by other EA countries (non-domestic spillovers). We use the panel dataset on individual bonds issues by 10 largest EA countries’ governments at a monthly frequency from March 2015 up to December 2018. To deal with potential endogeneity, own purchases are instrumented with two variables constructed based on the PSPP eligibility criteria.

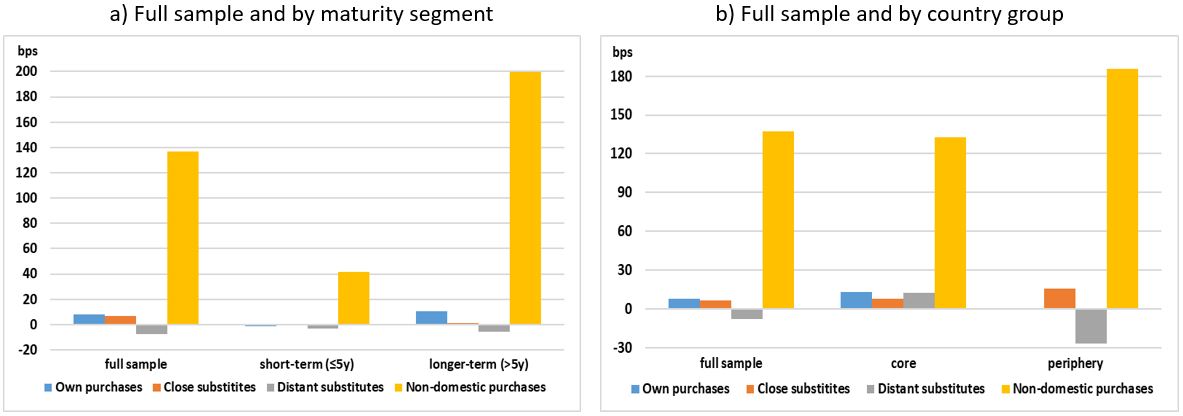

Our findings show that both domestic and non-domestic PSPP purchases significantly increased bond returns in the EA. However, the price elasticity of bond returns to purchases depends on the type of purchases considered. In terms of magnitude, the average monthly effect of non-domestic purchases on bond returns is substantially larger than the effect of own purchases (see Figure 1, full sample). This implies that spillovers from other countries in the EA – i.e., the general purchase pace of the ECB across all involved EA countries – were of great relevance for the PSPP’s effectiveness. Moreover, it points to an important role of arbitrage within the EA government bond markets, despite the existing segmentation.

Figure 1: Effects on bond returns of one standard deviation increase in PSPP purchases

Notes: The figure plots the effects (in basis points, bps) on a bond return of 1 standard deviation increase in own purchases, other domestic purchases (close and distant substitutes), and non-domestic purchases under the PSPP, calculated as the coefficient estimate multiplied by 1 standard deviation in the corresponding purchases variable. See Mudde et al. (2024) for details.

As an extension, we examine whether the effects differ across maturity segments and country groups. First, we distinguish short-term bonds (remaining maturity up to 5 years) and longer-term bonds (remaining maturity over 5 years). The effects of purchases are found to be more pronounced for longer-term bonds, in line with a higher duration risk extracted from this market segment (see Figure 1a). This holds for domestic (own and substitutes) purchases and non-domestic ones. In particular, spillovers from purchases in other countries account for the largest portion of the impact.

Second, we find a stronger impact of non-domestic purchases on bond returns in non-core countries (Ireland, Italy, Portugal, and Spain) compared to core countries in our sample (Austria, Belgium, France, Finland, Germany, and the Netherlands). In terms of the economic size, a one standard deviation increase in non-domestic purchases raised an average bond return by 133 basis points in core countries and by 186 basis points in the non-core ones (see Figure 1b). This suggests that the general pace of the PSPP had a relatively stronger effect on bond returns in the EA non-core economies, in line with the observed data.

The above results are theoretically plausible, because risk premia are likely to decline as well when risk-free rates decrease, for instance due to improved debt sustainability. Since risk premia are larger in non-core countries, the potential for increasing bond returns, i.e. lowering yields, through portfolio rebalancing is larger in these jurisdictions. The already low yields in core countries may incentivize investors to rebalance their portfolios towards higher yielding bonds issued by non-core countries, thereby creating additional demand for those bonds and boosting their returns. In addition, non-core jurisdictions may benefit relatively more from improved market liquidity and anticipation of increased risk sharing and reduced borrowing costs due to the PSPP.

Our findings have several policy implications. First, we show that the impact of PSPP purchases in single bonds spread across countries and maturity segments, highlighting an important role that arbitrageurs play in EA government bond markets. If these markets were completely fragmented, bond purchases in one EA country would have no effect on bond returns in other EA countries, ceteris paribus. The large cross-border spillover effects suggest that arbitrageurs impact bond prices across EA government bond markets following Eurosystem’s large-scale purchases.

Second, the effect of cross-border spillovers from PSPP varies across maturity segments and countries. Spillovers are most pronounced for bonds with longer maturities and lower credit ratings, due to the larger duration and credit risk extraction in these cases. The relatively large impact in these market segments can be attributed to spillovers from higher-rated low-maturity bonds due to investors rebalancing their portfolio towards higher yielding sovereign bonds.

Third, the precise distribution of bond purchases over different countries may have a limited impact on the overall transmission of the ECB’s monetary policy across EA countries as long as the arbitrage functions well in bond markets. With arbitrageurs at work, it appears to be less relevant which bonds are being bought – as long as the overall volume is purchased. Nevertheless, the transmission of bond purchases across countries may depend on market liquidity and may be weakened during financial stress. There could also be limitations when purchases are concentrated in a few bond issues or in one maturity segment. In particular, price distortions would arise when purchases crowd out arbitrageurs and preferred habitat investors fully dominate these bond holdings. Preventing these potential market distortions can justify spreading bond purchases across a large number of bonds when conducting the PSPP.

Lastly, our insights are valuable for understanding the design and calibration of future asset purchase programmes in the EA, while the empirical approach can be applied to study the transmission of past programmes. While the unique settings of the EA should be kept in mind, our work sheds light on spillover effects between government bond market segments (e.g., between bonds of different maturities or issued in different jurisdictions), and therefore can have a broader application for analysing central bank asset purchases, outside the EA.

In the current phase of unwinding asset purchases in the EA, the effective transmission of monetary policy may depend on how well financial markets are able to adjust, limiting the risks of distortions and fragmentation. In this context, considering cross-border spillovers could be relevant, as the amount of arbitrageurs needs to be sufficient to ensure smooth adjustments of markets to new liquidity conditions and pricing.

Kabaca, S., R. Maas, K. Mavromatis, and R. Priftis (2023). Optimal quantitative easing in a monetary union. European Economic Review 152: 104342.

Mudde, Y., A. Samarina, and R. Vermeulen (2024). Spillover effects of sovereign bond purchases in the euro area, International Journal of Central Banking 20(2): 343-389.