References

Brunnermeier, M. K., S. Langfield, M. Pagano, R. Reis, S. V. Nieuwerburgh, and D. Vayanos (2017), “ESBies: Safety in the Tranches”, Economic Policy, 32, 175–219.

Delpla, J. and J. von Weizsäcker (2010), “The Blue Bond Proposal,” Bruegel Policy Brief.

Caballero, R. J. and E. Farhi (2018), “The Safety Trap,” The Review of Economic Studies, 85, 223–274.

Giudice, G., M. de Manuel, Z. G. Kontolemis, and D. P. Monteiro (2019), “A European Safe Asset to Complement National Government Bonds,” available at SSRN.

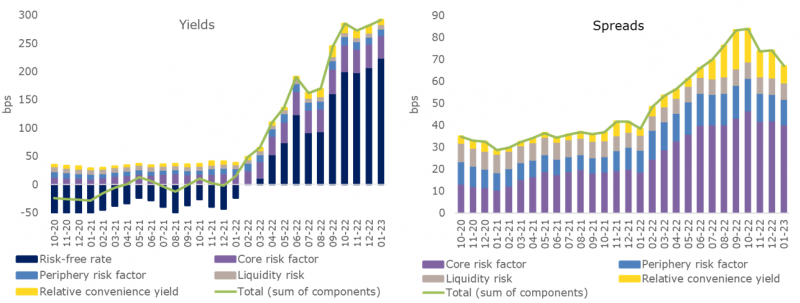

Monteiro, D. P. (2022), “The Market Performance of EU Bonds,” Quarterly Report on the Euro Area, 21, 31–42.

Monteiro, D. P. (2023), “Common Sovereign Debt Instruments in the Euro Area”, European Economy Discussion Paper 194, European Commission.

Monteiro, D. P. (2023b), “Macrofinancial Dynamics in a Monetary Union,” European Economy, Discussion Paper 188, European Commission.