This policy brief is based on ECB Working Paper No 3048. The views expressed here are those of the authors and do not necessarily reflect those of the ECB.

Abstract

We show that the transmission of monetary policy weakens as volatility in short-term money market rates rises: in times of high volatility, output and prices fall by less in response to a monetary policy tightening than in times of low volatility; and this pattern shows up already at earlier stages of transmission, including to bank lending rates and volumes. Conceptually, it is consistent with uncertainty creating an ‘option value of the status quo’, as argued in a long-standing theoretical literature. Central banks could in principle adjust to this dampening effect by adopting a more or less aggressive interest rate policy, depending on the prevailing degree of volatility. However, this strategy hits a snag because money market volatility is heteroskedastic: when high on average, it also swings around a lot from month to month, which complicates policy conduct. Limiting such volatility thus appears as a desirable feature for the design of a central bank’s operational framework.

A core function of central banks’ operational frameworks is to steer short-term money market rates in line with the desired monetary policy stance. Since these short-term rates are determined in a market setting, they may fluctuate also absent changes in the stance, for instance owing to temporary shifts in commercial banks’ demand for liquidity. Central banks, in turn, can influence the scope for such non-policy induced volatility via the parameters of the operational framework. For example, a narrower differential between the rates at which central banks lend reserves to commercial banks and accept those reserves as deposits reduces the leeway for money market rates to fluctuate (and vice versa).

In Holm-Hadulla and Pool (2025), we highlight an important reason for keeping the scope for short-rate volatility within reasonable bounds. In particular, we present empirical evidence showing that higher short-rate volatility significantly dampens the transmission of monetary policy on key macroeconomic variables, including economic activity and prices. At the same time, in calibrating the parameters of an operational framework, the benefit of greater rate controllability needs to be traded off against other desirable features, such as preserving some room for money market activity, which speaks against fully muting any volatility in key short-term rates.

The estimates stem from a standard local projections model using high-frequency financial market data to identify exogenous variation in policy rates. Monetary policy shocks are measured by changes in short-term OIS rates around ECB policy communication events, using the Euro Area Monetary Policy Event-Study Database (Altavilla et al., 2019). These shocks are then interacted with the standard deviation of daily short-term money market rates realised over the maintenance period preceding the shock (maintenance periods essentially mark the interval between two ECB Governing Council meetings but start a few days later, when a ECB policy rate decision is implemented).

A challenge in estimating our model is that the observed variation in short-rate volatility may not be exogenous to the other variables in the system. For instance, short-rate volatility may not just influence macroeconomic variables, such as output and prices, but the causality may also run in the opposite direction. Moreover, notwithstanding the rich set of controls included in our baseline, we cannot rule out the existence of unobserved confounders that correlate with short-rate volatility and the main outcome variables.

To address these potential sources of endogeneity, we exploit the heteroskedasticity-based identification strategy proposed by Rigobon (2003). The basic intuition is that, in a system of simultaneous equations, distinct shifts in the volatility of one type of shock can be used to recover the structural parameters of other equations. In the canonical example of a supply and demand system, a shift from low to high volatility in the supply shocks, for instance, would imply that the observed outcomes become more clustered around the demand curve. This, in turn, can be exploited to identify the location and shape of the demand curve.

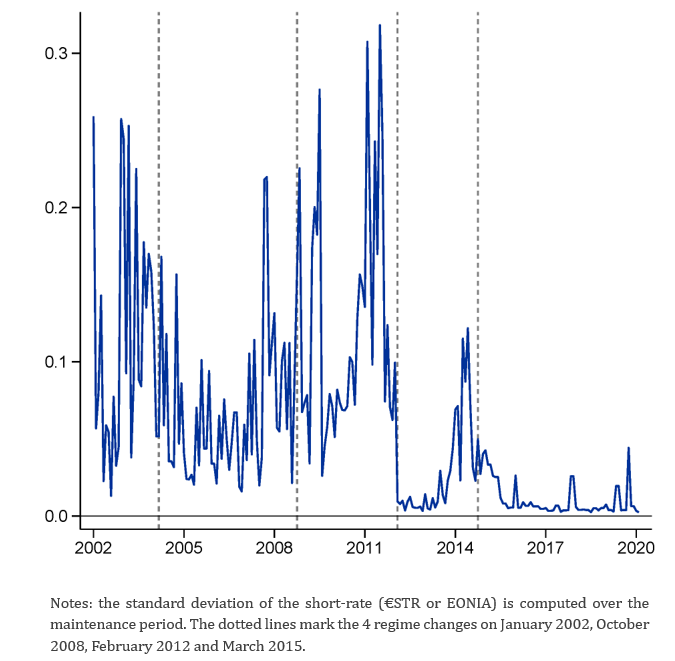

In applying this approach to our research question, we benefit from the fact that the ECB’s modalities for implementing monetary policy have undergone several regime changes since the start of the euro; and these regime changes, mostly as a side effect, have generated stark differences in how short-rate volatility has fluctuated from period to period – a key enabling factor for the heteroskedaticity-based identification strategy. In particular, we define five unique regimes, which are displayed in Figure 1 and described in more detail in the underlying paper.

Figure 1. Short-rate volatility across regimes (y-axis: percentage points; x-axis: years)

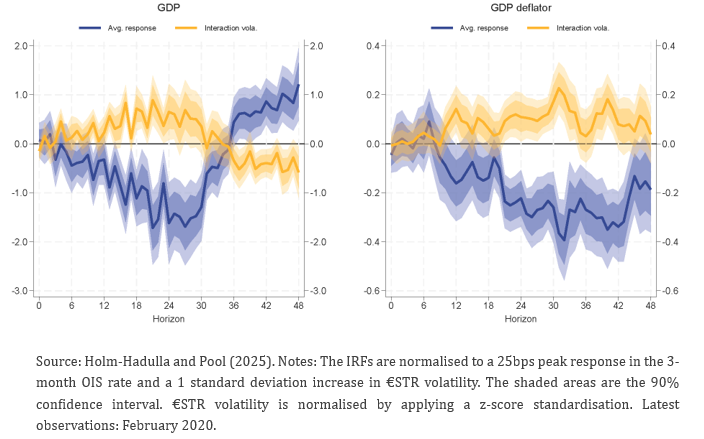

Figure 2 shows, in blue, the impact of an unexpected 25 bps policy rate hike on GDP and the deflator at average short-rate volatility levels. The impulse responses follow the typical patterns found in the related literature, with GDP contracting with a lag and prices following suit with some additional delay. Also, the scale of the impacts is broadly comparable to recent studies using a similar estimation strategy. In yellow, the chart shows how these impacts change for each one-standard-deviation increase in short-rate volatility (as estimated by the interaction-term coefficient). The significantly positive coefficients on this interaction term indicate that rate volatility has a dampening effect on the GDP and deflator responses to a monetary policy shock. This dampening effect is economically relevant: for instance, two years after the shock, the output contraction is roughly cut in half if volatility rises by one standard deviation above average.

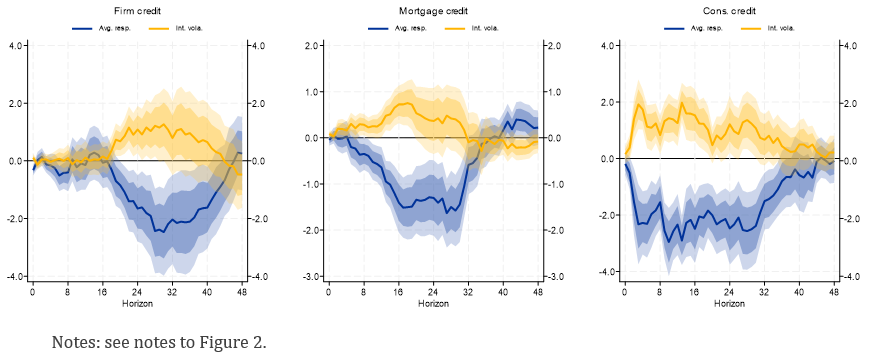

The dampening effect of short-rate volatility shows up already at earlier stages of transmission. In particular, we see the same pattern in the response of bank intermediation which, especially in the euro area, is key to linking financial markets to the real economy. Loan volumes, on average, contract in response to the monetary policy tightening (for the discussion of lending rate responses, see underlying paper). Loans reach a trough after around two and a half years, for all categories (including household mortgages and consumer credit, as well as loans to firms), and then return to their pre-shock levels. Like for the other variables in the system, the impact is attenuated by higher short-rate volatility, which reduces, for instance, the absolute impact on household mortgage loans by around one-third after 18 months.

Figure 2. Response of output and prices to a monetary policy shock and its interaction with short-rate volatility (y-axis per cent, x-axis: months)

Figure 3. Response of bank intermediation to a monetary policy shock and its interaction with short-rate volatility (y-axis per cent, x-axis: months)

Our results connect to a long-standing literature on how volatility affects the response of economic agents to shocks. In particular, the dampening effect of short-rate volatility on monetary policy transmission echoes the classic Dixit (1991) result that uncertainty around relevant state variables creates a ‘range of inertia’. That is: it may be optimal for economic agents not to adjust in response to aggregate shocks, so long as these shocks remain within certain bounds. A core condition for this type of inertia to apply is that economic agents incur costs in adjusting the variables over which they optimize. Consistent with our empirical finding that the dampening effect of volatility arises already at the bank-lending stage of transmission, the respective literature indeed emphasizes adjustment costs as a key feature of lending behaviour (see Gerali et al (2010) and the references cited therein).

From a policy perspective, the results point to an interesting balancing act for banks. With more scope for short term interest rates to move around, there is in principle more room for market forces to work, which often makes economic outcomes more efficient. However, if market rates fluctuate a lot, key actors in the economy may become more reluctant to respond to changes in monetary policy and this complicates the central bank’s task of controlling inflation. This balancing act is likely to become more prominent over the coming years: as central banks gradually reduce their supply of liquidity, market rates should become more sensitive to changes in commercial banks’ liquidity demand. The changes in the operational framework announced in 2024, including the narrower range between the ECB lending and deposit rates, will contribute to smoothening the transition to this new environment.

Altavilla, C., Brugnolini, L., Gürkaynak, R. S., Motto, R., and Ragusa, G. (2019a). Measuring euro area monetary policy. Journal of Monetary Economics, 108:162179.

Dixit, A. (1991). Analytical approximations in models of hysteresis. The Review of Economic Studies, 58(1), 141-151.

Gerali, A., Neri, S., Sessa, L., and Signoretti, F. M. (2010). Credit and banking in a DSGE model of the euro area. Journal of Money, Credit and Banking, 42:107–141.

Holm-Hadulla F. and S. Pool (2025). Interest rate control and the transmission of monetary policy. ECB Working Paper No. 3048.

Rigobon, R. (2003). Identification through heteroskedasticity. Review of Economics and Statistics, 85(4):777–792.