The views expressed are those of the authors and do not necessarily reflect the official views of Deutsche Bundesbank or the Eurosystem.

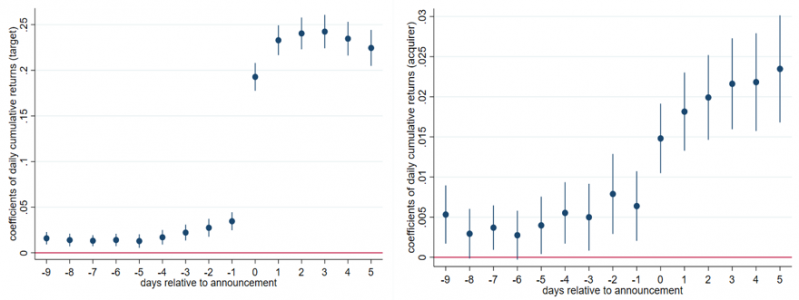

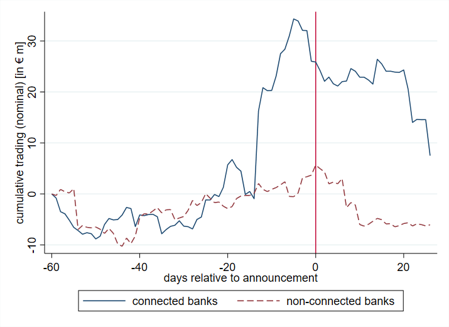

In Bittner et al. (2022), we provide evidence that M&A advisors share private information about imminent takeovers to closely connected banks, and that they do so in an incentive-compatible fashion. We uncover these connections using the network of banks in the international syndicated-loan market. Only target, rather than acquirer, advisors share the information with connected banks that purchase additional target stocks before the announcement and, as such, at lower prices. These effects are more emphasized when takeover announcements are associated with higher announcement returns, which is the case when deals are completed faster or are in cash. The additional pre-announcement demand drives up the pre-announcement price and thereby contributes to a higher offer premium without diminishing the probability of a successful takeover bid. Information leakage thus benefits target shareholders and ultimately the target advisor, reflecting the idea that bank networks aid the establishment of mutually beneficial relations.

Morrison, A. D. and Wilhelm W. J. (2007), ‘Investment Banking: Institutions, Politics, and Law’, Oxford University Press.