We analyze inflation dynamics in Bulgaria using different complementary econometric techniques. We find that common factors play a large role in EU members’ inflation dynamics but impact individual countries differently due to country-specific factors. Greater weight of energy and food in Bulgaria’s HICP basket amplifies the impact of commodity price shocks on headline inflation. Furthermore, second-round effects in Bulgaria seem more pronounced and, thus, associated with higher inflation persistence than in other EU countries. Recent ECB monetary tightening has been insufficient for Bulgaria and its transmission is relatively weak. Fiscal policy supported the recovery from the COVID crisis but added to inflationary pressures.

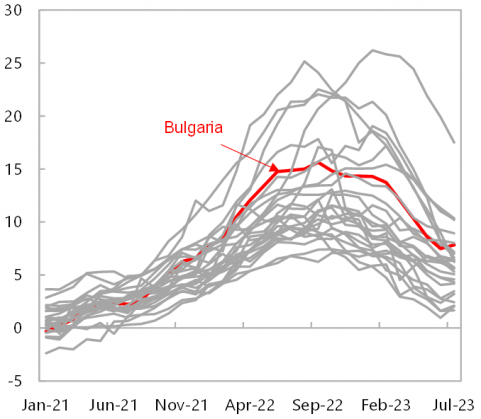

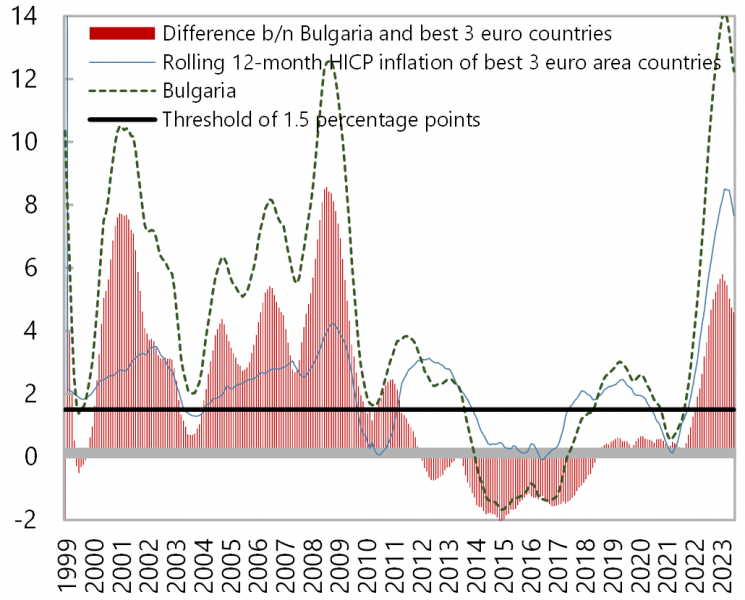

Inflation in Bulgaria peaked above 15 percent in 2022, marking its highest level since 2000 and has been relatively persistent, fading away only gradually over subsequent periods. The sudden rise in inflation after being low and stable for long was not limited to Bulgaria. It affected many countries around the globe, both advanced economies and emerging markets (Figure 1). However, relative price developments led to growing divergence between Bulgaria and best performers in Europe (Figure 2).

Figure 1: Inflation in EU Countries (Percent, y-o-y)

Sources: Eurostat, staff calculations.

Figure 2: Maastricht Criterion on Inflation (Percent)

*Assuming no outliers in the calculation of the top 3 performers.

Sources: Eurostat, staff calculations.

Against this global backdrop, in Nguyen, Takizawa, and Vassileva (2023), we explore the drivers and characteristics of recent inflation dynamics in Bulgaria. Questions include: (1) are there country-specific factors given the seemingly global nature of the post-covid inflation shock? (2) how persistent is inflation in Bulgaria? and (3) did policy contribute to the recent surge in inflation? Addressing these questions would help inform policies for managing inflationary risks, a particularly important issue for Bulgaria given its ambition to join the euro area in the near term.

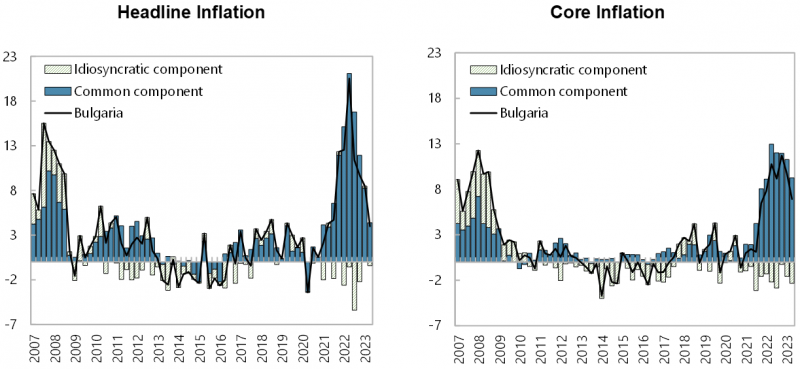

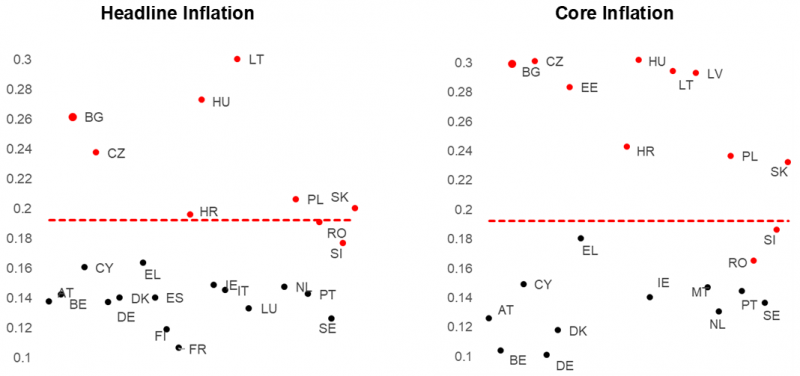

To explore these questions, we use a variety of complementary econometrics technics. First, building on a stylized discussion on inflation in Bulgaria and the EU, we use a principal component analysis to shed light on the potential interplay between common and country-specific factors affecting inflation dynamics. We find evidence that common factors explain a large share of inflation variations in the EU as well as in Bulgaria (Figure 3). This high level of synchronization in the consumer price developments across EU countries can be attributed to several factors, including common shocks, openness and trade integration within the EU, and likely similar policy responses to shocks. However, Bulgaria, together with the majority of CESEE countries, is more sensitive to global inflation fluctuations than its EU counterparts, as measured by the factor loadings for the first principal component (Figure 4). These differences in factor loadings, especially striking for core inflation, indicate that country-specific factors matter in the transmission and propagation of the same common shock. For instance, greater weight of energy and food in Bulgaria’s HICP basket amplifies the impact of shocks on headline inflation.

Figure 3: Decomposition of Headline and Core Inflation in Bulgaria by Common and Country-Specific Components

(Percent, seasonally adjusted annualized q-o-q)

Sources: Eurostat and IMF staff calculations.

Figure 4: Factor Loadings in the First Principal Component for Headline and Core Inflation

Source: IMF staff estimates.

Note: The red line is the average of factor loading to the first common component across all countries in the sample.

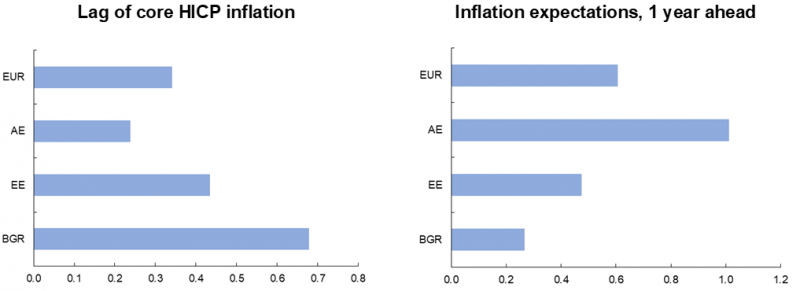

Figure 5: Selected Coefficients of Estimated Phillips Curves

Source: IMF staff estimates, see also IMF (2022).

Note: See details in Table 2 of Nguyen, Takizawa, and Vassileva (2023). For European economies (EUR), Advanced European (EA), Emerging European (EE) economies, estimates from a panel regression with country fixed effects. All the estimates are significant at least at 10 percent significant level.

Second, we delve deeper into identifying potential inflation drivers by estimating Phillips curves for Advanced European (AE) and Emerging European (EE) economies as well as Bulgaria over 2000Q1–2022Q4, using a similar specification as in IMF (2022) to facilitate the comparison. In particular, core inflation is regressed over lagged core inflation, one-year ahead inflation expectations based on consensus forecasts, unemployment gap (deviation from the Hodrick-Prescott —HP— filtered unemployment rate) and proxies of external price pressure (i.e., combined changes in foreign producer price indices and exchange rates), together with measures of food and energy prices (IMF 2022). The results suggest significant persistence of core inflation and an important role of short-term inflation expectation in Bulgaria (Figure 5). We also find that inflation dynamics appear to be more persistent in Bulgaria than those for European, EE and AE economies.

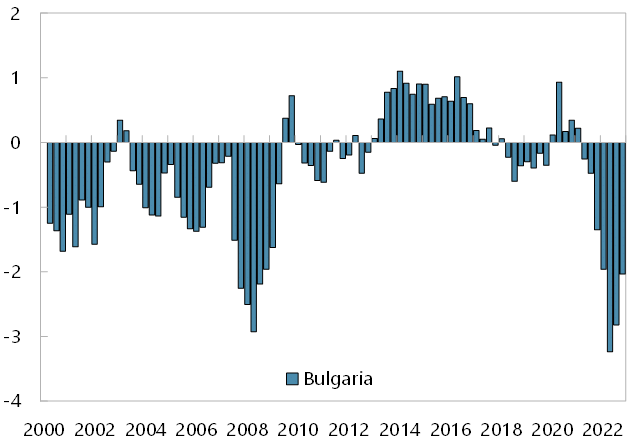

Third, we discuss the roles of and constraints on policies in managing inflation in Bulgaria. Regarding monetary policy, there is limited scope for an independent policy in Bulgaria as the Bulgarian National Bank (BNB) does not set a policy interest rate under the currency board. ECB monetary policy could therefore affect monetary conditions and deposit and interest rates in Bulgaria, which in turn could result in changes in demand and inflation. We develop a measure to capture the loosening/tightening of the ECB’s monetary policy stance for Bulgaria building on the literature by calculating the difference between the actual ECB deposit rate and a Taylor rule-based interest rate. The latter is derived based on parameters from a range of existing studies for the euro area and the output gap and inflation in Bulgaria. The result suggests that ECB’s policy rate was too accommodative for Bulgaria in 2021–22 and remained so as of mid-2023 (Figure 6). In addition, the transmission of ECB’s tightening monetary policy to Bulgaria’s economy appears weak, likely reflecting abundant liquidity in Bulgaria’s banking sector as well as strong competition in the banking sector for credit market in an environment of low funding costs.

Figure 6: Difference Between ECB Policy Rate and Taylor Rule-Implied Interest Rate

(Percentage points)

Sources: ECB, IMF, WEO, and IMF staff calculations.

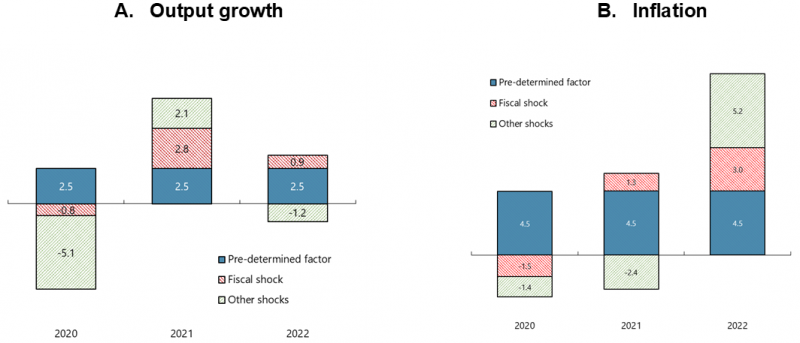

Besides monetary policy, fiscal policy appears to have played an important role in the recent inflation surge. We quantify the role of structural fiscal shocks via sign restrictions in a VAR framework. Specifically, the VAR model has four variables: real GDP growth (i.e., log difference of real GDP), core inflation (i.e., excluding energy and unprocessed food), a measure of short-term interest rate, and the primary fiscal balance in percent of GDP in the previous quarter.

Fiscal policy played an important role in supporting the recovery from the COVID-19 pandemic (Figure 7.A), but also contributed to inflation, as observed in other countries (Figure 7.B). Specifically, fiscal shocks explain about 1.3 percentage points of inflation in 2021 and about 3 percentage points of inflation in 2022. The significant impact in 2022 is due to the lagged effect of previous fiscal supports, particularly those that were implemented at the end of 2021 resulting in a significant and positive impact in 2022 (associated with high persistence of inflation dynamics in Bulgaria), together with looser-than-warranted policies in 2022 in the context of a strong recovery. Excluding deterministic contributions and initial conditions (pre-determined factors, thus not explained by model-based structural shocks), our results confirm that non-fiscal shocks are the main contributor to inflation in Bulgaria. The negative contribution in 2021 can be explained partly by the persistent effect of the negative demand shock in 2020 combined with the supply-side improvement in 2021, which pushed output up while lowering price. In 2022, these non-fiscal shocks, on average, explain more than 40 percent of core inflation, consistent with the view that external factors, including supply-chain constraints and the energy crisis in Europe amidst the recovery of demand from the COVID-19 pandemic, pushed global inflation.

Figure 7: A Decomposition of Recent Output Growth and Inflation Dynamics

Sources: IMF staff estimates.

Notes: The fiscal shock is identified by the restrictions that tightening fiscal policy raises primary balance, but lower GDP growth or inflation. The annual number is the sum of decomposition over quarters.

In sum, our analysis confirms the important role played by external factors, such as supply-chain constraints, commodity and food price shocks, synchronized significant policy supports, to inflation dynamics in Bulgaria. It also shows that greater weight of energy and food in Bulgaria’s HCPI basket has amplified the impact of shocks on headline inflation while second-round effect were stronger than in most other EU countries. Regarding policies, ECB monetary tightening seems to have been insufficient for Bulgaria and weakly transmitted. In supporting a fast recovery from the covid-crisis, fiscal policy likely also contributed to the inflation surge. These findings point to the importance of fiscal policy and liquidity management in managing inflation risks in Bulgaria, considering the currency board arrangement.

International Monetary Fund, 2022, “Inflation in Europe: Assessment, Risks, and Policy Implications,” Regional Economic Outlook: Europe.

Nguyen, A.D., Takizawa, H. and Vassileva, I., 2023. Inflation Dynamics in Bulgaria: The Role of Policies. IMF Working Papers, 2023(212).