The views expressed in this policy brief do not necessarily reflect the opinion of the Deutsche Bundesbank or the Eurosystem.

Since the 2007-08 financial crisis, the policy rates of numerous central banks worldwide have been close to the natural lower bound for nominal interest rates of slightly below 0%. It is therefore virtually impossible to lower the policy rate any further. In order to remain capable of monetary policy action in a low interest rate environment and, say, be able to influence future inflation rates, central banks have, for years now, employed unconventional monetary policy measures. These include, for instance, asset purchase programmes and exchange rate policies. Such measures are taken to ease monetary conditions that depend on money market rates and the exchange rate. The objective is thereby to reduce deflationary risks (Borio and Disyatat (2010)). Deflationary risks occur when the inflation rate is so low or negative that enterprises and consumers postpone investments because they expect lower prices going forward. This slows down economic growth. If a central bank, in a low interest rate environment, introduces a minimum exchange rate that is below the prevailing exchange rate, this causes a depreciation of the domestic currency, making goods produced domestically but intended for export cheaper with immediate effect. This boosts domestic economic activity and counters deflationary risks.

Following this logic, the Swiss National Bank (SNB) introduced a minimum exchange rate of CHF 1.20 per euro on 6 September 2011 in order to counter the massive appreciation pressure that the Swiss franc had been experiencing since the financial crisis of 2007-08. The Swiss currency is considered a “safe haven”, making it particularly popular with investors since the financial crisis. However, the resulting appreciation made Swiss goods more expensive abroad, threatening the competitiveness of the Swiss economy. Even back then, this appreciation pressure meant that one euro bought less than CHF 1.20 from the beginning of July 2011 until the introduction of the minimum exchange rate. That was significantly less than before the collapse of US investment bank Lehman Brothers in September 2008, when the euro was trading for at least CHF 1.60. In order to enforce the minimum exchange rate “with the utmost determination”, the SNB promised that it was prepared to “buy foreign currency in unlimited quantities” (SNB 2011).

Such purchases of foreign currency increase a central bank’s balance sheet total and generally entail higher financial risks. This is because, if the foreign currency were to depreciate substantially in the future, the central bank would risk a depletion of its capital. If market participants regard this risk to be high, this may undermine a central bank’s credibility. Nonetheless, it is true to say that the greater the increase in the balance sheet total as a result of foreign exchange purchases, the more effective they are (Fratzscher, Gloede, Menkhoff, Sarno and Stöhr (2019)). In addition, a central bank can expect the expansion of the balance sheet total to be greater the higher the minimum exchange rate, as foreign exchange purchases are then necessary for a larger range of exchange rates. Faced with this trade-off, central banks must ask themselves what minimum exchange rate to set in order to arrive at a balance sheet expansion that is still acceptable to them. Or to phrase it differently: what increase in the balance sheet total must a central bank expect if it wishes to implement a specific minimum exchange rate?

In order to answer these questions, Hertrich (2022) develops a model that central banks can use to estimate the size of foreign exchange interventions likely to be necessary to implement a minimum exchange rate regime over a certain time horizon. The model builds on a standard model (Krugman 1991) that was developed for two-sided exchange rate target zones – i.e. target zones with an upper and lower bound. A minimum exchange rate, however, represents a target zone limited at only one end. In a first step, the model was consequently adjusted so that it can be applied to a one-sided exchange rate target zone. Subsequently, the unobservable fundamental value of a currency was estimated using the method of Lera and Sornette (2016) on the basis of observable financial market data.

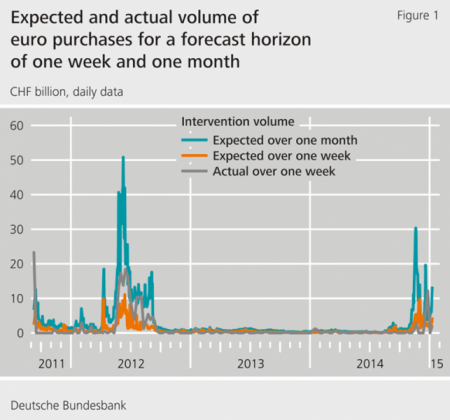

The determinants of the proposed model are available for time horizons of various lengths. A central bank can consequently estimate the amount of foreign exchange purchases to be expected in the short, medium and long term and decide, based on these estimates, whether and for how long it wishes to maintain a minimum exchange rate regime. Figure 1 shows, by way of illustration, the volume of euro purchases per week (= short term) and per month (= medium term) anticipated (“Expected over …”) by the model for the period after the start of the minimum exchange rate regime. As there is no public information on the volume of euro purchased by the SNB, this is proxied by the indicator most frequently used in the empirical literature, which is published on a weekly basis (“Actual over one week”). This indicator is the total amount of Swiss franc-denominated sight deposits that commercial banks and the Swiss Confederation hold with the SNB. Developments in sight deposits are generally considered a good indicator of the SNB’s interventions: if the SNB purchases foreign currency, it credits commercial banks with the equivalent amount in Swiss francs in their SNB accounts.

It is evident from Figure 1 that the dynamics of all three series are fairly similar. In order to verify this visual observation econometrically, Hertrich (2022) analyses how well the weekly euro purchases as predicted by the model explain the level of the indicator; to this end, the euro purchases expected per month are converted to a weekly frequency. The econometric results in Hertrich (2022) confirm that the newly developed model is astonishingly good at explaining the actual volume of the SNB’s euro purchases under its minimum exchange rate regime.

One episode that the model explains convincingly is the period shortly before the minimum exchange rate was discontinued. At the beginning of 2015, the Swiss franc came under strong appreciation pressure against the euro, as a decision on large-scale asset purchases and consequently a considerable monetary policy easing in the euro area was expected to be taken at the meeting of the Governing Council of the ECB on 22 January. For this particular situation, the model implies a considerable volume of potential euro purchases (see Figure 1) had the SNB not discontinued the minimum exchange rate on 15 January 2015: the model results for the day preceding the discontinuation of the minimum exchange rate suggest that the SNB would have had to carry out euro purchases amounting to roughly CHF 15 billion per month in the short term. A back-of-the-envelope calculation suggests that an intervention volume of roughly CHF 180 billion would have been necessary had the SNB maintained the minimum exchange rate regime for another year. This represents 32% of the SNB’s balance sheet total of CHF 561.2 billion as at the cut-off date of 31 December 2014 – a figure that makes the SNB’s decision to abandon the minimum exchange rate regime quite comprehensible.

The model developed in Hertrich (2022) is good at empirically explaining the SNB’s euro purchases. As the exchange rate plays a key role in the transmission of monetary policy in small open economies, central banks in such economies could use the model going forward to analyse the impact of a minimum exchange rate regime and different levels of the minimum rate on this transmission. The results of the analysis of this transmission channel could be used, in a subsequent step, for a comparison with the effects of alternative unconventional measures (for instance asset purchase programmes) aimed at – directly or indirectly – influencing the exchange rate.

Borio, C. and Disyatat, P. (2010). Unconventional monetary policies: An appraisal. The Manchester School, Supplement, 53-89.

Fratzscher, M., O. Gloede, L. Menkhoff, L. Sarno and T. Stöhr (2019). When is foreign exchange intervention effective? Evidence from 33 countries. American Economic Journal: Macroeconomics, 11(1), 132-156.

Hertrich, M. (2022). Foreign exchange interventions under a minimum exchange rate regime and the Swiss franc. Review of International Economics, 30(2), 450-489. URL: https://onlinelibrary.wiley.com/doi/full/10.1111/roie.12571

Krugman, P. R. (1991). Target zones and exchange rate dynamics. Quarterly Journal of Economics, 106(3), 669-682.

Lera, S. C. and D. Sornette (2016). Quantitative modelling of the EUR/CHF exchange rate during the target zone regime of September 2011 to January 2015. Journal of International Money and Finance, 63, 28-47.

Swiss National Bank (2011). Swiss National Bank sets minimum exchange rate at CHF 1.20 per euro. Press release (6 September 2011).