References

Banerjee, R., V. Boctor, A. Mehrotra, and F. Zampolli, 2023b. “Fiscal Sources of Inflation Risk in EMDEs: the Role of the External Channel.” BIS Working Paper No. 1110.

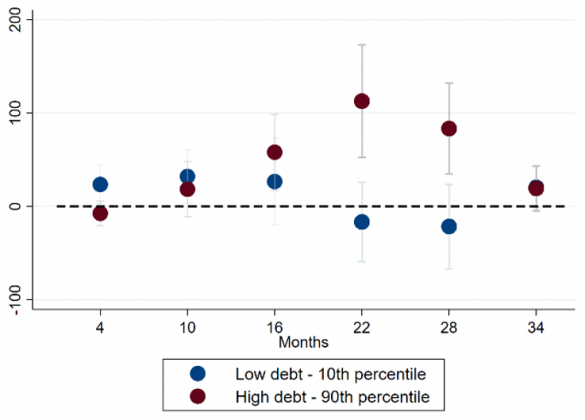

Brandao-Marques, L., M. Casiraghi, G. Gelos, O. Harrison, and G. Kamber, 2023, “Is High Debt Constraining Monetary Policy? Evidence from Inflation Expectations,” BIS Working Papers No 1141.

Grigoli, F. and D. Sandri, 2023, “High public debt levels raise household inflation expectations – but central banks aren’t powerless,” VoxEU Column, April 2023.

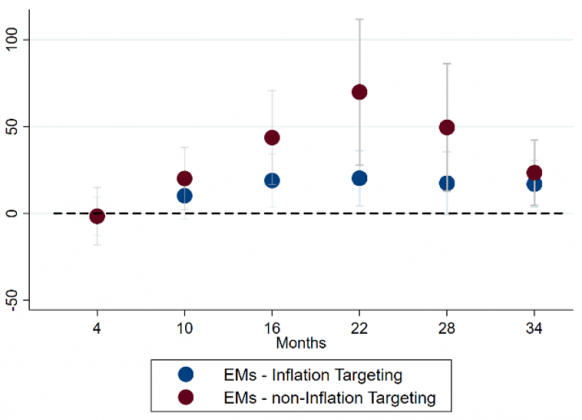

Unsal, D. F., Papageorgiou, C., and Garbers, H., 2022, “Monetary Policy Frameworks: An Index and New Evidence,” IMF Working Paper WP/22/22, (Washington, International Monetary Fund).

Vorisek, D., U. Panizza, M.A. Kose, H. Matsuoka, and J. Ha, 2022, “Anchoring inflation expectations in emerging and developing economies, VoxEu column, February 2022.