In the face of the COVID-19 crisis, the International Monetary Fund (IMF) took unprecedented measures including, in 2021, an historical SDR allocation to cover long-term global reserve needs and ultimately support vulnerable countries. Since the allocation members have held most of the allocated SDRs as reserves, but emerging economies and low-income countries have used them to service their debts with the IMF and (primarily) to exchange for currencies. Those funds have mainly been used for budgetary purposes in the face of the food and energy crisis triggered by the war in Ukraine. Furthermore, in line with the G20’s objective to channel USD 100 bn of SDRs to vulnerable countries, members with sound economic positions have lent some of their SDRs to IMF trusts. This partly offsets the fact that countries that needed the allocated SDRs most received less.

The IMF’s Special Drawing Right (SDR) is not a currency but an international reserve asset unconditionally assigned to member countries in proportion to their quotas through so called general allocations. Member countries can use their SDR holdings in different ways and their accumulated SDR allocations are held as liabilities on their balance sheets.1 Other entities and the IMF itself can also hold SDRs, but not the private sector.

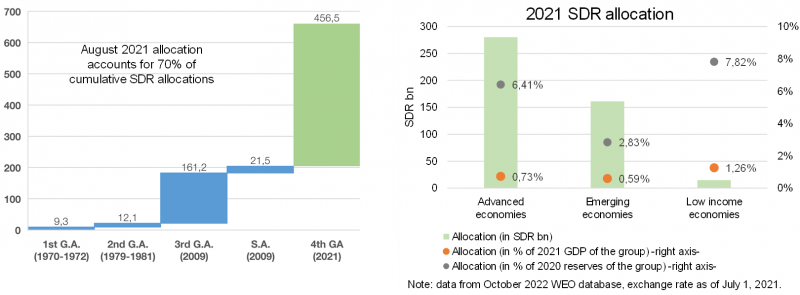

The general allocation agreed in August 2021 has been by far the largest in IMF history accounting for 70% of total SDRs allocated to date. The allocation boosted global liquidity, supplementing members’ reserve assets and enhancing global market confidence. 60% of the allocation went to advanced economies, but low-income countries received a larger share in terms of their economic size (see chart 1).

Chart 1: SDR allocations and distribution of the 2021 allocation

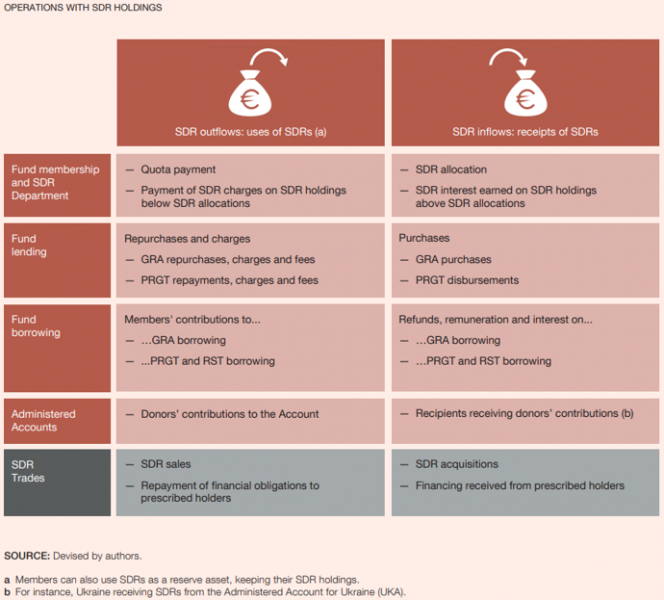

Member countries can keep SDRs as reserves or operate with their SDR holdings.2 Such operations take place between participants in the SDR Department who are IMF country members, the IMF itself through the General Resources Account (GRA) and certain designated entities referred to as “prescribed holders”.3 Member countries’ operations “using” SDRs (see Table 1) include, among others, the reimbursement of IMF loans and charges, the exchange of SDRs for currencies or the lending of SDRs to the IMF both to borrowing instruments (NAB and Bilateral Borrowing) or to its trusts (PRGT and RST). Members receive SDR holdings not only at the time of allocations, but also as a result of operations such as disbursements (purchases) of their loans from the Fund, exchange of their currencies for SDRs, or repayments or interest earned on their loans to the Fund. In addition, when members hold more (less) SDRs than their cumulative allocation they earn (pay) the SDR interest rate on their net SDR position.

Table 1: Members’ operations with SDR holdings

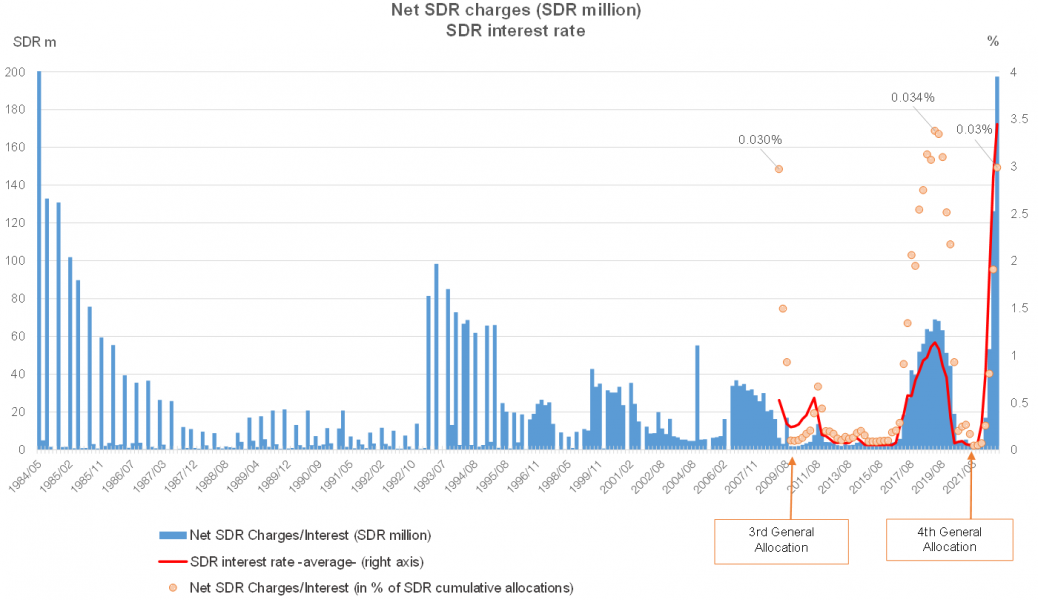

Using SDRs has several advantages: SDRs are unconditional liquidity that does not entail in principle4 an obligation for repayment, they do not carry any associated policy conditionality, they can help reduce the risk premium for highly indebted countries and its cost5 is much lower than market rates for most countries. In fact, although the SDR interest rate —that is linked to international interest rates— has increased from 0.05% at the time of the 2021 allocation to 3.8% in May 2023, it is still lower than the market rates in developing economies. Yet, the intense use of SDRs by some countries together with rising interest rates have multiplied SDR charges by 25 in the last twelve months, reaching levels almost unseen in the IMF’s history (chart 2).

Chart 2: SDR charges and SDR interest rate

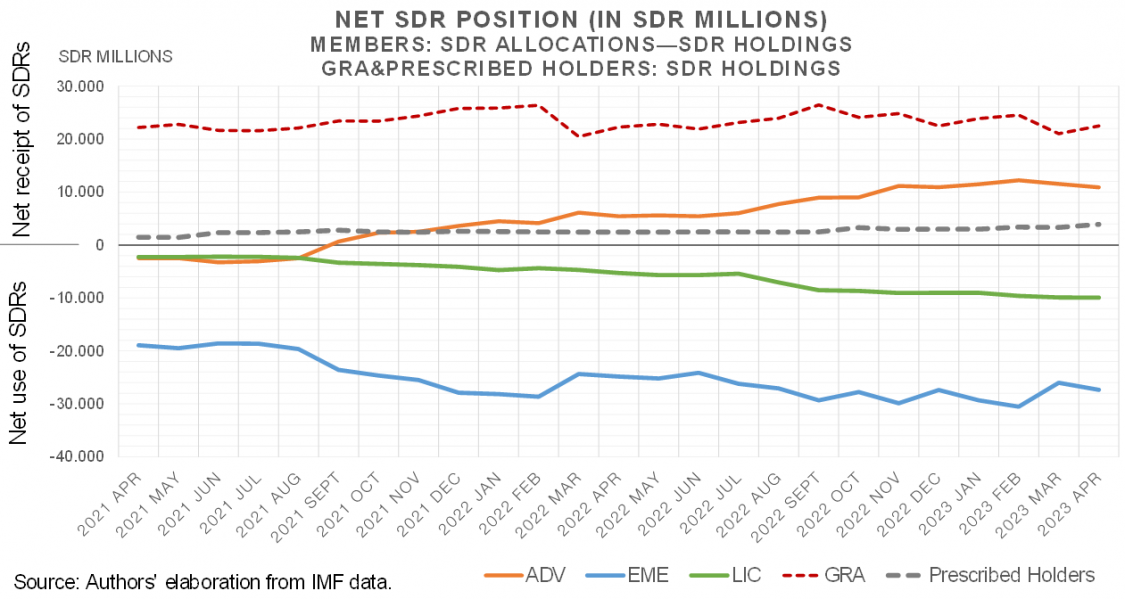

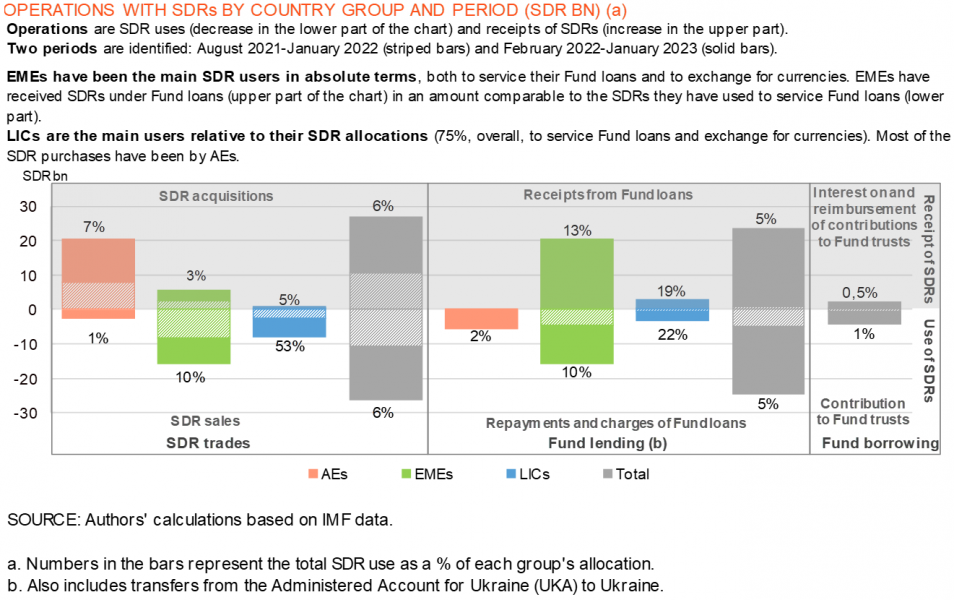

Analyzing the data provided by the Fund67, we disentangle what members have done with their allocation until January 2023. The trend of SDR holdings gives a first insight of whether members have used SDRs or kept them as reserves. In this period, the SDR holdings of emerging market economies and middle-income countries (EMEs) and low-income developing countries (LICs)8 have increasingly been falling (chart 3), which means they are net users of SDRs: they have traded their SDRs for freely usable currencies or used them to pay their IMF debts. By contrast, advanced economies (AEs) have been net SDR buyers and have kept SDRs as reserves.

Chart 3

Data as of January 2023 show that almost 90% of the allocation remains “unused” as reserves. About 11% of the allocation has been used to exchange for currencies (SDR sales) and to pay IMF debt —around SDR 25 bn each, slightly more to exchange for currencies— (chart 4). But differences appear in the two periods of analysis: from August 2021 (when the general allocation was made) to January 2022, and from February 2022 (onset of the war in Ukraine) to January 2023. In fact, SDRs have been used more intensively since January 2022, meaning that the allocation is attending members’ needs beyond those at the time of the allocation. As a consequence, the use of the 2021 allocation has been more than triple of that of the 2009 general allocation —the second largest allocation, that increased the existing stock of SDRs by nine times— in the first eighteen months after each one.

The types of use and users also differ between periods. Taken together, members have used more SDRs in the second period than in the first one for both types of operations. However, the sale of SDRs for currencies was the prominent operation of the members in the first period —mainly EMEs, and LICs in a greater proportion of their allocation—, while since the onset of the war in Ukraine, members —mainly EMEs—have used SDRs mainly to pay their debts to the IMF9. In fact, in the first quarter after the allocation countries’ SDR sales accounted for 28% of the total SDRs allocated.

Chart 4

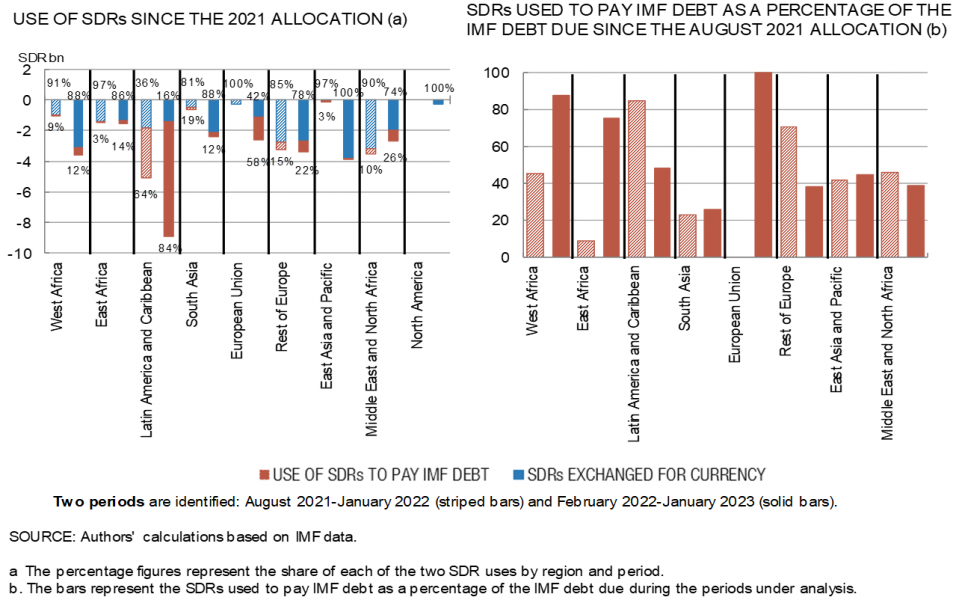

When grouping countries into regions we find that Africa stands out as the primary user of SDRs, which were mainly used to exchange them for currencies. In fact, 19 African countries drew down more than 100% of their SDR allocation. Per regions, West and East Africa drew down 41% of their allocation accounting for 20% of the estimated total global sales of SDRs. Following these African regions, the Middle East and North Africa has exchanged 16% of its allocation, and six countries within the region drew down more than 100% of their allocation.

Unlike other EMDEs, countries in Latin America have used far more SDRs to service their Fund loans than to exchange for currencies (chart 5, left). But, when Argentina is excluded from the sample, the share of SDRs used for IMF debt repayments declines very notably (from 64% to 3% in the first period and from 84% to 12% in the second period). Besides, even though the use of SDRs to pay IMF debt seems relatively low in other regions, when compared with the debt due to the Fund over the same periods, some regions have used SDRs to pay more than 60% of their debt payments to the IMF since August 2021 (chart 5, right).

Chart 5

The IMF SDR tracker10 provides additional information on the use of SDR at country level. SDRs exchanged for currencies have been largely used in African countries for fiscal purposes. As for Latin America, most of the countries chose to increase their international reserves, very few have used their SDRs for fiscal purposes and few have used SDRs to payback IMF debt. The same applies to Asia, where most countries have used their SDRs to supplement existing reserve assets.

With regard to the Middle Eastern countries, use of SDRs has been diverse. Some countries have used all of its allocation to pay down its debt to the IMF, while others have drawn the SDR allocation for budget financing in lieu of higher domestic debt issuance.

Advanced economies and many emerging economies –some MENA countries among others- have purchased SDRs to provide usable currencies to other countries. Moreover, in line with the G20 commitment,11 some advanced and emerging economies with sound economic positions have lent part of their SDRs to finance IMF trusts set up to support countries in need on affordable terms.

In conclusion, the 2021 general SDR allocation has served its members well not only in the face of the Covid-19 but also in the midst of the food and energy crisis after the war in Ukraine, making this allocation the most used. In the first year and a half following the allocation, members —primarily EMEs and LICs— used a total of 43 bn SDRs, 11% of total allocated SDRs, almost equally to cancel their debts with the Fund (5%) and to exchange SDRs for currencies (6%). Most SDRs used to pay IMF debt are from EMEs —mainly driven by Argentina—. LICs used 75% of their allocation mostly (70%) to exchange for currencies for fiscal purposes.

Furthermore, some advanced and emerging economies with sound positions have pledged almost 24% of their 2021 allocation to support IMF trusts (the PRGT and the recently created RST). This lending to IMF trusts allows inactive SDRs to be channeled from countries who received the highest volume of SDRs to vulnerable economies who received a lower amount of SDRs but needed them most. As a result, the voluntary channeling of SDRs partly compensates for the fact that the distribution of the SDR allocation and countries’ liquidity needs (which ultimately determine the size of the allocation) do not necessarily bear any relation to one another. Additional ways to lend SDRs and make the best use of them continue to be studied.

Garrido, Isabel, Xavier Serra e Irune Solera. (2021). “Box 2. The IMF’s recent general allocation of special drawing rights and the options for channelling them to vulnerable economies”. Economic Bulletin – Banco de España, 3/2021, pp. 25-27. https://repositorio.bde.es/handle/123456789/17643

Garrido, I and I Solera (2023): “Has the 2021 general SDR allocation been useful? For what and for whom?”, Banco de España. Documentos Ocasionales No.2318. August. https://repositorio.bde.es/handle/123456789/33423

International Monetary Fund. (2021). “Proposal for a General Allocation of Special Drawing Rights”. Policy Papers, No. 2021/049, July 12. https://www.imf.org/en/Publications/Policy-Papers/Issues/2021/07/12/Proposal-For-a-General-Allocation-of-Special-Drawing-Rights-461907

International Monetary Fund. (2023). “IMFC Statement by Christine Lagarde, President. European Central Bank”. IMFC Forty-Seventh Meeting. April 13-14. https://meetings.imf.org/-/media/AMSM/Files/SM2023/IMFC/ECB.ashx

Pazarbasioglu, Ceyla, and Uma Ramakrishnan. (2021). “Sharing the Recovery: SDR Channeling and a New Trust”. IMF Blog, October 8. https://www.imf.org/en/Blogs/Articles/2021/10/08/blog100821-sharing-the-recovery-sdr-channeling-and-a-new-trust

Pérez Álvarez, Manuel A. (2022). “New allocation of Special Drawing Rights”. Documentos Ocasionales, 2201, Banco de España. https://repositorio.bde.es/handle/123456789/20482

Members’ cumulative SDR allocations increase only at allocations and might decrease (a) in the event that the Board of Governors (BoG) decides to cancel SDRs in a basic period (Article XVIII of the Articles of Agreement of the IMF) or (b) in the event that the member withdraws from the IMF. That said, no such BoG decision has been taken to date and no member has left the IMF since the first SDR allocation.

For simplicity, references in this document to “use of SDRs” or “receipt of SDRs” —except in an allocation— mean the use/receipt of “SDR holdings”.

In an allocation only members receive equal amounts of SDR holdings (an asset for the country) and SDR allocations (a liability). The GRA and prescribed holders receive no allocation and only have SDR holdings.

Unless members’ SDR allocation decreases, which has never occurred in the Fund’s history (see footnote 1).

Members pay (receive) interest on the SDRs held below (above) their cumulative SDR allocation.

As per SDR holdings movements, we use two sources of data published on the IMF’s website: the “Financial Statements and Quarterly Reports on IMF Finance”, that since October 2021 provides information on two major types of SDR operations by each country member (Fund-related operations and SDR trades), and monthly data on members’ positions on SDR holdings.

A detailed explanation of the methodology applied to use the data can be found in Garrido and Solera (2023).

This document classifies IMF member countries into three groups: 36 advanced economies (AEs), 85 emerging market economies and middle-income countries (EMEs) and 69 low-income developing countries (LICs) (which may access the PRGT).

EMEs have also received the largest sum of SDR receipts on their IMF loans in the period (upper part in Chart 4) largely concentrated in a few countries. Argentina and Ukraine alone received around 66% of total SDR inflows from Fund loans and the Administered Account for Ukraine (UKA). Likewise, half of the total charges on the Fund’s loans since the allocation have been paid by Argentina, followed by Egypt with almost 20%.

Information on the SDR Tracker is available at https://www.imf.org/en/Topics/special-drawing-right/SDR-Tracker.

In G20 Rome Leaders’ Declaration. Rome, 31 October, 2021: “We are working on actionable options … voluntary channelling of part of the allocated SDRs … according to national laws and regulations … towards a total global ambition of USD 100 billion of voluntary contributions for countries most in need”. In June 2023, the IMF’s Managing Director announced that the target had been reached “The target … was set at US$100 billion. And I can announce today that we reached that target”.