References

Chatelais, N. and Schmidt, K. 2017. The impact of import prices on inflation in the euro area. Rue de la Banque n°37.

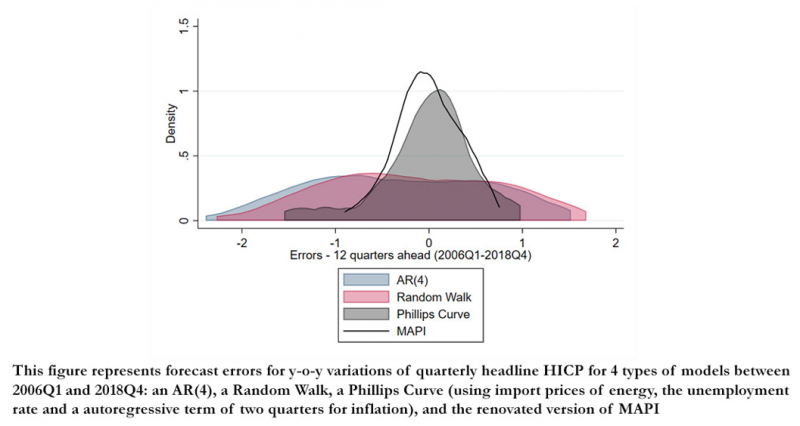

De Charsonville, L., Ferrière, T. et Jardet, C., 2017. MAPI: Model for Analysis and Projection of Inflation in France, Banque de France Working Paper 637.

Kalantzis, Y., Ouvrard, J.-F., 2018. The impact of oil prices on inflation in France and the euro area, Banque de France Eco Notepad n°50.

Lemoine, M., Turunen, H., Chahad, M., Lepetit, A., Zhutova, A., Aldama, P., Clerc, P., Laffargue, J.-P., 2019. The FR-BDF Model and an Assessment of Monetary Policy Transmission in France. Working Paper Series no. 736.