Key takeaways

The ECB’s pandemic emergency purchase programme (PEPP) has been a crucial tool in the ECB’s response to the Covid-19 crisis. Now that net purchases under the PEPP have ended, it is important to draw lessons from this experience for the future design of ECB asset purchase programs. This note uses a structural model of sovereign yield curves in a heterogeneous monetary union, calibrated partly on the basis of the observed impact of PEPP, to shed light on the program’s transmission channels and to analyze how its flexible design affected its impact.1

The model extends the term-structure modelling approach of Vayanos and Vila (2021), which underpins much recent analysis of quantitative easing programs.2 This approach assumes that financial market participants include both preferred-habitat investors, who seek to hold bonds of a specific maturity and/or issuer, and risk-averse arbitrageurs, who invest wealth across all types of bonds, trading off expected returns versus risk. In such markets, net bond issuance by the government raises yields, while bond purchases by the central bank lower them.

Much of this literature addresses asset purchases in the US, and assumes that US Treasury bonds carry no nominal default risk. Extending the model to the euro area requires consideration of default risk as well as the term risk emphasized in US analyses. Our model endogenizes the default probability under the assumption that, in some jurisdictions, member state governments may be hit by debt rollover crises. A government may decide to default in order to relieve the short-term fiscal pressure it faces when creditors refuse to roll over its bonds.3 A higher deficit or a higher flow of bond redemptions raises fiscal pressure, increasing the default probability. However, bond redemptions to the Eurosystem imply less fiscal pressure than redemptions of privately held bonds, since (particularly in the absence of cross-country “risk sharing” of asset purchases) payments to a national central bank to redeem bonds largely return to the corresponding government as dividends. In this way, Eurosystem asset purchases reduce future fiscal pressure, and thereby the default probability.

An advantage of Vayanos and Vila’s approach is that, under certain assumptions, it yields a simple analytical solution for bond yields.4 When their model is extended to incorporate default risk, the yield on a bond of residual maturity τ can be decomposed into four terms:

To understand the channels of asset purchase transmission, it suffices to study a monetary union with just two member states. The results in this note are based on a model version calibrated to Germany and Italy, allowing for default risk on Italian but not on German bonds.5 Hence the last two yield components are zero in the case of German bonds. The only exogenous stochastic factor considered is the risk-free short rate, which is calibrated to one-month German bonds. The expectation of this risk-free rate determines the expected rates component of yields.

We quantify the rest of the yield decomposition by calibrating the remaining parameters. Given the expected dynamics of the riskless rate (which we proxy using monetary analysts’ surveys), we identify the degree of risk aversion in bond markets by matching the mean German term premium over the pre-pandemic period 2013-2019. The level and slope of the default probability function are then identified by jointly matching the average Italian yield curve over the pre-pandemic period, and the shift in Italian yields when PEPP was announced. Given these parameters, we can then observe how much of Italy’s sovereign spread actually reflects expected losses due to default, and how much instead reflects the market’s required compensation for the risk associated with default (the credit risk premium).

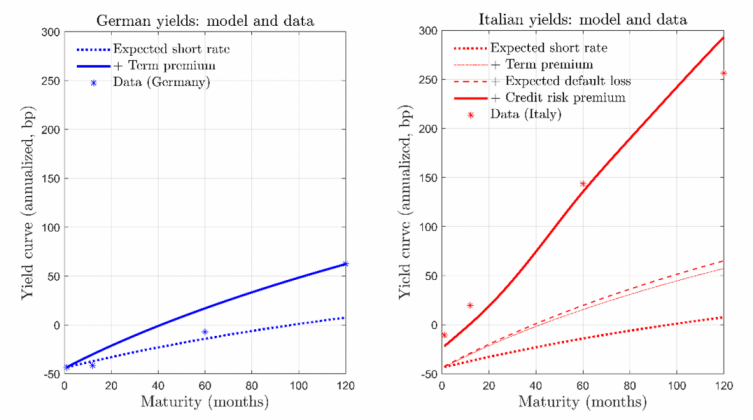

Figure 1: German and Italian yield curves, means 2013-2019 and 2-country simulation

Notes: Stars: average yields on zero-coupon bonds, 2013-2019, for 1m, 1Y, 5Y, and 10Y maturities. Source: Datastream. Lines: model-generated yield curve decomposition. Source: Costain, Nuño, and Thomas (2022).

Figure 1 shows the decomposition of average German and Italian yields over the pre-pandemic period. Survey expectations indicated rising risk-free rates during this period, leading to the positively-sloped expected rates component that is seen as a dotted line in both the German (left panel) and Italian (right) yield decompositions. The remainder of the German yield curve is therefore attributed to the term premium (which is roughly 50bp for 10-year bonds). An analytical finding of our model is that term premia are approximately equalized across countries as long as the default probability is small, and that they depend approximately on the aggregate net supply of bonds in the market, regardless of which country issued them. The result under our calibrated parameters is nearly identical term premia for Germany (left, solid blue line) and Italy (right, dash-dot red line).

The very low estimated default probability is also evident in the Italian yield decomposition, where we see the expected default loss as the small gap between the dashed and dash-dot red lines. The expected default loss rises from almost zero at the short end of the yield curve to roughly 10 basis points per annum on ten-year bonds, because Italian debt and deficits were expected to rise over time during this period, implying an increasing path for fiscal pressure and thus for the default probability. However, even at the long end, the expected default loss inferred by the model is an order of magnitude smaller than the ten-year Italian sovereign premium of roughly 200bp. In other words, the Italian sovereign premium is overwhelmingly driven by the fourth component of yields, namely, the credit risk premium. The quantitative discipline imposed by our structural approach – which must simultaneously explain yields on core and peripheral bonds — is crucial for distinguishing the true expected loss due to default events from the compensation for holding default risk. While the default probability is estimated to be very small, the riskiness of German bond yields is likewise very low, so the degree of risk aversion required to generate a 50bp term premium on German ten-year bonds also implies a 200bp credit risk premium on Italian bonds of the same maturity.

The slope of the default probability function – that is, the increase in the sovereign default probability caused by a given increase in fiscal pressure on the Italian government — is the key parameter for matching the impact of the PEPP announcement. The program implied that a substantial fraction of new Italian bond emissions would be taken onto the Eurosystem balance sheet, lowering anticipated fiscal pressure on the Italian government since redemptions of those bonds would generate seigniorage revenue in Italy.

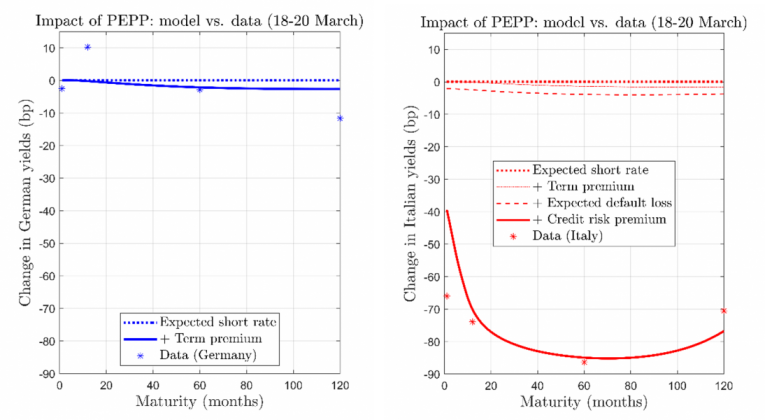

Figure 2: Effects of the PEPP announcement, 18-20 March, 2020

Notes: Change in yields after PEPP announcement: data and model. Stars: change in yields on zero-coupon bonds, March 18-20, for 1m, 1Y, 5Y, and 10Y maturities. Source: Datastream. Lines: model-generated decomposition of shift in yield curve. Source: Costain et al. (2022).

Figure 2 shows how the calibrated model fits the impact of the PEPP announcement (the change in yields from market close on March 18 to market close on March 20). Following the announcement, the German term premium decreased slightly, and the Italian yield curve shifted down in a roughly parallel fashion, which the model matches well. Again, the crucial yield component is the credit risk premium, which accounts for most of the decline in Italian yields. Hence, duration risk extraction — which acts through the term premium — was not the main channel of transmission of the PEPP announcement. The relevant channel is better described as default risk extraction. Under this mechanism, Eurosystem purchases of peripheral sovereign bonds reduce the quantity of defaultable bonds that private investors must absorb; at the same time, they reduce future fiscal pressure on peripheral governments, decreasing the default probability itself. These two effects reinforce each other to jointly shrink the credit risk premium.

The decrease in the expected default premium is seen in the right panel of Figure 2 as the distance between the dashed and dashed-dot lines. The decrease is tiny: between two and three basis points. But the expected loss from default was already small ex ante, and the associated risk is highly priced, so this small decrease in the expected default loss contributes materially to the much larger decrease (around 70 to 80bp) in the credit risk premium.

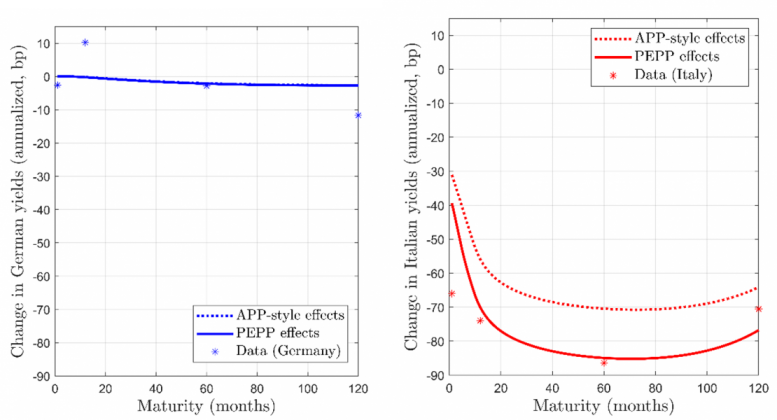

Our structural model also serves to assess possible changes in asset purchase design. Figure 3 shows that PEPP’s flexibility enhanced the yield impact of its announcement, compared with a counterfactual alternative program with the same envelope but with the more rigid design of the APP purchases. The figure (right panel) shows that the flexibility of PEPP contributed approximately 15 basis points to its overall impact on Italian yields, relative to an APP-style announcement with a constant purchase pace and cross-country allocations by capital key. At the same time, there is virtually no difference between PEPP and an APP-style program in terms of their impact on German yields (left panel).

Figure 3: Comparing yield curve response between PEPP and APP-style programs

Notes: Model-generated yield curve responses: comparing PEPP vs. APP-style purchase scenarios. Stars: change in yields on zero-coupon bonds, March 18-20, for 1m, 1Y, 5Y, and 10Y maturities. Source: Datastream. Lines: model-generated yield response to PEPP (solid) or APP-style program (dotted). Source: Costain et al. (2022).

PEPP’s stronger impact was attributable both to its flexible timing (frontloading of purchases over March to June, 2020) and to its flexible cross-country allocation (initial purchases of Italian bonds were roughly 3.6 percentage points above capital key). These two dimensions of flexibility are complementary, but most of the gains seen here come from flexibility in allocation across countries. Given the quantitative importance of the default risk extraction channel, reallocating purchases towards member states that are vulnerable to default increases their yield impact, both on those member states themselves, and on average across the euro area.

The flip side of PEPP’s greater effectiveness is that flexible asset purchases are more efficient, as Table 1 illustrates, showing the envelope that would have been necessary, under the APP design, to achieve the same yield curve impact as PEPP. The upper panel of the table shows the required envelope, assuming a constant purchase pace and allocations by capital key, to achieve the same fall in Italian yields (an 86bp drop at five-year maturity) that was observed in the case of PEPP. Counterfactual simulations show that an envelope of €910b would have been needed, in contrast to the €750b that was actually announced.6 The lower panel reports an analogous exercise, but seeks to match the 31bp drop in GDP-weighted average euro area five-year yields.7 The required APP-style envelope would be €903b in this case. The results in the two panels are similar since, under the default risk extraction channel, the impact on average euro area yields goes primarily through peripheral yields.

Table 1: Equivalent envelopes under an APP-style design

| Total PEPP envelope | Effect on Italian yield (5Y) |

Equivalent envelope, APP design |

| €750b | -86bp | €910b |

| Total PEPP envelope | Effect on aggregate yield (5Y, GDP weights) |

Equivalent envelope, APP design |

| €750b | -31bp | €903b |

Structural, quantitative modelling of the impact of asset purchases demonstrates that default risk extraction is the main channel of transmission in the euro area. Default risk extraction does not imply that the Eurosystem actually faces a large expected sovereign credit loss in its balance sheet. On the contrary, by absorbing a small credit risk that would otherwise remain in private hands, asset purchases improve market functioning, both by endogenously decreasing the default probability on sovereign bonds, and by reducing the large credit risk premium that risk-averse private investors demand to hold sovereign bonds themselves.

The default risk extraction channel implies that flexibility enhances both the effectiveness and the efficiency of asset purchases. A flexible allocation that permits greater purchases from member states that face greater sovereign credit risk, when necessary, leads to a larger impact on average euro area yields. Flexibility in timing complements flexibility in cross-country allocation. The greater effectiveness of flexibly-designed purchases also makes them more efficient: the same yield impact can be achieved with a smaller volume of purchases, and therefore smaller side effects and reduced risks for the Eurosystem balance sheet.

Overall, the results in this note point to flexibility as a valuable feature that should be inherited by the ECB’s asset purchase programs after the end of PEPP net purchases. Flexibility may be particularly useful in circumstances of unwarranted fragmentation, that is, when the smooth transmission of the single monetary policy to all euro area jurisdictions becomes compromised, as was the case in the early stages of the pandemic crisis.