This policy brief is based on Latvijas Banka Working Paper No 8 / 2023. The opinions expressed and arguments employed are those of the authors.

In this policy brief we examine the relationship between inflation and fiscal sustainability. We explain that higher rates of inflation have a positive and significant impact on the measure of fiscal sustainability. The magnitude of the improvement in fiscal sustainability in response to inflation depends on the type of inflation considered. The largest positive effect is found for core inflation, which is mostly demand-driven, while energy inflation tends to have a smaller and insignificant effect.

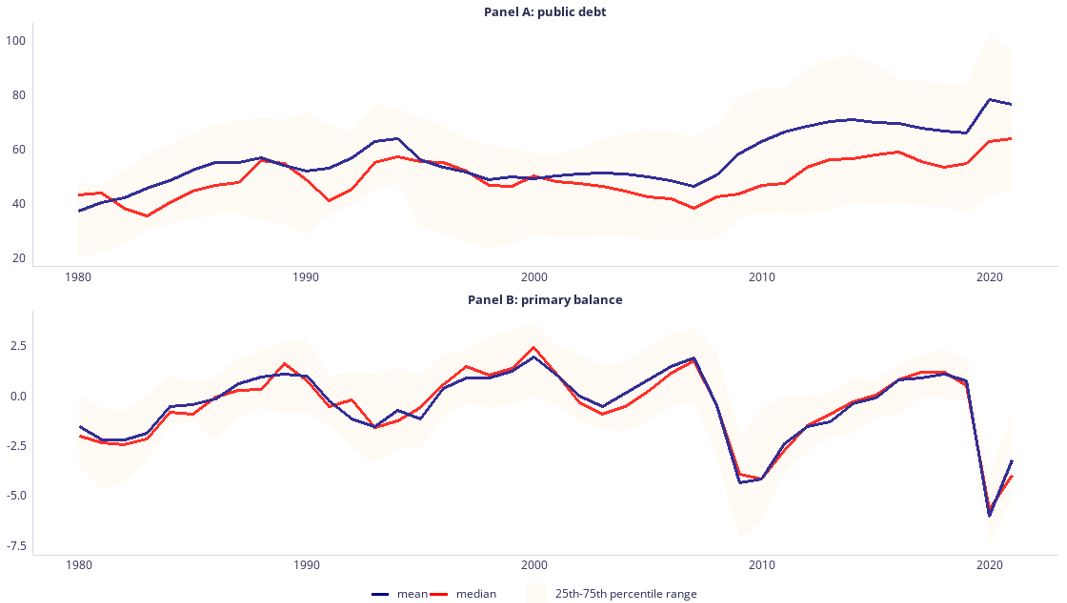

Whether fiscal policy is sustainable in the long run is a fundamental question in macroeconomic analysis. A country is typically deemed to be fiscally sustainable when government revenues closely align with government expenditures and when the fiscal authorities manage to achieve a primary balance that essentially stabilises the debt-to-GDP ratio. The issue of fiscal sustainability is particularly relevant right now, as the average level of public debt in advanced OECD economies has increased from 37% in 1980 to 76% in 2021, with a significant rise of some 10 percentage points occurring during the Covid-19 crisis (Figure 1). This recent increase in debt is associated to large deficits due to fiscal measures implemented to mitigate the economic repercussions of the pandemic. At the same time, inflation has surged since mid-2021 to levels reminiscent of the 1970s and the early 1980s, after a decade when it was below the target of 2%. This raises the question of whether higher inflation alleviates or aggravates the challenges associated with fiscal sustainability.

There is no universally accepted measure of fiscal sustainability in economic literature. Our study, like many other papers, uses Henning Bohn’s definition of fiscal sustainability (Bohn, 1998), which describes fiscal sustainability as the positive response of the primary balance in year t to the public debt-to-GDP ratio accumulated by the end of the previous year, i.e. t-1. There are two ways in which inflation may influence this fiscal responsiveness. One is that the expectation of higher inflation in year t increases expected nominal GDP, lowering the level of the public debt-to-GDP ratio expected by the end of year t. Fiscal authorities that expect the debt ratio to decline may in response increase expenditures and reduce tax rates, ultimately weakening the response from the primary balance in year t to the accumulated public debt. The other way inflation may exert an influence is that the fiscal authorities may view higher inflation as giving them an opportunity to strengthen the fiscal policy stance. They may do this by refraining from adjusting certain expenditures in line with the inflation rate, thereby reducing the value of the expenditure in real terms. In the first scenario, the response of the primary balance to the accumulated level of public debt would be expected to worsen, whereas in the second case, that measure of fiscal sustainability should improve.

Figure 1: Primary balance and public debt in OECD countries, % of GDP, 1980–2021

Source: IMF, OECD.

Note: Figure shows the mean and median public debt-to-GDP ratio and primary balance-to-GDP ratio across OECD countries for each year between 1980 and 2021. In some years (particularly at the beginning of the time sample) data is not available for some countries, hence the mean and median levels are calculated across available countries only.

The analysis is conducted using a sample of industrialised economies from the OECD and, separately, a more homogenous group of the euro area countries between 1981 and 2021. The study employs the two-step approach. In the first step, we estimate the Bohn (1998) fiscal reaction function that relates primary balance to the lagged debt-to-GDP ratio. We follow the Schlicht (2021) approach and estimate the time-varying fiscal response coefficient for each country in the sample in each year. The obtained fiscal responsiveness is further used as the measure of fiscal sustainability. In the second step, we apply a panel regression technique to analyse the impact of alternative measures of inflation, such as the headline inflation, core inflation, energy inflation and food inflation, on the previously obtained fiscal response coefficient in a panel setting. We control for the difference between the interest rate from the ten-year sovereign bond yield and output growth.

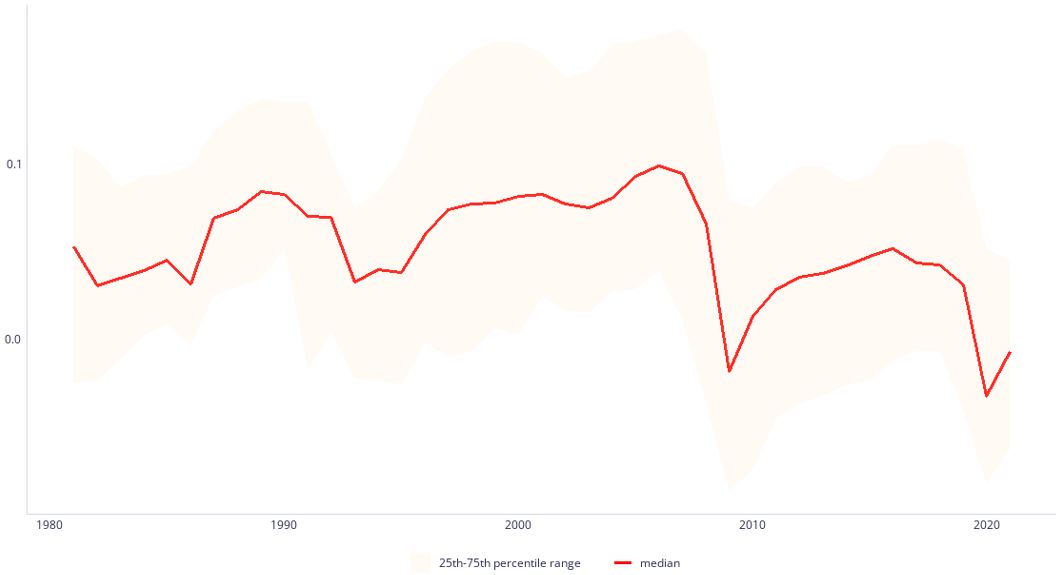

Figure 2 illustrates the evolution of the median value and the interquartile range of fiscal responsiveness in OECD countries. The estimated fiscal sustainability indicator varies significantly across countries but exhibits some common temporal trends: initially, between 1980 and 2007, the median increases gradually, starting at 0.05 and reaching the maximum of almost 0.1, then dips below zero in 2009 during the financial crisis and subsequently stabilises at approximately 0.04 during the latter half of the 2010s. In the wake of the Covid-19 pandemic in 2020, it falls substantially below zero again. Overall, fiscal sustainability tends to deteriorate during economic downturns.

Figure 2: The developments of the fiscal response coefficient in OECD countries, 1980-2021

Source: Authors’ estimation.

Note: Figure shows the median value of the estimated fiscal response coefficient (which relates primary balance in period t to the public debt in a previous year t-1). It also displays the interquartile range of the estimated fiscal responsiveness.

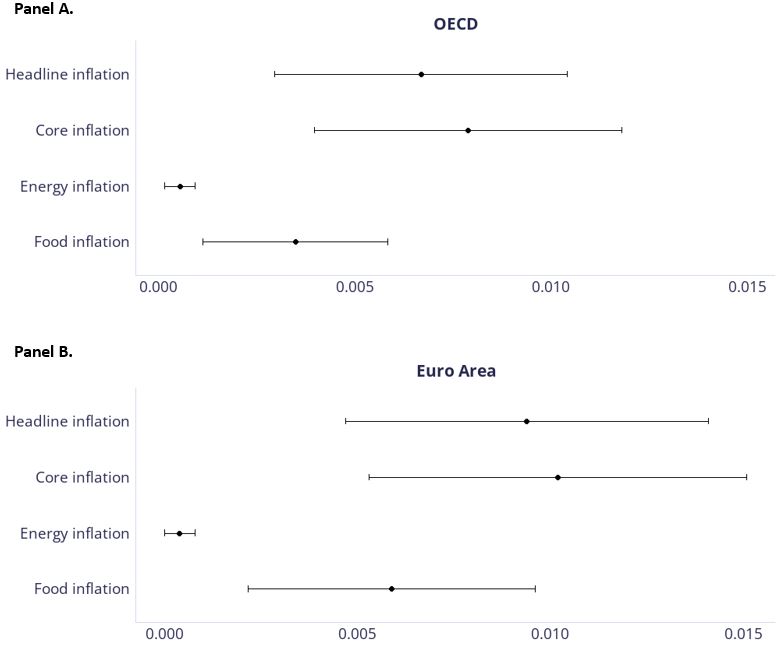

The estimation results of the second step panel regressions for different types of inflation are presented in Figure 3. The dots in the figure correspond to point estimates. The lines display the 95% confidence bands around those estimates. The estimation results indicate that fiscal policy makers tend to tighten the fiscal stance more forcefully in response to a given increase in public debt as inflation rises. For the sample of OECD countries, the primary balance improves by an additional 0.007 percentage point on average with each additional percentage point of inflation. For a country with a fiscal response coefficient of 0.05, which corresponds to the median of the OECD sample, this represents a substantial 14% increase in fiscal responsiveness when inflation rises by one percentage point. The magnitude of this effect is somewhat larger for the sample of the euro area countries. That inflation has a positive impact on fiscal behaviour and may suggest that fiscal authorities use inflation strategically as a tool to tighten the fiscal stance, perhaps by not fully adjusting expenditure.

Next, we investigate whether the extent of fiscal policy tightening varies for different types of inflation. Core inflation is often regarded as a measure of demand-driven inflation, food is driven by both demand and supply (as it contains both processed and unprocessed food), whereas energy inflation is understood to closely correspond to cost-push inflation. Core inflation emerges as the primary driver behind the increase in the fiscal response coefficient. In contrast, energy inflation appears to have a negligible effect and is found to be insignificant. The effect of food inflation lies somewhere in between. The impact of inflation on the measure of fiscal sustainability remains consistent with the baseline findings even after numerous robustness checks which we thoroughly describe in our study.

Figure 3: The effect of inflation on fiscal sustainability (measured by “fiscal responsiveness”) in OECD countries (panel A) and the Euro area countries (panel B)

Note: A dot represents a point estimate of the panel regression relating fiscal responsiveness to the corresponding inflation type. A line is the 90% confidence band.

This study is the first to analyse the impact that inflation has on fiscal sustainability. Understanding this relationship is more important today as public debt levels are at the historically highest level across the globe, and inflation has just recently started to abate. The findings imply that the ongoing burst of higher inflation might temporarily help ameliorate fiscal sustainability problems. This is likely to be the case because high inflation makes it easier for governments to re-adjust the real value of certain revenue and expenditure items by deciding whether and by how much to readjust their value in nominal terms. At the same time, the results indicate that the effects vary over various inflation measures and with the underlying source of the inflation shock, since only demand-driven inflation seems to improve fiscal sustainability, whereas inflation caused by an energy price shock is not associated with improved fiscal responsiveness. Overall, we believe our results imply that the initial burst of inflation caused by the energy price shock in 2021 likely did not help improve fiscal sustainability, but the subsequent high core inflation probably had a positive effect.

Bohn, H. (1998). The Behavior of U.S. Public Debt and Deficits. The Quarterly Journal of Economics 113 (3), 949–963.

Schlicht, E. (2021). VC: a method for estimating time-varying coefficients in linear models. Journal of the Korean Statistical Society 50 (4), 1164–1196.