All opinions expressed here in this policy brief are our own and do not necessarily reflect those of Bank of Finland or the Eurosystem.

Abstract

This paper examines the primary sources of information on the fiscal stance of European countries, including the Stability and Growth Pact, the European Commission, and the European Central Bank (ECB). It explores how inflation is reflected in their respective forecasts and assessments, and how forecast errors may reveal insights into the role of fiscal variables in inflation. Although direct linkages between fiscal variables and inflation are challenging to establish, forecast errors suggest that fiscal variables play a significant, non-negligible role in inflation dynamics.

Inflation has traditionally been viewed as a monetary phenomenon, with central banks regarded as the primary custodians of price stability. The classic monetarist doctrine, exemplified by Milton Friedman’s assertion that “inflation is always and everywhere a monetary phenomenon,” posited that controlling the money supply or interest rates was sufficient to manage inflation, relegating fiscal policy to a secondary role. In practice, policymakers and forecasters often overlooked fiscal variables, such as deficits or debt, when forming inflation expectations, assuming that monetary policy could counteract any fiscal influence. This perspective was reinforced by decades of low inflation in advanced economies despite rising public debt, leading many to conclude that “deficits don’t matter.” However, a growing body of theory and evidence suggests that fiscal factors—government deficits, debt levels, and fiscal policy regimes—can significantly influence inflation, particularly under specific conditions (e.g., Cochrane, 2023).

Against this backdrop, it is surprising that official policy documents have largely remained silent on the possibility that fiscal policy actions could influence inflationary developments. While such possibilities have been acknowledged in the context of developing countries, it was only after the COVID-19 pandemic that serious analyses emerged for developed economies, with fiscal issues gaining prominence in public discourse (e.g., Martin, 2025; Faria-e-Castro, 2025).

This study focuses on the European Union, particularly Euro area countries, nearly all of which have experienced unprecedented increases in indebtedness, with some facing public debt management crises. We investigate how major public institutions have incorporated fiscal balances into their inflation forecasts and assess whether fiscal variables have operated independently or contributed to observed inflation trends. Additionally, we aim to quantify how forecast errors may explain inflationary developments in the Euro area.

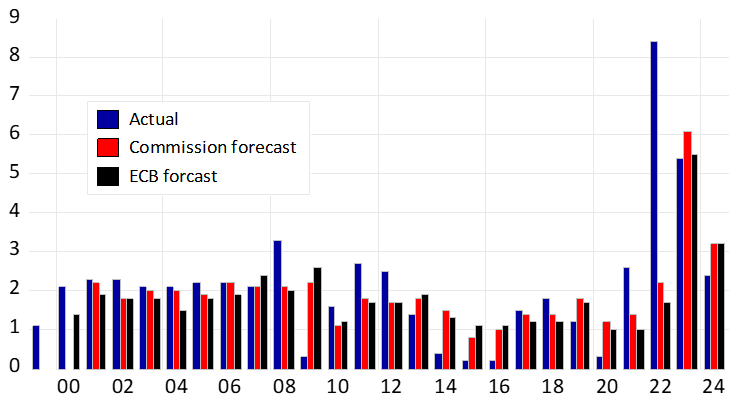

We begin with the data. The Stability and Growth Pact (SGP) data are sourced from the Compliance Tracker maintained by the European Fiscal Board (EFB). This database (Larch et al., 2022) monitors EU Member States’ compliance with SGP rules, focusing on numerical adherence to four key fiscal indicators: deficit, debt, structural balance, and expenditure. These variables are also assessed by the European Commission, which provides regular forecasts (see https://economy-finance.ec.europa.eu/economic-forecast-and-surveys/economic-forecasts_en). Additionally, the European Central Bank (ECB) issues quarterly forecasts for fiscal variables alongside other macroeconomic indicators (see https://www.ecb.europa.eu/press/projections/html/index.en.html). Both the European Commission and the ECB provide inflation forecasts, which are not automatically included in SGP data. There is little divergence between ECB and Commission inflation forecasts (Figure 1). Both exhibit a convergence toward the 2% threshold, a trend that becomes more pronounced over a two-year horizon (Granziera et al., 2024).

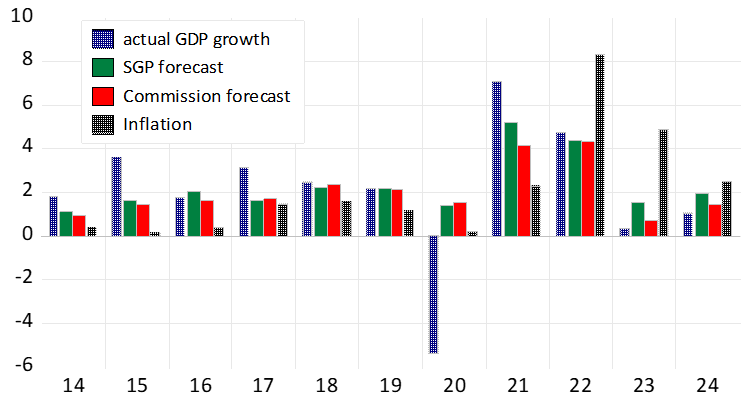

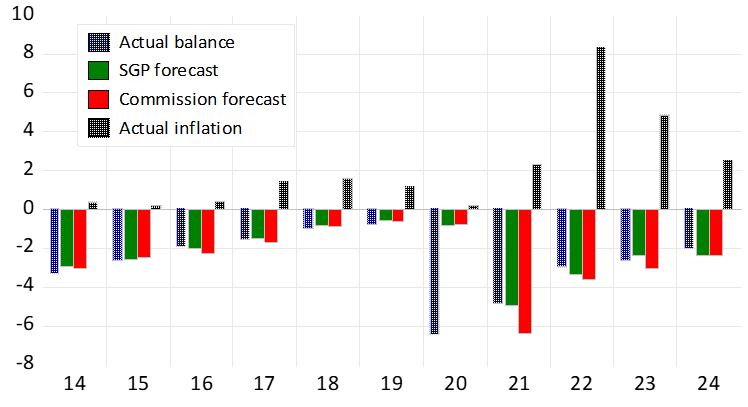

We first examine fiscal data from the SGP and the European Commission. Figures 2 and 3 present actual and forecasted values for GDP growth, the net lending/GDP ratio (henceforth referred to as government balance), and actual inflation. These data highlight key trends in assessing future fiscal prospects in the EU. A dominant feature is the convergence toward expected steady-state values for economic growth and fiscal balance. However, the COVID-19 pandemic initiated a five-year period of significant deviations in both variables. Even so, convergence remains the underlying trend in forecast trajectories. Regarding inflation, establishing a direct link with growth or fiscal balance is challenging. Prior to 2020, government balance and inflation appear positively correlated, but post-2020, this relationship aligns more closely with economic theory, as high inflation coincides with persistent deficits. Then also output growth and inflation are positively correlated.

Figure 1. Comparison of Commission and ECB one-year-ahead inflation forecasts

Figure 2. GDP growth forecasts for the next year and inflation

Figure 3. Government balance forecasts for the next year and inflation

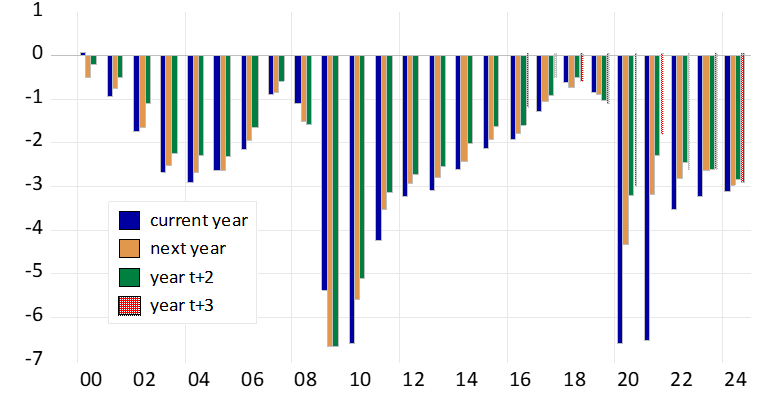

Focusing on ECB data, a clearer picture emerges due to a longer sample period and extended forecast horizons. Figure 4 displays ECB forecasts for government balance across different time horizons, from the current year to three years ahead, averaged over quarters. These forecasts reveal a notable optimism: deficits are expected to diminish over time, independent of specific macroeconomic developments, suggesting that deficits follow their own logic.

Figure 4. ECB’s quarterly government balance forecasts for different time horizons

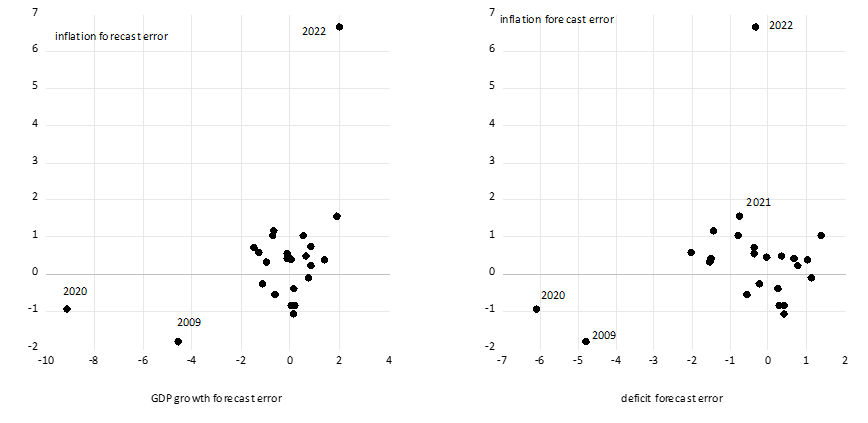

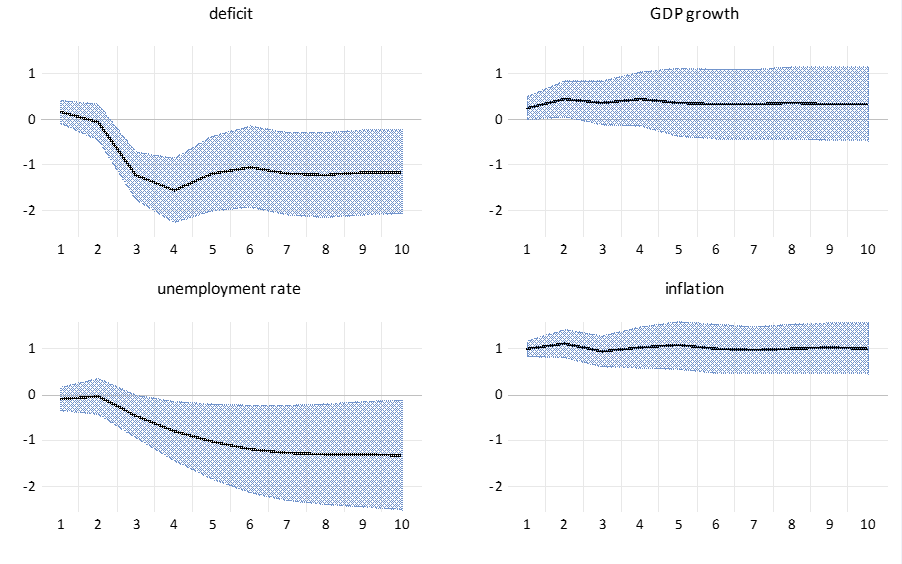

If deficits operate independently, what can we infer about their impact on inflation? As establishing a direct relationship between fiscal stance and inflation is difficult, we focus on forecast errors, as shown in Figure 5. These figures present scatter diagrams of one-year-ahead forecast errors for inflation, GDP growth and government balance. However, significant outliers—stemming from the financial crisis, the COVID-19 pandemic, and the war in Ukraine—complicate the analysis, and explain why it is difficult to establish the relationship between the key macro variables with the data from the EMU period only. To address this, we employ time-series modeling tools, given the high autocorrelation in the data (e.g., the first-order autocorrelation for inflation forecast errors in panel data is 0.85 on quarterly basis and 0.42 on annual basis). We estimate a four-variable vector autoregression (VAR) with Cholesky identification, using the following variable ordering: government balance, GDP growth, unemployment rate, and inflation. The corresponding impulse responses for inflation forecast errors are shown in Figure 6.

Figure 5. Annual comparison of forecast errors

Note: All observations are annual mean values of quarterly forecasts.

Figure 6. Cumulative impulse responses from our 4-variable VAR model with ECB panel data

Note: The responses are for the inflation forecast errors from the ECB panel data for different quarterly forecasts. Also, the other variables are forecast errors. Periods are years.

The results are noteworthy. Government balance affects inflation with a considerable lag of two to three years, and its impact is substantial, as indicated by variance decompositions. Other variables align with theoretical expectations (not shown here due to space constraints). However, these findings pertain to forecast errors, not actual values, so direct mapping is limited. Nevertheless, the results suggest that fiscal variables’ effects on inflation may not manifest immediately and may operate through channels beyond output growth, such as labor market dynamics.

In conclusion, the relationship between fiscal variables and inflation is conditional but significant. For too long, this relationship was overlooked—not because it was incorrect, but because it seemed irrelevant in an era of stable monetary dominance and due to measurement challenges. The post-2020 inflation surge has reignited this debate, with empirical evidence indicating that fiscal deficits play a more substantial role than purely monetary models suggest. Ignoring fiscal policy in inflation models is not merely an analytical oversight; it poses a systemic risk to credibility, expectations, and price stability. The next inflation surprise may be preventable, but only if we account for fiscal influences and avoid optimistic biases in forecasting.

Cochrane, J. (2023). The Fiscal Theory of the Price Level. Princeton University Press.

Faria-e-Castro, M. (2025). A Look at Inflation in Recent Years through the Lens of a Macroeconomic Model. Federal Reserve Bank of St. Louis Economy Blog. https://www.stlouisfed.org/on-the-economy/2025/jan/look-inflation-recent-years-lens-macroeconomic-model

Granziera, E., P. Jalasjoki and M. Paloviita (2024). The bias of the ECB’s inflation projections. SUERF Policy Brief 970. https://www.suerf.org/wp-content/uploads/2024/09/SUERF-Policy-Brief-970_Granziera-et-al.pdf

Larch, M. J. Malzubris and S. Santacroce (2022). Numerical Compliance with EU Fiscal Rules: Facts and Figures from a New Database. Intereconomics 58(1) 32-42. https://www.intereconomics.eu/contents/year/2023/number/1/article/numerical-compliance-with-eu-fiscal-rules-facts-and-figures-from-a-new-database.html

Martin, F. (2025). The Fiscal Origin of the Covid-19 Price Surge. Federal Reserve Bank of St. Louis Economy Blog. https://www.stlouisfed.org/on-the-economy/2025/mar/fiscal-origin-covid19-price-surge

Tanzi, V. (1977). Inflation, lags in collection, and the real value of tax revenue. IMF Staff Papers, 24(1), 154–167.

https://www.elibrary.imf.org/view/journals/024/1977/001/article-A008-en.xml