Disclaimer: This SUERF policy brief is based on the ESM working paper, “Concessional credit lines for sovereigns in financial distress”. The views expressed in this policy brief are those of the author(s) and do not necessarily represent those of the ESM or ESM policy.

Abstract

In a world of high public debt and frequent external shocks, it is cheaper to prevent financial crises than to resolve them. This makes access to precautionary concessional credit lines during financial distress crucial for countries. Focusing on a small representative euro area economy, we show that credit lines with grace periods, if fully used when tapped, reduce sovereign spreads and default risk in response to exogenous shocks that increase the government’s gross financing needs. While these credit lines help countries by reducing fears of default and give them time to stabilize their economies before debt repayments begin, the grace periods might lead to slightly higher long-term debt and borrowing costs if they are not paired with fiscal rules. We also quantify the stigma premium, the politically perceived cost of using credit lines, and show that it could be substantial.

High public debt and frequent external shocks increase the likelihood of financial distress for governments. As past crises have shown that crisis prevention is less costly than crisis resolution, access to precautionary credit lines from international financial institutions during financial distress can be an efficient crisis management tool.1 Our recent ESM working paper (Mimir and Önder, 2025) quantitatively assesses the macroeconomic effects of accessing concessional credit lines with grace periods during financially turbulent times.

We explore the mechanisms underpinning the efficiency and effectiveness of precautionary credit lines as a crisis management tool. For that purpose, we assess how credit lines impact sovereign borrowing costs during distress, their role in macroeconomic stabilisation, the benefits and costs of grace periods together with their long-term effects on sovereign borrowing, and the extent of the politically perceived cost (stigma premium) of utilizing credit lines, using a quantitative sovereign default model based on Önder (2022). We only consider credit lines that are cheaper than market rates, hence concessional, and are fully utilised if tapped.

In our framework, the government decides sequentially each period whether to default on its debt and how much to borrow, following Eaton and Gersovitz (1981). Defaulting incurs an income cost, temporary exclusion from issuing debt, and a loss of access to credit lines, which are available only during financial distress. These lines include grace periods where payments are suspended, even during default and exclusion. Our model is calibrated to the Portuguese economy, chosen as a representative small open economy in the euro area with strong economic and financial fundamentals but vulnerable to external shocks.

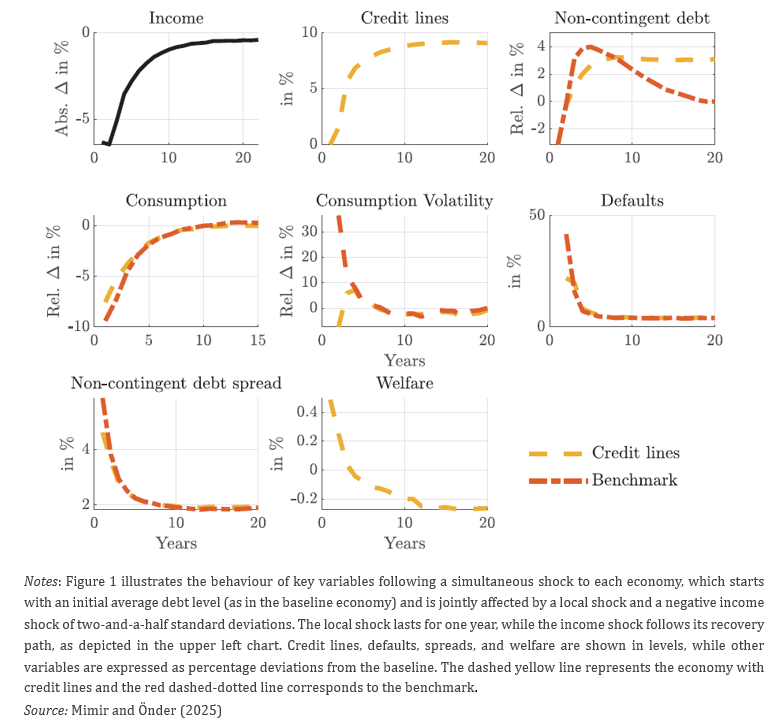

We first show the impact of a country-specific income shock on the economy (Figure 1). After an income shock that increases the government’s gross financing needs by 10%, the benchmark economy without credit lines (red dashed lines) slightly increases its debt. The government would have preferred to borrow more to smooth consumption, but default risk constraints it. As default risk rises, borrowing costs (spreads) increase sharply, limiting the government’s ability to smooth consumption through borrowing. In contrast, the model economy with credit lines (yellow dashed lines) faces lower default risk and consumption volatility, allowing for cheaper borrowing from the market. Access to new funding through credit lines helps the sovereign to avoid significant borrowing costs and default risk while boosting economic activity by supporting consumption in the short-to-medium term.

Figure 1. Credit lines mitigate the rise in sovereign spreads and reduce default risk while helping smooth consumption

Effects of a country-specific income shock in economies without and with credit lines (in % deviation from steady state)

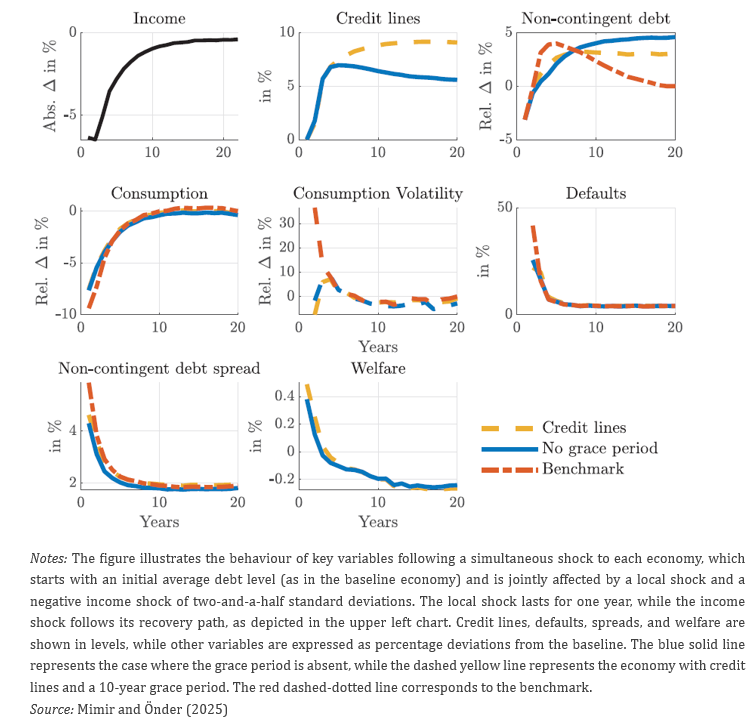

We then assess the role of grace periods attached to credit lines. Grace periods are common in multinational lending agreements (see International Monetary Fund (2024a), International Monetary Fund (2024b), European Stability Mechanism (2024b)). Incorporating grace periods into economic models of sovereign default is important for their practical relevance as they give countries time to stabilize their economies and implement structural reforms before debt repayments begin, reducing default risk and supporting long-term debt sustainability. While grace periods provide temporary relief during adverse income shocks, they can exacerbate the ‘debt dilution problem’ by reducing the value of existing debt and raising borrowing costs.2 Figure 2 compares the impact of a country-specific income shock in “credit line” economies with and without grace periods to the baseline without credit lines. Both credit line economies display similar dynamics in the very short run. Both economies immediately tap the credit lines to stave off default risk and initially rely on credit line financing, which leads consumption front-loading and lower borrowing costs during a local shock when credit lines are first introduced.

However, in the long run, the credit line economy without a grace period uses those lines less, increasing the sovereign’s precautionary savings for adverse shocks. This higher default cost allows for more non-contingent debt accumulation, leading to higher interest payments and slightly lower consumption. Since welfare closely tracks consumption, long-term welfare in the economy with the no grace period is similar to the credit line economy with 10 years of grace period.

Figure 2. Although grace periods help slightly reduce sovereign spreads and consumption volatility in the short run, they could increase sovereign debt in the long term

Effects of a country-specific income shock in economies under credit lines with and without grace periods in comparison to the baseline economy (in % deviation from steady-state)

An obvious question is why credit lines, despite their clear benefits of reducing sovereign spreads and default risk, and long-standing availability, have not been widely adopted. We attribute this to a political stigma premium (European Stability Mechanism, 2024a). The “stigma premium” on loans from financial institutions refers to the additional costs or challenges that countries may encounter when seeking financial assistance from such entities due to associated reputational or political risks and negative perceptions. It has been long established that for many countries, IMF loans are seen as a measure of last resort, and borrowing from the IMF can carry a significant social and economic stigma. This perception can result in elevated costs for the borrowing country, both directly and indirectly, beyond the standard interest rate or repayment terms (see Reinhart and Trebesch (2016)).

Table 1. Stigma premium is larger for credit lines with grace periods

(Long-run moments of different model economies, in %)

In our model, we quantify the stigma premium associated with credit lines, as an additional “perceived” interest rate cost by countries, which discourages them from using these credit lines due to potential reputational or political risks. The penultimate column of Table 1 indicates that the stigma premium could rise to 25% for larger credit lines with extended grace periods (capped at 10% of annual GDP with a grace period of 10 years) while the last column shows that without grace periods, the stigma premium can be as high as 5%. This means that the politically perceived cost of utilizing these credit lines would need to reach 5% to account for their lack of use by countries. Finally, while not included in the table for brevity, for a credit line capped at 4% of annual GDP with a grace period of 3 years, the stigma premium is approximately 9%.

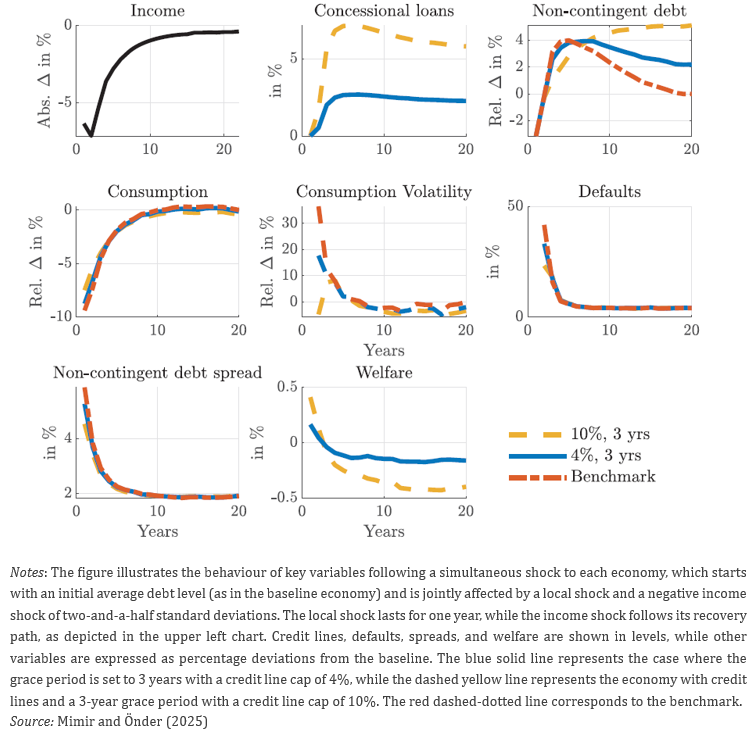

We also examine the impact of setting a lower cap on available credit lines, specifically reducing it to 4% of GDP instead of the 10% cap (Figure 3). This lower cap presents several trade-offs. Although the reduction in the government’s default probability and spreads in the next period is less significant upon its introduction of credit lines with a lower cap, long-term consumption and welfare are higher compared to the higher cap counterpart, while long-term debt is lower. It is important to note that during a local shock, the government’s gross financing needs increase by 10%, but the reduced credit lines can only partially finance this.

Figure 3. Although credit lines capped at 4% reduce default risk and sovereign spreads less, long-term consumption is higher while long-term debt is lower than under credit lines capped at 10%

Effects of a country-specific income shock in economies with credit lines capped at 10% and 4% of annual GDP in comparison to the baseline economy (in % deviation from steady-state)

We assess the advantages of credit lines with grace periods, which are accessible only during ‘risk-on’ episodes when government financing needs become elevated in response to country-specific income shocks. Our model, calibrated to Portugal, demonstrates that credit lines help to mitigate default risk and reduce sovereign spreads while providing macroeconomic stability during financially turbulent times. Grace periods give additional fiscal breathing room to countries, further helping to smooth consumption. Over the long term, it is beneficial to combine credit lines with grace periods with the enforcement of fiscal rules to prevent higher debt accumulation.

Eaton, Jonathan, and Mark Gersovitz. 1981. “Debt with potential repudiation: theoretical and empirical analysis.” Review of Economic Studies, 48: 289–309.

European Stability Mechanism. 2024a. “ESM staff report on the comprehensive review of the maximum lending volume, adequacy of the authorised capital stock and financial assistance instruments.” European Stability Mechanism Staff Report.

European Stability Mechanism. 2024b. “Portugal | European Stability Mechanism.” https://www.esm.europa.eu/assistance/portugal, Accessed: 2024-09-17.

IMF. 2023a. “Flexible Credit Line (FCL).” https://www.imf.org/en/About/ Factsheets/Sheets/2023/Flexible-Credit-Line-FCL, Accessed: 2025-01-28.

IMF. 2023b. “Precautionary and Liquidity Line (PLL).” https://www.imf.org/en/ About/Factsheets/Sheets/2023/Precautionary-Liquidity-Line-PLL, Accessed: 2025-01-28.

International Monetary Fund. 2024a. “The Extended Credit Facility.” The Extended Credit Facility (ECF).

International Monetary Fund. 2024b. “The Stand-by Credit Facility.” The Stand by Credit Facility (SCF).

Mimir, Yasin, and Yasin Kürşat Önder. 2025. “Concessional credit lines for sovereigns in financial distress”, ESM Working Papers, No. 70/2025.

Önder, Yasin Kürsat. 2022. “Liquidity crises, liquidity lines and sovereign risk.” Journal of Development Economics, 154: 102772.

Reinhart, Carmen M., and Christoph Trebesch. 2016. “The International Monetary Fund: 70 Years of Reinvention.” Journal of Economic Perspectives, 30(1): 3–28.

The European Stability Mechanism (ESM) addresses financial stability risks in the euro area through various instruments, including precautionary credit lines. These credit lines are designed to help countries with sound economic conditions maintain market access by strengthening economic credibility and preventing crises. Unlike the ESM’s macroeconomic adjustment programmes, which are aimed at countries with significant financing needs that have lost access to markets, the credit lines are targeted at countries with fundamentally sound economies that are experiencing difficulties due to exogenous macroeconomic shocks rather than home-grown problems. These credit lines come with either no conditionality or light conditionality, similar to IMF credit lines (IMF (2023a), IMF (2023b)).

Debt dilution occurs when the issuance of new debt reduces the value of existing debt, potentially raising borrowing costs.