This policy brief is based on BIS Working Paper, No 1266. The views do not necessarily represent those of the Bank for International Settlements or the Bank of Thailand.

Abstract

When trade is invoiced in a few dominant currencies—notably the US dollar—exchange rate swings affect firm profits in domestic currency. This “valuation channel” can outweigh the traditional expenditure-switching effects in the short run when dollar prices tend to be sticky. We develop firm-level measures of trade invoice-currency mismatches to capture firm exposures to this valuation channel. We find that the valuation effects significantly affect firm liquidity and credit conditions, as well as influencing their investment and hiring decisions. The effects are particularly pronounced for small and medium-sized exporters.

How exchange rate fluctuations affect the economy is a central policy question for small open economies. Traditional focus is often on how currency movements affect the price competitiveness of exports and hence trade volumes. This “expenditure-switching” effect is important when exchange rate swings alter buyer prices, which is the case if exporters invoice trade in their own currency or if they can flexibly adjust prices in the buyer currency. In reality, neither condition holds at least in the short run. For global trade invoicing, few currencies in fact dominate, with the US dollar commanding the largest share (“dominant currency paradigm”). And with short-run price stickiness, firms do not flexibly adjust the dollar prices in response to exchange rate fluctuations. As a consequence, firms must absorb exchange rate variations through cash flows and revenues in the domestic currency.

Our recent research, Nookhwun et al. (2025), examines how the valuation effects of exchange rates influence firms’ profits, financial conditions, as well as real investment and hiring decisions. We utilize detailed micro-level data from Thailand, an emerging market economy highly dependent on trade. The Thai economy presents an interesting study case, as it features predominant – but not exclusively – US dollar pricing and large currency mismatches in trade transactions, exposing firms to the valuation channel. Our research contributes to a scant but emerging literature that so far has focused only on advanced economies, such as Barbiero (2021) and Adams and Verdelhan (2022). Beyond providing the first EME perspective, our extensive micro-level data allow an analysis of real and financial effects that is more comprehensive in scope than previous studies.

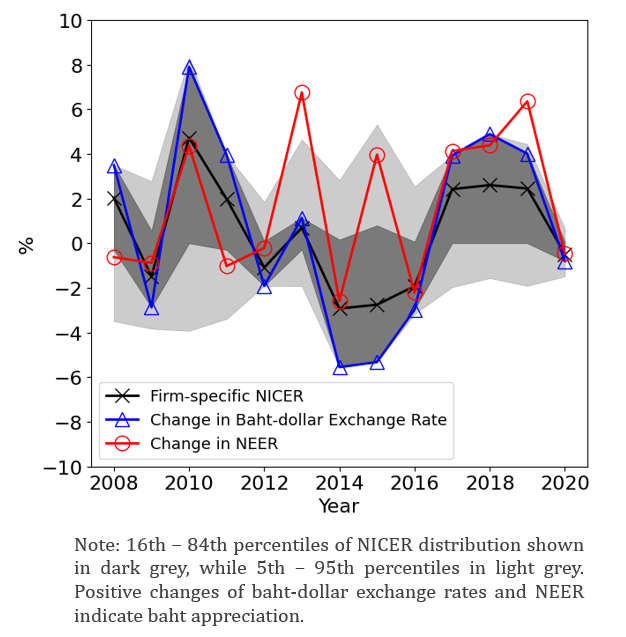

To measure the valuation effects, we develop a new firm-level exchange rate index, “NICER” (for Net-Invoice-Currency-Weighted Exchange Rate). The index weights exchange rate movements by the mismatches in invoicing currencies between a firm’s exports and imports. The index captures the idea that a firm that invoices its exports heavily in the US dollar would be more susceptible to dollar swings, but less so if it also imports heavily in the US dollar and has lower mismatches. Figure 1 plots the NICER time-series and the cross-sectional dispersion. It shows that exchange rate exposures vary substantially across firms for a given period, reflecting the differences in both invoice currencies used and the degree of currency mismatches. Large firms, for example, tend to have less mismatches and experience smaller NICER fluctuations. Despite the outsized role of dollar in invoicing trade (around 80 percent), significant NICER dispersion suggests that dollar exchange rates may not accurately represent the underlying exchange rates that matter at the firm level. Trade-weighted exchange rates such as the nominal effective exchange rates (NEER) are even more disconnected with NICER, given the downplayed role of the dollar.

Figure 1. Firm-level NICER versus Traditional Exchange Rate Indices of Exporting Firms

NICER movements significantly affect firms’ profits, especially for exporters. A one-percentage-point appreciation in NICER leads to a 0.2-percentage-point reduction in earnings before interest and taxes (EBIT) relative to total assets, during the same year. Importers experience a smaller impact, possibly due to a larger presence of domestic business and ability to substitute between inputs. Notably, NICER outperforms traditional trade-weighted exchange rates in predicting firm profits, reaffirming the importance of accounting for invoicing currencies. This is especially the case for exporters, whose profit sensitivity is larger. These valuation effects to be strongest in the short term but can persist for several years.

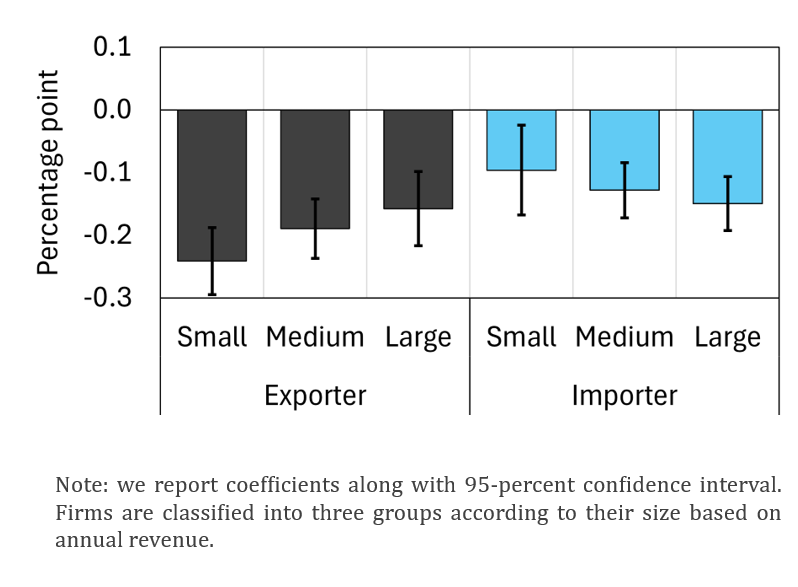

The impact of NICER fluctuations is largest for small and medium-sized exporters (Figure 2), which already have limited access to hedging instruments and less diversified revenue streams. The effects on importers are generally smaller, even after accounting for firm sizes. Beyond dollar transactions, non-dollar invoicing currencies such as euro and yen also induce significant impact on firm profits. This underscores the importance of understanding a firm’s invoicing currency mix for accurately assessing its exchange rate risks.

Figure 2. Impact of 1-pp Increase in NICER on Firm EBIT by Firm Size

Trade dependency shapes firms’ sensitivity to valuation effects. A larger proportion of export revenues or import costs increases profit sensitivity to NICER movements. FX hedging, in principles, could help lessen exchange rate risks and weaken the valuation channel. However, using FX transaction data, we show that FX Hedging only partially mitigates exchange rate exposures. A full hedging weakens the valuation effects by about one-third relative to no hedging. The relatively short maturity of forward contracts, typically no more than a few quarters, may explain this finding and highlights the challenges of managing FX risks through financial instruments alone.

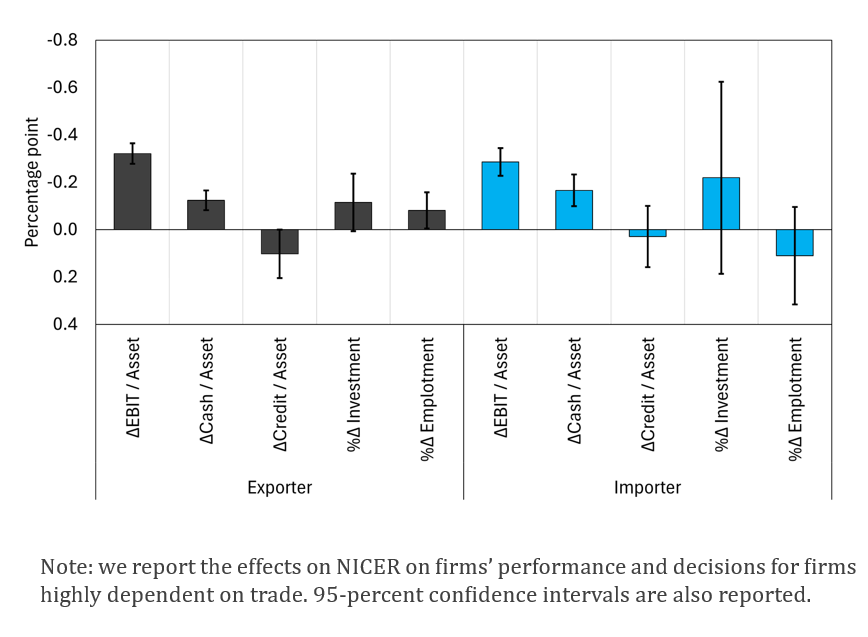

Valuation effects extend beyond short-term profits to firm liquidity (Figure 3). A NICER appreciation, in addition to reducing local currency profits, depletes cash holdings for both exporters and importers. If firms are financially constrained, these liquidity squeezes can hinder day-to-day operations and ability to seize investment/growth opportunities. We find that only large exporters demonstrate the capacity to raise short-term financing and cushion these cash flow shocks, allowing them to maintain liquidity even in the face of adverse currency movements. Meanwhile, we do not find any significant impact on firms’ credit risks, as measured by non-performing and special-mention loan indicators. While firms may experience financial strains from exchange rate swings, these do not translate into defaults that could disrupt banks’ credit supply conditions.

Figure 3. Impact of 1-pp Increase in NICER on Firm’s Performance and Decisions

For the real economy, NICER movements significantly influence exporters’ investment and employment decisions. Exporters cut investment and hiring as NICER appreciates and their profitability and liquidity are squeezed. These real effects are driven mainly by dollar exposures. For firms most dependent on trade, a one-percentage-point adverse change in dollar-based NICER can reduce investment growth by 0.2 percentage point and employment growth by 0.1 percentage point. These real effects can persist even after the immediate cash-flow impacts on profits subside, underscoring the longer-term implications of exchange rate volatility. Meanwhile, we do not find significant real impacts on importers, who appear better able to weather cash-flow shocks.

Our research findings underscore the importance of looking beyond traditional exchange rate indices to fully grasp the impact of exchange rates on firms and the economy. Policymakers should be mindful of the “valuation channel” of exchange rates on firm profits and cash flows, which could have broader implications for financial and macroeconomic stability. This channel, driven by invoicing currency mismatches, can be particularly potent in economies where dominant currency pricing is prevalent, and is likely to be more important than the trade competitiveness channel in the short term. Furthermore, because exchange rate fluctuations affect firms unevenly, taking this micro-level heterogeneity into account is important even for macroeconomic assessments. This also means FX intervention can have an important re-distributional effect, which policymakers may wish to consider when formulating policies.

Patrick Adams & Adrien Verdelhan, 2022. “Exchange rate risk in public firms,” Technical report, Working paper, MIT Sloan.

Omar Barbiero, 2021. “The Valuation Effects of Trade,” Working Papers 21-11, Federal Reserve Bank of Boston.

Nuwat Nookhwun & Jettawat Pattararangrong & Phurichai Rungcharoenkitkul, 2025. “Exchange Rate Effects on Firm Performance: A NICER Approach,” BIS Working Papers 1266, Bank for International Settlements.