The policy brief is based on Kanelis and Siklos (2025), published in the Deutsche Bundesbank Discussion Paper Series. The views expressed here are those of the authors and do not necessarily reflect the opinions of the Deutsche Bundesbank or the Eurosystem.

Abstract

This study uses modern methods from Speech Emotion Recognition and Natural Language Processing to examine how the tone and words of European Central Bank President Mario Draghi influenced sovereign bond yields in major euro area countries. We find that both vocal and verbal emotions in central bank communication have significant and varied effects on financial markets. Positive signals raised yields in Germany, France, and Spain, while negative signals increased Italian yields. Our findings suggest that positive communication influences the risk-free yield component, whereas negative cues affect the risk premium.

When Mario Draghi, former President of the European Central Bank (ECB), spoke, financial markets listened. This is because central bank communication provides valuable insights into the central bank’s assessment of the economy. To understand the information and signals that influence market reactions, researchers in recent years have conducted detailed analyses of the ECB president’s spoken and written words (e.g., Parle (2022); Schmeling and Wagner (2025)). However, experience teaches us that communication extends beyond words alone and also relies on non-verbal cues. In this context, the tone of a speaker’s voice plays a crucial role in shaping how messages are perceived by the audience. Several examples highlight how journalists and observers have detected and reported non-verbal reactions of former ECB president Mario Draghi, like his calm behavior or his annoyed reaction when questioned about criticism from Germany.

To better understand how the sophisticated interplay of verbal and vocal cues affects financial markets, we construct a sentiment indicator based on the voice and language during the ECB press conferences under Mario Draghi’s presidency. We then estimate the impact of this form of sentiment on the yield curves in the four largest euro area economies and on European stock markets. For this analysis, we also leverage the real-time dataset from Altavilla et al. (2019) and construct a dataset comprising synchronized audio and textual data spanning the period from May 2012 to October 2019.

To quantify emotions and generate a numerical variable for our event-based regressions, we employ techniques from Speech Emotion Recognition (SER), a specialized subfield of machine learning. Specifically, we create a Fully Convolutional Neural Network from scratch based on García-Ordás et al. (2021). This model is tailored to flexibly process audio data with high variability in length and classify emotions into six categories: Neutral, Calm, Happy, Sad, Angry, and Pleasantly Surprised. These classifications are then aggregated into three broader groups: positive (Happy, Pleasantly Surprised), neutral (Neutral, Calm), and negative (Angry, Sad) vocal cues.

With a SER model in place, measuring vocal cues from the introductory statement is relatively straightforward. However, capturing the fleeting moments of emotions expressed in Draghi’s voice during the Q&A session requires a more granular approach. To achieve this, we focus on individual answers as the appropriate level of observation. The Q&A session, however, poses a unique challenge, as Draghi often addressed multiple questions consecutively on entirely different topics. To address this, we leverage a key feature of the ECB press conference transcripts: the ECB staff identifies individual answers and organizes them into distinct paragraphs. This structure allows us to align the audio data with each individual response, ensuring precise synchronization between vocal cues and the corresponding textual content.

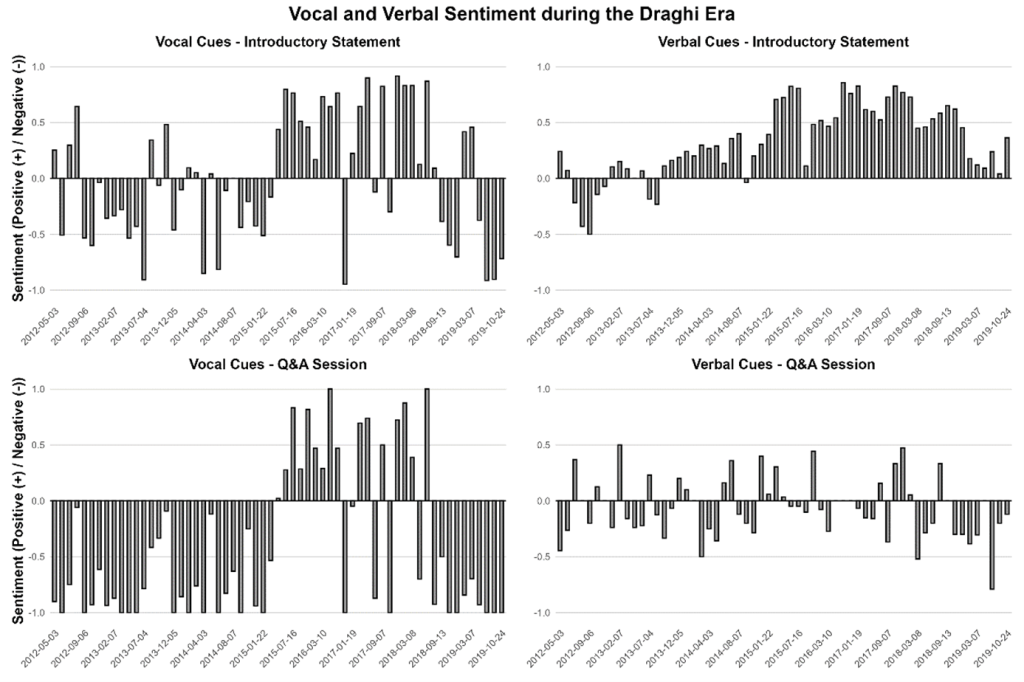

To assess the sentiment of verbal cues during the Q&A session, we utilize FinBERT, a language model specifically designed to analyze economics and finance-related textual data, offering a more nuanced approach than traditional dictionary-based word-counting methods (Huang et al., 2023). For the introductory statement, we rely on the sentiment data for the Draghi presidency from Geiger et al. (2025) who introduced the Monetary-Intelligent Language Agent, a Large Language Modeling approach specifically designed to analyze euro area central bank communication (Deutsche Bundesbank, 2025). We use the aggregated vocal and verbal sentiment data on the press conference level for the introductory statement and the Q&A session (Figure 1).

Figure 1.

Note: The figure displays the sentiment of vocal and verbal cues during the introductory statements and Q&A sessions of ECB press conferences held between May 2012 and October 2019. Ten press conferences were excluded from the analysis due to poor audio quality. To enhance clarity, only every fourth press conference date is displayed on the x-axis.

As the above figure demonstrates, there is a clear distinction in sentiment depending on whether the cues are vocal or verbal in nature. For example, there are clearer patterns in sentiment for vocal cues than for verbal cues, at least as far as the Q&A sessions are concerned. Noteworthy observations include a strong correlation of 83.4% between vocal sentiment during the introductory statement and the Q&A session, as well as a moderate correlation of 47.8% between vocal sentiment in the Q&A session and verbal sentiment in the introductory statement. This suggests that vocal cues during the press conference tend to align with the macroeconomic expectations verbally expressed in the introductory statement, which reflect economic optimism or pessimism regarding the euro area’s economic outlook and satisfaction with inflation dynamics.

During the European Sovereign Debt Crisis (ESDC), vocal sentiment is consistently negative in both the introductory statement and the Q&A sessions which can be interpreted as a reflection of the intense pressure and psychological stress associated with crisis management. Following the end of the ESDC, vocal sentiment temporarily improves across both segments before turning more negative again throughout much of 2014. The launch of the Asset Purchase Program in early 2015 is accompanied by a marked increase in positive vocal and verbal sentiment possibly reflecting Draghi’s success in implementing unconventional monetary policies despite internal dissent within the governing council (Brunnermeier et. al., 2016). However, vocal sentiment begins to decline again in 2018, aligning with rising political and economic uncertainties (Draghi, 2018), and reaches a new low when the ECB resumes its quantitative easing program in 2019, just months after attempting to initiate a policy normalization.

After quantifying the vocal and verbal sentiment for the press conferences, we analyze how their interplay impacts European sovereign bond yields and stock prices. To do so, we regress the aggregated sentiment indicators at the press conference level on the change in median yields observed within a ten-minute window preceding the press conference and a ten-minute window following its conclusion. This method enables us to isolate an unbiased and direct causal effect. By concentrating on median yield changes within these intervals, as provided by Altavilla et al. (2019), we also mitigate the influence of high volatility and noise commonly associated with higher-frequency financial market data.

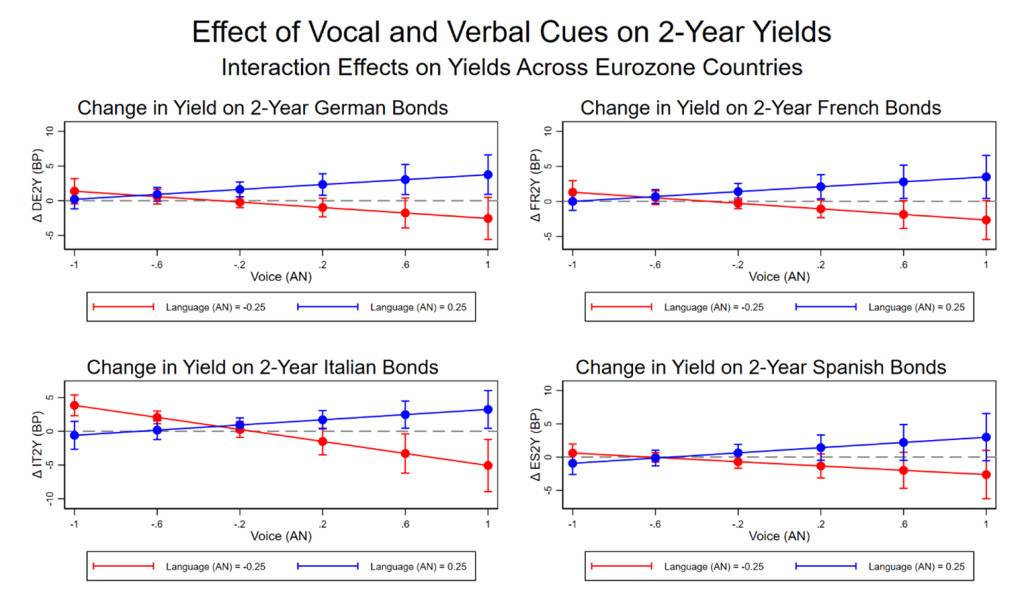

Figure 2.

Note: The figure illustrates the estimated impact of the interaction between vocal and verbal cues during the Q&A session, aggregated at the press conference level, on the yields of German, French, Italian, and Spanish two-year bonds. The sentiment of verbal cues is fixed at two levels: moderate positive with 0.25 (blue line) and moderate negative with -0.25 (red line). Predictive margins are presented with 95% confidence intervals. “AN” denotes “Answer,” as the sentiment of both vocal and verbal cues is measured exclusively from the ECB president’s responses to the audience. Changes in bond yields are reported in basis points.

As seen in the accompanying figure (Figure 2) we find a significant impact of sentiment on sovereign bond yields for Germany, France, Italy, and Spain across the maturities. In all cases, this effect originates from the sentiment conveyed during the Q&A session, while the vocal or verbal cues from the introductory statement have no discernible influence on yields. Notably, the interplay between vocal and verbal cues during the Q&A session asymmetrically affects bond yields: German, French, and Spanish bond yields rise in response to a combination of positive vocal and verbal cues, whereas Italian bond yields increase in reaction to negative cues.

When examining yield spreads relative to German yields of the same maturity, we observe that only Italian spreads are affected, and only in response to negative cues from the ECB president. This suggests that positive vocal and verbal cues during the Q&A session primarily influence expectations regarding the risk-free interest rate, functioning in a manner akin to a monetary policy impulse. In contrast, negative communication impacts the risk premium without altering the risk-free interest rate. Notably, the combination of negative vocal and verbal cues is also associated with declines in European stock markets.

Our research adds to the expanding literature highlighting the impact of vocal cues on financial markets, emphasizing that effective communication extends beyond the content of words alone. Additionally, our findings support the hypothesis that euro area bond yields exhibit idiosyncratic variations. Nonetheless, it is important to recognize that the expression of emotions is a natural aspect of human communication and should be viewed as a feature, not a flaw, in the context of conveying monetary policy decisions and narratives to both markets and the public. It will be interesting to assess whether financial markets remain responsive in future to emotions expressed by central bankers. After all, Goodhart’s law suggests that the effects from novel sources of information, such as non-verbal cues, dissipate over time as policy makers become aware of the tools used to measure their behavior in press conferences or other public fora.

Altavilla, C., Brugnolini, L., Gürkaynak, R.S., Motto, R., Ragusa, G., 2019. Measuring Euro Area Monetary Policy. Journal of Monetary Economics 108, 162-179

Brunnermeier, M.K., James, H., Landau, J.P., 2016. The Euro and the Battle of Ideas. Princeton University Press

Deutsche Bundesbank, 2025. Monetary Policy Communication According to Artificial Intelligence. Monthly Report – March 2025

Draghi, M., 2018. The Outlook for the Euro Area Economy. Speech by Mario Draghi, President of the ECB, Frankfurt European Banking Congress, Frankfurt am Main, 16 November 2018

García-Ordás, M.T., Alaiz-Moretón, H., Benítez-Andrades, J.A., García-Olalla, O., Benavides, C., 2021. Sentiment Analysis in Non-Fixed Length Audios Using a Fully Convolutional Neural Network. Biomedical Signal Processing and Control 69

Geiger, F., Kanelis, D., Lieberknecht, P., Sola, D., 2025. Monetary-Intelligent Language Agent. Deutsche Bundesbank Technical Paper Series

Huang, A.H., Wang, H., Yang, Y., 2023. FinBERT – A Large Language Model Approach to Extracting Information from Financial Text. Contemporary Accounting Research 40(2)

Kanelis, D. and Siklos, P.L., 2025: Emotion in Euro Area Monetary Policy Communication and Bond Yields: The Draghi Era, Deutsche Bundesbank Discussion Paper Series 16/2025

Parle, C., 2022. The Financial Market Impact of ECB Monetary Policy Press Conferences – A Text Based Approach. European Journal of Political Economy 74, 102230

Schmeling, M., Wagner, C., 2025. Does Central Bank Tone Move Asset Prices? Journal of Financial and Quantitative Analysis 60(1), 36-67