This SUERF Policy Brief summarizes Bank for International Settlements No.1145 and Bank of Korea working paper No. 2023-22, Nov 2023. This article should not be reported as representing the views of the Bank for International Settlements or the Bank of Korea.

The recent aggressive US monetary policy tightening and a strong dollar are causing a deterioration in government bond liquidity in emerging market economies (EMEs). Using a unique tick-by-tick dataset, this paper finds that a strong US dollar impairs government (Treasury) bond liquidity in Korea. The effects are more pronounced when funding liquidity conditions are tighter, when banks’ total capital ratio is lower with greater foreign currency risk, or when there is a large foreign investor sell-off. These results support the financial channel of exchange rates affecting EME’s Treasury market liquidity. Specifically, a strong dollar as a global risk factor can limit the market intermediation capacity of emerging market dealers through the currency exposures of borrowers or dealers and thus tighten market conditions.

The recent aggressive policy rate increases in advanced economies (AEs) and a strong dollar have tightened emerging market economy (EME) financial conditions and impaired market liquidity, even in the government bond market where most benchmark bonds are traded. However, EME government bond liquidity and exchange rate fluctuations have received less attention than those of major advanced economies. I address this gap by estimating government bond liquidity using unique real-time trade and quote data from Korea, a representative EME,1 and analysing its relationship with the US dollar.

For my analyses, I have used four liquidity measures commonly estimated in the market microstructure literature, using tick-by-tick data from on-the-run bonds with maturities of 3,5, and 10-years: the bid-ask spread, price impact, quoted depth and liquidity index.2 In particular, a wider bid-ask spread refers to lower liquidity because it signifies a larger difference between the prices at which market participants are willing to buy and sell a security. Dealers or market makers often widen the bid-ask spread to protect themselves from potential risks and ensure they are compensated for the costs associated with maintaining an orderly market and providing liquidity.

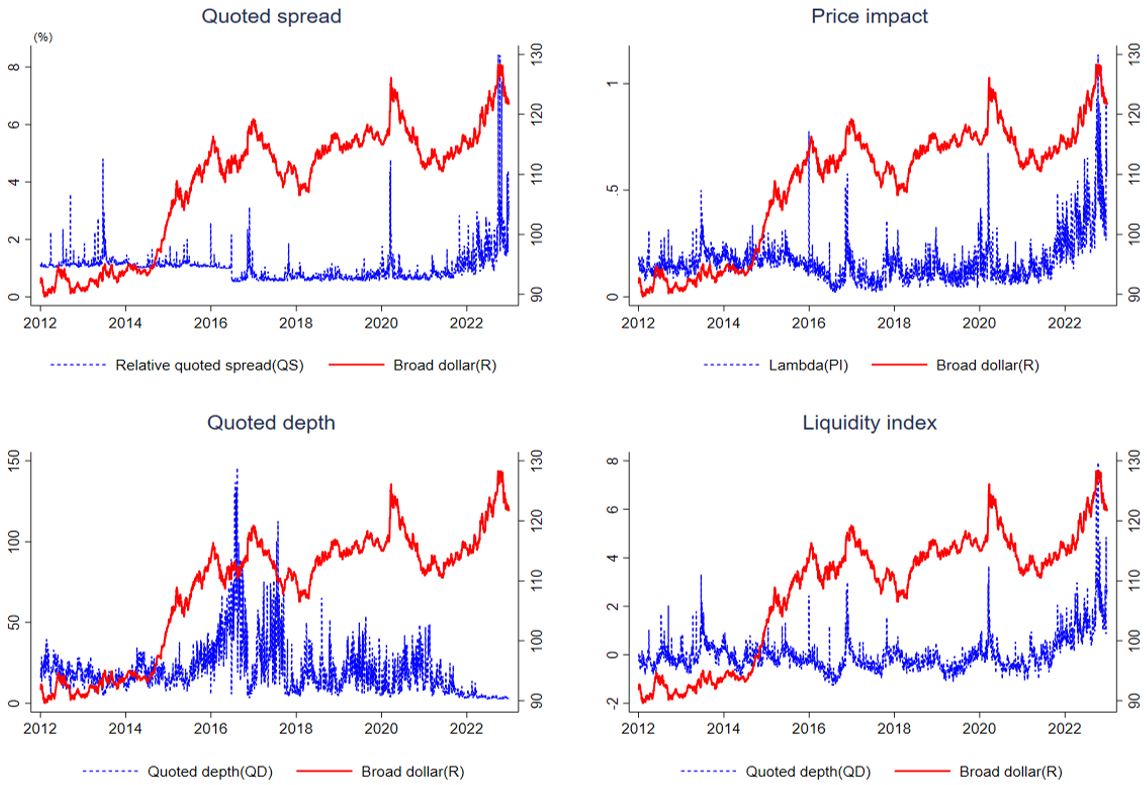

Analysis shows that a strong dollar is likely to hamper government bond liquidity in EMEs. Figure 1 illustrates that all the illiquidity measures (blue dotted lines) have shown a tendency to move in tandem with the broad US dollar returns (red lines)—a higher value means a stronger dollar. Notably, during periods of dollar spikes or appreciations (e.g., Taper tantrum, the Covid-19 pandemic, US monetary policy tightening and Project Financing-Asset Backed Commercial Paper distress), Korea’s government bond liquidity experiences significant drops.

Figure 1: Time series of the broad US dollar index and Treasury market liquidity measures a,b

a) Volume-weighted average of each liquidity measure for 3-, 5-, and 10-year Treasury bonds for quoted spread, price impact and quoted depth. Liquidity index is the composite index of 9 liquidity measures (e.g., quoted spread, price impact, and quoted depth for 3-, 5-, 10- year maturity bonds), estimating illiquidity. Broad dollar is the level of the nominal broad US dollar index from FRED. b) Plotted lines are 22-day moving averages.

Sources: BOMIS; Infomax; authors’ calculation.

Furthermore, I find qualitatively similar results in the regression analyses after controlling for the variables that are associated with Treasury bond liquidity from 2 January 2012 to 28 December 2022 at a daily frequency. Specifically, a 10 percentage point increase in the broad dollar returns is associated with an increase in the relative quoted spread by 0.7 basis points on average per day. This suggests that EME primary dealers are likely to decrease liquidity provisions to the government bond market, possibly due to their constrained market-making capacity in response to the dollar appreciation.

This study proposes three financial channels of exchange rates affecting government bond liquidity, namely funding liquidity conditions, original sin, and original sin redux.

The funding liquidity channel. EME dealer banks are likely to provide less liquidity when they face funding constraints during the times of dollar appreciation period.

This idea is consistent with previous studies regarding the feedback loop between funding liquidity and market liquidity (e.g., Brunnermeier and Pedersen, 2009). By using implied volatilities, bond yields and the bank-level CDS spreads as proxies of funding liquidity conditions, I find that the adverse impacts of the dollar on Korea’s government bond liquidity become stronger when uncertainty, government bond yields and bank-level credit spreads increase. This implies that the effects of US dollar on government bond liquidity can be amplified by tightened EME funding liquidity conditions.

The original sin channel. EME dealer banks are likely to reduce liquidity when they experience heightened foreign currency exposures due to an expansion of their lending in foreign currency-denominated loans or a decline in their BIS capital ratio.

“Original sin” refers to the inability of EMEs to borrow in their own currency, leading to increased exposure of EME borrowers to currency mismatch and heightened vulnerability to exchange rate fluctuations (Eichengreen and Hausmann, 1999). Recent research has noted that the original sin channel continues to be prevalent among EME corporates despite its gradual reduction among major EME sovereign issuers (Du and Schreger, 2022; Onen et al., 2023).

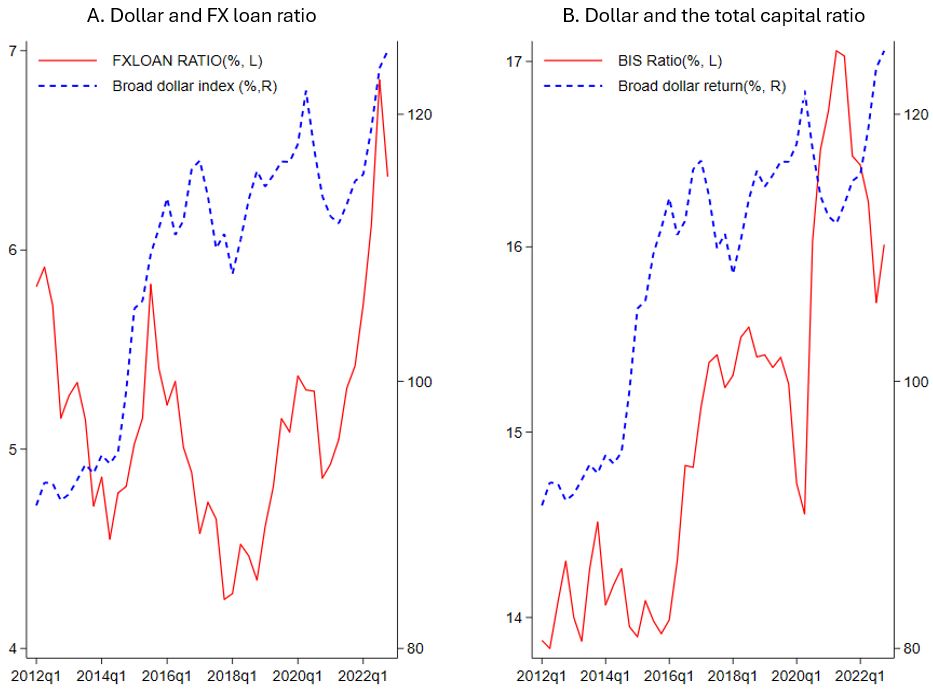

In line with this, when dealer banks have greater provisions of foreign currency-denominated (FX) loans to EME corporates, they encounter greater foreign currency risk and currency mismatch. This expansion of FX loans can be linked with a rise in FX risk-weighted assets (RWA) on dealers’ balance sheets, subsequently reducing the BIS ratio (Total Capital / (FX RWA + KRW RWA)), which may necessitate dealers to acquire additional funds to meet regulatory requirements, especially during periods of dollar appreciation. This burden can limit the market intermediation capacity of dealers, ultimately dampening government bond liquidity. Figure 2 presents corroborating evidence that a stronger dollar is associated with a heightened FX loan ratio and a lower BIS ratio at the bank level. Empirical evidence further shows that the impact of the dollar on liquidity becomes more pronounced when banks have higher FX loan ratios or lower BIS ratios, thereby supporting the original sin channel.

Figure 2: FX loan ratio, BIS ratio, and the broad dollar index a,b

a) FXLOAN RATIO is the ratio of the foreign currency loans to the total loans by banks. b) BIS RATIO is the total equity divided by risk-weighted assets by banks.

The original sin redux channel. EME dealers are likely to exposed to vulnerability to capital outflow or large foreign sell-off in the local currency bond market, especially during the times of a strong dollar, which can adversely affect their market making activities.

The concept of “original sin redux” suggests that even when EMEs can borrow from abroad in their own currency, currency mismatch can remain on the balance sheet of foreign investors in EME local currency bonds (Carsten and Shin, 2019). When EME currencies depreciate against the dollar, foreign investors sell EME local currency bonds which lower EME bond returns, triggering the return-amplifying role of the dollar exchange rate (Hofmann et al, 2020). In an extreme case, this may lead to panic selling by foreign investors, who face the greater currency mismatch, reducing dealers’ market-making capacity due to the high likelihood of unwanted inventory holdings, and thus worsening liquidity in the government bond market during periods of foreign investor sell-off. While increases in foreign investors in local currency government bond markets may enable EMEs to borrow from abroad, investor sensitivity to foreign exchange rates may in fact increase EMEs’ vulnerability through capital outflows or outsized foreign selling of EME government bonds, which can hamper market making activities of EME dealers. Over the past decade, there has been a rise in foreign bond holdings in Korea3 and other EMEs. My empirical evidence shows that the impact of the dollar on government bond liquidity becomes more pronounced during periods of significant foreign sell-offs of EME government bonds, particularly when the dollar appreciates.

The strength of the US dollar plays a pivotal role in determining the liquidity of EME government bond markets as a global risk factor. Notably, the effects of the US dollar on EME government bond liquidity can be amplified when market uncertainty and government bond yields increase, when banks have lower total capital ratios and greater exposure to foreign currency loans, and when there is a large foreign investor sell-off of EME government bonds. These findings support the idea that EME dealers are influenced by the dollar appreciation through both the channels of “original sin” and “original sin redux”, as corporates affected by “original sin” and foreign investors subject to “original sin redux” serve as their primary business partners. Moreover, the strong linkages between the exchange rate and local financial markets highlights that policy measures to stabilize EME foreign exchange markets can also contribute to enhancing government bond liquidity and thus domestic financial stability.

Benos, E., Gurrola-Perez, P., & Alderighi, S. (2022). Centralising bond trading. World Federation of Exchanges Research.

Brunnermeier, M. K., & Pedersen, L. H. (2009). Market liquidity and funding liquidity. Review of Financial Studies, 22(6), 2201-2238.

Carstens, A., Shin, H.S. (2019). Emerging markets aren’t out of the woods yet. Foreign Affairs, 15 March.

Du, W., & Schreger, J. (2022). Sovereign risk, currency risk, and corporate balance sheets. Review of Financial Studies, 35(10), 4587-4629.

Eichengreen, B., & Hausmann, R. (1999). Exchange rates and financial fragility.

Hofmann, B., Shim, I., & Shin, H. S. (2020). Bond risk premia and the exchange rate. Journal of Money, Credit and Banking, 52(S2), 497-520.

Onen, M., Shin, H. S., & von Peter, G. (2023). Overcoming original sin: insights from a new dataset. BIS Working Papers No. 1075.

Korean Treasury bond market is a good EME government bond market to study due to its size and liquidity as well as the availability of real-time data. The Korea exchange has become one of the largest and most liquid market among global bond exchanges (Benos et al., 2020).

All four measures, except for quoted depth, serve as indicators of illiquidity, with higher values suggesting lower liquidity levels. Quoted depth estimates liquidity, with higher values implying higher levels of liquidity.

The share of Korea Treasury bond holding by foreign investors has increased from 14% in 2016 to 20% in 2022.