This SUERF policy brief is based on the authors’ ECB working paper. The views expressed in this note are those of the authors and do not necessarily reflect those of the European Central Bank (ECB).

Abstract

Independent central banks are better placed to ensure price stability. Based on an empirical analysis of 155 countries for the period 1972 to 2023, this note shows that central bank reforms leading to increased independence improve monetary policy discipline and enhance monetary policy credibility. The impact is strongest in democracies, where independent central banks are publicly held accountable for their decisions. Its effects are more pronounced in countries with no monetary policy targets and in flexible exchange rate regimes. Furthermore, the effect is also particularly notable in countries characterized by high public debt-to-GDP ratios, since greater central bank independence helps to limit government access to inflationary monetary financing.

There has been renewed interest in the benefits and costs of central bank independence (CBI), especially given recent political pressures on central bank officials in advanced economies. Because central bank independence is a key factor influencing price stability, there are substantial risks associated with weakening institutional autonomy.

This policy brief explores two reasons why central banks must remain independent from government influence to preserve price stability: monetary discipline and credibility. Important knowledge gaps are addressed, particularly regarding the exact mechanisms by which CBI reforms may affect domestic inflation dynamics through these channels and the extent to which their impact depends on political and institutional frameworks.

Central bank independence, which has been described as the “DNA” of good central banking practice, refers to the institutional separation of a central bank from political pressures. Independence is critical to achieving price stability and stable long-term economic growth (Adrian, 2024). History has shown that higher central bank independence is associated with lower inflation. The theoretical study by Rogoff (1985) established that legal independence is an institutional response to the time-consistency problem and that appointing a “conservative central banker” is key for monetary policy credibility. Alesina and Summers (1993) showed empirically that central bank independence helps to achieve price stability at no cost to economic performance. Today, there is a broad consensus among academics and policymakers that independent central banks should not attempt to undertake monetary financing of public debt, and that the public should be in the position to hold them accountable for their role.

Independent central banks are powerful, since they are at the heart of the money creation process. In his book “Unelected Power”, Tucker (2020) outlined several principles under which a society can endeavor to delegate responsibility for price stability to an independent agency. To avoid misuses of power, the scope of central banks must be limited to monetary policy aiming at price stability (Issing, 2021). Furthermore, the institutional framework should include sufficient checks and balances of its institutions, high standards of accountability and transparency, a clear mandate for price stability, and the absence of any form of monetary financing.

It enables it to conduct monetary policy with no or minimal government intervention. Central bank independence can be assessed based on two dimensions: “de jure” and “de facto”. Cukierman (1992) shows that legal independence, as laid down in laws and central bank statutes, may diverge from actual independence. Even when central banks enjoy a high degree of legal independence, the actions of politicians can exert a notable influence on the decisions made by central bankers.

Even if formally established as independent, central banks may still be subject to political influences. A study examining 118 central banks in the 2010s showed that around 10% of them faced political pressure in an average year – even those central banks with a high degree of legal independence (Binder, 2021). Moreover, policy reforms may give rise to a “seesaw effect”, which refers to the behavior that, following a reform, governments may have an incentive to regain control over monetary policy and undo the effects of CBI reforms with political appointments of governors (Acemoglu et al., 2008).

Case studies have provided robust evidence that in many countries governors have been dismissed before the end of their regular term, thereby allowing governments to have greater influence on monetary policy and inflation (Cukierman, 1992 and 2008; Crowe and Meade, 2008; Hayat and Farvaque, 2011; De Haan and Eijffinger, 2019; Ioannidou et al., 2023). Over recent decades, attempts to weaken CBI have occurred in concomitance with extraordinary circumstances such as massive financial or political crises, pandemics, fiscal dominance situations, and the rise of populist movements (Binder, 2021).

The focus of our empirical analysis is on central bank reforms, which lead to quantifiable changes in the degree of legal central bank independence, and their effects on monetary discipline and credibility.

Enhancements of central bank independence involve a combination of legal, institutional, and policy reforms. Such reforms typically yield significant benefits for price stability, while improving monetary policy transparency and credibility. Reforms aimed at enhancing central bank independence are often considered relatively easy to implement in the broader context of economic reforms.

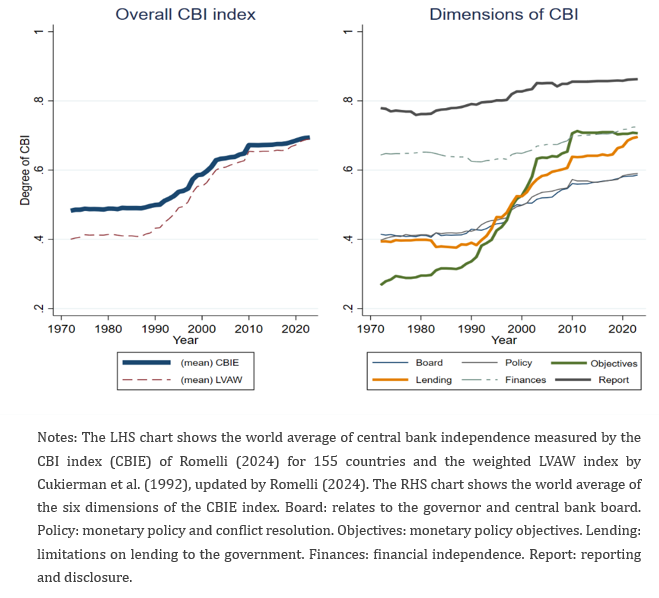

The German Bundesbank has one of the longest traditions of central bank independence in monetary history. Following its example, starting in the 1990s, many countries adopted central bank reforms aimed at increasing the legal independence of their central bank (see Figure 1, LHS). The increase in the degree of central bank independence, observed across countries with varying levels of economic development, signals a widespread recognition of the importance of independent monetary policy in maintaining price stability.

Figure 1. Central bank independence: 1972-2023

Countries with large and influential financial sectors or countries forming monetary unions were at the forefront of this trend (Posen, 1995). The reform effort peaked in 1998 when the Economic and Monetary Union in Europe was created, and the ECB became the sole monetary policy authority for the euro area countries. A further wave of reforms followed the 2008 financial crisis, with increases in the central bank index mainly associated with improvements in the degree of independence related to the clarity of policy objectives, and limitations on lending to the government (see Figure 1, RHS). In some instances, especially over the last decade, reversals of earlier reforms were observed, given that some central banks broadened their mandate to include secondary objectives such as financial stability and climate change or even increased their involvement in banking supervision.

Earlier research has investigated the relationship between central bank independence and macroeconomic performance, and the prevailing consensus suggests that as independence increases, there is a corresponding improvement in price stability. Importantly, this does not have adverse effects on economic growth, the public finances or financial stability.

Important knowledge gaps still exist, however, particularly regarding the exact mechanisms through which CBI reforms affect domestic inflation dynamics and the extent to which their impact depends on other factors. Two mechanisms appear to be key in this respect, notably a better control of the money supply growth and enhanced central bank credibility (Rogoff, 1985; Cukierman, 1992).

The “money view”, grounded on a stable long-run link between excess money growth and inflation, highlights the importance of monetary discipline for price stability, since it implies that variations in the money supply are a primary source of changes in the price level (Barro, 2007; McCallum and Nelson, 2011; Jung, 2025).

Likewise, credibility-enhancing monetary policy strategies have proven particularly effective in anchoring inflation expectations and mitigating time inconsistency problems. These strategies have improved the management of inflation expectations through credible communication and increased policy transparency (Blinder et al., 2008).

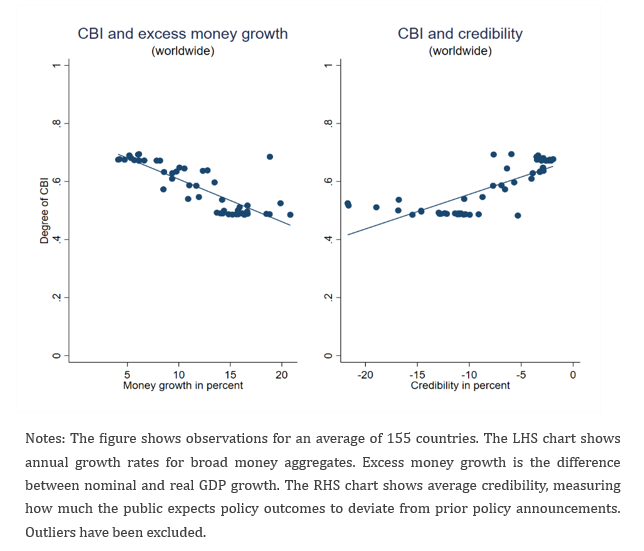

The link between CBI and monetary discipline or credibility is illustrated in Figure 2. Data for an average of 155 countries document a negative correlation between CBI and excess money growth and a positive correlation between CBI and credibility for the past 50 years. Though this descriptive evidence does not yet allow a conclusion about the causality of the links.

Figure 2. CBI, monetary discipline and credibility

Our primary proxy for monetary discipline is annual excess broad money growth, defined as the difference between nominal money growth and real GDP growth (Barro, 2007). The measure of monetary discipline rests on the long-run relationship between money growth and inflation, embodied in the quantity theory of money. Central bank credibility is assessed using deviations between observed inflation and announced inflation targets (Weber et al., 1991). While alternative, forward-looking measures of credibility have been discussed in the literature, our credibility measure is backward-looking and reflects data constraints on private inflation expectations, especially in developing countries.

We employ local projections with instrumental variables (LP-IV; for details, see Jordà and Taylor, 2025) to explore the links between changes in the legal CBI index, as our measure of central bank reforms, and monetary discipline and credibility, respectively. This econometric method is known for establishing causality and addressing potential endogeneity concerns, if an appropriate instrument is used that is relevant and exogenous (Stock and Watson, 2018). Drawing on Romelli (2022), we identify regional peer pressure as a relevant instrument, given its key role as a driver of reforms in central bank design.

Our panel dataset is comprehensive and covers 155 countries over more than 50 years (1972–2023). The dataset integrates macroeconomic, institutional, and control variables from the World Bank’s World Development Indicators (WDI), the IMF’s International Financial Statistics (IFS), and the ECB’s Statistical Data Warehouse (SDW).

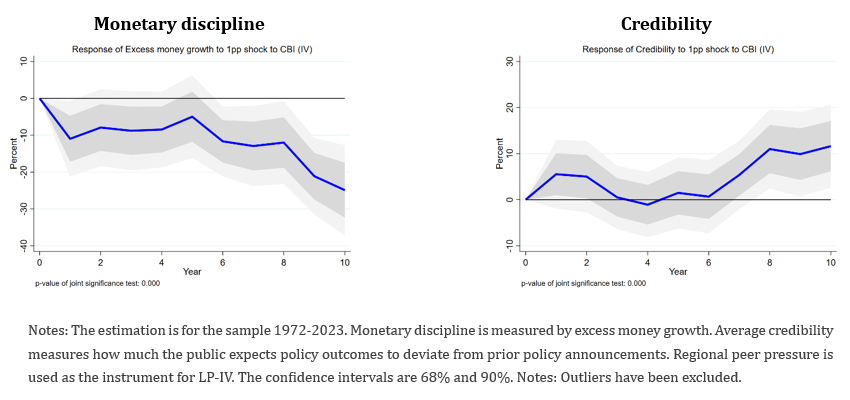

Figure 3. Results from instrumental variable local projections for legal CBI (LP-IV)

The results demonstrate that central bank independence is a core determinant of monetary discipline and credibility, since improvements in central bank independence are causal for increases in monetary discipline and central bank credibility (see Figure 3). The results in Figure 3 (LHS) suggest that a one-percentage-point increase in the CBI index is associated with an average reduction in excess money growth of 21% after ten years following a reform. Higher independence also strengthens monetary policy credibility. The results of the LP-IV estimates in Figure 3 (RHS) show that an increase in the CBI index leads to a significant increase in average credibility, by almost 15% after ten years. This effect is persistent and most pronounced eight years after a reform.

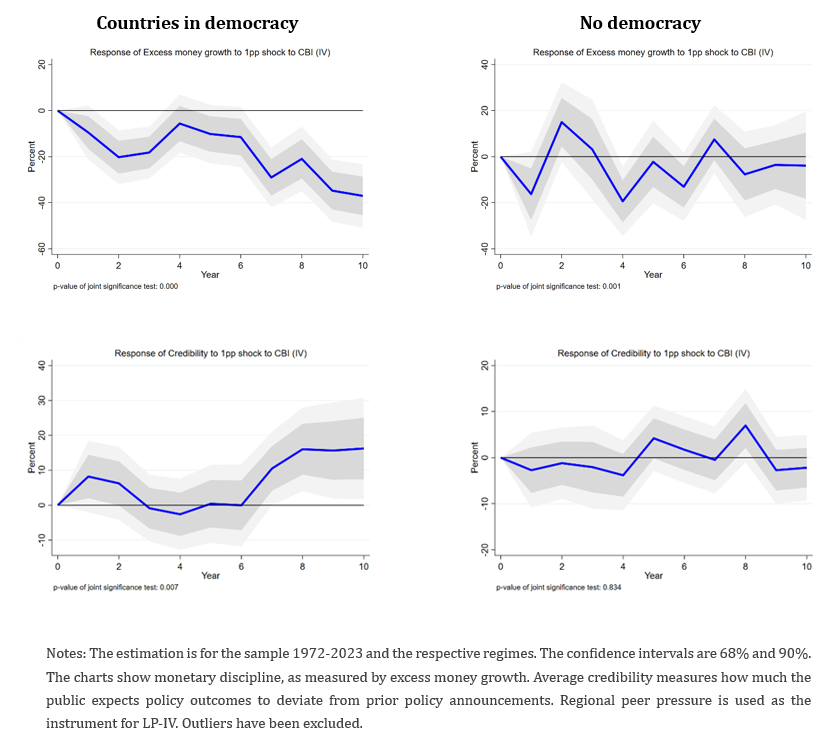

The impact of central bank reforms also depends on the political system. Democracies typically have higher transparency and accountability standards than autocracies. Therefore, democracies are more likely to establish and maintain independent central banks (Crowe and Meade, 2008).

Anecdotal evidence suggests that leaders in autocratic countries often exerted pressure on central banks to monetize debt, which has stimulated inflation. Prominent examples include Zimbabwe (under Robert Mugabe) and Venezuela (under Nicolás Maduro), where political pressure on the central bank led to hyperinflation. Political interference is less likely in democracies, since monetary policy decision-making is more transparent, and the central bank is held accountable by democratic institutions. As suggested by Bodea and Hicks (2015), the freedom to oppose government actions correlates with lower money growth. However, in democracies, the electoral cycle can create pressures for more expansionary fiscal and monetary policies, undermining monetary discipline.

To test whether differences in political systems influence the effects of central bank reforms on monetary discipline, we re-estimate the local projections, distinguishing between the impact of reforms in democracies and autocracies. The results of these estimations (Figure 4) suggest that, in democratic countries, an increase in the CBI index leads to a significant decline in excess money growth and credibility, while those effects are not significant in autocracies.

A further point is that in democracies the relationship between CBI and monetary discipline may be influenced by the specific type of electoral system in place, notably whether a country has a presidential (or semi-presidential) or a parliamentary system, given its implications for the decision-making process, the accountability of governments, and macroeconomic performance (Persson et al., 1997; McManus and Ozkan, 2018). In presidential systems, the capacity for a president to exert influence over the central bank can be more significant and lead to increased pressure on the central bank to ease monetary policy, whereas the diffusion of powers in parliamentary systems can enhance CBI, as the central bank may be more insulated from direct political pressure. Our results suggest that the link between CBI and monetary discipline works especially in countries with presidential (or semi-presidential) systems.

Figure 4. Results from instrumental variable local projections for legal CBI: Political systems

Global inflation receded after the Great Moderation, partly due to the beneficial impacts of globalization on prices and the adoption of inflation-targeting (IT) strategies. This monetary policy strategy represents an explicit public commitment by the central bank to low and stable inflation, as discussed by Bernanke et al. (1999).

Since the mid-1990s, the popularity of the IT approach has increased. Inflation targets have played a crucial role in achieving and maintaining price stability by providing a clear reference point for monetary policy and private expectations. They help central banks guide expectations and decisions regarding inflation and other economic variables and facilitate accountability for policy decisions. In fact, countries adopting inflation targeting strategies experienced improved inflation performance, particularly when paired with independent central banks (Mishkin and Schmidt-Hebbel, 2007).

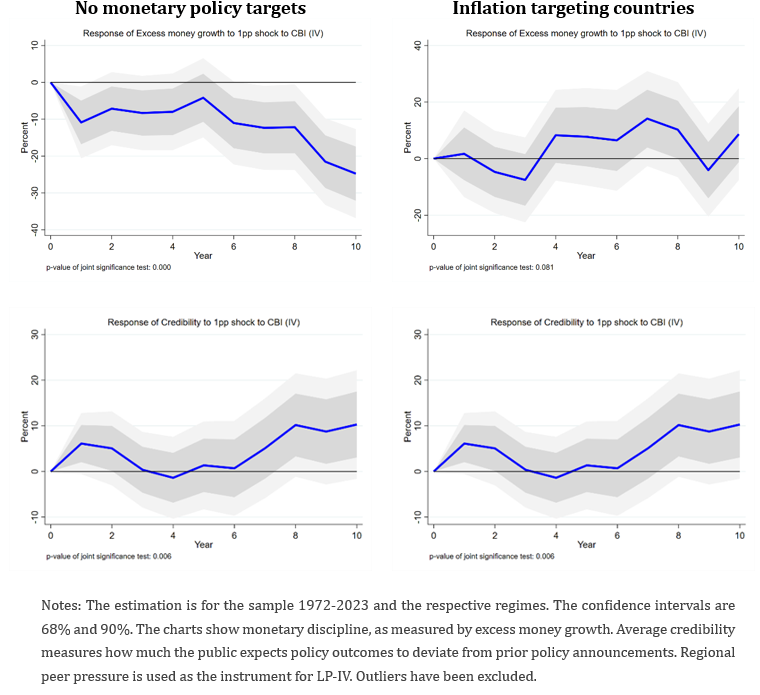

We examine whether monetary policy strategies explain differences in how CBI reforms impact monetary discipline. The results of these estimations (see Figure 5) show that the influence of CBI on monetary discipline and credibility is significant for countries adopting no monetary policy targets and is weak or even absent for countries with IT strategies. Although this finding may in part be related to the fact that most countries with IT strategies already have a high level of central bank independence, it supports the view that central bank reforms and decisions about the monetary policy strategy are independent tools.

Figure 5. Results from instrumental variable local projections for legal CBI: The monetary policy strategy

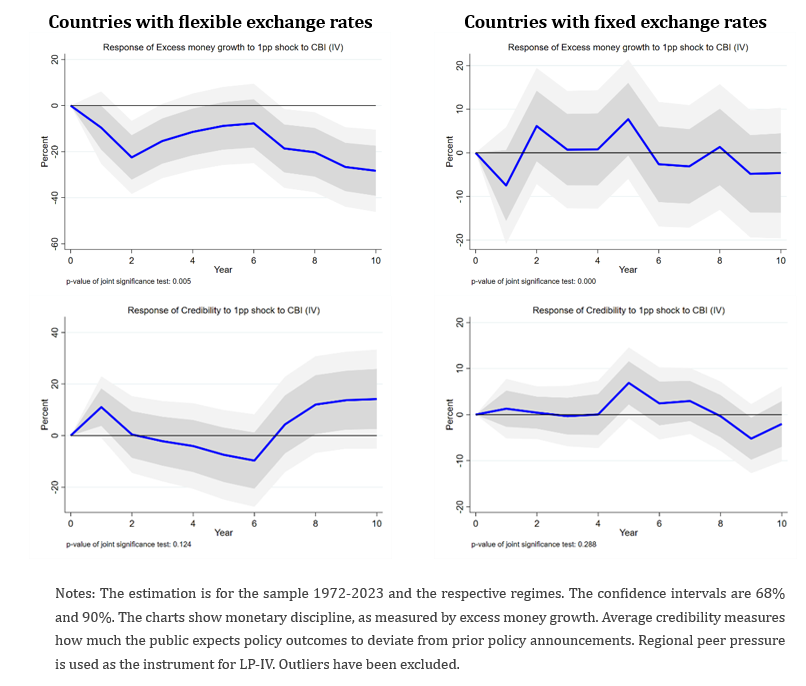

Next, we examine whether the exchange rate regime explains differences in how CBI reforms impact monetary discipline. Independence and flexible exchange rates allow central banks to set the monetary policy stance consistent with domestic inflation targets. In fixed exchange rate regimes, however, a country imports low inflation from an anchor country and loses control over its domestic money supply (Obstfeld and Rogoff, 1995).

The results (see Figure 6) show that the disciplining effect of CBI on excess money growth and credibility is visible in countries with flexible exchange rates, whereas it is not significant for countries with fixed exchange rates.

Figure 6. Results from instrumental variable local projections for legal CBI: The exchange rate regime

Beyond monetary discipline and credibility, the literature stresses that fiscal discipline is an essential complement to CBI for achieving price stability (Woodford, 2001). When independent central banks cannot monetize public debt, governments are incentivized to adopt sustainable fiscal policies, reducing inflationary pressures (De Haan and Eijffinger, 2019). Effective fiscal and monetary policy coordination helps to control inflation, as it aligns government spending and taxation plans with monetary objectives. Fiscal rules can further amplify the effectiveness of monetary policy strategies by aligning fiscal and monetary objectives (von Thadden, 2004), particularly in high-debt contexts where fiscal dominance risks are prominent.

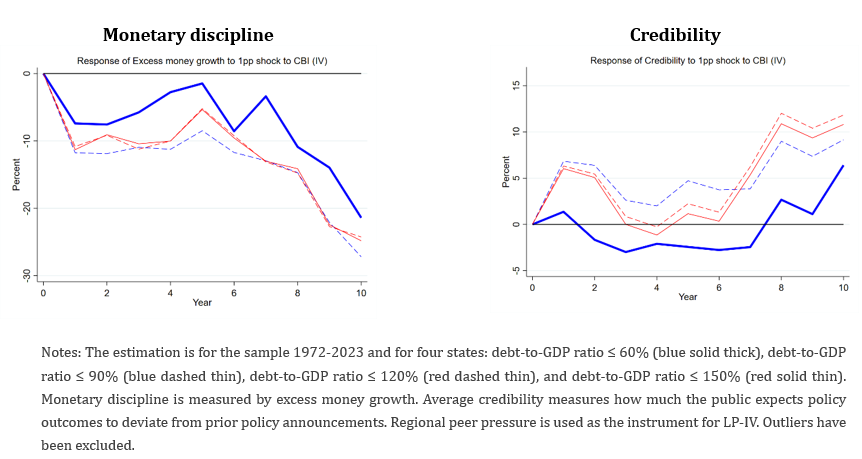

Figure 7. State-dependence: different public debt regimes

The impact of CBI on monetary discipline varies significantly depending on the fiscal context of a country (see Figure 7). In countries with debt-to-GDP ratios above 90%, CBI reforms reduce excess money growth more substantially, reflecting the alleviation of fiscal dominance pressures. Conversely, in low-debt environments (debt-to-GDP below 60%), the effects are more muted, as fiscal pressures on monetary policy are less severe.

The pronounced effects of CBI in high-debt environments suggest that its influence extends beyond enhancing monetary discipline and credibility. Countries with high debt-to-GDP ratios experience disproportionate improvements in monetary discipline from CBI reforms. This is even more evident when looking at the significant decline in excess money growth in these contexts, which suggests that CBI reforms alter fiscal incentives by limiting access to inflationary monetary financing. These findings suggest that the lack of prudent fiscal frameworks preventing high-debt levels can amplify the benefits of CBI reforms by reducing political incentives to monetize debt.

Successful central bank reforms require sustained changes to the legal and institutional frameworks governing the central bank. However, as monetary history has shown, there have been many examples of countries where central bank reforms have been reversed. In our sample, we counted 76 countries with decreases in the independence index, of which 15 countries displayed large reversals of earlier reforms (i.e. significant declines in the index). Such reversals of earlier reforms can profoundly impact the central bank’s autonomy and ability to implement policies without political interference.

Especially countries with political instability, weak institutions, and high public debt levels often have reversed reforms (Cukierman, 2008; De Haan and Eijffinger, 2019; Dincer and Eichengreen, 2014). If the identified relationship is linear and symmetric, our results imply that those reversals, will reduce incentives for monetary discipline and weaken the credibility of the central bank, contributing to unanchored inflation expectations and declining policy effectiveness.

The study also employs semiparametric estimates following Acemoglu et al. (2019) to distinguish the effects of large reforms and reversals, notably changes in the CBI index above or below historical means. Our results indicate that large reforms enhancing CBI have led to a persistent reduction in excess money growth and improved credibility, with effects materializing over a decade and lasting up to 20 years. In contrast, reversals of such reforms produce adverse effects for monetary discipline and credibility, though those effects are more difficult to prove, in part owing to the relatively small number of observations.

Additionally, the study tests the robustness of the findings on the relationship between central bank independence and monetary discipline using various measures, including alternative CBI indices and democracy indices. Results confirm a negative relationship between CBI and monetary discipline, with key dimensions like monetary policy, conflict resolution, clear policy objectives, and limitations on government lending driving this influence while financial independence matters as well, at least over longer horizons. Overall, the link is more pronounced in emerging markets and developing countries, possibly reflecting threshold effects identified at a CBI index level of 0.80. Non-linearities were explored but not found significant.

Furthermore, the study examines the decoupling between de jure and de facto independence, influenced by political pressures and factors like democracy levels. Using turnover rates of central bank governors as proxies for de facto independence, the study finds no significant relationship between reductions in de facto CBI and excess money growth or credibility. These findings reflect limitations in using turnover rates as proxies for de facto independence, as they may not fully capture operational independence due to non-political reasons for leadership changes.

Based on the evidence and the relevant literature, several practical recommendations emerge for policymakers seeking to leverage the benefits of central bank reforms:

Reforms that increase legal CBI yield long-lasting improvements in monetary discipline and credibility. CBI reforms limit excessive money supply growth, an important driver of inflation according to the “money view”. CBI reforms also strengthen central bank credibility, thereby stabilizing inflation expectations in line with publicly announced inflation targets. These results highlight the key benefits of preserving and strengthening institutional autonomy to maintain price stability.

CBI’s effectiveness depends on political and institutional frameworks. The effects of CBI on monetary discipline and credibility are stronger in democratic countries, where it incentivizes policymakers to avoid inflationary monetary expansions. Its effects are also pronounced in countries with flexible exchange rates and countries without a predefined monetary policy strategy. Additionally, the effects of CBI on monetary discipline and credibility are more substantial in countries with high public debt-to-GDP ratios.

Central bank independence is a key institutional feature that improves the effectiveness of monetary policy in controlling inflation. Policymakers designing reforms in central bank design should account for existing fiscal frameworks and monetary regimes. For instance, combining central bank reforms with fiscal reforms that enhance coordination between monetary and fiscal policy could amplify the long-term inflation-stabilizing effects of CBI.

Reforms should also consider the broader political context of a country, as the impact of CBI on monetary discipline and credibility is less pronounced in countries characterized by weak democratic institutions. Therefore, strengthening democratic governance can amplify the benefits of CBI by ensuring accountability and reducing political interference.

Acemoglu, D., Johnson, S., Querubin, P., Robinson, J.A., 2008. When does policy reform work? The case of central bank independence. Brookings Papers on Economic Activity 2008(1), 351–418.

Acemoglu, D., Naidu, S., Restrepo, P., Robinson, J.A., 2019. Democracy does cause growth. Journal of Political Economy 127(1), 47-100.

Adrian, T., 2024. Central Bank Independence: Why It’s Needed and How to Protect It. Speech at the Bank of Thailand Annual Retreat, 14 June 2024.

Alesina, A., Summers, L., 1993. Central bank independence and macroeconomic performance: some comparative evidence. Journal of Money, Credit and Banking 25(2), 151-162.

Barro, R., 2007. Macroeconomics: A Modern Approach. Thomson/South-Western Educational Publishing, 8th Edition.

Bernanke, B., Laubach, T., Mishkin, F., Posen, A., 1999. Inflation Targeting. Princeton University Press.

Binder, C., 2021. Political pressure on central banks. Journal of Money, Credit and Banking 53(4), 715-744.

Blinder, A.S., Ehrmann, M., Fratzscher, M., De Haan, J., Jansen, D., 2008. Central bank communication and monetary policy: a survey of theory and evidence. Journal of Economic Literature 46(4), 910-945.

Bodea, C., Hicks, R., 2015. Price stability and central bank independence: Discipline, credibility, and democratic institutions. International Organization 69, 35-61.

Crowe, C., Meade, E.E., 2008. Central bank independence and transparency: Evolution and effectiveness. European Journal of Political Economy 24 (4), 763-777.

Cukierman, A., 1992. Central Bank Strategy, Credibility, and Independence. Cambridge: MIT Press.

Cukierman, A. 2008. Central bank independence and monetary policymaking institutions – Past, present and future. European Journal of Political Economy 24(4), 722-736.

De Haan, J., Eijffinger, S., 2019. The Politics of Central Bank Independence. in: R. Congleton, B. Grofman, S. Voigt (eds.), The Oxford Handbook of Public Choice, Volume 2.

Dincer, N., Eichengreen, B., 2014. Central bank transparency and independence: Updates and new measures. International Journal of Central Banking 10(1), 189-253.

Hayat, M., Farvaque, E., 2011. When are central bankers removed? Revue économique 62(3), 471-478.

Ioannidou, V., Kokas S., Lambert, T., Michaelides, A., 2023. (In) Dependent Central Banks. CEPR Discussion Paper No. DP17802.

Issing, O., 2021. Central Banks – Independent or Almighty? SAFE Policy Letter No. 92, November.

Jordà, O., Taylor, A., 2025. Local Projections. Journal of Economic Literature 63(1), 59-110.

Jung, A., 2025. The Quantity Theory of Money: An empirical analysis for 1870 – 2020. Journal of Macroeconomics, forthcoming.

McManus, R., Ozkan, F.G., 2018. Who does better for the economy? Presidents versus parliamentary democracies? Public Choice 176(3), 361-387.

McCallum, B.T., Nelson, E., 2011. Money and Inflation: Some Critical Issues. In B. Friedman and M. Woodford (eds.), Handbook of Monetary Economics 2, 97-154.

Mishkin, F., Schmidt-Hebbel, K., 2007. Does Inflation Targeting Make a Difference? NBER Working Paper No. 12876.

Obstfeld, M., Rogoff, K.S., 1995. The mirage of fixed exchange rates. Journal of Economic Perspectives 9(4), 73-96.

Persson, T., Roland, G., Tabellini, G., 1997. Separation of powers and political accountability. The Quarterly Journal of Economics 112(4), 1163-1202.

Posen, A., 1995. Declarations Are Not Enough: Financial Sector Sources of Central Bank Independence. in: NBER Macroeconomics Annual 1995, Vol. 10, 253-274, National Bureau of Economic Research.

Rogoff, K., 1985. The optimal degree of commitment to an intermediate monetary target. Quarterly Journal of Economics 100, 1169-1189.

Romelli, D., 2022. The political economy of reforms in central bank design: evidence from a new dataset. Economic Policy 37(112), 641-688.

Romelli, D., 2024. Trends in Central Bank Independence: A De-jure Perspective. Bocconi University Working Paper No. 217, February 2024.

Stock, J., Watson, M., 2018. Identification and estimation of dynamic causal effects in macroeconomics using external instruments. The Economic Journal 128, 917-948.

Tucker, P., 2020. Unelected Power: The Quest for Legitimacy in Central Banking and the Regulatory State. Princeton: Princeton University Press.

Von Thadden, L., 2004. Active monetary policy, passive fiscal policy and the value of public debt: Some further monetarist arithmetic. Journal of Macroeconomics 26(2), 223-251.

Woodford, M., 2001. Fiscal requirements for price stability. Journal of Money, Credit and Banking 33(3), 669-728.