This Policy Brief summarizes our research on the sovereign-bank nexus in the context of European banks for the decade beginning with the Global Financial Crisis focusing on the composition effects of sovereign portfolio holdings on the risk profile of banks. As predicted, we find that bank risk is higher a) when the bank is domiciled in a country with high sovereign risk, and b) when sovereign portfolio holdings include a larger share of securities issued by crisis sovereigns. However, the differential risk impact of carrying a high share of government debt issued by crisis sovereigns is statistically lower for banks located in a high-risk country compared with those headquartered in a low-risk country. This finding may suggest that past Euro Area policies (e.g., reforms of the institutional framework such as the Banking Union) were successful in mitigating the risk of high-risk sovereigns and stabilizing bank risk.

The 2008 Global Financial Crisis (GFC) brought risks from sovereign-bank linkages to the forefront, particularly in the European Union where banks buy large quantities of sovereign debt as part of their securities portfolio. Now, more than a decade later, European banks still carry a significant amount of sovereign debt on their balance sheets, raising concerns about the implications on bank risk.

Our research, summarized in this Policy Brief, belongs to the literature on the management of the sovereign-bank nexus. Most research previously analyzed the determinants of sovereign portfolio holdings of banks, whereas others focused on their size effects. Our research contributes to the latter strand of literature by presenting evidence on the link between the composition of sovereign portfolios and banks’ risk profile.1 We are particularly interested in how the choice of sovereign portfolios may affect bank risk, taking into consideration the domiciliation of the bank.

Our methods differ from previous studies with respect to the sample and period coverage, as well as the measures of risk considered. First, we use a large sample of banks incorporated in the euro area and the non-euro European Union (EU) countries plus Norway and Iceland, providing a more comprehensive picture about the importance of sovereign portfolio composition on bank risk, compared with previous studies. Second, the analysis period (2009-2018) covers the marked return of distressed European sovereigns to the market, in contrast to previous studies that are generally limited to the GFC period (mid-2007 to 2009).

Further, we use accounting measures of overall bank risk (the standard deviation of return on average assets (ROAA) and the Z- Score) instead of market measures of risk because private banks make up the majority of banks in the EU (in our sample, less than 3 percent of banks are publicly listed). This choice of risk measures allows us to capture a larger and more representative sample of banks compared with other related studies that use market measures of risk. Another advantage is that, during stress episodes, these indicators are less volatile and noisy than market measures of risk, as the latter might reflect information that is due to speculation by agents rather than changes in bank risk per se. Hence, our analysis complements other research that employs market-based indicators of bank risk.

Using sovereign exposure data from the European Banking Authority for a large sample of 156 European banks from the EU plus Norway and Iceland over the 2009-2018 period, we find the following:

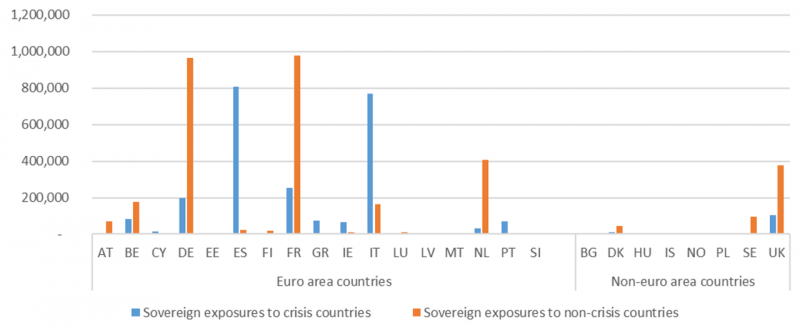

Figure 1

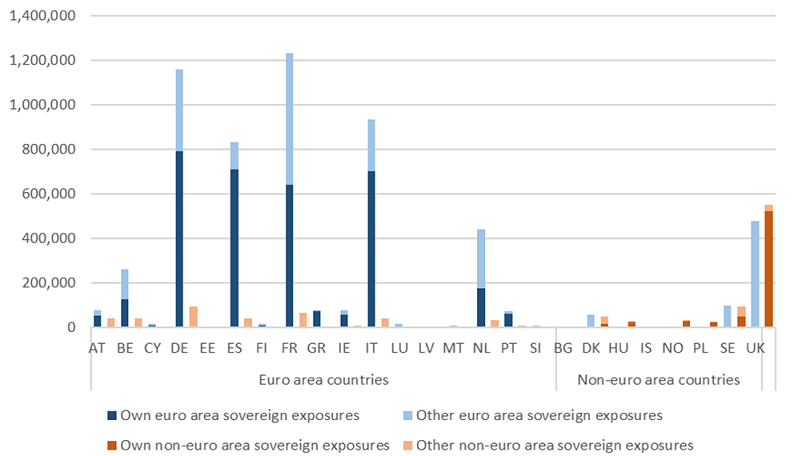

Figure 2

Our measures of bank risk may underestimate bank risk (variability of ROAA) because EU banks hold the largest proportion of their sovereign portfolios in the ‘Available For Sale’ category, where revaluations of the sovereign portfolio are not reflected in banks’ P&L.

Selva Bahar Baziki, María J. Nieto, Rima Turk-Ariss (2023), Sovereign portfolio composition and bank risk: The case of European banks, Journal of Financial Stability, Volume 65, 2023, 101108. https://doi.org/10.1016/j.jfs.2023.101108.

Baziki, Nieto and Turk-Ariss (2023).