Disclaimer: The views expressed represent the authors’ personal opinions and do not necessarily reflect the views of the Deutsche Bundesbank or the Eurosystem.

We utilize the Eurosystem securities lending facilities as a laboratory to investigate the impact of collateral scarcity on market functioning. The reduction of securities lending fees, implemented in November 2020, provides a natural experiment for our analyses. This policy change results in a surge in the utilization of securities lending facilities, particularly for bonds with limited supply elasticity in the repo market. We find no evidence of substitution effects; instead, the overall activity in the repo market expands through the collateral multiplier. The improved pricing conditions alleviate collateral scarcity and enhance market quality in both the repo and cash markets.

Quantitative easing has expanded central banks’ balance sheets, making them one of, if not the largest single owners of sovereign and public-sector bonds. This significant ownership has the potential to exacerbate existing demand and supply imbalances for safe assets imbalances for safe (Caballero and Krishnamurthy, 2009; Krishnamurthy and Vissing-Jorgensen, 2012), leading to adverse effects on the functioning of financial markets. Specifically, safe assets play a pivotal role as collateral within the financial system. The withdrawal of these assets from the market can impair the functioning of the collateral market, i.e., the repo market. Considering the key role the repo market plays for allowing arbitrage of government bonds (Adrian, Begalle, Copeland and Martin, 2013), any deterioration in market quality within the repo market can adversely impact liquidity and price discovery in the cash market. Moreover, impaired market functioning could feed back into the efficacy of monetary policy as it relies on a smooth transmission of key policy rates through money and bond markets.

To counteract such negative side effects, central banks have chosen to make their purchased bonds available for securities lending. These securities lending facilities (SLFs) are supposed to act as a backstop, providing market participants, in particular primary dealers, with collateral when specific securities become scarce, thereby safeguarding market functioning. As a result, with the establishment of securities lending facilities in most developed financial markets, central banks effectively have assumed the role of the “securities lender of last resort”.

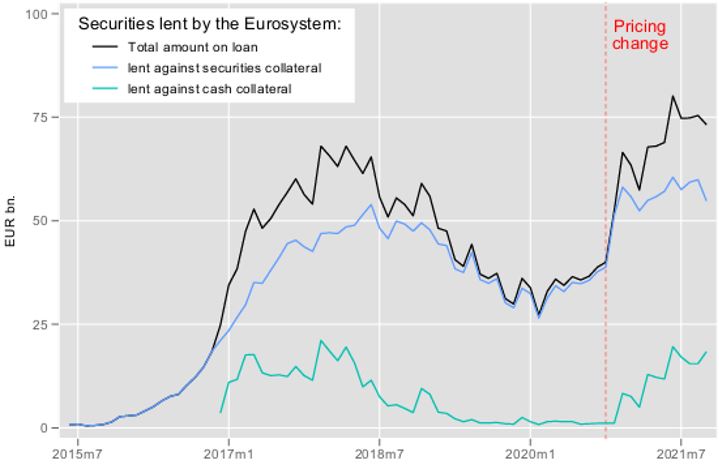

This policy brief summarizes recent research (Greppmair & Jank, 2023), which utilizes the securities lending facilities as a laboratory to understand the effects of collateral scarcity on market functioning. Specifically, we capitalize on a natural experiment that took place in November 2020, where the Eurosystem modified the pricing conditions of its securities lending facilities, resulting in a significant reduction in the cost of borrowing securities. The pricing change reduced the minimum rate for securities borrowing against cash collateral by a third, and against securities collateral by half. As a result, the utilization of SLFs within the Eurosystem nearly doubled, surging from 35 billion EUR to 69 billion EUR, as can be seen in Figure 1. We utilize this sizable central bank-induced collateral supply shock to comprehend how collateral is channeled through the financial system and what impact it has on market functioning in both the repo and cash markets. Our identification strategy builds on the pricing change, combined with the fact that securities are differentially impacted by the new pricing conditions. In particular, we hypothesize – and subsequently validate in our analysis – that the utilization of securities lending facilities will be higher for securities with a lower elasticity in supply to the repo market. In our empirical analysis, we utilize the comprehensive ownership data available in the Securities Holdings Statistics to measure the supply elasticity of securities within the repo market.

Figure 1: Eurosystem’s public sector securities lending balances

Note: This figure shows Eurosystem PSPP and public sector PEPP securities lending balances over time since the start of the securities lending facilities. The figure shows the total on-loan amount as well as the breakdown by securities lent against securities collateral and securities lent against cash collateral, the latter being possible as of December 8, 2016. The red dashed line marks the Eurosystem’s change in pricing conditions effective since November 02, 2020. Data source: ECB.

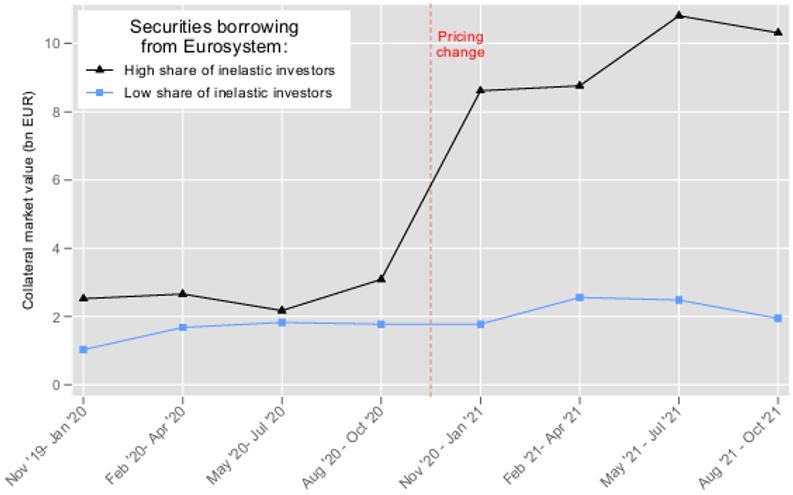

Following the enhancement of pricing conditions in securities lending facilities by the Eurosystem, there is a substantial surge in utilization, particularly for bonds with inelastic supply to the repo market. We illustrate this finding in Figure 2, which plots the aggregate securities borrowing from the Eurosystem for securities with low and high shares of inelastic investors, with the median as cutoff. Before the pricing change, securities with an inelastic investor base are borrowed to a slightly greater extent from the Eurosystem than securities with an elastic investor structure. After the Eurosystem changed its pricing policy we see a sharp increase in securities borrowing only for bonds with otherwise inelastic supply to the repo market. Securities borrowing of bonds with low supply more than doubles from 3 billion EUR in the months August to October 2020 to 8 billion EUR in the months November 2020 to January 2021. Securities borrowing of bonds with high supply, on the contrary, remains unaffected by the change in pricing conditions. The increase in borrowing securities is of comparable magnitude across cash and securities collateral and it mainly takes place at longer tenors, up to one week and above.

In our further analyses, we find no evidence that market participants substitute securities borrowing from other market participants with borrowing from central banks. On the contrary, securities borrowing and lending increases among market participants, consistent with the theory of a collateral multiplier (Bottazzi, Luque and Pascoa, 2012; Gorton, Laarits and Metrick, 2020; Infante, Pressand Saravay, 2020). This implies that a securities borrowed from the central bank by one market participant is subsequently reused in another separate repo transaction with a different market participant. The recipient of the security then reuses it in yet another transaction, and so on. Consequently, through multiple reuses, the collateral provided by the central bank leads to a significant expansion in the overall collateral available within the market. Based on our estimates, we find that when the central bank lends out one unit of collateral, it effectively expands the total available collateral in the repo market by more than three units.

Figure 2: Securities borrowing from the Eurosystem across securities with otherwise elastic and inelastic supply to the repo market

Note: This figure shows aggregate securities borrowing from the Eurosystem for securities with an otherwise low and high share of inelastic investors, with the median as cutoff. We report the average daily market value of securities borrowed during periods of three months. The sample consists of MMSR reporting agents and their repo activity in government bonds of financially developed markets; the sample period is November 01, 2019 to October 31, 2021. The red dashed line marks the Eurosystem’s change in pricing conditions effective as of November 02, 2020.

The increase in collateral availability has a notable impact on both the repo and cash markets. After the pricing change, securities with otherwise inelastic supply become less scarce, in particular in the overnight segment. As complementary evidence for improved repo market functioning, we also observe a significantly lower level of rate dispersion for bonds with low supply elasticity. The greater collateral availability appears to also improve market making in the cash market, as evidenced by an increase in secondary market liquidity after the pricing change. For bonds with inelastic supply to the repo market, we observe significant reductions in bid-ask spread and yield curve fitting errors after the pricing change.

Overall, our evidence suggests that making securities available for lending helps alleviate QE-induced scarcity effects in financial markets. Additional collateral supply, resulting from a reduction of the Eurosystem’s lending fees, enhances market conditions in both repo and cash markets without diminishing private market activity. Hence, securities lending facilities appear to be an effective tool through which central banks can support bond market functioning.

Adrian, T., Begalle, B., Copeland, A., & Martin, A. (2013). Repo and securities lending. In Risk topography: Systemic risk and macro modelling (pp. 131-148). University of Chicago Press.

Bottazzi, J.-M., Luque, J. and Pascoa, M. R. (2012), ‘Securities market theory: Possession, repo and rehypothecation’, Journal of Economic Theory 147(2), 477–500.

Caballero, R. J., & Krishnamurthy, A. (2009). Global imbalances and financial fragility. American Economic Review, 99(2), 584-588.

Gorton, G., Laarits, T. and Metrick, A. (2020), ‘The run on repo and the Fed’s response’, Journal of Financial Stability 48, 100744

Greppmair, S., & Jank, S. (2023). Collateral scarcity and market functioning: Insights from the Eurosystem securities lending facilities (No. 31/2023). Deutsche Bundesbank Discussion Paper.

Infante, S., Press, C. and Saravay, Z. (2020), Understanding collateral re-use in the us financial system, in ‘AEA Papers and Proceedings’, Vol. 110, pp. 482–86.

Krishnamurthy, A., & Vissing-Jorgensen, A. (2012). The aggregate demand for treasury debt. Journal of Political Economy, 120(2), 233-267.