This policy brief is based on Andersen Institute Note, Federal Reserve Independence, Federal Finance, and the Uneasy Relationship. The views expressed are those of the authors and do not represent an official position of the Andersen Institute for Finance and Economics or affiliated organizations.

Abstract

This note explores some of the implications for central banks of the long-term adverse trends in federal finance across many countries. In the United States, many forecasters project a rapid increase in the debt to GDP ratio over coming decades from an already elevated level. Based on some simple exercises, that trend could be associated with significant upward pressure on longer-term Treasury yields and strains in Treasury market liquidity. Many other countries are facing similar issues. Given the importance of sovereign debt markets in the implementation and transmission of monetary policy, the Federal Reserve and other central banks have already taken important steps to provide support for sovereign debt markets. As supply-driven pressures in sovereign debt markets mount over coming decades, central banks could find it necessary to take even more aggressive actions along these lines—actions that may be necessary to promote their macroeconomic objectives but at the same time may also heighten political pressures that pose risks to central bank independence.

Central banks and central governments have faced enormous challenges in connection with sovereign debt markets and federal finances over recent years and there seems to be little chance of relief in the foreseeable future. In the United States, persistent budget deficits are projected to push the debt to GDP ratio (DGDP ratio) much higher over coming years. Federal finances are under strain in other major countries as well including many in the Euro area and Japan. As discussed in more detail below, in this environment, the Fed may find itself increasingly drawn toward measures to support the smooth functioning of the Treasury market and to offset a prospective tightening of financial conditions that could otherwise accompany intensifying fiscal pressures. Absent improvement in the fiscal outlook, other central banks may similarly be pulled toward greater involvement in sovereign debt markets over time. That increased involvement may be necessary for central banks to achieve their macroeconomic objectives but at the same time may also expose central banks to increased political pressures and a possible erosion of independence over time.

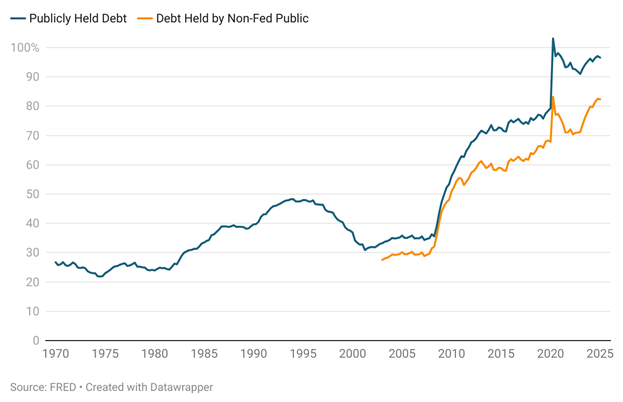

As shown in Figure 1, the DGDP ratio in the United States moved up appreciably over the 1980s and early 1990s, reaching a peak of about 48 percent before trending lower over the 1990s.1 The DGDP ratio ballooned over the next 25 years in light of persistent budget deficits and especially those associated with the Global Financial Crisis (GFC) and the pandemic. After passage of fiscal legislation this summer, the Yale Budget Lab projection had the DGDP ratio moving up to about 1.9 by 2054.2

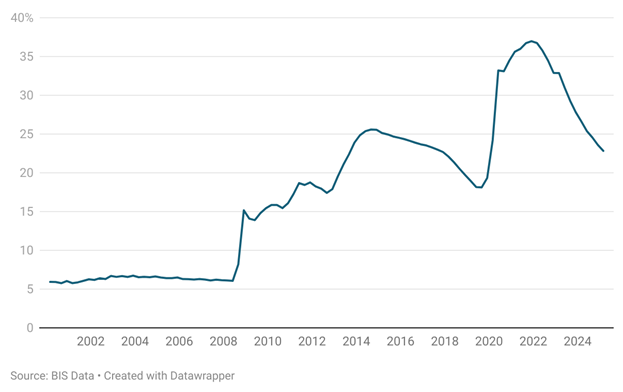

Of course, the GFC and the pandemic had enormous implications for the Fed’s balance sheet as well. As shown in Figure 2, Fed assets as a share of GDP moved sharply higher over the periods 2008-2012 and 2020-2021 reflecting the effects of large-scale asset purchase programs conducted to address those crises. The Fed has been gradually reducing the size of its balance sheet since June of 2022. All else equal, the reduction in the Fed’s holdings of Treasury securities implies that the non-Fed public has needed to play a large role in absorbing the increase in Treasury supply.

Figure 1. Debt to GDP Ratios

Figure 2. Fed Assets to GDP Ratio

We can explore some of the connections between the Fed’s balance sheet policies and federal debt trends using a simple debt to GDP calculator. 3 In the analytical framework underlying the calculator, Treasury and Fed actions that remove longer-term securities from the private sector tend to reduce federal government financing costs over time through two channels. The first channel is a supply and demand effect on term premiums; all else equal, larger Fed holdings of longer-term securities imply lower holdings of longer-term securities by the non-Fed public, driving bond prices up and bond yields down. In addition, Fed purchases of longer-term securities may drive down government financing costs if the yields on long-term debt are above the level of the interest rate on reserve balances. In that case, larger holdings of longer-term securities in the Fed’s portfolio tend to increase Fed remittances and so reduce the government’s funding need.

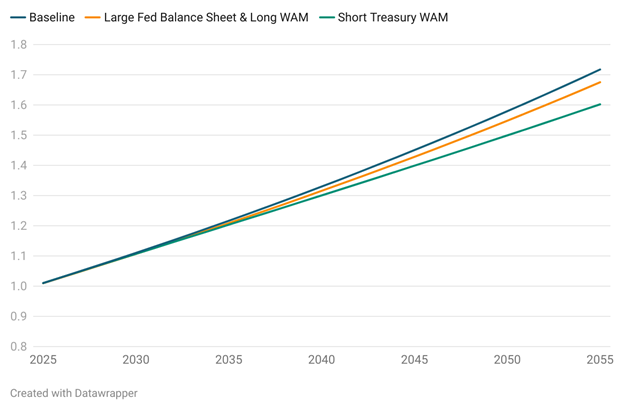

Figure 3 below shows projections for the DGDP ratio over time for some illustrative scenarios. In the baseline scenario, the Fed targets a weighted average maturity (WAM) for its portfolio of 6 years with the size of its balance sheet held constant as a share of GDP at about 23 percent. The short Treasury WAM scenario assumes that the Treasury adjusts its issuance over time to reduce the long-run WAM of federal debt from 6 years to 4 years. The large Fed balance sheet & long WAM scenario assumes that the Federal Reserve targets a WAM of its Treasury portfolio of 9 years and also aims for a long-run size of its balance sheet at 30 percent of nominal GDP.

In all the simulations, the trajectory of the DGDP ratio is largely driven by persistent primary budget deficits. However, the simulations do suggest that Fed balance sheet decisions, and especially Treasury debt management decisions, can have meaningful effects on the DGDP ratio and related statistics over time. Fed actions that increase the size of its balance sheet and lengthen the maturity composition of its securities holdings will tend to put downward pressure on longer-term yields. The same is true for Treasury actions to reduce the WAM of federal debt outstanding.

Figure 3. DGDP Ratios, Alt Sims

The analysis of alternative scenarios points to ways in which the Fed could find itself indirectly influenced by government debt management decisions over time in pursuing its statutory mandate to promote maximum employment and stable prices.

Potential Effects on Policy Implementation: In a scenario in which term premiums are increasing gradually over time, it would also likely be the case that demand for securities financing by dealers and others would put upward pressure on overnight interest rates and particularly the overnight repo rate. The upward pressure on repo rates, in turn, could pull up other short-term rates, including the federal funds rate. In this scenario, the Fed might conclude that the “ample” level of reserves had risen and that it needed to expand the size of its balance sheet. In a sense, the ample level of reserves would be higher but not because banks needed more reserves to operate efficiently but rather because the level of the Fed’s securities holdings needed to be higher to relieve financing pressures in securities markets. As shown in the large Fed balance sheet & long WAM simulation, operating with a larger and longer maturity Fed balance sheet would help put downward pressure on longer-term interest rates and could reduce financing pressures in repo markets. For central banks implementing policy in a “demand-driven” operational framework, the increase in financing pressures might be reflected more in increased borrowing at the central bank’s repo facility.

Potential Effects on Treasury Market Functioning: In the simulations, the effect of increasing debt on yields plays out slowly and smoothly over time. In the real world, those types of effects could occur in very unpredictable and large jumps with accompanying bouts of dysfunction in the Treasury market. In part to address the risks of Treasury market dysfunction, the Fed implemented two standing facilities in 2021—the Standing Repo Facility (SRF) and the FIMA repo facility—that provide financing to primary dealers and foreign official institutions, respectively, at a rate currently set at the top of the target range for the federal funds rate.4 Faced with the type of rate pressures in the baseline scenario described above, one could easily imagine that the Fed would find it necessary or expedient to expand access to these liquidity facilities or to create additional types of standing facilities over time to support smooth functioning in the Treasury market.5

Neutrality and Dueling WAMs: The long Treasury WAM simulation notes that the Treasury can lower the cost of debt finance over time by reducing the WAM of its issuance and the overall debt portfolio. A parallel move by the Fed to shorten the WAM of its securities holdings has the opposite effect on interest rates. As a result, if the Treasury opts to reduce the WAM of its issuance in an effort to reduce its financing costs and the Fed follows suit by reducing the WAM of its securities holdings to remain “neutral” with respect to the Treasury’s new policy, that would have the effect of offsetting a portion of the interest rate reductions that the Treasury was seeking to achieve.

More General Policy Interaction Effects: Many economic models posit that aggregate demand depends importantly on the level of longer-term interest rates. All else equal, in this type of model, an increase in term premiums would tend to put downward pressure on spending and inflation over time. As a result, the Fed would need to adjust the stance of policy in response to rising term premiums resulting from the increased supply of Treasury debt.

Lowering the path of short-term interest rates would be one possible way the Fed could adjust to rising term premiums. In effect, the long-run equilibrium level of the federal funds rate, r*, would have moved lower. A lower value for r* makes the Fed’s job more difficult because it tends to bring the zero lower bound on interest rates into play more frequently in the event of adverse shocks to the economy.

Another type of policy response could involve the Fed adjusting the size and composition of its balance sheet to blunt the rise in term premiums and the corresponding decline in r*. This could be accomplished by lengthening the WAM of the Fed’s securities holdings and/or increasing the size of its balance sheet.

Other types of policy interactions are possible as well. For example, as discussed above, if the Treasury sought to shorten the maturity of debt outstanding to reduce debt service costs, that would tend to put downward pressure on term premiums over time. But the associated fall in longer-term interest rates could then boost aggregate demand and inflation pressures. In this case, Fed policy tightening aimed at promoting maximum employment and stable prices could offset some of the savings on debt service costs that the Treasury was seeking to achieve.

The Fed is certainly not alone in facing the challenges posed by fiscal pressures in sovereign debt markets.

In the Euro area, these questions have come back into focus in 2025 as France has struggled to agree on a policy proposal that would bring its fiscal deficit back in line with European Union fiscal rules. So far, the market’s reaction to France’s inability to pass any fiscal austerity measures has been muted (with French spreads rising nearly 30 bps since the start of 2024 to over 80 bps as of September 31st). However, there’s been speculation that if French spreads were to rise more substantially, the ECB could use the Transmission Protection Instrument (TPI) to intervene. The TPI program was introduced in 2022 and allows the ECB to buy an unlimited number of bonds from a euro zone country facing a disorderly and unwarranted tightening in financial conditions, provided the eurozone country is in compliance with the European Union’s fiscal rules. While the goal of the program is to facilitate the smooth transmission of monetary policy, critics of TPI claim that the program artificially depresses yields, distorting incentives away from fiscal consolidation.

In the United Kingdom, in the aftermath of the gilt market crisis in 2022, the BoE has explored a range of steps to strengthen the resilience of the gilt market. After a period of study, the BoE established a contingent nonbank repo facility early this year that will be available during periods of stress to provide financing to a range of nonbank financial institutions active in the gilt market. And in September, the BoE released a discussion paper noting a range of steps under consideration to strengthen gilt market resilience including central clearing and standardized minimum haircuts.6

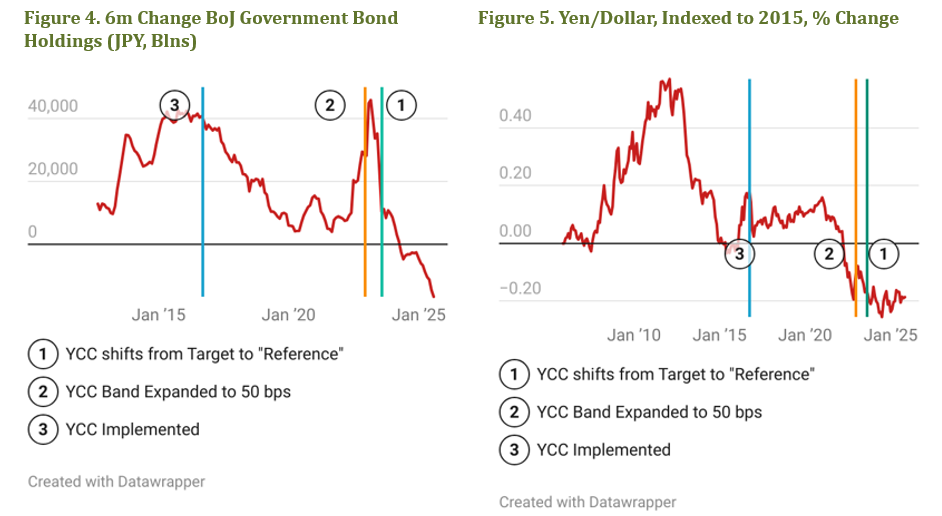

In Japan, the BOJ broke from modern central banking norms in 2016 when it began targeting longer-term interest rates. In the case of YCC and the BOJ’s QQE policies more generally, the goal was to overcome deflation and to achieve the BOJ’s new higher inflation target of 2 percent, not to minimize financial costs for the government. Nonetheless, the policies created significant communications challenges. As former BOJ Governor Haruhiko Kuroda described it:

Recently, the cooperation between monetary and fiscal authorities increasingly has been drawing attention globally…. In economic theory, a policy mix is assumed to be conducted in an appropriate manner through monetary and fiscal policies based on their own particular policy objectives. In recent discussions, however, some seem to confuse a policy mix with debt monetization by central banks. – BoJ Governor Haruhiko Kuroda, December 2019

Consistent with the BoJ’s monetary policy goals, when Japan’s inflationary situation changed radically coming out of the COVID shock, exceptionally easy monetary policies were no longer justified and the BoJ dropped its YCC policies.

Near the end of the YCC, the BoJ was forced to rapidly expand its balance sheet to defend the yield target band. Partially as a result, the yen also weakened significantly throughout 2022. This yen weakness spurred intense political criticism of YCC policies. More recently, the BOJ has been winding down its balance sheet but has been doing so very cautiously. Long-term Japanese bond yields have risen sharply as price-sensitive bond market investors are now acting as the marginal buyers for Japanese government debt for the first time in over a decade.

Central banks are vitally concerned with the functioning of sovereign debt markets. These markets are critical for the effective implementation and transmission of monetary policy and for the overall stability of financial markets. Deteriorating budget outlooks in many countries raise the prospect of continued strains in these markets for the foreseeable future. That trend, in turn, portends growing economic and political pressures on central banks to implement additional measures over time aimed at supporting the functioning of sovereign debt markets and mitigating undesired upward pressure on longer-term yields.

Clouse, James A. and Khia Kurtenbach (2025). “Federal Reserve Independence, Federal Finance, and the Uneasy Relationship,” Andersen Note, 2025-5. Federal Reserve Independence, Federal Finance, and the Uneasy Relationship – Andersen Institute

Duffie, Darrell, Michael Fleming, Frank Keane, Claire Nelson, Or Shachar, Peter Van Tassel (2023).“Dealer Capacity and U.S. Treasury Market Functionality,” Federal Reserve Bank of New York, Staff Report. Dealer Capacity and Treasury Market Functionality

Hubbard, Glenn L., Donald Kohn, Laurie Goodman, Kathryn Judge, Anil Kashyap, Ralph Koijen, Blythe Masters, Sandie O’Connor, and Kara Stein, (2021). Report of the Task Force on Financial Stability, Brookings Institution, June.

Kashyap, Anil K., Jeremy C. Stein, Jonathan L. Wallen and Joshua Younger (2025), Treasury market dysfunction and the role of the central bank, Brookings Institutions, March 26. Treasury Market Dysfunction and the Role of the Central Bank

Liang, Nellie (2025). Treasury market resilience—ever more important. Brookings Institution.April 30. Treasury market resilience—ever more important, Brookings Institution

Logan, Lorie, (2025). Opening remarks for panel titled ‘The increasing role of nonbank institutions in the Treasury and money markets’, May. Opening remarks for panel titled ‘The increasing role of nonbank institutions in the Treasury and money markets’

Report of the G30 Working Group on Treasury Market Liquidity (2021). U.S. Treasury Markets, Steps Toward Increased Resilience, G30 Report on U.S. Treasury Markets, Steps Toward Increased Resilience.

In Figure 1 and in the main text, the DGDP ratio is based on all publicly held Treasury debt, a category that includes holdings of the Federal Reserve, the private sector, and the foreign sector.

For more detail see Long-term Impacts of the One Big Beautiful Bill Act, as Enacted on July 4, 2025 | The Budget Lab at Yale.

The methodology underlying the calculator is detailed in Federal Reserve Independence, Federal Finance, and the Uneasy Relationship – Andersen Institute.

The SRF also is available to a number of depository institutions as well.

See Duffie et. al. (2023), Hubbard et. al. (2021), Kashyap et. al. (2025), Liang (2025), Logan (2025), G30 (2021) for discussion of various aspects of Treasury market resilience and functioning in an era of expanding federal debt.

See Enhancing the resilience of the gilt repo market | Bank of England.