The US dollar currently has a dominant – albeit not exclusive – role for invoicing of international trade flows. We contrast how economic fundamentals and policy actions impact this pattern drawing on an extensive multi-country database. In terms of economic fundamentals, the weight of a region in international trade supports use of its currency. Trade to the United States or the Euro area is more invoiced in dollars and euros respectively, as is trade to countries that peg to these major currencies. Exporters in more homogenous sectors coalesce on similar invoicing choices, which solely benefits the dollar. We assess the role of policy through the impact of renminbi swap lines set by some countries with the People’s Bank of China. Focusing on a subsample for which we have information on renminbi use, we find that swap lines promote it in countries which trade extensively with China. This occurs primarily at the expense of the dollar, and to a lesser extent, the euro.

While the world has many currencies, only a small subset of them dominate international financial and trade markets (ECB 2021). Among them, the US dollar has a dominant role in many respects, including in foreign exchange reserves, foreign exchange turnover, international borrowing and lending, and international trade in goods and services. Use of specific currencies to denominate international trade flows – also known as “invoicing” of trade – has important macroeconomic implications. For instance, it matters importantly for the transmission of exchange rate movements to inflation and growth, and for international competitiveness.

A large body of research has shown that the US dollar is used significantly as an invoicing unit for international trade, to an extent that well exceeds the role of the US as a source or destination country for imports and exports. The US is involved in about 10% of global trade flows, but the dollar is used as invoicing currency for about 40% of those flows (Goldberg and Tille, 2008; Gopinath, 2015; Boz et al., 2020). The greenback is hence used even in transactions between non-US countries, a feature known as vehicle-currency invoicing. Research has shown that this “dominant currency paradigm” (Gopinath et al., 2020) makes the international business cycle particularly sensitive to US shocks and economic policy.

Although the dollar’s role in international trade is dominant, it is far from exclusive. Other currencies also matter, either to a material extent, such as the euro, or to a growing one, such as the renminbi. In recent research, we assess the relative role of economic fundamentals and policies as drivers of the use of currencies (Georgiadis et al., 2021). The euro and renminbi offer two opposing examples of the impact of policies, as European officials adopted – until recently2 – a “hands-off” approach, while Chinese officials have been traditionally more active, with the People’s Bank of China (PBoC), for instance, establishing a large network of central banks swap lines.

Our assessment relies on a data set that expands the one of Boz et al. (2020). To our knowledge, it is the most extensive source on the international use of invoicing currencies and covers 115 advanced and emerging economies from 1999 to 2019. Specifically, the data include the share of exports and imports invoiced in dollars, euros, the exporting country’s currency, and in remaining currencies. A subset of the data also provides information on use of the renminbi.

Research has shown that exporters want to stabilize their price relative to their competitors to limit the volatility of their sales (e.g. Mukhin, 2021). This so-called “coalescing” motive is particularly relevant in sectors in which firms cannot materially differentiate their goods from what their competitors produce. This induces exporters to set their price in a currency that is also used by competitors. When selling to a large market where domestic firms account for a large share, such as the United States or the euro area, firms thus have an incentive to use the dollar or the euro, respectively.

Using a panel econometric analysis, we find evidence in support of the coalescing motive. Countries for which the United States or the euro area represent a larger share of exports present a larger share of these trade flows invoiced in dollars and euros, respectively. While the effect is statistically significant for both currencies, it is more pronounced for the dollar. Each additional percentage point going to the United States (the euro area) leads to an extra 0.8 percentage point of invoicing in dollar (0.3 percentage point of invoicing in euro). A higher share of exports destined to countries that peg to the dollar or the euro is also associated with more use of these currencies.

As predicted by theory, the coalescing motive is stronger for goods that are relatively homogenous, and for which movements in relative prices across firms lead to more reallocation of sales. Each additional percentage point of exports consisting of homogenous goods (according to the classification of Rauch, 1999) is associated with an additional 0.2 percentage point use of the dollar as the invoicing currency. This effect is only seen for the dollar and comes at the expense of the euro, for which use declines when homogenous goods account for a larger share of trade. This reflects, among other things, the still very entrenched role of the greenback in commodity markets.

A major development in international trade patterns in recent decades is the rise of global value chains (GVC, Hummels et al., 2001). This matters for invoicing choice, as the exports of a firm actively participating in a GVC include a smaller component of local-value-added than the exports of firms not relying on imported inputs. The former firm is thus less concerned about setting the price of its exports in its own currency. Higher participation in GVC could therefore lead to more use of dollar or euro. Our analysis finds only a limited role for GVC participation, however. Specifically, GVC participation does not alter the use of the dollar but raises the use of the euro in export invoicing. That latter effect is, however, regional and observed only for European countries.

Until recently, the discussion of currencies that could challenge the dominant role of the dollar had focused on the euro, whose creation led some to expect a major realignment. The rapid and sizable rise of China as a heavyweight in the world economy begs the question of whether one should expect the renminbi to be a new and potentially stronger challenger for the dollar.

We consider this question by relying on a subset of countries (not including China itself) for which we have data on the use of the renminbi in addition to the dollar and the euro. In addition to the economic fundamentals considered above, we also control for the presence of currency swap lines between the PBoC and the central banks of other countries, as one of their explicit aims is to facilitate the international use of the renminbi.

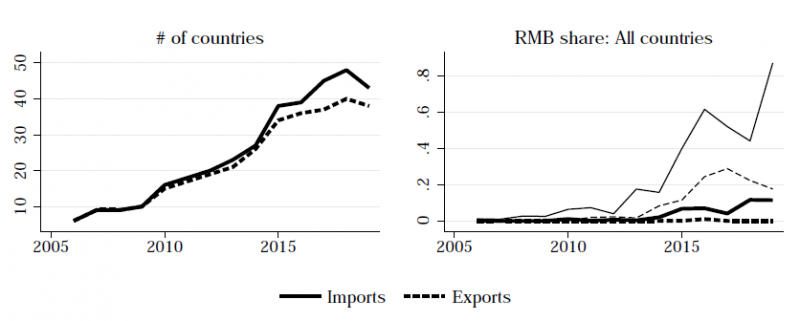

While the renminbi only account for a very small share of international trade, the situation is rapidly evolving towards higher use. A growing number of countries use the renminbi (left panel of figure 1), and its share in exports is gradually increasing, with substantial heterogeneity (right panel). The right part of figure 1 shows a moderate increase in the median share of exports and imports invoiced in renminbi among countries using it (thick lines), along with the 75th percentile (thin lines).

Figure 1: Evolution of renminbi invoicing

Source: Georgiadis et al. (2021).

Notes: The left panel sows the number of countries with data on renminbi invoicing. The right panel shows the share of exports and imports invoiced in renminbi, with the median (thick lines) and the 75th percentile (thin lines).

Unsurprisingly the fundamentals that impact the use of the dollar and the euro also matter for the renminbi, but with different patterns. Specifically, a larger role of China as a trading partner is associated with higher use of the dollar as an invoicing unit, offset by a smaller role of the euro, but with little impact on renminbi use. This can reflect the fact that, until recent years, the Chinese currency was managed heavily relative to the dollar. The effect is also quite contrasted across regions. In Europe, a higher share of imports coming from China raises the use of the euro at the expense of the dollar. In South-East Asia and Oceania, however, the same development has the opposite effect: use of the euro declines to the benefit of the dollar and, for Oceania, the renminbi.

As indicated above, Chinese authorities have taken a more active role in promoting use of their currency than their European counterparts. The PBoC has set up currency swap lines with foreign central banks to lower the cost of using the renminbi (Bahaj and Reis, 2020). Our sample shows that the invoicing share of the renminbi is indeed larger in countries that have a swap line arrangement with the PBoC.

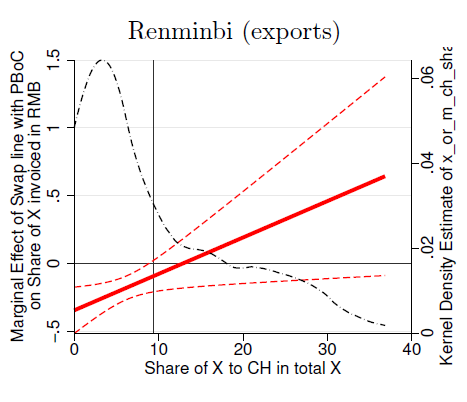

Our econometric analysis shows that the impact of such swap lines depends on the intensity of trade with China. Specifically, we not only include the existence of a swap line as an explanatory variable, but also interact the latter with the share of trade destined to/sourced from China. The overall effect of a swap line on renminbi use is shown in Figure 2, where the share of China in total exports is shown on the horizontal axis (we focus on exports for brevity as the results with imports follow a similar pattern). Setting up a swap line per se is not associated with more renminbi invoicing. But it is so once China is a large enough trade partner.

Figure 2: Impact of swap line on renminbi invoicing

Source: Georgiadis et al. (2021).

Notes: The figure shows the marginal effect of a PBoC swap line on renminbi invoicing depending on the share of a country’s exports going to China. The solid line indicates the point estimate and the dashed line the 90% confidence interval. The blue dashed line is the kernel density estimate of the distribution of the share of exports destined to China.

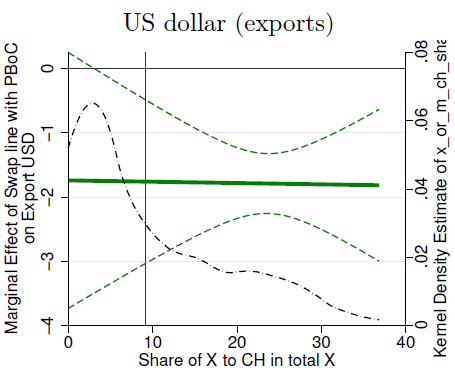

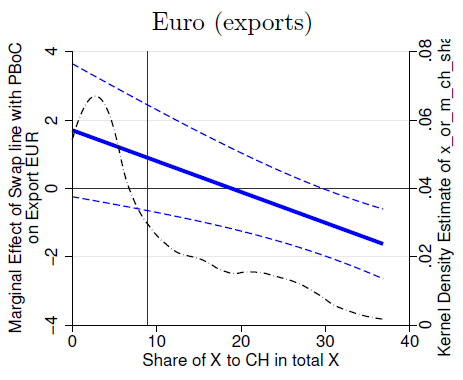

If renminbi usage increases, which currency’s role drops? Figure 3 is built in a similar spirit as Figure 2 for the invoicing shares of the US dollar and the euro (see the left and right panels, respectively). The PBoC swap lines lead to a reduction in the use of the dollar, regardless of China’s importance as a trade partner, as well as the euro in countries trading a lot with China.

Figure 3: Impact of swap line on dollar and euro invoicing

|

|

Source: Georgiadis et al. (2021).

Notes: The figure shows the marginal effect of a PBoC swap line on dollar invoicing (left panel) and euro invoicing (right panel) depending on the share of a country’s exports going to China. The solid line indicates the point estimate and the dashed line the 90% confidence interval. The blue dashed line is the kernel density estimate of the distribution of the share of exports going to China.

Our analysis shows that the growing use of the renminbi impacts other currencies in a very heterogenous manner. Economic fundamentals have only raised its role – so far – in China’s neighbouring regions and benefited the dollar. Policy support by contrast has dented the role of the dollar, in contrast, to the benefit of the renminbi. It has also reduced use of the euro in countries for which China is a sizable trading partner.

Bahaj, S., and Reis, R. 2020. Jumpstarting an International Currency. CEPR Discussion Paper 14793.

Boz, E., Casas, C., Georgiadis, G., Gopinath, G., Le Mezo, H., Mehl, A., Nguyen, T., 2020. Invoicing Currency Patterns in Global Trade. Vox, 9 October.

Commission, 2021. Communication on the European economic and financial system: fostering openness, strength and resilience, 19 January.

European Central Bank, 2021. The International Role of the Euro, Frankfurt.

Georgiadis G., Le Mezo, H., Mehl, A., Tille, C., 2021. Fundamentals vs. Policies: Can the US Dollar’s Dominance in Global Trade Be Dented? CEPR Discussion Paper 16303.

Gopinath, G., 2015. The International Price System. NBER Working Paper 21646.

Gopinath, G., Boz, E., Casas, C., Diez, F.J., Gourinchas, P.O., Plagborg-Møller, M., 2020. Dominant currency paradigm. American Economic Review 110, 677-719.

Gopinath, G., Stein, J., 2020. Banking, Trade, and the Making of a Dominant Currency. The Quarterly Journal of Economics 136(2), 783-830.

Goldberg, L., Tille, C., 2008. Vehicle-currency Use in International Trade. Journal of International Economics 76, 177-192.

Hummels, D., Ishii, J., Yi, K., 2001. The Nature and Growth of Vertical Specialization in World Trade. Journal of International Economics 54, pp. 75-96.

Mukhin, D., 2021. An Equilibrium Model of the International Price System. Mimeo.

Rauch, J., 1999. Networks vs. Markets in International Trade. Journal of International Economics 48, 7-35.

The views expressed in this column are those of the authors and do not necessarily reflect those of the ECB or the Eurosystem. They should not be reported as such.

Commission (2021).