This policy brief represents the author’s personal views and does not necessarily reflect those of Bank of Finland or SUERF or any affiliated institutions. All errors remain the author’s responsibility.

Abstract

The relationship between inflation and public sector finances is fundamentally bidirectional: fiscal variables affect inflation, while inflation itself has powerful feedback effects on tax revenues, expenditures, deficits, and debt sustainability. This interplay complicates empirical testing of macroeconomic theories such as the Fiscal Theory of the Price Level (FTPL). Using panel data from EU countries 1976–2024, we show that moderate inflation typically raises nominal revenues faster than expenditures, lowers real debt ratios, and sometimes improves short-run fiscal balances. However, rising interest costs eventually offset these gains if central banks respond by tightening monetary policy. The findings indicate that while inflation can offer temporary fiscal relief, it is not a reliable policy lever for debt reduction.

After a decades-long era of low inflation, the surge in prices since 2021 has refocused attention on the interplay between inflation and public sector finances. Inflation may stem not only from fiscal behavior but also has significant effects on government budgets, a phenomenon many policymakers have not encountered since the early 1980s. This combination of high debt and high inflation raises questions about the underlying mechanisms. The relationship between fiscal variables and inflation is complex: fiscal policies can drive inflation, particularly when markets expect monetization, while inflation affects fiscal variables—either simultaneously or with a lag (see, e.g., Olivera, 1967; Tanzi, 1977). Inflation alters real debt burdens, nominal revenues, and expenditure outlays, often redistributing resources among economic agents, including the state. An apparently improved fiscal balance may encourage governments to pursue additional fiscal expansion, potentially exacerbating inflationary pressures.

Despite decades of scholarship, from the classics of Sargent and Wallace (1981) to modern reappraisals by Cochrane (2021), many controversies persist. How significant is the inflation tax on government debt in real-world settings? Do governments, particularly in high-debt contexts, have an incentive to allow or encourage moderate inflation to ease fiscal pressures? Under what conditions does the Fiscal Theory of the Price Level (FTPL) apply, and how do institutional frameworks—such as independent central banks, supranational currency unions, or debt mutualization—moderate these effects?

This paper revisits these issues, focusing on the channels through which inflation affects fiscal variables, using cross-country data from EU countries for 1975–2024. We rely on realized values, although expectations and lagged effects play a significant role in the transmission of effects. Our analysis examines various fiscal variables and different time periods to provide a comprehensive assessment.

The most obvious channel through which inflation affects fiscal variables is government debt, which is rarely in the form of inflation-indexed securities. Inflation ultimately influences nominal interest rates and, consequently, interest expenses. This effect became evident after the Covid-19 pandemic, when the near-zero interest rate environment ended in 2021. However, the change was less abrupt than the developments in the early 1980s, offering a valuable perspective for analyzing inflation’s impact on fiscal variables.

Government revenues and expenditures are affected by inflation in distinct ways. Revenues are typically tied to nominal variables, such as prices and wages, resulting in a slightly positive real effect due to progressive income taxation, a primary revenue source in most countries. By contrast, expenditures do not necessarily have such a tight relationship with inflation. However, the difference between revenues and expenditures is often less significant than expected, as many countries index income transfers to inflation, and government sector wages are at least as sensitive to inflation as private sector wages. Over the past decade, however, indexation linkages have weakened, although exceptional events, such as the Covid-19 pandemic and the war in Ukraine, may obscure the data.

We first focus on results from estimating a simple descriptive equation relating fiscal variables (x) to inflation (∆log(P)), using GDP growth rates and fixed effects as controls. A summary of results, specifically the estimated coefficients for inflation, is presented in Table 1.

∆log(x) = b0 + b1*∆log(P) +b2*∆log(GDPQ)

Over the long term (1976-2024), the b1 coefficients for revenue categories exceed one and are slightly larger than those for expenditures. In the last decade, however, these coefficients are smaller, particularly for expenditures, including social transfers. The Covid-19 pandemic and the war in Ukraine make it challenging to assess the generalizability of these results (Table 1, last column).

Table 1. Coefficient of inflation for different periods in the panel with 27 countries

Note: Large coefficients for public investment seem to reflect the coincidence of high inflation with EU-Covid-19 rescue-package induced investments.

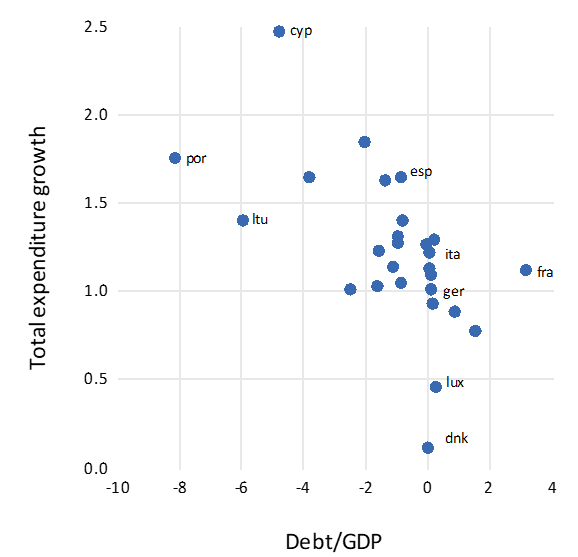

Additionally, cross-country differences are substantial, affecting the inflation impact on government debt and, to a lesser extent, expenditure growth (see Figure 1). Across the entire panel, inflation significantly reduces the debt/GDP ratio, benefiting government finances. For deficits, the inflation effect is small and significant only over the long term, indicating higher surpluses during high-inflation periods.

Figure 1. Inflation effect on debt/GDP ratio and expenditure for the period 1976-2024

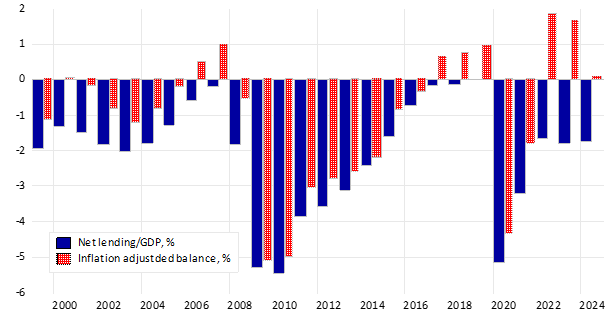

During the EMU period (see Figure 2), deficit data show that inflation had a significant effect only in 2021–2024. By computing an inflation-adjusted deficit rate—subtracting the loss in the real value of debt from deficit (net borrowing) values, as in Lawler (1978)—we find that average deficit ratios changed sign in 2022–2024. Thus, the inflation tax effectively eliminated the true deficit, despite sharply rising interest expenses in 2022 (see Figure 3).

Figure 2. General government net lending: unadjusted and adjusted for inflation

Figure 3. Interest rate expenses and inflation (in terms of GDP deflator)

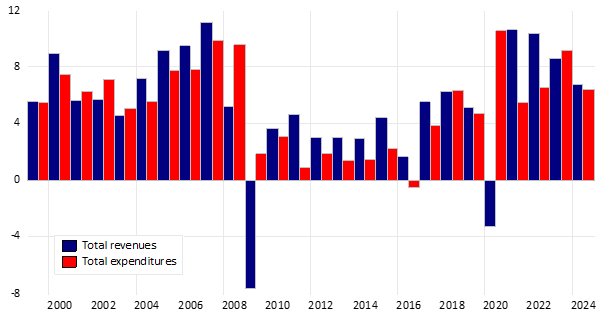

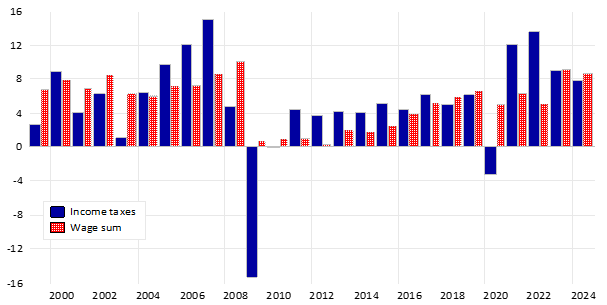

Turning to expenditures and revenues, both have generally grown faster than inflation. The difference in growth rates was minimal until the 2009 financial crisis and the Covid-19 pandemic, when significant divergences emerged. In 2022, revenues increased substantially more than expenditures, but this advantage was short-lived (see Figure 4). By 2023, growth rates were nearly equal. A similar pattern appears when comparing income tax revenues and government wage expenditures (see Figure 5). Tax revenues surged in 2021, partly offsetting 2020 losses, but by 2022, both series exhibited similar trends. Thus, inflation no longer significantly affects the balance between revenues and expenditures.

Figure 4. Growth rate of total revenues and expenditures

Figure 5. Growth rates of income tax revenues and governments’ wages

Recent inflationary episodes reaffirm a classic principle: inflation and fiscal variables are deeply intertwined. Governments may benefit from a short-run bonus from rising prices—higher revenues and lower real debt—particularly where indexation is incomplete. Seigniorage income provides additional fiscal relief. However, inflation is not a sustainable strategy for fiscal consolidation, as central banks typically respond with higher interest rates, and affected households demand real compensation over time. The literature, from historical hyperinflation analyses to contemporary FTPL debates, shows that while inflation may temporarily mask fiscal imbalances, enduring stability requires credible fiscal policy, prudent debt management, and independent monetary institutions. For the EU, a single currency means country-level inflation benefits are not guaranteed and are often overshadowed by ECB-wide policy goals.

Barro, R. J., & Bianchi, F. (2023, revised 2025). Fiscal Influences on Inflation in OECD Countries, 2020–2023. NBER Working Paper No. 31838. https://www.nber.org/papers/w31838

Bohn, H. (1998). The behavior of U.S. public debt and deficits. Quarterly Journal of Economics, 113(3), 949–963.

https://academic.oup.com/qje/article/113/3/949/1905202

Cochrane, J. H. (2021). The Fiscal Theory of the Price Level. Working Paper, Stanford University.

https://johnhcochrane.blogspot.com/p/research-papers.html

Hukkinen, J. and M. Viren (2025) What can we learn from the Argentina’s new economic regime? SUERF Policy Brief 1098. https://www.suerf.org/publications/suerf-policy-notes-and-briefs/what-can-we-learn-from-argentinas-new-economic-regime/

Lawler, P. (1978) The case for an inflation-adjusted deficit. Federal Reserve Bank of Dallas Research Paper 7802. https://www.dallasfed.org/~/media/documents/research/papers/1978/wp7802.pdf

Olivera, J. (1967). Money, prices and fiscal lags: a note on the dynamics of inflation. PSL Quarterly Review Vol. 20 No. 82. https://rosa.uniroma1.it/rosa04/psl_quarterly_review/article/view/11702

Sargent, T. J., & Wallace, N. (1981). Some unpleasant monetary arithmetic. Federal Reserve Bank of Minneapolis Quarterly Review, 5(3), 1–17. https://www.minneapolisfed.org/research/qr/qr531.pdf

Tanzi, V. (1977). Inflation, lags in collection, and the real value of tax revenue. IMF Staff Papers, 24(1), 154–167.

https://www.elibrary.imf.org/view/journals/024/1977/001/article-A008-en.xml